在过去三、四年里,加密世界的热点像跑马灯一样切换:以太坊合并点燃了 LSD 赛道,空投积分把所有人拉进了「刷榜」狂潮,如今轮到稳定币收益成为新的焦点。热闹是常态,但在每一次声音退去之后,总能看到 Pendle 站在舞台中央——不喧嚣,却稳稳负责把幕后管道铺得更宽、更深。

如果说 2023 年的 LSD 热主要靠 Lido 做流动性、Rocket Pool 做去中心化,那支撑收益拆分和定价的,就只有 Pendle;如果说 2024 年玩空投的人靠 Excel 记积分、靠推特比手速,那用 YT 把「未来收益」直接明码标价的,还是 Pendle;到了 2025 年,稳定币市值节节攀升,收益型美元统治叙事,最大的二级交易场依旧是 Pendle。三段行情,一条脉络——谁掌握了链上利率的「拆装」方法,谁就能在下一轮叙事里提前占位。

从 USDT 到 PT:稳定币 + 固定收益双引擎

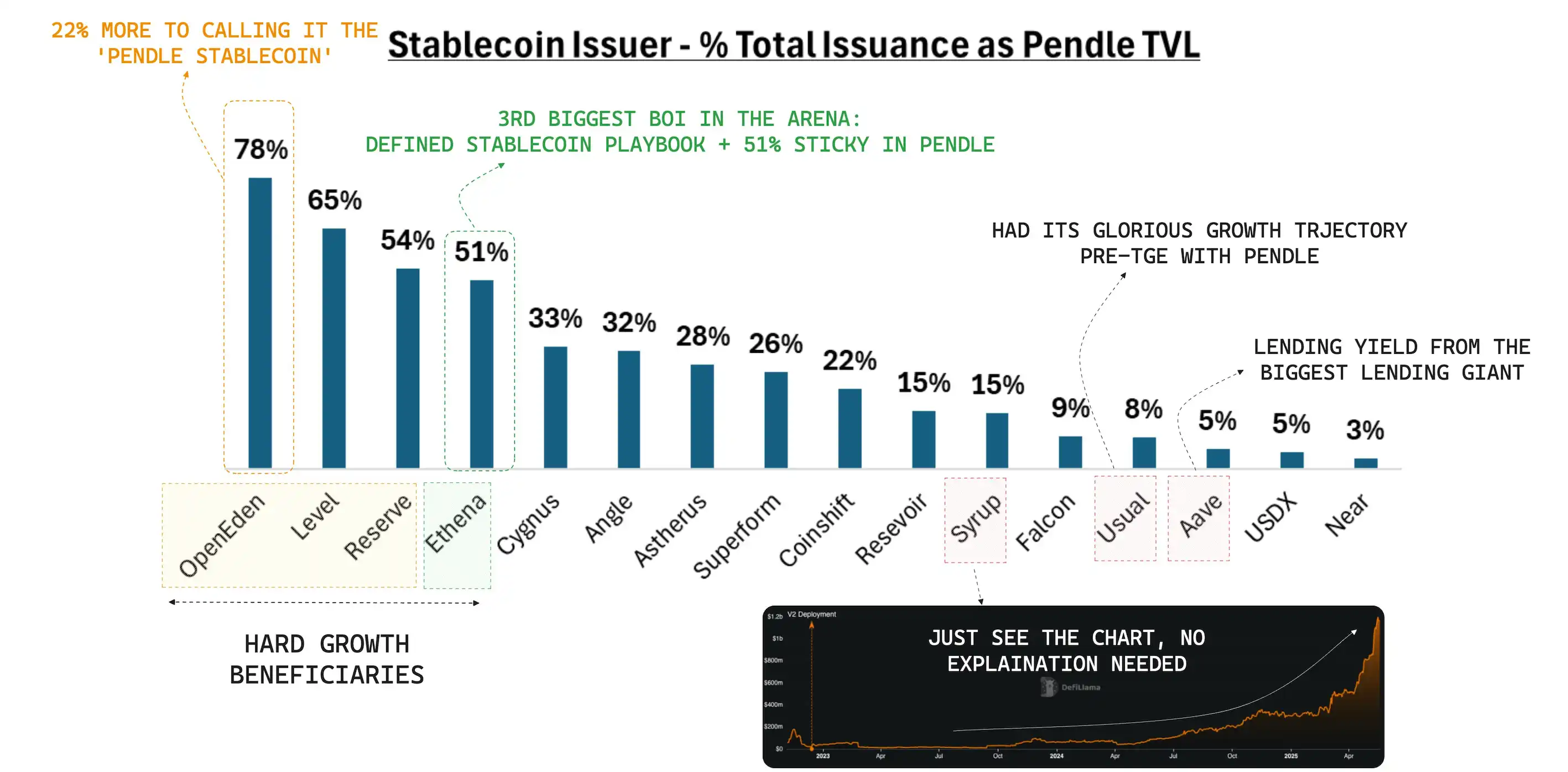

现在行业里讨论稳定币,嘴里蹦出的不仅仅只是 USDT、USDC 这些「老钱」,而是 USDe、cUSD0、LevelUSD 这一票带收益的新面孔。数据很直白:过去一个月,Pendle 的 TVL 进入二挡加速:8 月 9 日创下 82 亿历史新高,8 月 13 日进一步接近 90 亿。更关键的是资金「回流力道」——Aave 在本周「悄悄」把 PT-USDe(Sep 2025)头寸上限再抬高 6 亿美元,且 不到 1 小时就被填满,显示机构与鲸鱼对 PT 的需求不仅没被分流,反而更强了。

很多人还把 Pendle 记成「空投积分乐园」,其实人家早就换了赛道。PT/YT 的命名从今年 6 月开始换成了更易懂的格式,前端把「1 PT 到期兑回本金,1 YT 累积全部收益」的话写得明明白白,新手不用求助 Telegram 群也能看懂。后台还加了每日提示,仓位动了多少、收益到手多少,打开网页后弹窗就会告诉你。

Tradfi 方面,Citadels 与 Edge Capital 的合作。这家四亿美元规模的对冲基金,它把 mEDGE 策略库打包成 PT 直接丢进 Pendle,目前 mEDGE 的 TVL 已经超过千万美元;另一边,Spark 的稳定币 USDS 24 小时流入过亿,光是 Spark 的 25 倍积分就把一票羊毛党吸进来,Pendle 上的 USDS TVL 一路冲到两亿多。配套的借贷市场同样给力,Aave 里流通的 PT 总额已经突破数十亿美元——固定收益真的开始「变成钱」了。

PT 为何更「抗行情」:以 Liquid Leverage 活动为例

7 月 29 日,Ethena 把 Liquid Leverage 推上 Aave:用户 50% USDe + 50% sUSDe 做抵押,叠加借贷利率与促销奖励,是一条更「市场化」的收益路线。上线当天市场的确在讨论「会不会挤压 PT」?现实结果是:Aave 的 PT-USDe 限额上调立刻被抢完,而 Liquid Leverage 的收益结构里,一部分来自 ENA 生态的奖励,对行情与活动强度更敏感;相对地,PT 的回报由折价锁定,波动敞口更小。换句话说:LL 像是「运动饮料」,PT 更像「白开水 + 定存折」——前者在活动期很猛,后者在活动退潮后更稳。

Citadels:把 DeFi 固收做成帝国

简单理解,Citadels 就是 Pendle 的「走出去」计划:一手拉传统资本,一手插足新公链。合规、KYC、RWA、Solana、TON……听上去可能不好理解,核心逻辑却很简单:把 PT/YT 这套利率拼图搬去更多环境,让任何能产出收益的标的都能在 Pendle 上找到价格。如果说过去的 Pendle 像个支线任务满满的副本,那 Citadels 就是要把主城建成金融帝国,谁想发稳定币、想做 RWA、想搞资金费率对冲,都得先来这里挂个牌。

机构化 PT 与跨链 PT:下一步怎么走

Pendle 的 Citadels 不是「改名字的官网页」,而是三条真实的分发通道:

(1)非 EVM PT 出海:把 PT 一键带到 Solana / TON / HYPE 等高速生态,扩大可触达的用户与资产池;

(2)KYC 合规 PT:面向机构的钱包与券商接口,把链上固定收益打包成「可合规持有」的资产;

(3)策略方直连:如 Edge Capital 的 mEDGE 已把策略库直接铸成 PT 在 Pendle 分发,给到「机构策略 × DeFi 固收」的桥。简单说:一个 PT,两条腿走路(跨链 & 机构),把「利率拼图」摆到更多市场前端。

为什么是 Pencosystem?

Pencosystem:拆开利率后发生了什么

对协议方来说,Pendle 从来都不是一个「把收益做成代币就完事」的工具,而是一台能把 TVL、流动性、市场信号同步放大的发动机。池子一旦挂上,单边做市 + 零 IL 直接把 LP 留住;PT 的折价、YT 的溢价,又等同于一块 24 小时亮着的价格发现仪表盘,让团队能实时读到外部资金的温度。EtherFi 就是最典型的案例——eETH 上线 Pendle 不到半年,协议 TVL 暴涨 15 倍;LevelUSD 两个月里供应量翻了 2.3 倍;原本停滞的 OpenEden 也在挂池后一个月增速 45%。一句话:Pendle 赢,底层协议跟着赢。

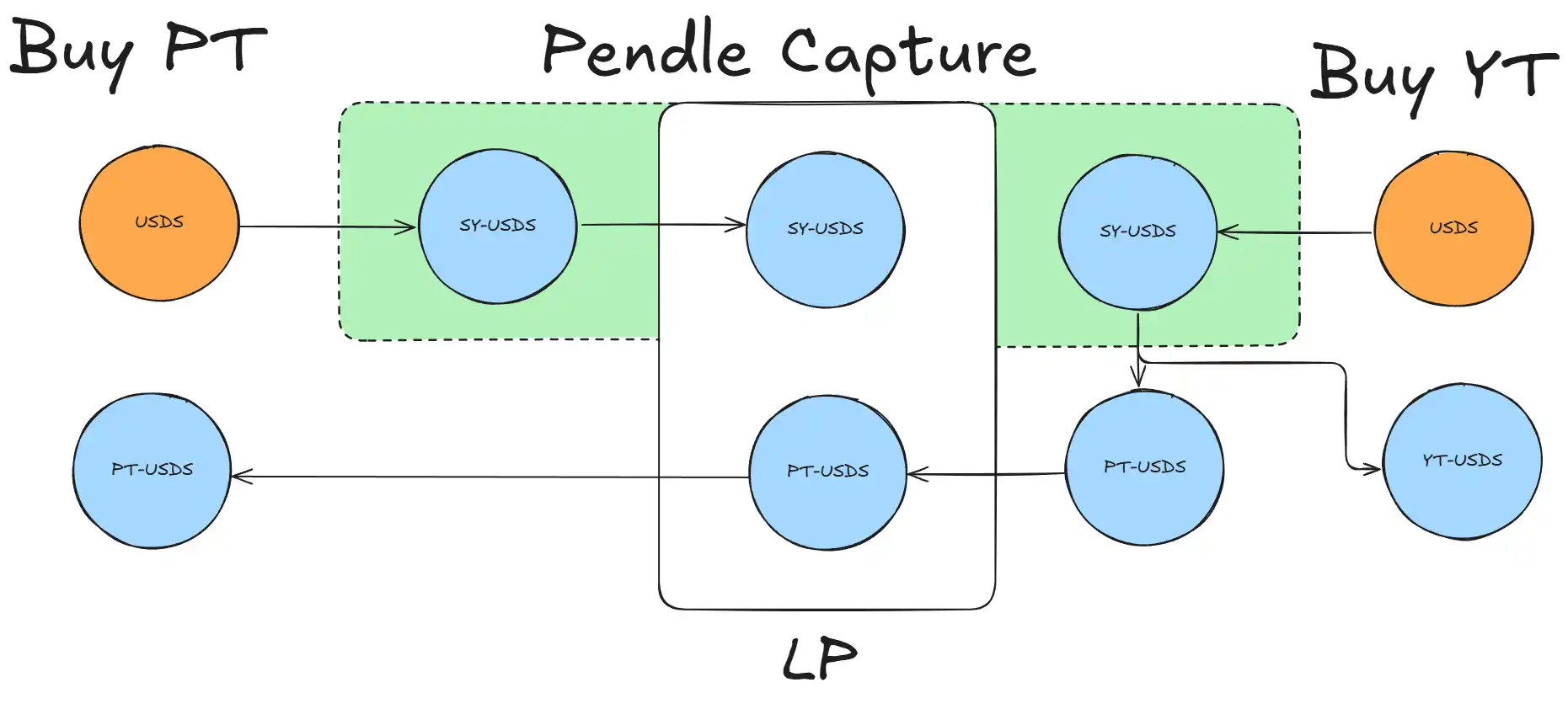

Pendle 的魔法其实不复杂:把一块会生息的资产切成固定收益和浮动收益两半。PT 像是一年期美元债,躺到期稳拿 3‑12% APY;YT 就像利率互换加期权,要赌空投、赌美联储、赌资金费率,全靠它。拆完之后,市场自己把价差压平——PT 打折越狠,意味着锁定收益越香;YT 溢价越高,说明大家觉得未来还会有红包雨。

别小看这种拆分,它让 LP 只需要押单边就能赚手续费,无常损失几乎可以忽略,还能拿拆分出来的 PT 去 Aave 循环套杠杆。大户们常用三到五倍杠杆把稳健 APY 提升到 25‑30%,在链上账本里全程公开,真实到连投行分析师都能复现 Excel 模板。

从 2023 年底到现在,Pendle 吃过 27 次大额到期事件,其中 7 次单次到期规模过十亿。去年六月最大的一次赎回 38 亿美元,链上照样「秒清」;最近 5 月 29 日又到期 16 亿,峰值 TVL 从 47.9 亿掉到 42.3 亿,一周就弹回 44.5 亿,留存率稳在 93%。钱可不是凭空回来——有 35% 的到期资金直接滚去新的 Pendle 池子,这是历史最好的七日留存纪录。

稳定币的 Launchpad

稳定币是 Pendle 故事里最直接、也最吃红利的主角。PT 把 3–12% 的固定年化写进链上合约,YT 则把未来利率、空投积分、资金费率的「悬念」一次性打包给投机者——结果就是,新美元一登场就自带两条产品线:稳健票息 + 高波动押注。

数据最有说服力:USDe 在 10 亿 TVL 之前有一半锁在 Pendle,走到近 60 亿仍维持 40% 占比;cUSD0 原地踏步三周,上 Pendle 一个月增速 45%;最新的 USDS 仅 24 小时就吸进 1 亿美元。流动性留存同样亮眼:5 月 29 日那波 16 亿美元到期洪峰里,USDe 相关 TVL 只掉 6%,四天后便补回。对任何稳定币来说,没有什么比「洪峰过后资金依旧原路返回」更能打动机构的钱包了。

过去一年,任何一家收益型稳定币想提升 TVL,白皮书里都会把「Pendle Pool」写进启动章节。LevelUSD 两个半月把供应量翻了两倍多,背后是 Pendle 池子流动性跟着一起水涨船高;OpenEden cUSD0 原本增速停滞,上 Pendle 不到一个月直线拉 45%。谁想发新美元,先把价格发现和早期流动性扔给 Pendle 已经成了默认剧本。

如果把镜头再拉远一点,稳定币本身也走在一次结构性扩容的大趋势里。据 Modular Capital 在《Pendle:Era of Stablecoin Expansion》中的统计,全球稳定币供应已冲破 2,500 亿美元,而收益型稳定币在短短十八个月里从不到 15 亿提到 110 亿,占比从 1% 抬到 4.5%。同一份报告还做了情景测算:在《GENIUS Act》法案落地、美联储维持相对高利率的背景下,未来 18–24 个月稳定币规模有望再翻一倍到 5000 亿美元;其中 15% 或 750 亿美元会流向收益型产品。

如果 Pendle 能把现在大约 30% 的市占维持成「稳定份额」,那就意味着它的 TVL 有机会涨到 200 亿美元,照 100bp 费率算年化收入上看 2 亿美元——正如 Modular Capital 的结论:在 DeFi 固收这条赛道里,Pendle 很可能享受 "美国国债 + 纳斯达克成长股" 的双估值锚。

PT 正在长成一条经济带

今天的 Pendle TVL 有百分之八十以上是美元资产,牛熊都吃得下。固定 APY 从当初喧嚣的 80‑120% 降到如今 3‑12%,听着没那么刺激,却更像一个成熟债市。PT 在 Aave、Morpho、Euler 三大货币市场的流通量半年翻了一倍,突破二十亿。与此同时,越来越多 LP 开始把到期 LP 直接滚去下一期,新 TVL 反而「灌」得更快。

把 7 月 29 日之后的市场变动放进来复盘,PT 的年化在多数时段仍显著跑赢「单靠借贷挤点息差」的抵押品组合,原因有二:其一,PT 的「票息」由折价锁定,不受借贷侧资金面与促销强度的直接影响;其二,PT 可在 Aave 等货币市场做抵押循环,形成「固定票息 × 杠杆」的复合收益,资本效率并不输传统抵押物。Aave 社区风控报告也显示,PT 作为抵押的供给在一个多月内跃升至数十亿美元,需求韧性可见一斑。

利率时代刚刚开始

空投积分能让行情短暂起飞,但真正能吸住大资金的,永远是「收益确定、流动性充足、衍生品齐全」。传统金融有 600 万亿美元的利率衍生品覆盖率,DeFi 相比之下还差得太多,更别说行业内真正被交易的收益不到三个百分点。Pendle 这三年做的事,就是把那 97% 的空白慢慢填上。

Pendle 的崛起证明了两件事:链上完全可以安全结算亿级本金到期,也可以在市场冷却时保持资金黏性;更重要的是,它把利率这条价值链从「项目方闭门定价」推到链上公开竞价,优胜劣汰由市场说话。接下来,只要有收益,就会有人做 PT/YT,只要有人拆收益,就很难离开 Pendle。空投季和山寨季或许会过去,但利率市场才刚开盘,坐稳,电影才放到一半。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。