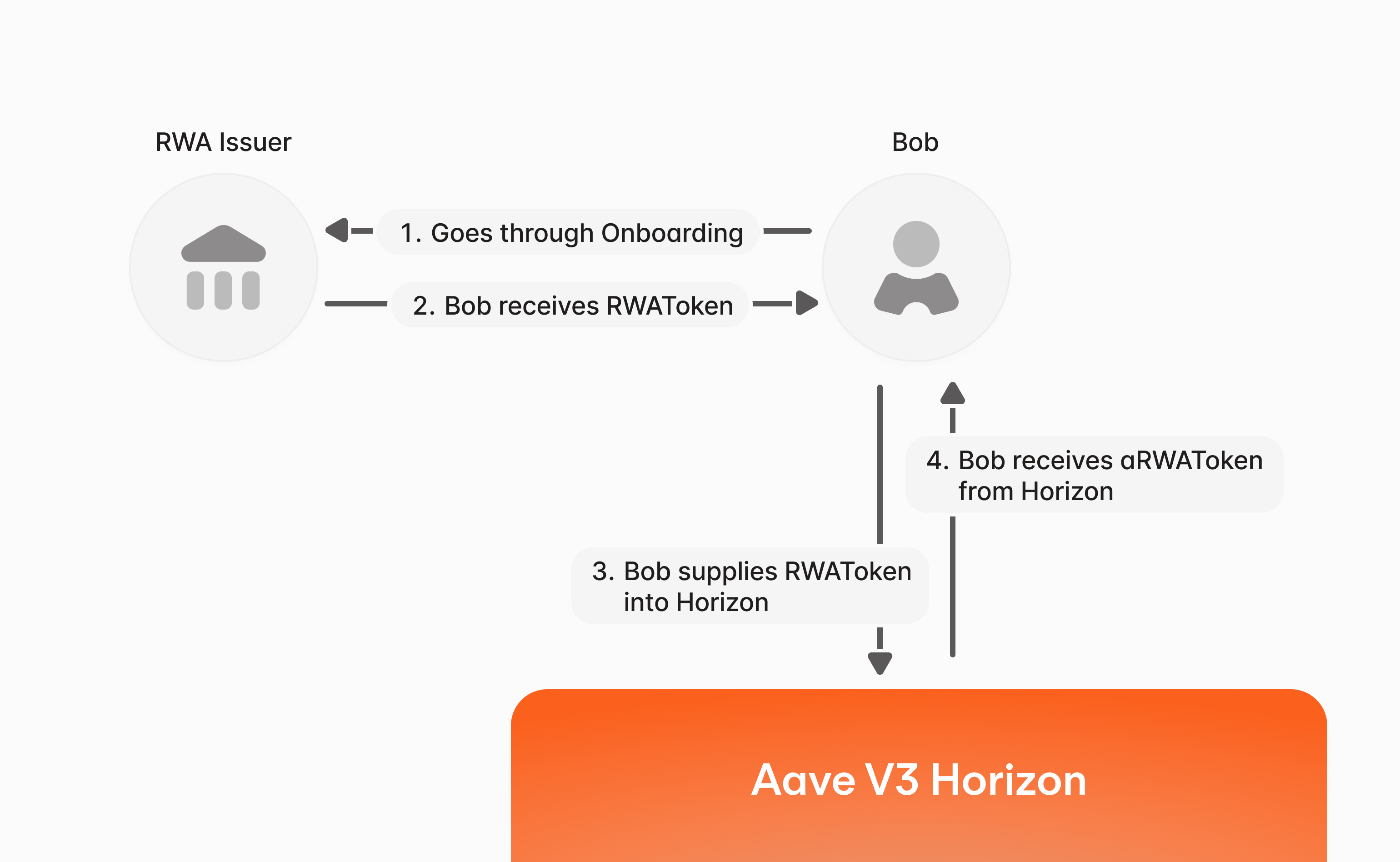

Aave Labs has launched Horizon, its new platform dedicated to institutional borrowers to access stablecoins using tokenized versions of real-world assets (RWAs) like U.S. Treasuries as collateral.

At launch, institutions will be able to borrow Circle's USDC, Ripple's RLUSD and Aave’s GHO against a set of tokenized assets, including Superstate’s short-duration U.S. Treasury and crypto carry funds, Circle’s yield fund, and Centrifuge’s tokenized Janus Henderson products.

The platform aims to offer qualified investors with short-term financing on their RWA holdings and allow them to deploy yield strategies.

With Horizon, first announced in March, Aave aims to tap into the rapidly growing, $26 billion tokenized asset market and turning those assets into usable capital for institutions. Tokenized assets are projected to balloon into a multiple trillion-dollar market over the next few years as major banks and asset managers increasingly place traditional instruments like bonds, equities, real estate on blockchain rails as a token for operational efficiency.

However, efforts to make RWA tokens useful in the decentralized finance (DeFi) lending markets are in the early innings, limiting their practical use.

"Horizon delivers the infrastructure and deep stablecoin liquidity that institutions require to operate on-chain, unlocking 24/7 access, transparency and more efficient markets," Aave Labs founder Stain Kulechov said in a statement.

The protocol runs on Aave V3, which is the largest decentralized lending protocol with more than $66 billion in assets on the platform, according to DefiLlama data.

The platform's setup blends permissioned and permissionless features: collateral tokens embed issuer-level compliance checks, while the lending pools remain open and composable.

Chainlink’s oracle services supply real-time pricing data, starting with NAVLink, delivering net asset values of tokenized funds directly on-chain to ensure the loans are appropriately collateralized.

Launch partners include a range of asset issuers including Ethena, OpenEden, Securitize, VanEck, Hamilton Lane and WisdomTree, with plans to expand collateral selection to more tokenized assets.

Read more: Tokenization of Real-World Assets is Gaining Momentum, Says Bank of America

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。