撰文:Jaleel 加六

特朗普家族半年磨一剑的核心项目 WLFI 已上线,举世瞩目。有人在赌涨跌,还有人炒热点币。除了「押上下方向」的真实交易之外,我们还能不能靠更确定的方式,吃到这波热度的钱?答案是套利。在本文中律动 BlockBeats 整理了一些 WLFI 可实操的套利机会:

价差套利

1、CEX 之间的价差套利

由于不同交易平台的撮合规则、开放时间、买盘密度、手续费与充提安排并不一致,短时间就会对 WLFI 有价差,也就有套利空间。

比如 WLFI 在 Binance 是今晚 9 点开现货,但提现是明晚 9 点,这意味着在提现开通前,资金只能「流入 Binance、卖给场内买盘」,却暂时「流不出来」,单向流动会让场内定价更容易偏贵。

可落地的打法其实很朴素。先挑两到三个可控场景作为「价差三角」,通常是一家一线 CEX(今天多半是 Binance,因其买盘与舆论关注度最高)、一家支持提现的次级 CEX(可以选手续费低一点的,一进一出更能保住利润),再加一个链上观察哨(比如 Uniswap 的 WLFI 池,用来判定链上边际买盘的强弱)。

同时打开两家交易所的盘口和最近成交,把 WLFI 的价格差盯住。一旦看到 Binance 的价格明显高过 另一家,而且算上吃单费、点差、可能的滑点之后,净差仍然是正的,就可以买入、然后在 Binance 卖。

整件事的难点不在「逻辑」,而在「节奏」。跨所搬砖,本质上是在和延迟赛跑:充提没开、风控弹窗、链上确认、甚至你自己点确认的手速,都会决定这 0.x% 到 1.x% 的毛利能不能落袋。所以,先用很小的金额走一遍完整流程,测清楚每一步的耗时与费用,再放量,是最稳的做法。

2、三角套利

三角套利可以简单理解为是上一种「CEX 之间的价差套利」的升级版,会涉及到更多链上路径,有时还要做稳定币之间的换汇。因此机会更多、摩擦也更多。

项目开盘早期最常见的「三明治价差」是:BNB 链上价格约等于 Solana 链上价,大于以太坊主网价,大于 CEX 场内价。由于 BNB 链上和 Solana 链上一般池子小、bot 多,价格更容易被几笔单子冲高;以太坊手续费高、bot 少,成交相对保守,因此价格低一点;而中心化交易所由做市商控盘,还常常不开充提或限额,价差无法立刻被搬平,因此现货价最低。由于 WLFI 是多链部署,因此也有这样的操作空间。

另外,新稳定币 USD1 与 USDT/USDC 可能会有微小脱锚或手续费差异,也会放大回路收益。

但需要注意的是,三角套利相比 CEX 套利更复杂,新手最好不要尝试,前置条件是提前熟悉跨链机制、跨链路径、滑点和手续费等等。

3、现货 - 永续基差 / 资金费套利

这种「现货 - 永续基差 / 资金费」套利,也是做市商、市场中性基金、量化和套利者常用的手法。散户也能做,但体量小、费率和借贷成本较高,优势不明显。

它套的「利」只有两种本质来源:第一是资金费率(funding)。永续价格高于现货、资金费为正时,多头要按周期把「利息」付给空头——你就做「现货多 + 永续空」,定时收这笔利息;反过来资金费为负时,做「卖出现货 + 永续多」,由空头向多头付。这样一来,你的净敞口接近零,资金费像活期利息,在一定时间周期内滚动结算,吃的是「情绪溢价 / 悲观折价」的现金流。

第二是基差回归。上线或情绪波动时,永续相对现货会出现一次性的溢价或贴水;当情绪降温、做市修复,永续会向现货 / 指数价靠拢,你在对冲结构里能把这段「价差缩小」的一次性收益装进口袋。两者合起来,就是「利息 + 回归」的组合,减去借贷成本、手续费和滑点,才是净收益。

但需要注意的是了解不同交易平台的清算机制、滑点、手续费、资金费率结算时间和交易深度等各种信息,防止发生 XPL 的逼空事件。

另外在最常见的「现货多 + 永续空」策略上,也可以找到一些年化收益比较高的金库,比如 StakeStone 和 Lista DAO 的金库在补贴之后有 40%+ 的 APY。

4、组 LP+ 卖空对冲套利

单纯组 LP 不是套利,它更像是在「用方向风险换手续费」。但如果叠加卖空对冲,只留下「手续费 − 资金费 / 借币利息 − 调仓成本」的净收益曲线,也是一个比较好的对冲思路。

最常见的结构,是在链上(如 WLFI/USDC 或 WLFI/ETH 池)提供集中流动性,同时在交易所做空同等名义价值的 WLFI 永续;如果没有永续,也可以在保证金账户里借币卖出现货,但摩擦会更大。这样做的目的,只是让你不去赌涨跌,把注意力全部放在「成交越多、手续费越厚」的那一边。

执行时,把 LP 当作「收费的做市区间」。先选一个你能盯得住的费率和价格带,比如新币期用 0.3% 或 1% 费层,区间设置成贴近现价的「中等宽度」。部署之后,LP 头寸里会有一部分变成 WLFI 现货,一部分是稳定币,你用这部分 WLFI 的「等值名义」去开空永续,初始时把两条腿的美元价值对齐。价格在区间内来回晃,链上那条腿靠换手收手续费、靠被动再平衡吃一点点价差;方向由空腿承担成反向敞口,整体趋近中性。如果此时资金费为正,你的空腿还能额外收息;若资金费为负,就要靠更宽的区间、更低的杠杆和更低频的再对冲去把净收益撑住。

和基差套利的差别在于,基差套利吃「永续和现货」的价差回归与资金费,这里吃的是「链上换手带来的手续费」。和纯 LP 的差别在于,纯 LP 的盈亏很大程度取决于方向与无常损失。

WLFI 币股 ALTS 与 WLFI 对冲

ALT5 Sigma(纳斯达克:ALTS)用发行股票 + 私募的方式筹到约 15 亿美元,其中一部分直接换取 WLFI 代币、另一部分用于在二级市场配置 WLFI,由此把自己做成了一个持有 WLFI 的「金库 / 代理敞口」。关于 WLFI 币股 ALT5 Sigma(Nasdaq: ALTS)的更多相关阅读可见:《不敢买代币,WLFI 币股还有机会吗?》

同时观察 ALTS 和 WLFI 上涨幅度,逻辑上是做强的一边空、弱的一边多,等它回到常态就对冲平仓。比如 WLFI 因上所与叙事推动先行拉升,而 ALTS 受限于美股交易时段或借券成本「滞涨」,价差被拉开;等到美股开盘、资金把 ALTS 的「代理敞口」补齐时,这段落差会回归。

如果用 WLFI 永续来对冲,还可能顺带拿到资金费,但主收益仍来自价差本身,而非单边方向。

这和前面的「基差 / 资金费套利」不同点在于:这里没有「现货—永续」的确定性锚,而是把股票当作代持 WLFI 的「影子」,逻辑更像「BTC 和 MSTR」的老思路,但执行的难点在摩擦与时段。加密端是 7×24 小时交易,WLFI 是 8 点解锁,但纳斯达克的开盘时间是 9:30,如果在这之前买卖就是盘前交易,能挂单、能撮合,但撮合规则与常规盘不同,同时还要注意停牌 / 熔断的可能性。

Polymarket 上的 WLFI 市值赌注

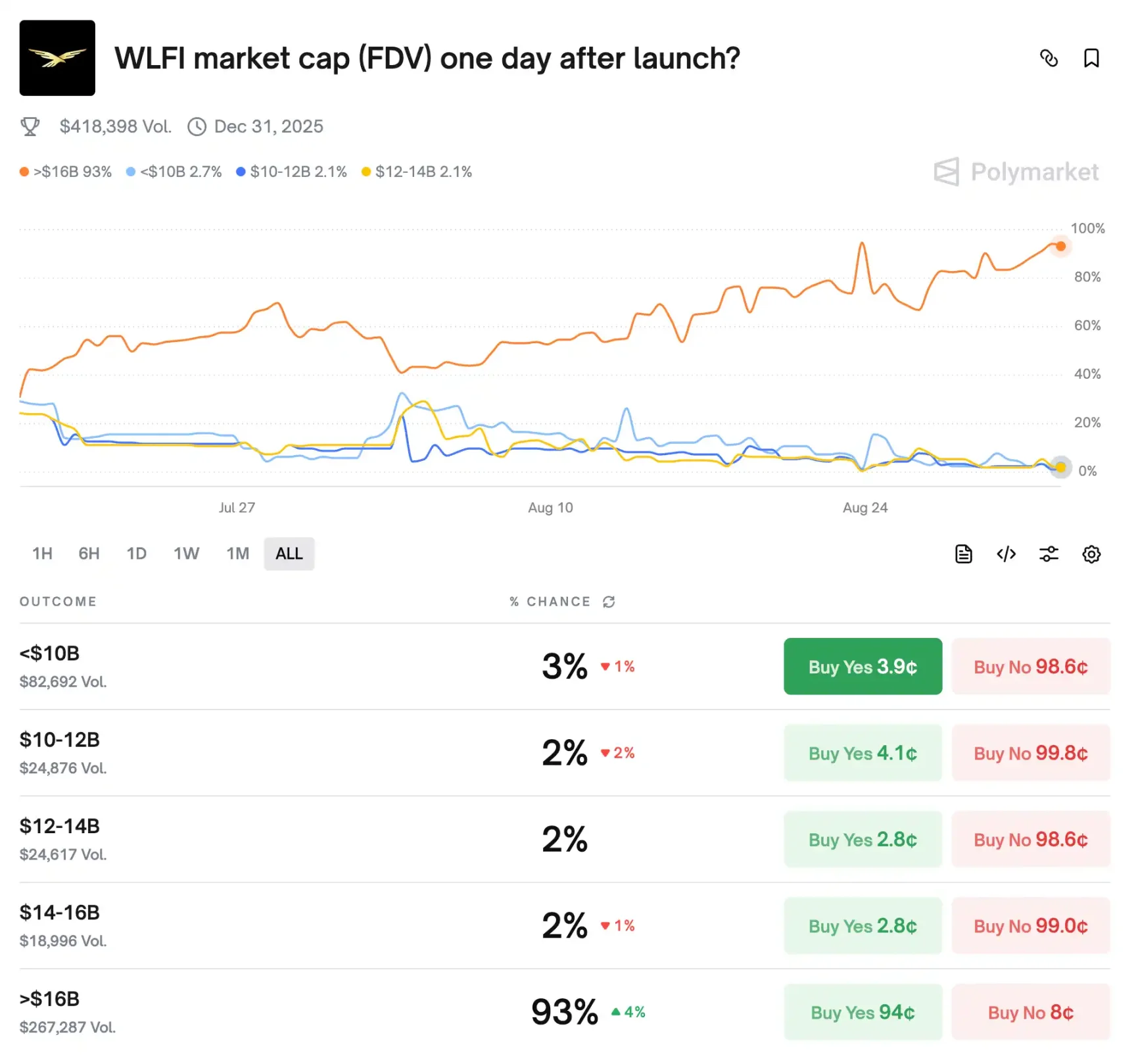

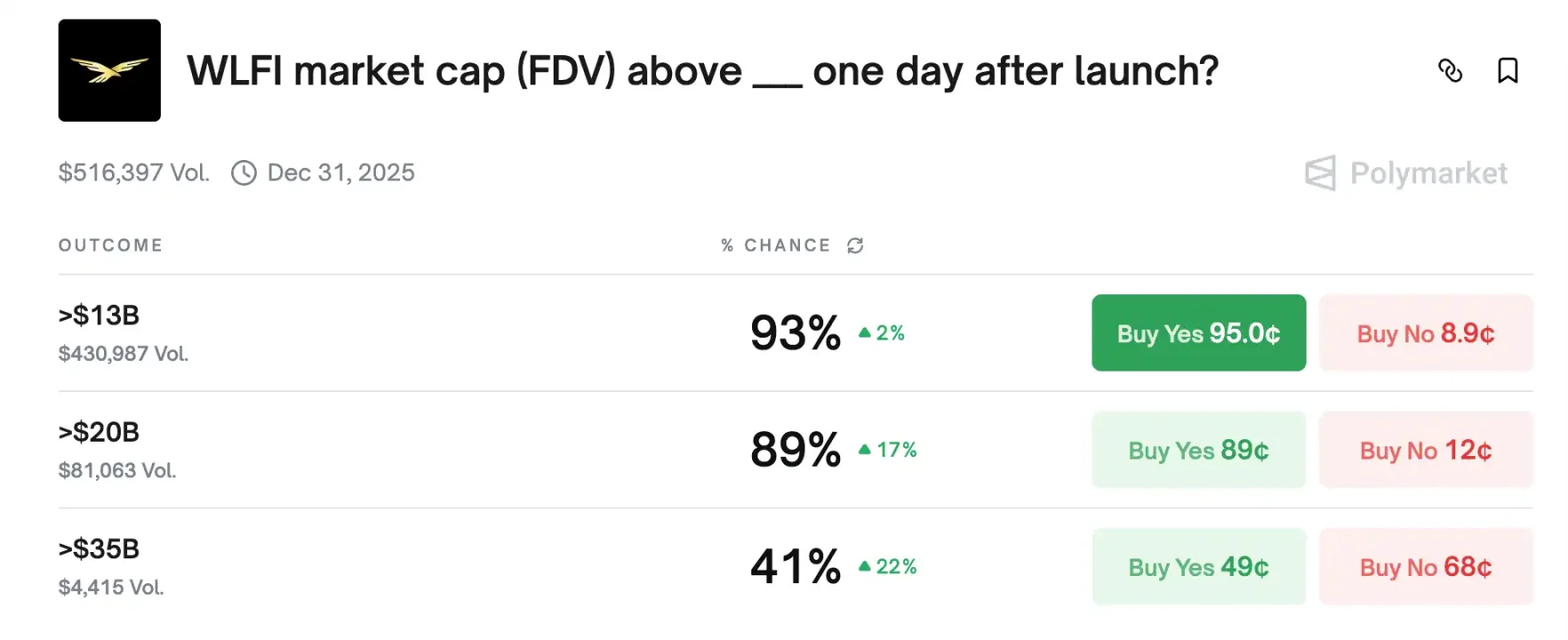

现在 Polymarket 上有两个关于 WLFI 的赌注,都是关于 WLFI 上线当天的市值,只是一个是分档市场($10B、$10–12B…、>$16B 五选一),第二张是阈值市场(>$13B、>$20B、>$35B 三个二元判断)。

因为问的都是「WLFI 上线一天后的 FDV」,它们的价格必须彼此一致:分档里的五档概率之和应当等于 100%。因此分档里的「>$16B」那档价格,必须与阈值里的 P(>16B) 一致。

同时,它在分档中的补集($10B、10–12B、12–14B、14–16B 四档)价格之和,必须等于阈值里的 1 − P(>16B)。如果你发现两边不对等,比如分档里「>$16B」报得很高,但四档的总和也不低,导致「>$16B + 其余四档」合起来明显大于 1,就在贵的那一侧挂卖或用 No 对冲,同时把便宜的那边买齐,做成「必得 1 美元、成本<1」的篮子;如果合起来小于 1,则直接把两边都买齐,锁住差额。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。