📌 #Binance HODLer Airdrop Project Phase 31 – Succinct (PROVE) Investment Mining and Price Analysis——

And why I have been continuously investing in #BNB | Seeking progress in stability!

The recent Binance HODLer airdrops have been almost non-stop; the feeling of $BNB rising while earning returns is very comfortable!

Especially with the recent rise of $BTC and $ETH, everyone is analyzing whether Altcoins will take off next. According to convention, generally before Altcoins take off, it’s the brokerage stocks, which means platform tokens lead the way;

Yesterday, everyone felt the excitement with OKB, and now BNB has broken through 850. I think reaching 1000 is just a matter of time; during a bull market, it’s worth paying more attention!

In another research report, I saw some data on BNB that I’d like to share:

By 2025, $BNB will continue to firmly hold the title of king of exchange platform tokens. I think it can be described in four words: Seeking progress in stability!

As the core asset of the Binance platform and the native token of BNB Chain, this "dual role" makes BNB unique among all platform tokens, combining market leadership and long-term practical value, step by step, with a market cap reaching 105 billion USD;

What I like is its stability:

After reaching an all-time high at the end of July, $BNB has maintained a steady trend, with only a 6% pullback, far better than other cryptocurrencies. BNB is also ranked among the top five global crypto assets, making it the most trusted and valuable long-term choice among exchange platform tokens.

My investment style is:

Hold onto an asset I recognize and then wait! Many people know that I bought a lot of BNB around 200 during the bear market, and then it was a three-year process of both eating and holding, which was really comfortable!

That said, let’s get back to the main topic of this issue: BNB's feeding—HODLer Airdrop Project Phase 31——

This time it’s a pretty hardcore infrastructure project—Succinct @SuccinctLabs $PROVE

Its positioning is to create a "foundation layer for ZK computing." If you’ve heard of zkVM, zero-knowledge proofs, or cross-chain bridges, you might feel it’s far from you;

But in fact, many on-chain projects may use its services in the future.

Below, I will provide some interpretations and price analysis——

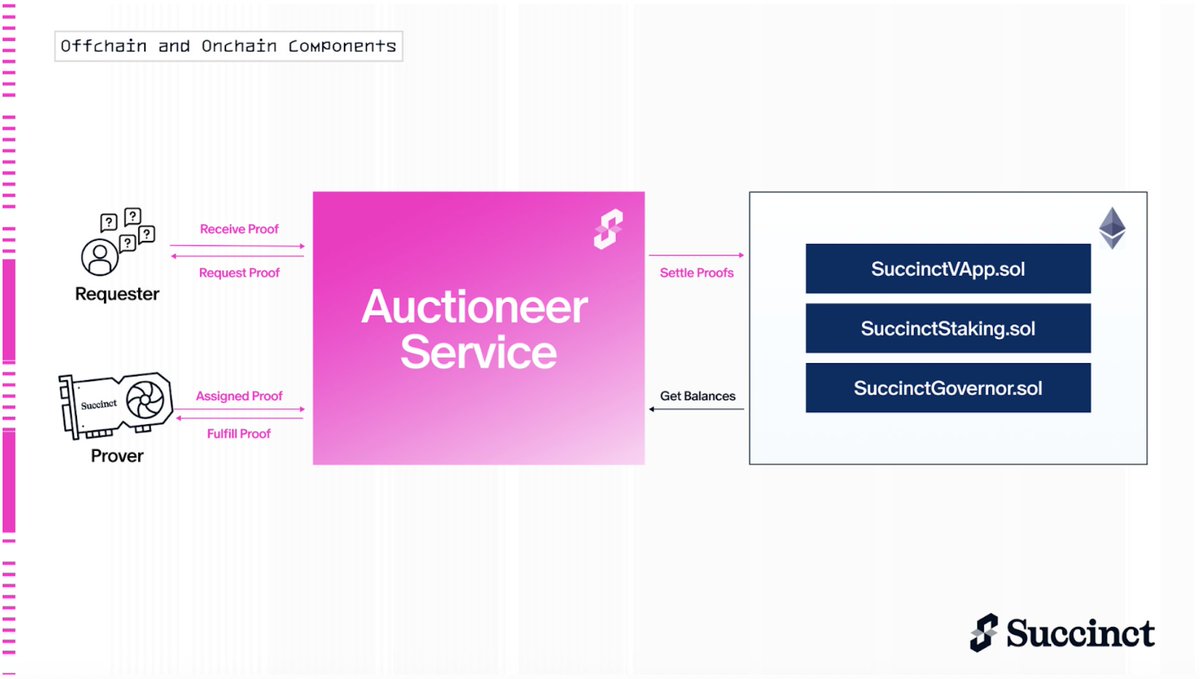

1️⃣ Project Positioning: General zkVM + Decentralized Prover Network

In simple terms, Succinct aims to be an "Amazon Cloud for ZK computing," allowing developers to request zero-knowledge proofs through its SP1 zkVM without needing to understand complex cryptography or set up hardware, with the help of globally distributed Prover nodes to complete the calculations.

It will simultaneously possess the following points:

1) Generality: Supports common languages like Rust / C++, with much stronger scalability than traditional custom circuits;

2) Decentralized Market: Anyone can provide computing power, generate proofs, and earn PROVE rewards;

3) High Performance: Performance on FPGA is 20 times better than traditional CPUs, and it will evolve towards ASIC in the future.

Its goal is to make ZK proofs as simple as calling an API, turning verifiable computing into a "standard feature" of Web3.

2️⃣ Token Mechanism: Payment, Staking, Security, Governance in One

Total Supply: 1 billion tokens

Initial Circulation: 195 million tokens (19.5%)

Airdrop: 2% allocated to Binance HODLers

Token Uses:

Payment Fees: Developers use PROVE to pay for proof generation costs;

Staking Guarantee: Prover nodes stake tokens to participate in bidding, with penalties for malicious actions or timeouts;

Governance Participation: Staked tokens can gain governance rights to vote on protocol parameters, upgrades, etc.;

Economic Incentives: Successfully generating proofs can earn rewards, and delegators can also share profits.

This model is somewhat like "ZK version of Ethereum Gas + PoS," binding usage scenarios and directly linking to network security.

3️⃣ Ecological Progress: Many applications have already been implemented

Partners: Leading projects like Polygon, Celestia, Lido, Mantle, Avail, Taiko are already using its proof services in production environments;

Developer Activity: Rust SDK downloads exceed 170,000, GitHub Stars over 1400, and over 5 million ZK proofs processed during the testnet phase;

Commercialization: Within a few days of launch, it generated $250,000 in USDC revenue, with an annualized ARR of about $2.5 million.

These data indicate that Succinct has moved from "technical demonstration" to a stage of "real customers and revenue."

4️⃣ Market Performance and Strategy——

$PROVE has already made it onto a "home run" level of exchange lineup:

Binance, OKX, Coinbase, Bybit, KuCoin are all included.

Current Price: Approximately $1.5;

Market Cap / Circulation: Circulating market cap around $300 million, FDV about $1.5 billion, circulation ratio 19.5%;

Trading Volume: 24h trading volume exceeds $100 million, with high activity in the Upbit Korean market;

On-chain Data:

Exchange token inventory has decreased by 34%, indicating that some chips have shifted to staking or long-term holding; institutional buying power is evident, with several funds building positions.

Holding Suggestions——

Short-term: Newly launched airdrop projects will experience significant early volatility, especially before the claim period ends (by 9/2), with alternating selling pressure and accumulation.

Mid-term: Pay attention to network activity, more partner integrations, and changes in staking volume; if ecological growth stabilizes, it may form a price support range.

Long-term: If you are optimistic about ZK as a foundational layer for Web3, PROVE will be a representative asset of early infrastructure.

5️⃣ Summary——

Succinct is building the foundational layer for ZK computing——

Making zero-knowledge proofs as simple as APIs. If this narrative succeeds, PROVE could become the "underlying electricity" of the ZK track.

This model has both technical barriers and a commercial loop. Its value depends more on whether the ecosystem can continue to expand rather than on short-term speculation.

If you received the airdrop, you can first focus on staking rewards and network progress;

If considering building a position, it’s recommended to do so in batches, waiting until the airdrop claim period ends and the market has fully turned over before increasing your position for more stability.

Lastly, I want to say:

Holding BNB is really comfortable, and I hope it reaches 1000 soon!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。