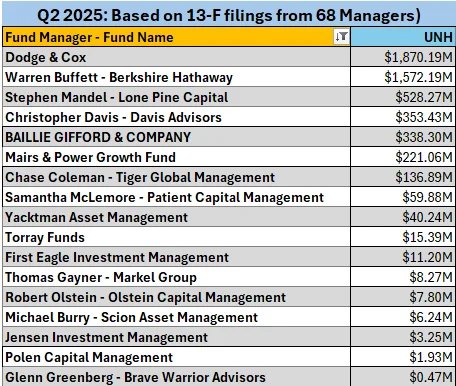

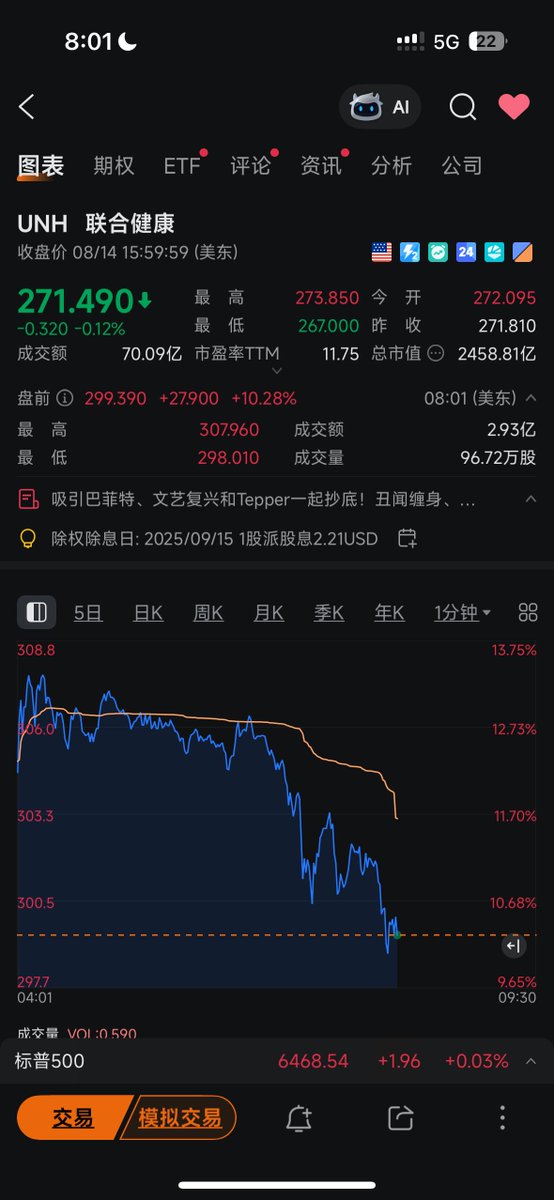

最近美股机构的13F报告集中披露,巴菲特公司伯克希尔,逆势抄底了联合健康(#UNH)深受瞩目,受此消息刺激,联合健康股价在今天盘前大涨10%,收回300美金以上。我决定今晚跟一手巴菲特的操作。🧐

今天在看美股机构13F报告时候,发现一个挺有意思的现象——市场大部分人避之不及,可巴菲特、David Tepper、文艺复兴、Michael Burry、沙特PIF这些大佬都在抄底。伯克希尔甚至是时隔14年重新杀回医疗保险板块,一口气买了504万股,价值15.7亿美元。

为什么我决定今晚跟一手呢?因为这帮老狐狸肯定不是为了短线博反弹,而是觉得这公司在被错杀。

📊先看 #UNH 基本面:

规模:美国最大医疗保险公司,2024年收入4003亿美元,净利润144亿美元,这规模在美股医疗板块里基本是“航空母舰”级别。

盈利能力:过去15年,分红每年都涨,而且盈利稳定——这是典型的“防御型现金牛”。

估值:现在的股价回到2020年的水平,市盈率只有12倍——这种龙头公司在正常市场环境下,保守预估20倍不算离谱。

我举个最直观的栗子🌰:

如果2003年底你花1万美元买了 #UNH,哪怕算上最近的暴跌,今天这笔钱大约还能变成10万美元,中途分红全程上调。要是暴跌前收益表现更佳,预估是18万美元。这种长期稳定复利能力,是真正的机构偏好标的。

📝#UNH 为什么暴跌?

这波下杀不是因为财务崩了,而是市场对风险的预期陡然升高:

1️⃣潜在刑事调查:司法部在查它,虽然公司说“充满信心”,但这种事一旦升级,可能影响合同、信誉。

2️⃣业绩指引暂停:7月公司直接取消年度业绩展望,还甩锅说“医疗需求激增导致环境突变”,这会让投资者觉得不确定性大增。

3️⃣高层变动:CEO Andrew Witty突然辞职(个人原因),临危换回老将Hemsley。换帅往往是风险信号,尤其是遇到监管风暴时。

4️⃣政策压力:美国政府削减医疗支出,医疗成本上涨,这对保险公司是双杀。

5️⃣网络安全和公众形象:网络攻击、CEO被枪杀这种黑天鹅事件,虽然和核心财务没直接关系,但对品牌和舆论压力不小。

我的抄底逻辑,其实很简单,首先肯定是这些大佬开始抄底了,给了我充足的信心支持。另外估值的确是便宜,虽然利空也不少,刑事调查、指引暂停、政策不确定性,这些事对股价冲击,已经实质性表现出来,也算消化的七七八八了,毕竟股价从600+跌下来的。

因为我个人是偏好价值长线投资,假如您跟我一样,是那种5年以上视野的价值投资者,这种时刻往往是布局的好机会。因为 #UNH 的基本盘——医疗保险的刚需性、行业龙头地位、庞大会员基础——没变。美国人口老龄化趋势还在,长期医疗需求只会更高。所以中长期来看,是相对确定性比较高的!

我觉得现在买 #UNH 有点像2008年买强生(#JNJ)——短期麻烦多、市场不爱,但长线可能是最甜的果子。跟随大佬们,用时间和耐心等市场情绪修复。🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。