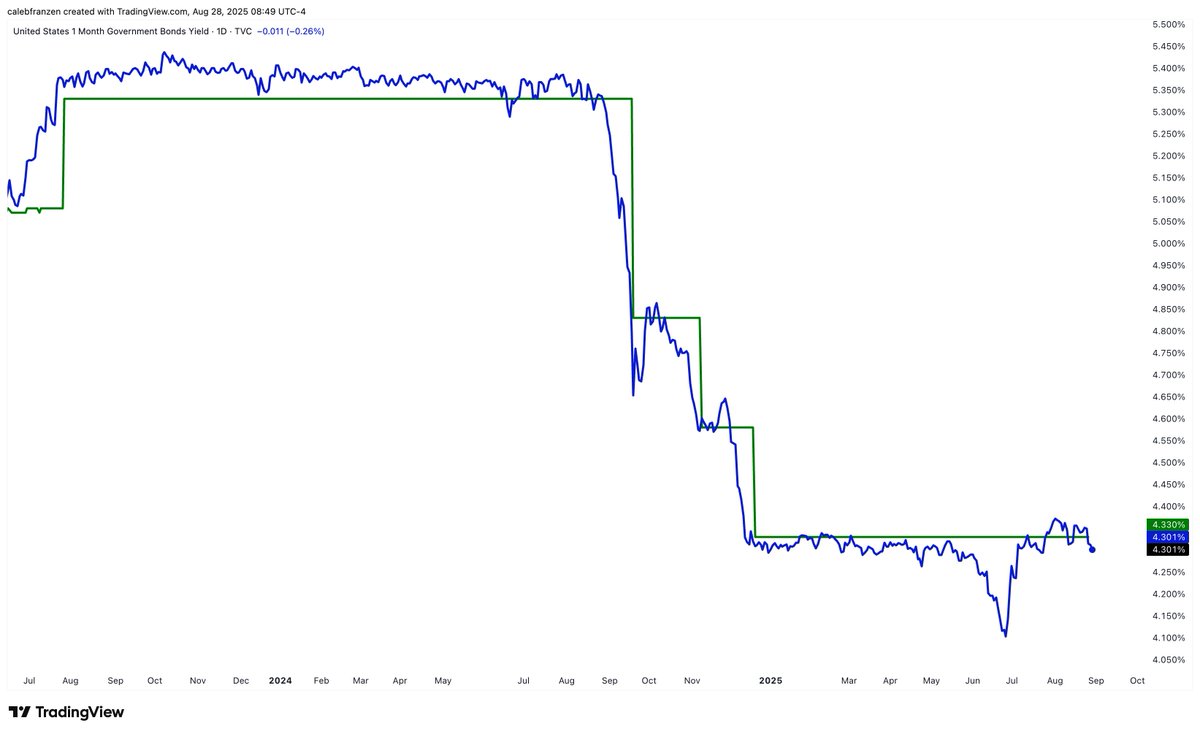

这是以下内容之间的关系:

🔵 1个月国债收益率

🟢 有效联邦基金利率

这是我们预测美联储在下次FOMC会议(9月17日)上可能采取行动的最佳工具。

特别是与3个月国债收益率结合使用时。

现在,债券市场不相信会降息,因为1个月收益率基本上等于有效联邦基金利率。

我们如何知道何时可能会降息?

当1个月国债收益率低于有效联邦基金利率0.13%时。

为什么?

因为美联储将降息25个基点。

所以如果1个月收益率低于有效联邦基金利率(0.5*0.25)%时,那么这正式告诉我们,美联储在下个月降息的可能性大于不降息的可能性。

简单来说,如果/当1个月国债收益率在或低于4.205%时,我们就知道市场正式在定价降息。

现在,1个月收益率为4.301%。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。