Today's homework isn't too difficult. The two days of the weekend have been like this; given the low liquidity, the $BTC volatility hasn't been too large, which is already good, indicating that investor sentiment remains quite stable. Politically, the focus is still on the Russia-Ukraine conflict. On Monday, Trump will meet with Zelensky. Although Trump claims to have made significant breakthroughs with Putin, as mentioned yesterday, it is still highly likely that this is under the premise of Ukraine ceding land.

Today, Bitcoin reached a high of around $118,500. However, considering that next week, aside from the Jackson Hole annual meeting on Friday, there aren't any major events, the market's focus remains on the game between Trump and Powell. Therefore, I haven't closed my long position; I'll hold on and see. In fact, closing today would have been relatively safe, but I got a bit greedy.

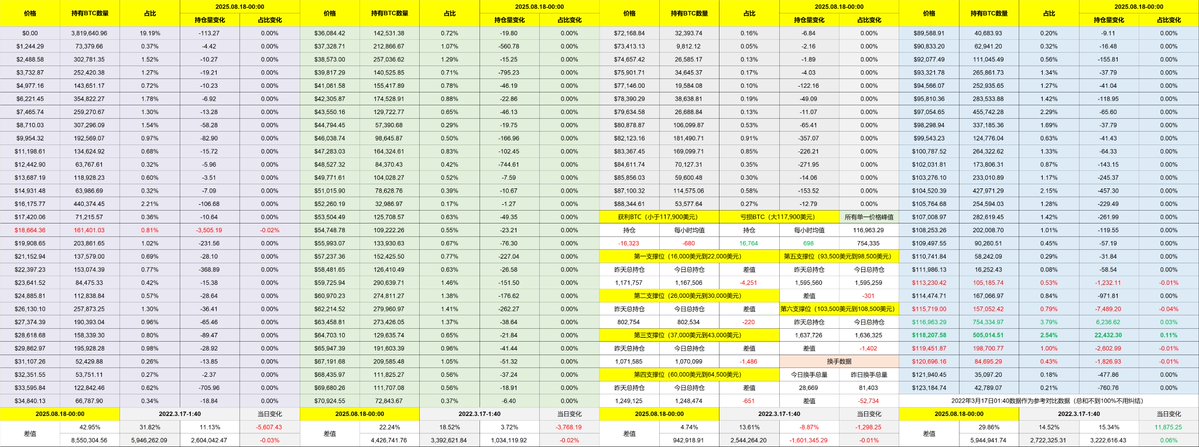

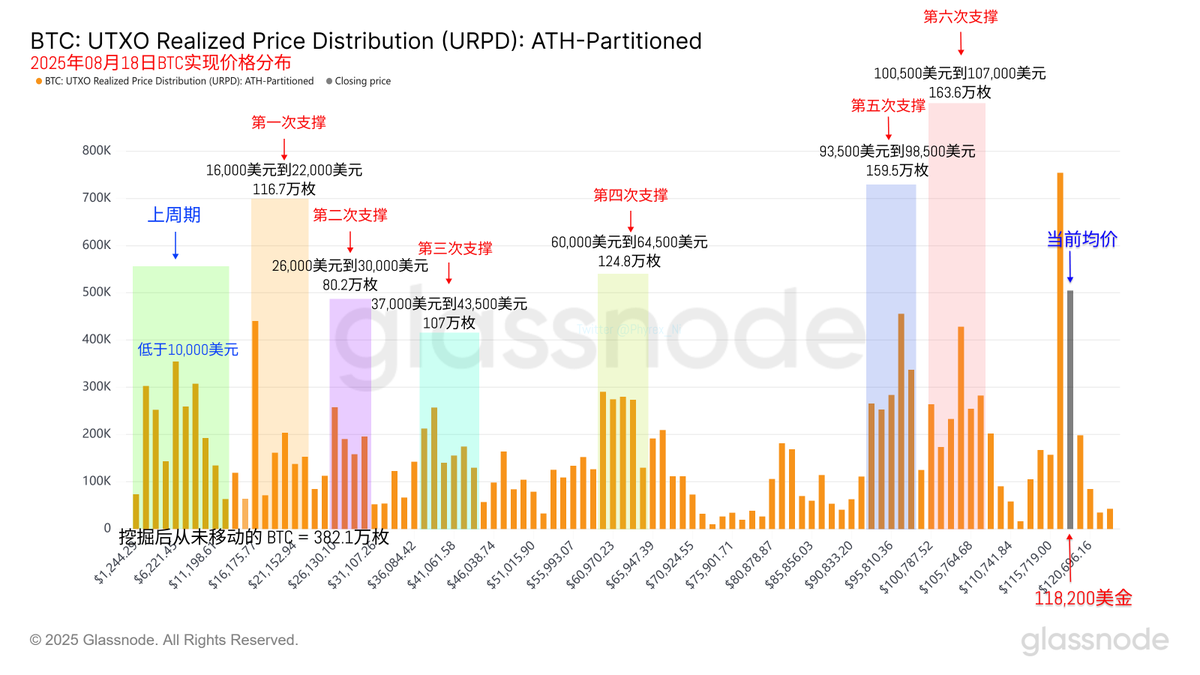

Looking back at Bitcoin's data, the turnover rate is shockingly low, which is typical during a bear market. This indicates that BTC investors have returned to the situation we previously discussed, where they are reducing sell-offs. This helps stabilize BTC prices. I haven't noticed any overly pessimistic situations before the Jackson Hole meeting.

There's not much else to report. Support is very stable, and there's no need to consider short-term fluctuations. Additionally, the positions at $117,000 have exceeded 750,000 coins, which looks fine for now. I still believe that even if the market is forced to choose a direction, it will likely be after Friday.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。