撰文:White55,火星财经

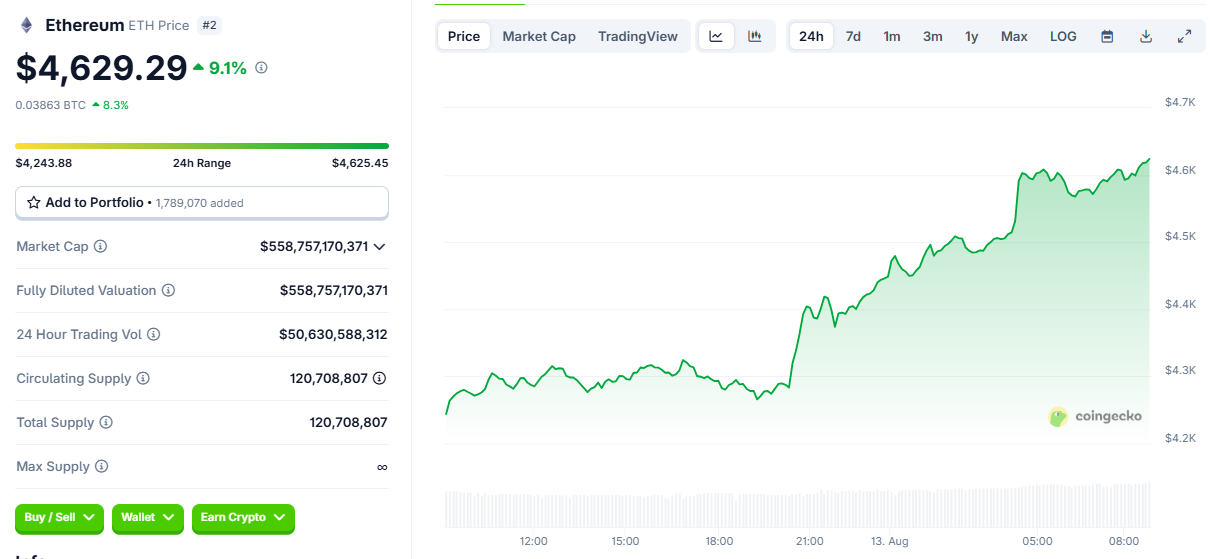

亚洲时区凌晨,投资者还在睡梦之中,以太坊再次以太坊冲破 4600 美元创三年新高,比特币剑指 12 万关口,一场由机构资本掀起的加密狂潮正席卷全球市场 ——短短四个月内暴涨 228% 的以太坊(自 4 月 1385 美元低点飙升至 4640 美元),叠加美股纳指道指盘中涨超 1% 的宏观暖风,彻底点燃了这场「狂暴大牛市」。

BitMine 史诗级 200 亿美元融资鲸吞 ETH 的计划,与 SharpLink 单日 2310 万美元的疯狂增持,将机构 FOMO 情绪推向沸点;而链上 24 小时4.74 亿美元爆仓血洗(空头独吞 3.44 亿美元)的惨烈画面,则成为这场资本盛宴最残酷的注脚。

当 ETH 距离历史峰值 4868 美元仅一步之遥,加密市场正式踏入「机构主导、以太领跑」的全新纪元。

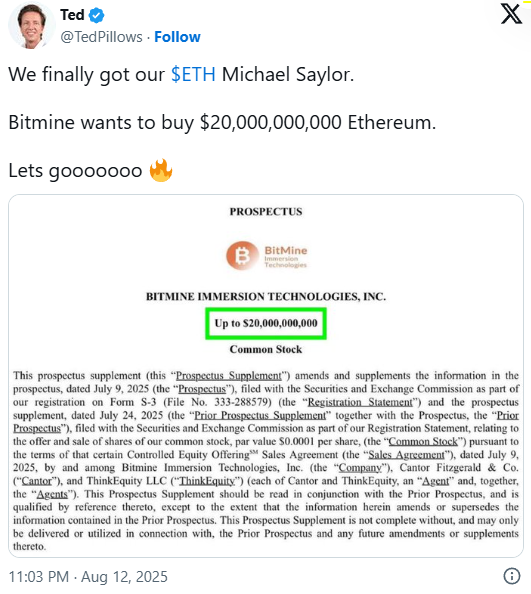

BitMine 史诗级融资 200 亿美金:机构鲸吞 ETH 的范式革命

市场将 BitMine 董事长 Tom Lee 比作「以太坊版 Michael Saylor」,其复制 MicroStrategy 的资产负债表策略 —— 通过发行股票融资并大规模配置加密资产,正在重塑传统资本对 ETH 的价值认知。

BitMine 向美国证券交易委员会(SEC)提交文件

区块链技术巨头 BitMine Immersion Technologies(BMNR)于 8 月 13 日向美国证券交易委员会(SEC)提交文件,宣布计划追加融资 200 亿美元用于增持以太坊(ETH),此举将其可支配的 ETH 购买资金总量推高至245 亿美元(含此前已披露的 45.6 亿美元)。

若计划完成,BitMine 持有的 ETH 总量将占全球流通量的近 5%。

受此消息刺激,BitMine 股价单日暴涨 5.6%,年内累计涨幅超 600%。

ETH 狂暴上涨的三大引擎:机构、ETF、与空头挤压

机构资金洪流颠覆供需格局

现货 ETF 持续吸金:美国现货 ETH ETF 连续 14 周净流入,累计规模突破 257 亿美元,在昨日 8 月 12 日,以太坊实现单日净流入首次超 10 亿美元,机构彻底 FOMO。

上市公司「ETH 微策略化」:85 家美股企业将以太坊纳入资产负债表,总持仓占流通量比例从 2023 年 0.7% 跃升至 1.9%,SharpLink、BitMine 等巨头持仓价值超 35 亿美元。

8 月 13 日,SharpLink 再掀买潮,增持 5,226 枚 ETH(约 2310 万美元),总持仓达 60.4 万枚 ETH,价值 26.9 亿美元,稳居机构持仓第二位;

8 月 13 日,新势力亿万富翁 Peter Thiel 收购以太坊财库公司 ETHZilla(ATNF)7.5% 股份,推动其股价单日暴涨 146%,成交量达 6.89 亿美元。

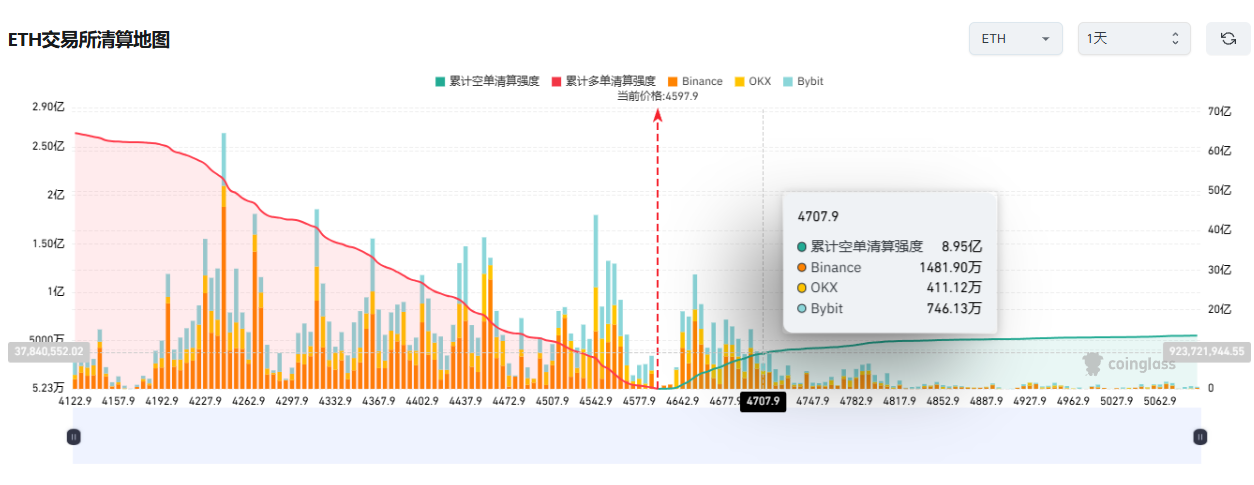

空头清算触发正反馈循环

伴随 ETH 突破 4600 美元、BTC 逼近 12 万美元,全网 24 小时爆仓额飙升至4.74 亿美元,涉及超 11 万人

空头遭血洗:过去 24 小时空单爆仓 3.44 亿美元,其中以太坊空单占比 76%(2.62 亿美元);空头平仓进一步加速买盘,形成「上涨 - 轧空 - 再上涨」的正向循环。

多空格局逆转:

当前以太坊持仓金额突破 630 亿美金再创新高,Coinglass 数据显示,若以太坊突破 3700 美金,还将发生超过 8 亿美金的空投清算。

ETH/BTC 汇率升至 0.038,收复 2025 年以来所有跌幅,资金从比特币向山寨币迁移趋势明确。

比特币高位盘整:蓄力冲击 13.5 万美金历史峰值

BTC/USDT 4 小时图。

BTC/USDT 4 小时图。

尽管 ETH 抢尽风头,比特币仍稳守 12 万美元关键位,距离 2024 年 12 月创下的 12.32 万美元历史高点仅差约 2%。技术面呈现多空胶着态势:

- 日线级别:20 日均线(116,779 美元)与 50 日均线(114,366 美元)构成支撑,RSI 维持正值区间,若突破 12.32 万美元阻力位,有望打开 13.5 万美元上行空间;

- 4 小时级别:价格沿上升通道运行,若有效站稳 12.32 万美元,可能加速冲击 12.77 万美元,进而挑战 13.5 万美元目标。

山寨币季爆发:BNB、Chainlink、Uniswap 技术面突破

BNB:幅震荡酝酿突破

BNB/USDT 4 小时图。

BNB/USDT 4 小时图。

日线级别:价格在 792-827 美元区间盘整,若突破 827 美元阻力,可能加速冲击 861 美元乃至 900 美元;20 日均线(787 美元)为关键支撑;

4 小时图:出现看跌背离信号,若跌破 50 日均线则短期趋势转弱。

Chainlink(LINK):强势突破 22.7 美元

LINK/USDT 4 小时图。

LINK/USDT 4 小时图。

日线级别:突破 22.7 美元阻力后开启加速上涨,目标指向 27 美元,若站稳则有望挑战 30 美元;20.83 美元为多空分水岭;

4 小时图:20 小时均线支撑强劲,RSI 超买显示多头主导。

Uniswap(UNI):蓄力冲击 12 美元关口

UNI/USDT 4 小时图。

UNI/USDT 4 小时图。

日线级别:50 日均线(9.05 美元)形成强支撑,若突破 12 美元阻力,目标看至 15 美元;20 日均线(10.19 美元)为回调防线;

4 小时图:多头死守 20 小时均线,突破 12 美元将打开 14-15 美元空间。

狂暴牛市启幕:ETH 剑指 5,000 美元的历史新纪元

当前技术指标全线看涨 ETH:

- 目标价位:突破 4600 美元后,短期目标上移至 4,868 美元(前高),站稳后将打开 5,000-6,000 美元空间;

- 长周期动能:渣打银行上调 ETH 年终目标至 4,000 美元,TokenAlchemist 等机构看涨 15,000 美元;若技术面复刻 2017 年「扩张楔形」形态,年底有望冲击 7,000-8,000 美元。

市场箴言:当贝莱德单日吸金 2.55 亿美元、上市公司 ETH 储备突破 304 万枚、ETH 在 RWA 代币化市场独占 83.69% 份额,这已非散户狂欢,而是机构资本重配的史诗级转折。以太坊联合创始人 Joseph Lubin 的断言正成为现实:「我们构建的不是加密货币,而是数字经济的操作系统。」

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。