根据路透社报道,中国正考虑首次允许发行人民币背书的稳定币,这一举措标志着中国对数字资产态度的重大转变。此举可能成为北京实现人民币国际化、将其提升为真正全球货币的重要一步。

战略政策转变

据消息人士透露,中国国务院预计将于本月晚些时候审议并可能批准一份路线图,明确人民币在国际市场中作用扩大的具体步骤。该路线图将设定明确的采用目标,分配监管机构的职责,并包括风险防范措施。此外,中国高层领导人计划召开一次关于人民币国际化及稳定币的专题会议,预计将发布指导意见,塑造稳定币在商业和贸易中的发展和应用。

从加密货币禁令到拥抱稳定币

这一潜在政策与中国2021年对加密货币交易和挖矿的禁令形成鲜明对比。当时,中国出于对金融稳定的担忧全面禁止加密货币活动。然而,稳定币——一种与法定货币挂钩的数字代币——已成为全球金融的重要工具。目前,根据国际清算银行的数据,美元背书的稳定币占据全球供应量的99%以上。

如果中国实施这一政策,人民币背书的稳定币可能直接挑战美元在全球货币市场的主导地位,为人民币在全球货币格局中赢得一席之地。然而,分析人士指出,中国严格的资本管制仍是人民币稳定币广泛采用的主要障碍。

全球稳定币热潮

路透社报道指出,其他亚洲经济体也在积极布局稳定币。韩国已承诺允许韩元背书的稳定币,日本也在开发相关基础设施。与此同时,香港——中国管辖下的特别行政区——已于8月1日正式实施稳定币监管框架。消息人士透露,香港和上海将成为人民币稳定币推广的关键枢纽,预计将在本月晚些时候于天津召开的上海合作组织(SCO)峰会上讨论跨境使用事宜。

全球货币竞争的地缘政治背景

中国推动稳定币计划的时机恰逢与美国地缘政治紧张关系加剧。在美国,总统唐纳德·特朗普公开支持稳定币,并推动建立美元挂钩代币的监管框架。美国在稳定币领域的积极进展被视为中国加速自身稳定币战略的部分原因,以确保人民币在数字时代保持全球货币竞争力。

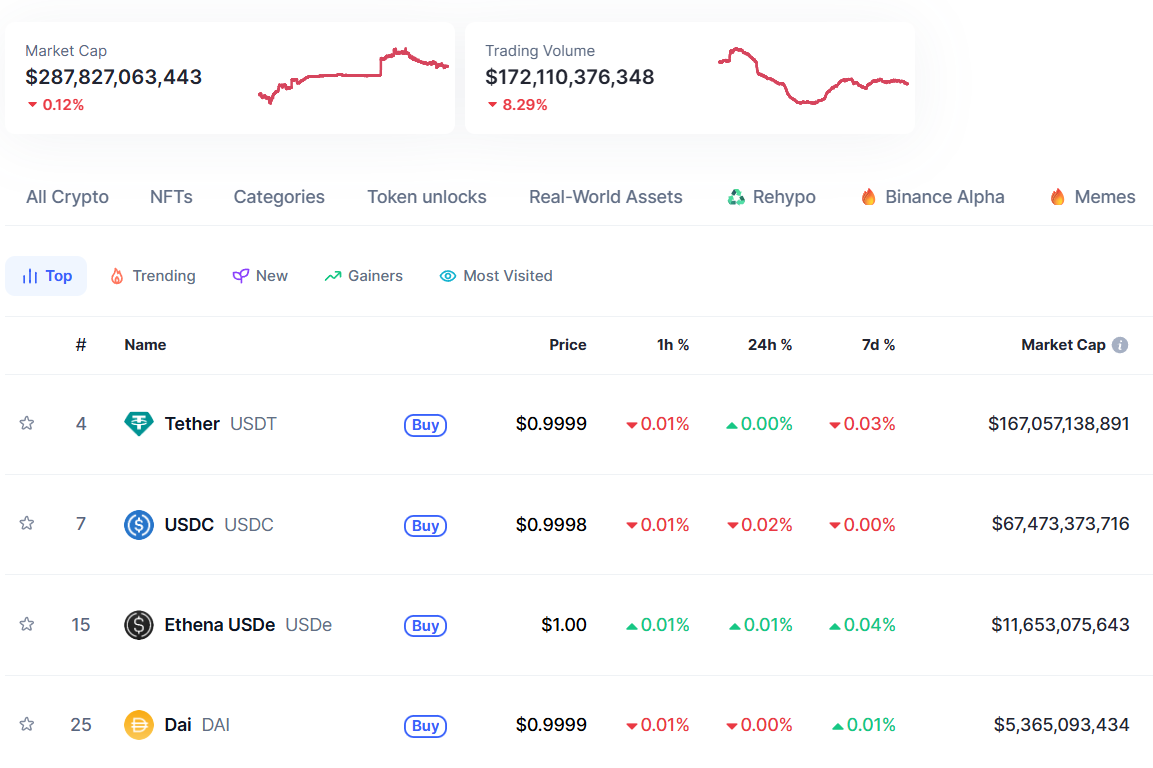

尽管当前稳定币市场规模相对较小,约为2870亿美元,但标准 chartered 预测,到2028年这一市场可能达到2万亿美元。如果北京推进人民币背书的稳定币计划,中国有望在这一增长中占据重要份额,同时推动人民币国际化的进程,加入全球货币竞争的赛道。

总结

中国从禁止加密货币到考虑允许人民币稳定币,显示出其在全球货币竞争中的战略雄心。尽管面临资本管制等挑战,人民币稳定币的推出可能为中国在数字金融领域开辟新局面,同时在与美元的全球货币角逐中占据更有利的位置。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。