On Monday, due to the U.S. holiday, the U.S. stock market is closed, and the market remains similar to the two days over the weekend, with only a slight increase in volatility, especially in the Asian time zone. Although the CME U.S. stock futures have limited opening hours, all three major index futures opened slightly lower before rising, indicating that investors likely experienced a relief in sentiment after the weekend.

The focus this week is on the labor data starting Wednesday, with Friday's non-farm payrolls being the most important. Wednesday and Thursday serve as a prelude, and the non-farm data is likely to be a key criterion for the Federal Reserve's decision on whether to cut interest rates in September. Currently, market expectations suggest that the data itself may not be very optimistic, but it depends on how the market interprets it and whether it will resemble the situation from two Fridays ago when Powell spoke.

This time, the increase in labor is limited, the unemployment rate has risen to 4.3%, and wage growth has seen slight changes, combined with rising inflation, which could lead the market to expect that the U.S. economy is entering a stagflation phase. Of course, the negative impact is that the probability of the Federal Reserve cutting rates in September will continue to rise, but the reason for this increase is adverse economic conditions, which is why I question whether we will replicate the movements from the Friday two weeks ago.

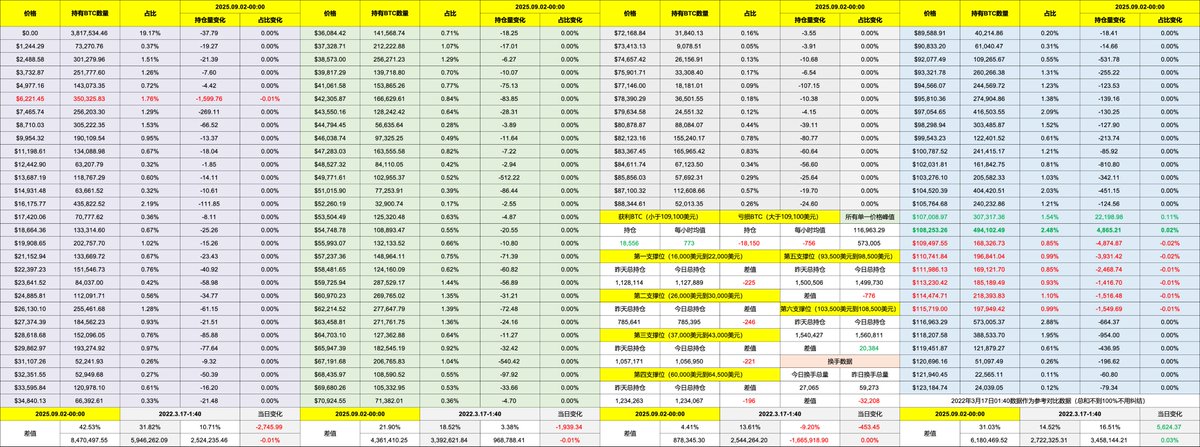

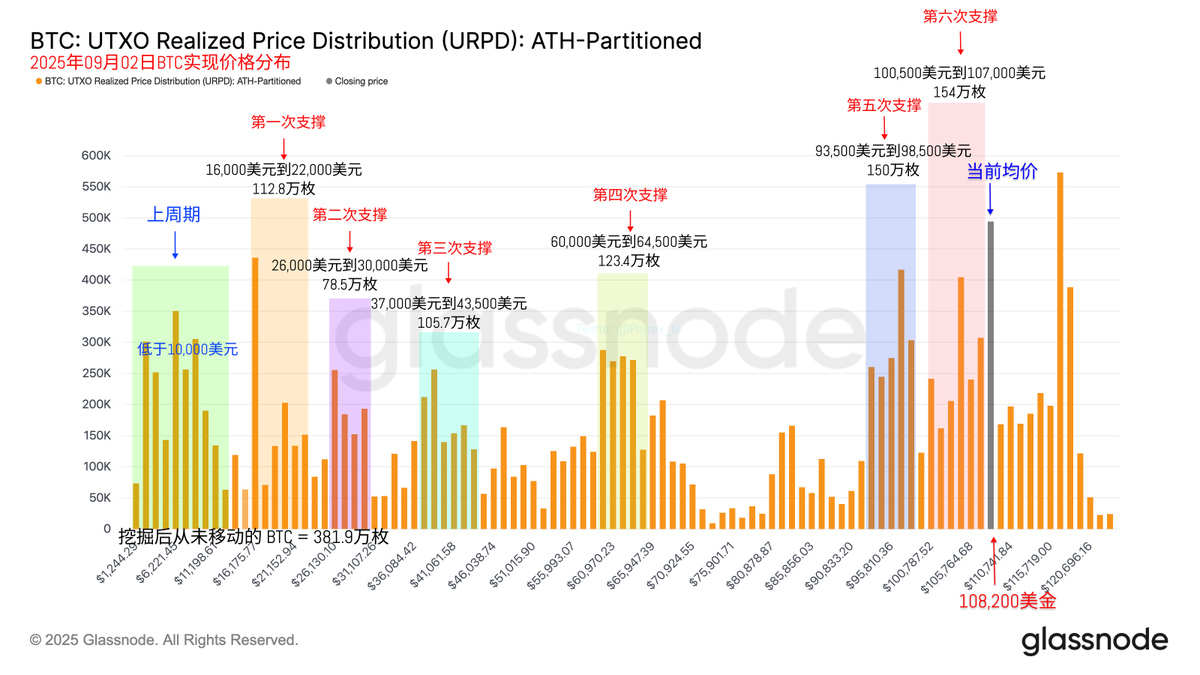

Looking back at Bitcoin's data, it aligns with yesterday's expectations, with little price fluctuation and very low turnover, which has already reached bear market standards. This indicates that investor interest in buying and selling $BTC over the three-day weekend was very low, but it is expected to increase as the workweek begins on Tuesday. This also suggests that the current price fluctuations of BTC are largely unrelated to ordinary investors.

The support level remains unchanged, and since there is not much turnover, it inevitably has little impact on the current support, which remains around $112,000 to $118,000. The two consecutive support levels can still stabilize for now, and Friday's non-farm payrolls do not rule out the possibility of a two-sided spike.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。