Today's homework is still somewhat challenging. Since this morning, as the A-shares have risen, $BTC has started to decline, but the drop in the U.S. stock market is not significant. I checked a lot of data and did not find a clear reason for the decline. After all, the U.S. stock market and Bitcoin are still highly correlated. Unless there is a significant drop in the U.S. stock market, the correlation with the U.S. market should not be very strong. Even Buffett's recent reduction in Apple shares did not have a major impact on the U.S. stock market.

Since I did not see any actual negative sentiment, I not only did not exit my long position but also added to my holdings, increasing from the previous $117,300 to $116,000, because I believe the essence of the market has not changed. The three major indices in the U.S. stock market experienced only very slight fluctuations before the market closed, and Trump's main focus in the past two days has also been on the Russia-Ukraine conflict.

In simple terms, the core of today's talks is a realistic discussion on territorial concessions and security guarantees. The U.S. and Europe have made moderate suggestions, but it still requires Zelensky to bring back counter-offers domestically. The constitutional referendum issue is seen as something for Ukraine to handle. Security commitments are viewed as key by Europe, while the U.S. hopes to form a principled consensus and legislate to ensure effectiveness across administrations. The expected timeline is weeks rather than months. The overall goal is to demonstrate unity among the U.S., Europe, and Ukraine, and to leave a clear path for the next round of negotiations.

Moreover, although the Russia-Ukraine conflict is quite complex, it has not fundamentally affected the U.S. economy and inflation, or the market has already anticipated that a complete ceasefire in the Russia-Ukraine conflict may be difficult to achieve in the short term.

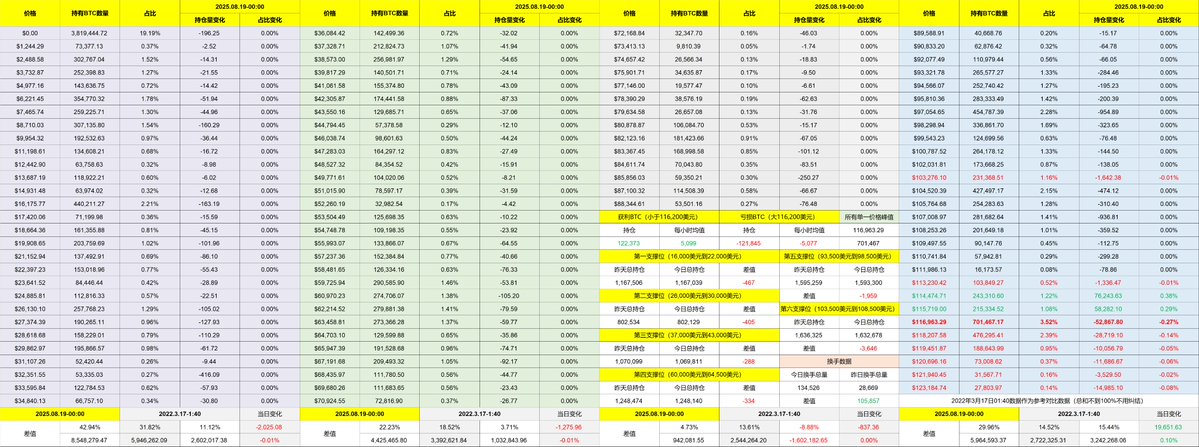

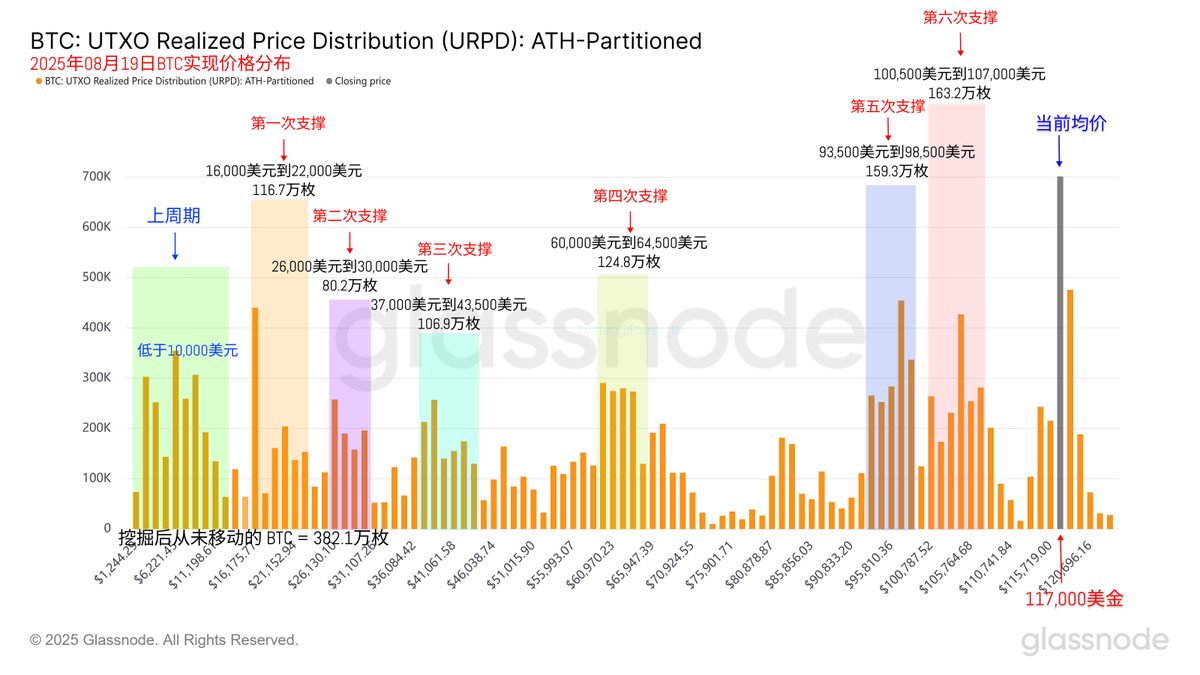

Looking back at Bitcoin's data, today's turnover rate is quite high, but the main trading is from investors who have been bottom-fishing in the past week. In contrast, earlier investors have not seen much change and are still maintaining a wait-and-see attitude. The trading volume for spot and ETFs is also not high, and there are no obvious signs of panic. Let's see if the market can self-correct in the next couple of days.

There's not much else to say. Although the price has dropped today, the support at $115,000 is still quite good. Investor consensus is gradually increasing, and the two main support levels have not been breached. A large number of investors continue to cluster around $117,000, making it likely that this position will form a new support level.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。