After Ethena ignited the combination of stablecoins + CeDeFi, the market once again realized: the CeDeFi Vault is not just a treasury, but also a mint.

Ethena has established a closed loop for stablecoin generation, yield extraction, and liquidity reuse through the arbitrage logic of USDe + sUSDe + Perp, with the Vault being the core structure of this entire on-chain alchemy. Recently, ENA has become extremely popular, with some jokingly saying, "If you don't understand Ethena Vault, don't call yourself a DeFi veteran."

CeDeFi Vault: Treasury, also an Engine

CeDeFi is essentially a hybrid of "centralized asset management + on-chain strategy execution." The Vault is the engine that builds credit for CeDeFi projects, designs yield distribution mechanisms, and ultimately guides the flow of funds. Ethena started from the Vault and later expanded into trading, pegging mechanisms, and other supporting functions.

In contrast, Orderly's path began with a DEX focused on deep liquidity and evolved into Omnivault after integrating with Ceffu, forming its own CeDeFi model. This has led both to gradually "reach the same destination through different paths": one builds a treasury and then a DEX, while the other establishes a DEX and then returns to build a treasury.

After Omnivault integrated with Ceffu, the biggest change is that its asset custody structure is closer to Ethena. Previously, most on-chain Vaults could only use on-chain assets and could not effectively utilize centralized liquidity pools. The integration with Ceffu essentially adds an "off-chain funding bridge" and a "centralized clearing insurance system" to Orderly's Vault, making its operational model more akin to a CEX + DeFi hybrid.

In simple terms, the Omnivault integrated with Ceffu is somewhat like an "ETHENA Pro" version—emphasizing both yield maximization and stability balance, with arbitrage strategies as a safety net, backed by centralized service guarantees for asset security.

Resilience Test of the Vault

From a risk perspective, the core challenge of the CeDeFi Vault remains the robustness of the "asset pegging mechanism + automatic liquidation system." If USDe experiences severe decoupling (for example, due to off-chain hedge account liquidation or delayed liquidation mechanisms), the overall health of the Vault will deteriorate rapidly.

After Orderly integrated with Ceffu, theoretically, its liquidation capability is stronger, but it also relies more on centralized execution layers. If there are black swan events such as centralized node failures, Ceffu withdrawing funds, or regulatory interventions, the Vault may face the risk of "apparent on-chain security, but in reality, funds are locked."

User Perspective: Retail vs. Institutions, Differences in Understanding the Vault

Retail investors look at the Vault more in terms of APY and whether it guarantees capital preservation; while institutions focus on leverage space, liquidation logic, and whether multi-strategy combinations are compatible.

Both Ethena and Orderly are gradually adapting to these two types of users: the former attracts low-risk preference users through sUSDe while guiding advanced users to participate in LP or holdings; the latter has already prepared institutional order book support at the DEX level, and now the construction of the Vault also carries a more professional trading service connotation.

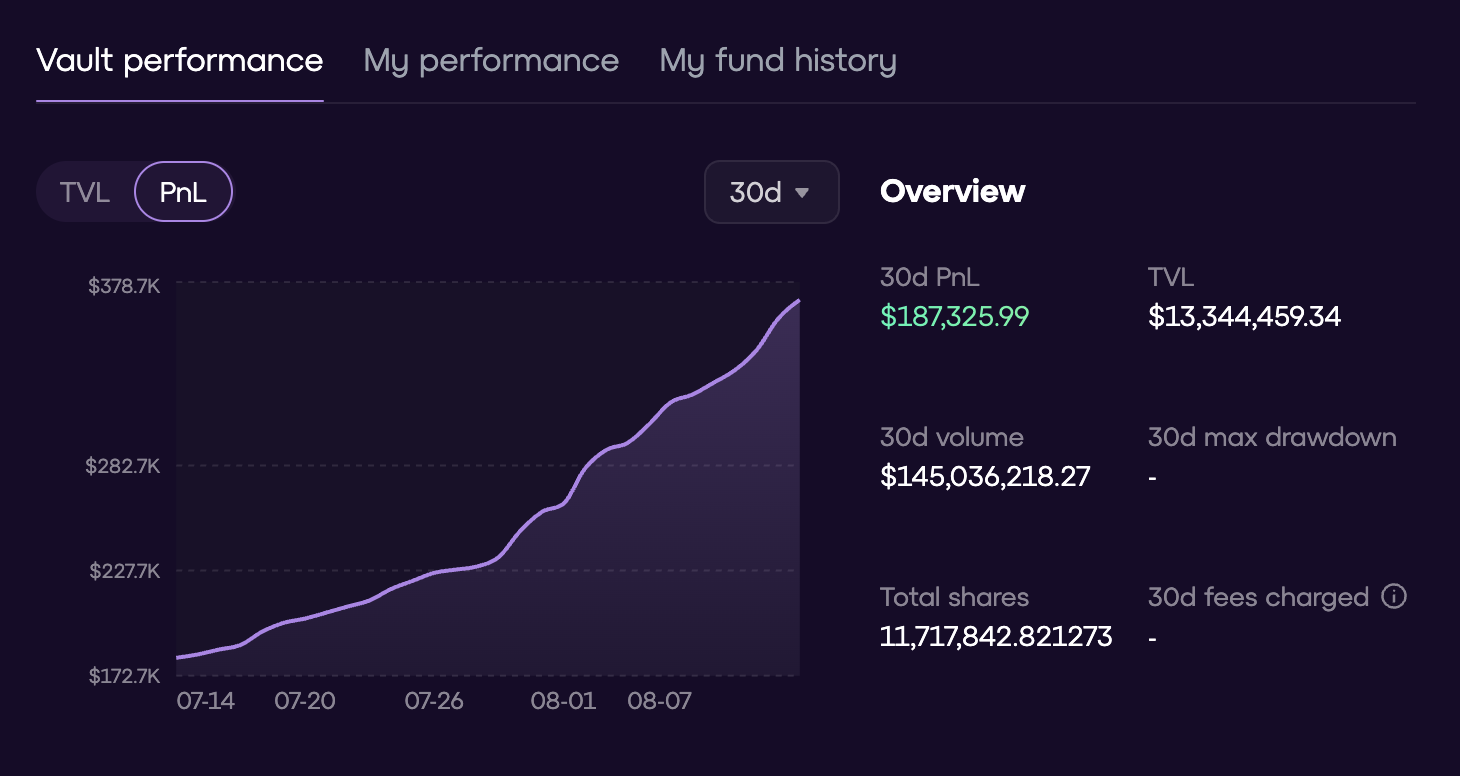

One focuses on "stable returns + simple strategies"; the other on "underlying trading + custody optimization." With different goals, both ultimately aim to capture a larger TVL in the funding puzzle of CeDeFi.

Future Prediction: Will the Next Generation of Vaults be Modular + AI Strategies?

Current Vaults are mostly closed strategy boxes, where users can only choose to "participate" or "exit." However, the next generation of Vaults is likely to be more modular:

- Users can select strategy modules (arbitrage, staking, market making)

- Risk parameters can be visually adjusted (stop-loss thresholds, leverage ratios)

- Introduce AI for real-time strategy adjustments, responding to market dynamics

- Multi-chain shared credit (one Vault, deployed across multiple chains)

CeDeFi is essentially a game of efficiency and trust, and the Vault is the core chip in this game. In the future, the Vault will evolve from a "yield tool" to a "fund allocation platform."

Evolution of Orderly's Vision Speculation: Could it be Stablecoins?

Currently, Orderly's omni Vault primarily focuses on reusing on-chain assets and strategy integration. However, as TVL grows and the integration with Ceffu deepens, it may follow the "reverse path of Ethena": first creating DEX + Vault, then launching stablecoin products to form a more complete asset closed loop.

Everything depends on the scale of the Vault and the maturity of the strategies—if the Vault can provide sufficiently strong yield stability, then "issuing a token linked to Vault yields" would be a natural progression.

After all, creating a Vault is for attracting capital, while creating stablecoins is "minting."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。