I. Introduction

In mid-August, ETH strongly broke through $4,700, reaching a four-year high, while SOL fluctuated mostly between $180 and $200 during the same period, significantly lagging behind the performance of BTC and ETH. Reflecting on the meme frenzy ignited by Solana on platforms like Pump.fun in 2024, it was once seen as the terminator of ETH. On January 19, 2025, SOL refreshed its historical high to around $293, followed by a pullback, sideways movement, and fluctuating sentiment, diverging from ETH's trend of "growing stronger." Behind the surface lies a systemic difference in funding entry, value anchors, and network narratives. So what are the reasons behind this? Can the Solana ecosystem shine again, and can the SOL token take off once more?

This article will analyze the on-chain data and ecological performance of Solana, dissecting the core reasons for SOL's phase of underperformance against ETH, and examining the advantages and disadvantages for SOL's potential resurgence. Based on this, we will look ahead to the possible trends for Solana in Q3-Q4 of 2025, providing readers with a systematic reference.

II. Comprehensive Analysis of Solana's Ecological Performance in 2025

Solana's growth path is distinctly different from Ethereum: it captures value not through "high gas fees + deflation," but through high throughput on a single chain and ultra-low fees accommodating massive long-tail and high-frequency trading.

1. Core On-Chain Indicators

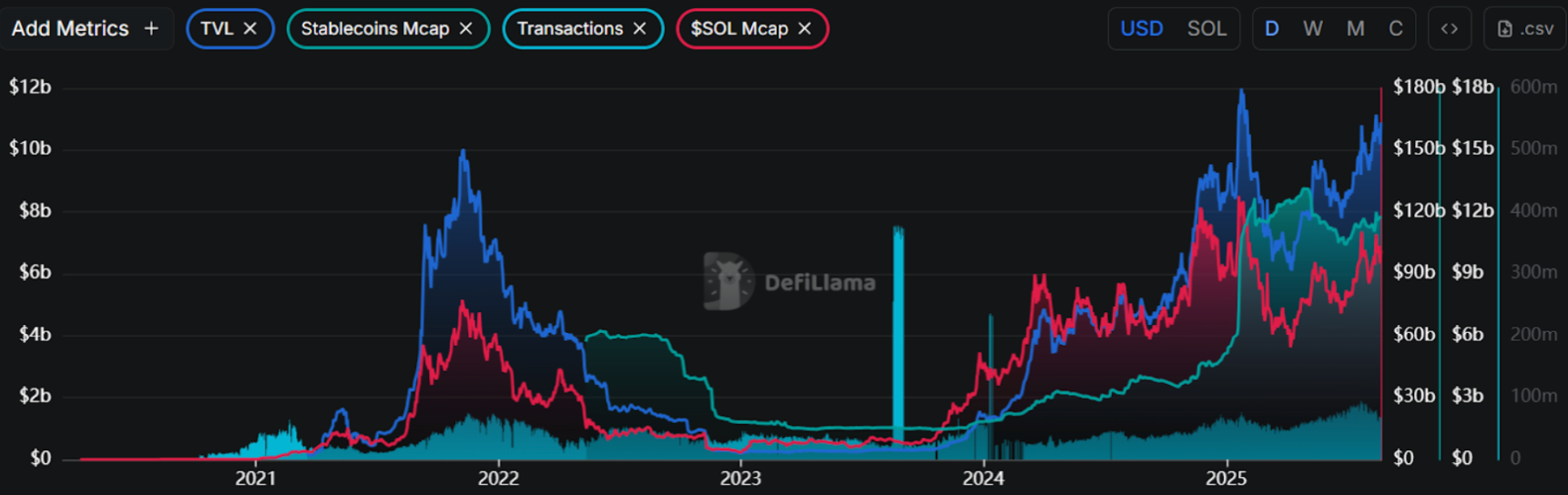

Since the beginning of this year, the Solana ecosystem has shown a trend of "high-level pullback followed by oscillating upward." TVL and stablecoin supply have shown a stepwise upward trend, with current TVL around $10.42 billion and stablecoin market cap around $11.62 billion, indicating that the on-chain "underlying dollar liquidity pool" has returned to and stabilized in the $10 billion range; the number of on-chain transactions remains high, maintaining an active "high-frequency/long-tail" trading state; the total market cap of $SOL saw a significant pullback in Q1, but has shown a wave-like oscillating upward rhythm since Q2; from a structural change perspective, the resurgence of meme popularity has marginally improved DEX/chain fees, but has not yet returned to the peak levels of the year.

Source: https://defillama.com/chain/solana

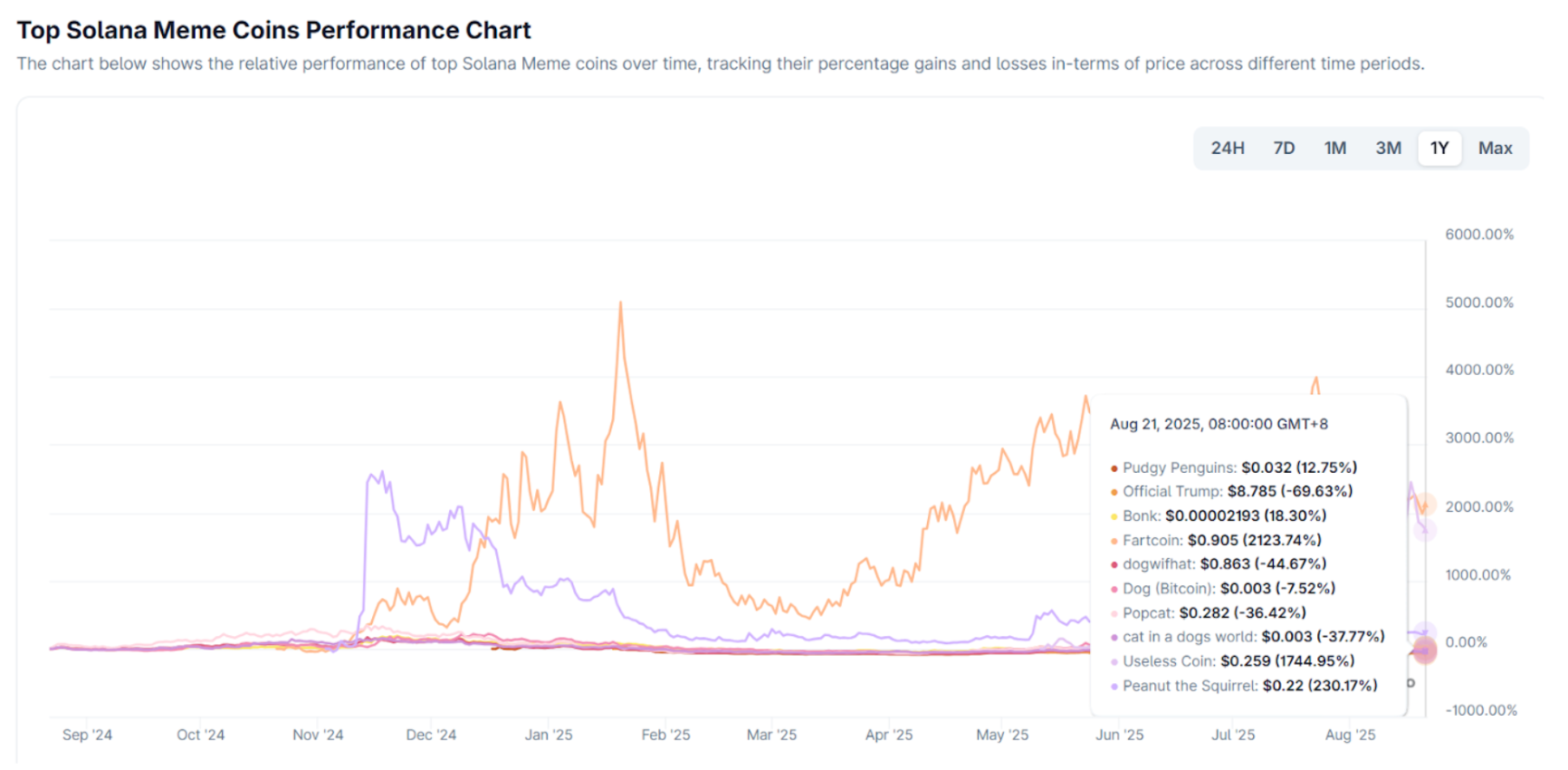

2. Meme Coin Sector

As the leading network for meme coins, Solana has produced star meme coins such as BONK, WIF, POPCAT, MOODENG, PNUT, TRUMP, PENGU, FARTCOIN, and USELESS. The common characteristics of Solana memes are "high volatility + strong rotation + strong event-driven," with the total market cap of the Solana meme sector currently around $11.7 billion. The top five meme coins with the highest popularity since the beginning of the year are as follows:

PENGU: A "brand coin" strongly tied to popular NFT IP, with physical toy sales exceeding $10 million, covering over 3,100 stores. Canary Capital has submitted a PENGU ETF application to the SEC, significantly strengthening throughout the year, ranking among the top in Solana memes.

BONK: The "veteran" of Solana's dog-themed coins and a community traffic entry point, it has seen significant growth with the emergence of LetsBonk.fun, but has recently pulled back noticeably.

TRUMP: A Trump meme, driven by political topics, has seen overall oscillating decline since its launch in January. The Trump crypto dinner in May sparked a round of warming, but it is still in a pullback state and is sensitive to event catalysts.

FARTCOIN: Its popularity stems from humorous themes and viral spread: users submit fart jokes or memes to earn coins, with each transaction producing a digital fart sound, combined with AI narratives (created by AI Truth Terminal), making it an AI-meme hybrid that easily triggers FOMO.

USELESS: USELESS emphasizes "uselessness" as a selling point, satirizing the hollow promises of other coins, becoming the most honest meme coin, where the higher the price, the more useless it is, making it more attractive to speculators.

Source: https://www.coingecko.com/en/categories/solana-meme-coins

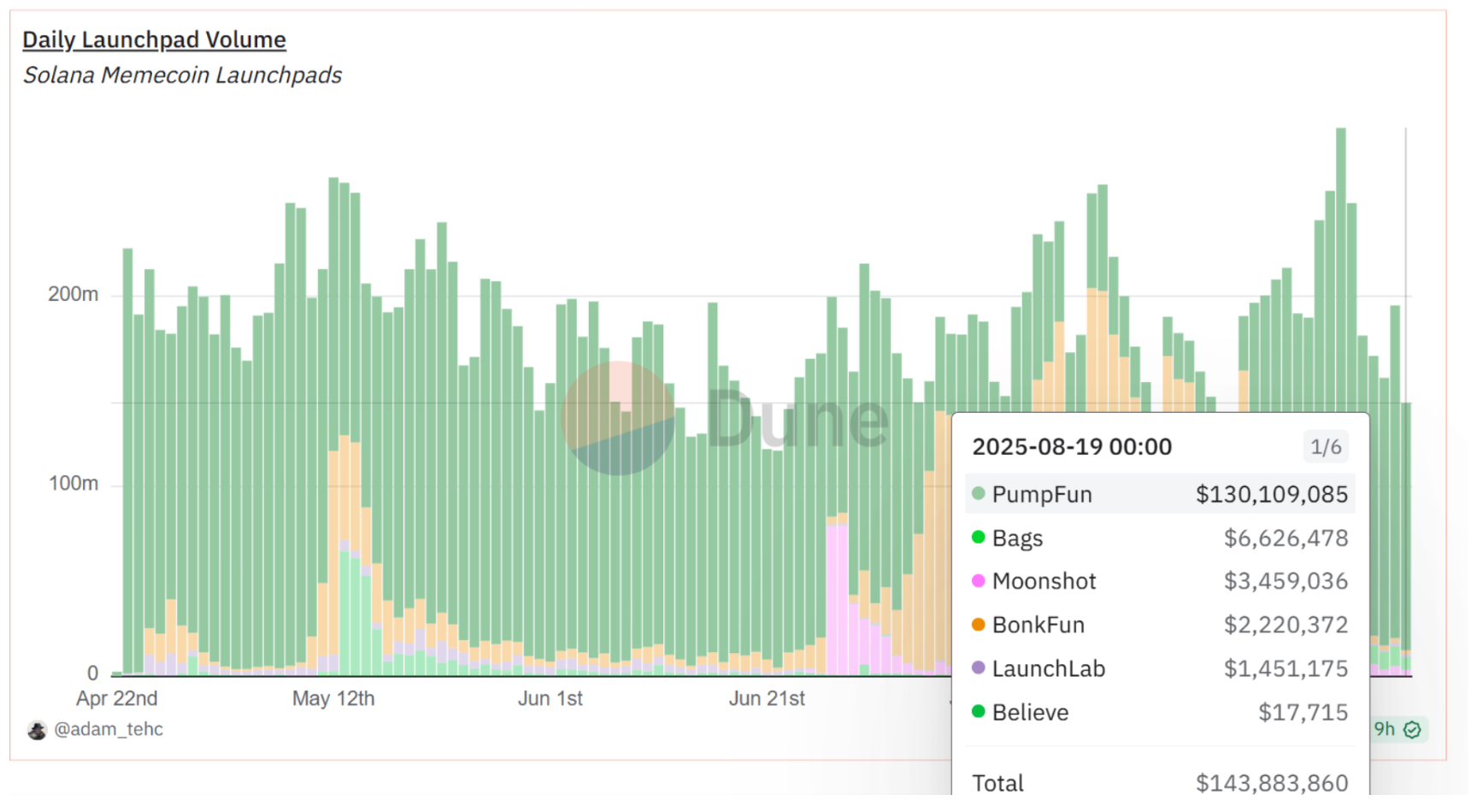

3. Launchpad Sector

The competition among Launchpads on Solana has evolved from "who is cheaper/faster to list" to a contest of "creator economy, token buybacks, and community governance."

Pump.fun: With a 1% transaction fee and "foolproof issuance," it has ignited the entire chain's meme. In mid-August 2025, weekly revenue reached approximately $13.48 million, returning to a phase high; cumulative revenue has surpassed $800 million; simultaneously, the dramatic reversal of "market share from 5% to ~90% in two weeks" has attracted widespread attention.

LetsBonk.fun: Rapidly rising after its launch in April 2025, it once captured over 78% of the issuance share in July, but has since seen a decline. Its "community mobilization + low-threshold issuance" path remains one of the core competitors to Pump.fun.

Bags: Focused on "creator profit sharing/royalties," emphasizing creator earnings and continuous distribution, it has entered a niche market tied to opinion leaders/creators, with trading volume exceeding $1 billion in the past 30 days.

Moonshot: A fiat entry-level app that supports Apple Pay direct top-ups and fiat deposits. It once topped the "Finance Free Apps" chart in the US App Store, significantly lowering the entry barrier for newcomers.

Believe: A social media entry point that issues coins upon replies, it faced controversy in June for pausing some on-chain revenue sharing and shifting to offline payments, adjusting automatic listings to "manual review."

Source: https://dune.com/adam_tehc/memecoin-wars

4. DeFi Sector

Solana's DeFi resembles "high-frequency/long-tail trading infrastructure." Raydium/Orca handle DEX trading and liquidity, Jupiter/Drift manage derivatives trading and route fragmented liquidity, while Kamino enhances capital efficiency, and Jito/Marinade provide "stable yield + liquidity" as underlying assets.

Raydium (AMM + Ecosystem Launch Pool): A veteran DEX/AMM on Solana, it handles most long-tail spot liquidity and launch pool functions; fees and revenue consistently rank among the top in its category, showing a positive feedback loop of "platform cash flow—token value."

Jupiter (Aggregator + Trading Entry): The default router on Solana, integrating liquidity from multiple DEXs like Raydium; the JPL pool aggregates a large amount of liquidity and has announced plans to launch a lending sector.

Kamino (Unified Liquidity/Lending/Market Making Position Management): Known for "active market-making treasury + lending," it has long maintained a top TVL position on Solana, becoming a "distribution center" for LPs and capital.

Jito (LST + MEV Infrastructure): By making MEV explicit through the Jito client/block engine/"Bundles," it allocates a portion of MEV to stakers via jitoSOL. Jito tips have accounted for a significant proportion of the on-chain "real economic value (REV)."

III. Analysis of SOL's Underperformance Against ETH

ETH has established a complete closed loop of "compliant funds → secondary liquidity → market making/derivatives" through spot ETFs, combined with a larger corporate treasury size and the narrative of being the "on-chain financial hub," forming a stronger capital attraction and valuation anchor. In contrast, Solana focuses on a trading-oriented ecosystem of "high-frequency/long-tail applications," where price elasticity is more dependent on thematic prosperity (Meme/Launchpad, etc.), making it more prone to "lack of anchoring" during risk appetite declines or hot topic rotations.

1. ETF Capital Increment Gap

SOL: There is already a Solana ETF (SSK) in the US stock market that offers staking rewards, but it is structurally complex and not an SEC-registered spot ETF, with cumulative net inflows of only about $150 million since its listing, far less than the capital-raising ability of ETH ETFs. The short-term market focus is on the SOL spot ETF applications from VanEck and Grayscale, which, if approved around October, could open up compliant models and passive capital channels similar to ETH.

ETH: The scale of spot ETFs has surpassed $22 billion, becoming the main entry point for institutional funds. Leading institutions (like BlackRock) are advancing applications for "stakable ETH ETFs," which, if realized, will combine "staking rewards" and "compliant channels," further solidifying long-term allocation.

SOL: Known as "SOL Microstrategy," Upexi currently has a NAV of approximately $365 million, holding 1.8 million SOL, and has invited Arthur Hayes to join its advisory board to strengthen strategy and visibility; other listed companies (such as DFDV, BTCM) are also slowly increasing their holdings, but the overall scale still shows a significant gap compared to ETH's treasury strategy.

ETH: BitMine Immersion (BMNR), which positions itself as "ETH Microstrategy," plans to increase its financing scale to $20 billion, with a current NAV of approximately $5.3 billion, ranking second only to Bitcoin's MicroStrategy; at the same time, endorsements from globally influential opinion leaders like Tom Lee significantly strengthen market narratives and capital appeal.

3. Differences in Network Narrative Positioning

Solana: More inclined towards "single-chain high throughput + ultra-low fees" for consumer applications and speculative hotspots (Meme, Launchpad). Although it has attempted to enter RWA multiple times this year, most efforts have ended in failure; in August, the collaboration between CMBI and DigiFT issued dollar money market fund tokens (CMBMINT) on Solana, which is a rare compliant RWA positive case. On that day, SOL rose above $200, seen by the market as a potential narrative switch point.

Ethereum: Ethereum is building a compliant and sustainable on-chain financial infrastructure and clearing layer position, receiving "structural subscriptions" from institutions. Half of the stablecoin issuance and about 30% of gas fees occur on Ethereum; at the same time, Robinhood launched stock tokens on Ethereum L2, and Coinbase is fully developing Base.

4. Different Value Capture Mechanisms

Solana: Achieves ultra-high interaction density through low fees + high throughput, with value capture relying more on total transaction volume and application layer fees/MEV; when meme/long-tail activities recede, chain fees and application fees cool down simultaneously, weakening the valuation anchor.

Ethereum: EIP-1559 burns the base fee directly, showing net deflation/low inflation during busy periods, combined with staking rewards, forming a valuation anchor of "supply-side contraction + cash flow."

5. Historical Risk Memory and "Credibility Discount"

Solana: The approximately 5-hour downtime on February 6, 2024, and subsequent occasional drops in consensus nodes have been repaired, but it remains a risk factor in institutional pricing tables.

Ethereum: "No downtime" and a broader developer/compliance ecosystem lead to a lower credibility discount—when macro volatility rises, this discount can be amplified by the market.

IV. Can SOL Take Off Again: Analysis of Advantages and Disadvantages

SOL has a solid foundation of "high activity + low fees + MEV sharing + application layer cash flow," combined with catalysts like spot ETFs and RWA compliance, providing a complete opportunity for a trend resurgence; however, with ETF increments not yet realized, treasury scale and narrative still weaker than ETH, and historical stability shadows not fully digested, the price remains highly "event-driven."

1. Advantages and Bullish Logic of SOL

**Single-chain Throughput + Low Fees = Natural Soil for Activity and Long-tail Assets

**Solana handles tens of millions of interactions daily on a single chain, with naturally active trading and market-making, and extremely low fees, conducive to the continuous trial and diffusion of memes, long-tail assets, and high-frequency DeFi.**Compliant RWA is Being Sampled

**CMBI × DigiFT has tokenized dollar money market funds and deployed them across multiple chains like Solana/Ethereum, claiming to be the first publicly compliant MMF on Solana, bringing "cash-like assets interpretable by institutions" and fiat/stablecoin entry. This represents a potential "long-term capital narrative."**Predictable Inflation Curve

**Solana's established inflation model: an initial 8%, decreasing by 15% every "year" (~180 epochs), with a long-term rate of 1.5%. The actual annualized rate for 2025 is expected to be around 4.3%–4.6%, with discussions on community-driven proposals to accelerate deflation. The predictable downward inflation is beneficial for medium to long-term valuation anchors.**If Spot ETF is Approved = "Capital Gate Opens"

**Several institutions, including VanEck, have submitted or updated S-1 filings for SOL spot ETFs to the SEC; once approved, it will replicate ETH's path of "compliant funds → passive allocation → market making/derivatives," attracting more corporate treasury participation.

2. Disadvantages and Bearish Logic of SOL

**True Increment of ETF is Still on the Way

**The scale of ETH's spot ETF exceeds $22 billion, forming a closed loop for institutional funds; meanwhile, SOL is still in the application/communication phase, and the current "staking" products in the US are not standard SEC spot ETFs, significantly weaker in capital attraction. The difference between realized vs. expected is directly reflected in relative returns.**Gap in Treasury Strategy Scale and "Spokesperson"

**The scale of treasury companies in the ETH camp (like BMNR) is significantly larger than that in the SOL camp (like Upexi), backed by first-line opinion leaders like Tom Lee; meanwhile, SOL's treasury is still in a "catch-up phase." This means that during turbulence, those with more "bullets" will have an advantage.**Network Narrative of "Financial Hub vs. Consumer/Speculative Chain"

**ETH firmly occupies the narrative high ground of stablecoins/clearing/compliant finance; Solana relies more on memes/launchpads/long-tails to drive activity and fees, with thematic rotations directly affecting on-chain fees and cash flow, making the price anchor more "floating."**"Fee Competition" from ETH Itself

**The reduction in fees on the Ethereum mainnet, along with competition from networks like BSC, Base, and Sui, means that "low fees" are no longer Solana's only selling point, leading to a diversion effect on new developers and capital.

V. Outlook and Summary of SOL Trends in Q3–Q4

The essence of Solana remains a consumer-grade high-frequency chain characterized by "high activity, low fees, and application monetization." Whether it can "take off again" in Q3–Q4 depends on whether the ETF brings in compliant increments, whether RWA can establish a scalable closed loop, and whether network stability continues to improve.

Baseline Scenario: Q3 enters a phase of "trading recovery + narrative waiting" with oscillating upward trends. On-chain activity and DEX/perpetual transactions remain high, with memes showing a cyclical pattern of pulse-like activity—retraction—then renewed activity. In terms of price, SOL will be pulled back and forth around "valuation center uplift due to fundamentals" and "risk premium contraction from event expectations," with a tendency towards oscillating upward.

Bullish Scenario: If spot ETFs are approved or enter a clear effective window around Q4, combined with the regular issuance of RWA (not just individual MMFs, but more government bonds/bills/fund products), then the three elements of SOL's "capital gate, sustainable cash flow, and network resilience" will be simultaneously strengthened, and the price is expected to show a trend upward, potentially breaking previous highs.

Bearish Scenario: If ETFs are delayed or denied again, if meme/launchpad activities significantly recede, or if other main chains introduce innovative functions or hot topics, it may trigger a loosening of valuation anchors and a collapse of trading beta; if combined with macro tightening or significant fee reductions on Ethereum mainnet/L2, SOL will enter a "high volatility downward—weak rebound" structure.

Conclusion

Solana has experienced a rollercoaster of popularity in 2025. From the dazzling heights of the meme frenzy at the beginning of the year to a relatively subdued position facing ETH's aggressive pressure mid-year, the market's positioning of Solana has fluctuated multiple times. However, it is certain that the unique value of Solana as a high-performance public chain remains prominent, and its ecosystem has not stagnated due to a temporary cooling. In the long run, whether Solana can lead again depends on its ability to convert its high-speed network advantages into sustained user value: retaining users after the speculative tide recedes and expanding broader application boundaries; also winning mainstream capital trust and sharing in the compliance process. Fortunately, we are already seeing signs: whether through institutional layouts, technological upgrades, or ecological narrative transformations, Solana is building momentum. Perhaps the current pullback is more like a buildup of strength, waiting for the right moment to take off again.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. Through "Weekly Insights" and "In-depth Reports," we analyze market trends for you; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening), we help you identify potential assets and reduce trial-and-error costs. Each week, our researchers also engage with you through live broadcasts, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize value opportunities in Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investment itself carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

[Mail: labs@hotcoin.com](mailto:Mail: labs@hotcoin.com)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。