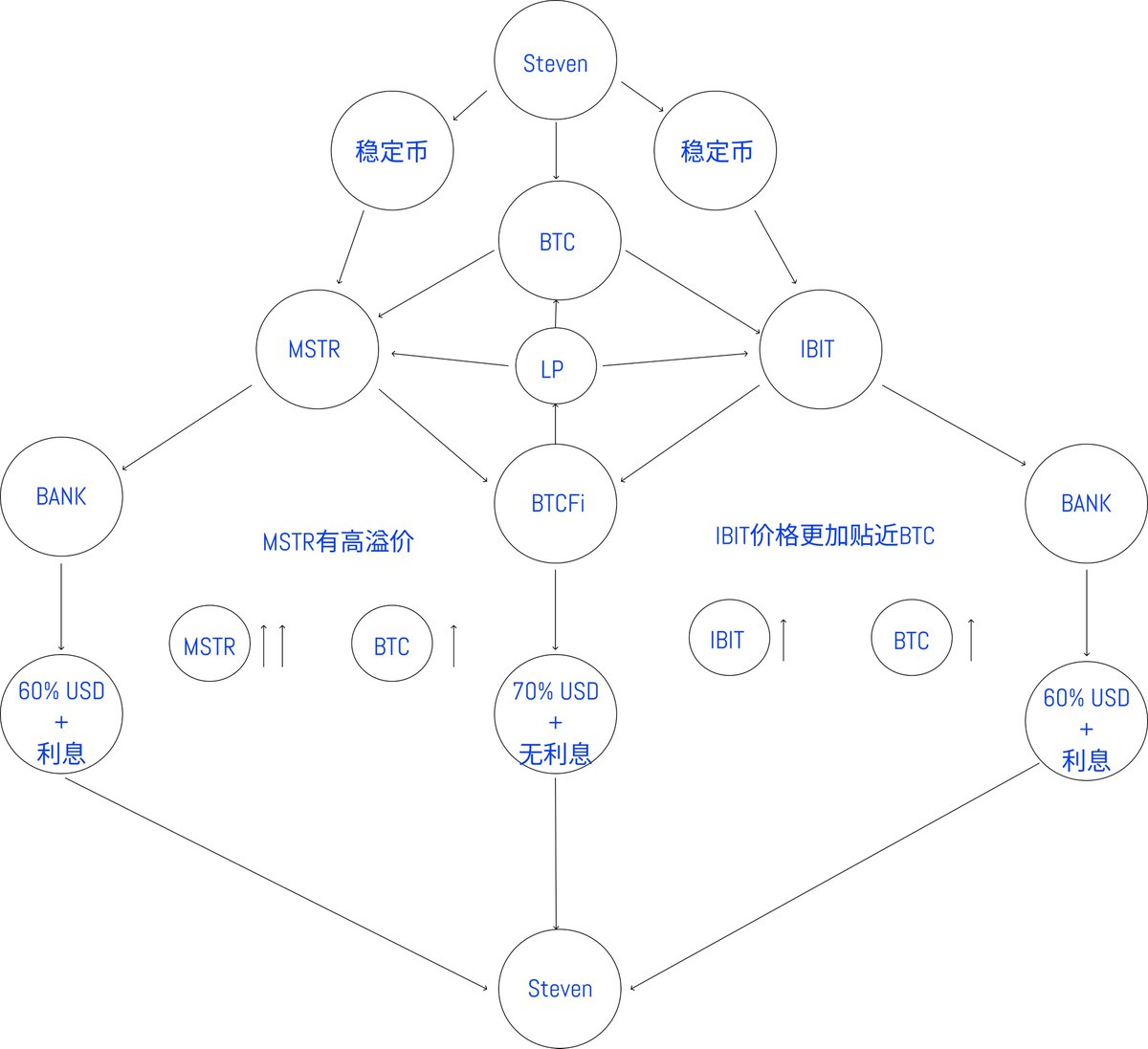

The term "on-chain broker" was coined by me. I wonder how many friends remember my plan for BTCFi at the beginning of the year. At that time, I had already been in contact with brokers and banks multiple times, and compliance in Singapore was already underway. It could be said that we were at the stage of taking action, but at this stage, one thing got stuck, and we couldn't continue to push forward, which is the issue raised by @TJ_Research01 about how to achieve risk hedging during non-U.S. stock trading hours.

Unfortunately, hedging is not possible. The only method I can think of, which many crypto stocks are currently using, is that I hold the positions myself. I buy first, and users come to me for settlement. I exchange tokens for securities on a one-to-one basis with users. Of course, there is a prerequisite: the holding amount must meet the standard; otherwise, it’s impossible to handle amounts of $18,000 or $8,000.

Even so, it still doesn't work because this essentially turns me into a broker. Under compliance, I can't even use a broker's license directly, and there is a fatal chain problem: if users only settle with me and cannot enjoy a premium, why would they buy from me?

In other words, users can only profit if they buy cheap tokens and then exchange them here for stocks or cash at the price of the underlying stock. However, during the time it takes to go through the process, the price may rise or fall, and no one can say for sure.

This is problem one. There is also problem two: who will provide liquidity? Since it is on-chain, liquidity cannot be provided using the AMM method because using AMM would not be able to correct the price of tokens to match the price of the underlying stock. If the prices do not align, it will be very difficult for me as a platform to make a profit, and I certainly can't operate it manually.

For price correction, I had a design plan at that time, which was that the price at the first second of the opening time and the last second of the closing time each day must match the underlying stock. This is somewhat similar to the opening and closing of CME, but this is definitely not something that AMM + oracle can achieve; it would require market makers. However, the problem is how I can reach an agreement with market makers, which I also cannot solve.

As for the 20x leverage mentioned by @TJ_Research01, please spare me. Almost all crypto stocks that dare to use leverage are betting against the platform and users because it is impossible to borrow money. If a madman actually bets $10 million at 20x leverage and wins, how would you compensate?

So being able to do spot trading is already quite good. I don't have a great solution for 24/7 spot trading; the only thing I can think of is centralized matching, where users do their own matching and bidding. At most, I can organize a market maker to absorb the bottom, but it has to be a target I believe in because the target is mine, so I can achieve T+1. No other user can do that.

I can't find a decentralized approach; the only thing I can think of is to connect with Nasdaq's market makers for pre-market and after-hours trading, and manage the profits and losses in between myself, with the liquidity pool and depth connected to Nasdaq. Other than that, I have no other options.

It's a pity for my #BTCFi, so I wanted to see if the on-chain broker could find a way out, which is just my personal speculation.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。