Original|Odaily Planet Daily (@OdailyChina)

Market data shows that early this morning, ETH broke through $4600, currently reported at $4670, less than 5% away from its all-time high; BTC price stabilized around $120,000, currently reported at $119,614; the total market capitalization of the cryptocurrency market surpassed $4.1 trillion, currently reported at $4.13 trillion, setting a new historical high. Major cryptocurrencies in the top 10 by market capitalization, such as SOL, XRP, and BNB, have all seen varying degrees of increase. The current question that crypto investors are most concerned about is: When will ETH break its all-time high? Is the main driving force of this cycle sufficient to support further gains? What is the price ceiling for ETH? Odaily Planet Daily will provide a brief analysis of these questions in this article.

ETH New High in Progress: May Reach Historical High Before This Friday

Around 8 PM yesterday, ETH once again broke through 4400 USDT, with a 24-hour increase of 5.3%; around 1 AM today, ETH broke through 4500 USDT, with a 24-hour increase of 4.9%. Around 4 AM today, ETH broke through 4600 USDT, with a 24-hour increase of 8.94%.

With continuous net inflows into ETH spot ETFs, the ETH reserve treasury companies, and the Federal Reserve's expectations of interest rate cuts in September, ETH's rise is unstoppable. Based on the 24-hour increase over the past few days, it may break its historical high as early as this Friday.

Main Driving Forces Behind ETH's Rise: ETH Reserve Companies and Institutions, ETH Spot ETF Net Inflows

Looking at ETH's explosive growth over the past three months, the key driving factors are the large buy orders from traditional capital markets and the market's purchasing demand expectations.

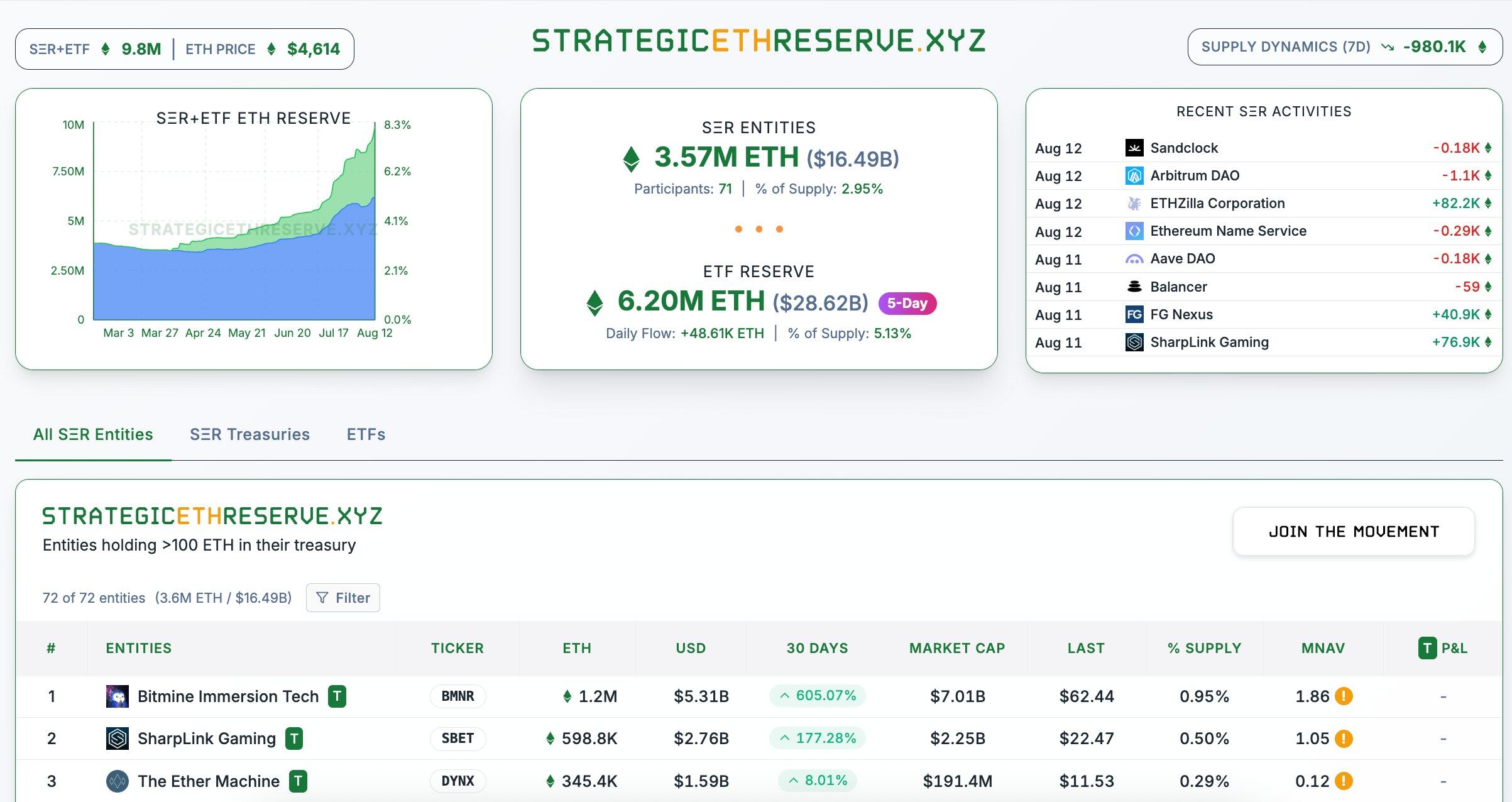

Overall Data on ETH Reserves: Total Reserve of Nearly 3.6 Million Coins, Valued at $16.5 Billion

According to data from Strategicethreserve, the cumulative reserve of ETH by reserve entities has surpassed 3.57 million ETH, valued at approximately $16.5 billion. Among them, Bitmine and Sharplink rank first and second with reserves of 1.2 million ETH and 600,000 ETH, respectively.

Overall Data on ETH Reserves

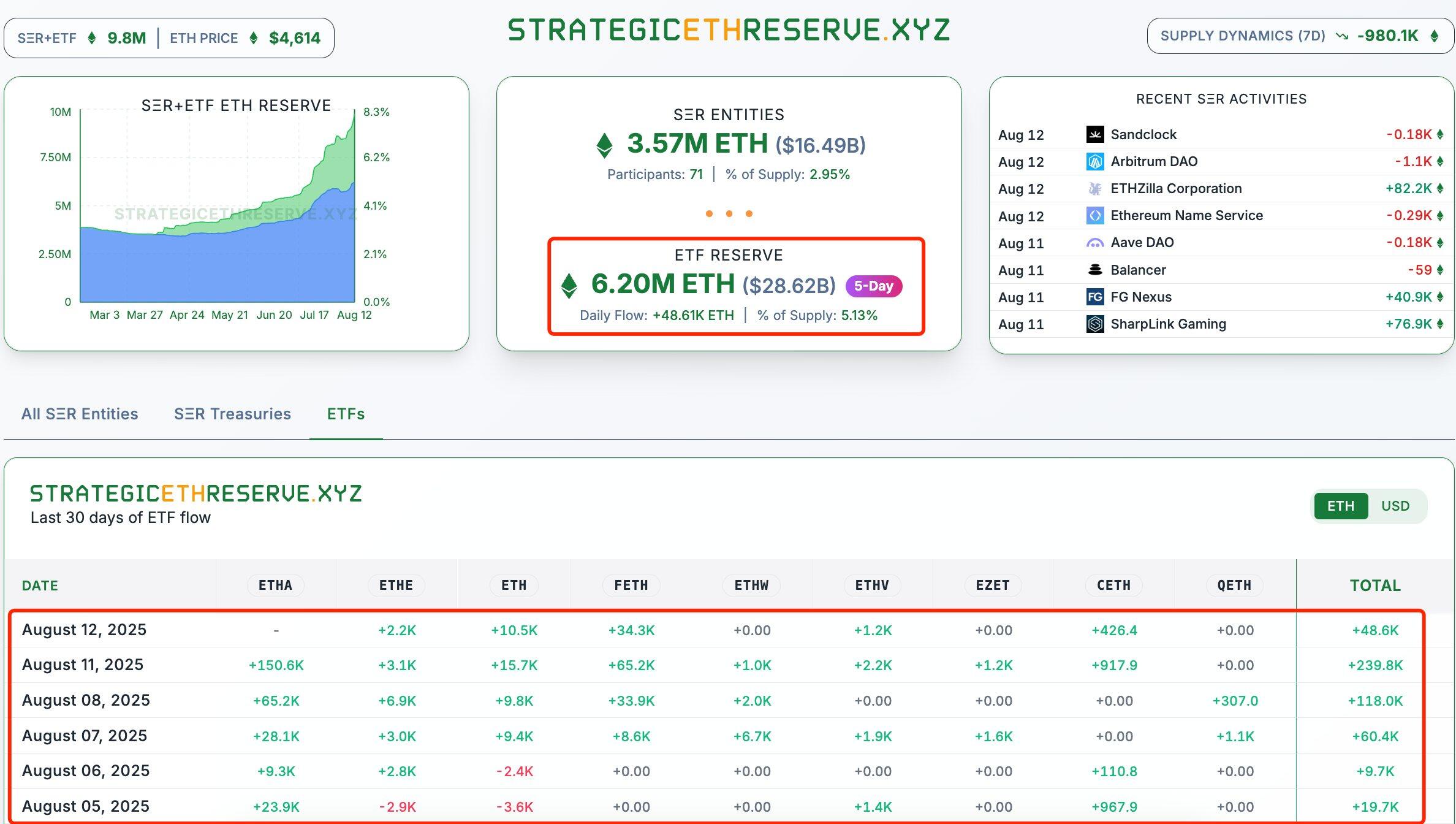

Continuous Net Inflows into ETH Spot ETFs

On the other hand, ETH spot ETFs have also been favored by traditional financial market investors, with net inflows for six consecutive days from August 5 to August 12. On August 11, the total net inflow of Ethereum spot ETFs surpassed $1 billion, reaching $1.019 billion, setting a new historical high. As of August 12, the total amount of ETH spot ETFs reached 6.2 million ETH, valued at $28.62 billion, accounting for approximately 5.13% of the total ETH supply.

Data Related to ETH Spot ETFs

Specifically, major ETH reserve entities are continuously increasing their funds to expand their ETH reserve scale.

"ETH Version Strategy" Leader: Bitmine Plans to Raise Up to $24.5 Billion for More ETH Acquisition

According to public documents from the SEC, Nasdaq-listed company Bitmine Immersion plans to increase the total amount of common stock available for sale under the sales agreement to a maximum of $24.5 billion to acquire more ETH, which includes up to $2 billion according to the prospectus, $2.5 billion according to the supplemental prospectus, and an additional $20 billion according to the latest supplemental prospectus.

From $2 billion to $4.5 billion to $24.5 billion, Bitmine, led by Tom Lee, is racing down the path of large-scale ETH reserves.

SharpLink Continues to Increase ETH Holdings, Surpassing 600,000 Coins

According to Lookonchain monitoring, SharpLink (SBET) increased its holdings by another 5,226 ETH last night, valued at $23.1 million.

Latest data shows that SharpLink currently holds 604,026 ETH, valued at $2.69 billion, ranking second among institutional Ethereum holdings.

ETHZilla (180 Life Sciences): Holds Approximately $350 Million in ETH and $238 Million in Cash Equivalents

Nasdaq-listed company ETHZilla (formerly 180 Life Sciences) recently announced that it currently holds 82,186 ETH, with an average acquisition price of $3,806.71, currently valued at $349 million. In addition to ETH, the company also holds approximately $238 million in cash equivalents.

Nasdaq-listed Company Fundamental Global Plans to Raise Up to $5 Billion for ETH Purchases and Business Operations

On August 8, Nasdaq-listed company Fundamental Global Inc submitted an S-3 registration statement to the U.S. Securities and Exchange Commission, planning to issue securities in batches for a total of up to $5 billion. The company plans to use the vast majority of the net proceeds from this issuance of common stock to purchase ETH, with the remaining funds allocated for working capital needs, general corporate purposes, and operating expenses.

Previously, Fundamental Global announced it had completed $200 million in private financing, with participation from Kraken, Hivemind Capital, Syncracy Capital, Digital Currency Group (DCG), and Kenetic.

Nasdaq-listed Company BTCS Plans to Raise $2 Billion to Expand ETH Reserves

According to media reports, Nasdaq-listed company BTCS Inc. plans to raise up to $2 billion through at-the-market offerings (ATM), convertible bonds, and warrants, with the proceeds intended for expanding ETH reserves, working capital, and other general corporate purposes.

Nasdaq-listed Company Intchains Group Partners with FalconX to Expand ETH Reserves

In early August, Nasdaq-listed company Intchains Group announced a partnership with digital asset prime broker FalconX to expand ETH reserves. This collaboration aims to enhance the efficiency of ETH acquisitions and explore potential yield enhancement through structured ETH yield strategies, with specific implementation depending on market conditions and risk considerations.

Peter Thiel Joins the ETH Reserve Camp: Holds 9.1% of Bitmine and 7.5% of ETHZilla

Notably, as a representative figure in Silicon Valley venture capital, Peter Thiel has also secured an important position in the ETH reserve trend.

Previously, SEC documents showed that PayPal co-founder and Silicon Valley venture capital giant Peter Thiel has acquired 9.1% of BitMine Immersion Technologies.

Yesterday's news reported that PayPal co-founder Peter Thiel and his investment team hold 7.5% of 180 Life Sciences (now renamed ETHZilla). Earlier news indicated that the listed company 180 Life announced on July 29 its intention to privately raise approximately $425 million and transform into an Ethereum treasury reserve company.

As cryptocurrencies become an important part of economic and financial discourse, the ETH reserve camp will be the absolute authority in mastering market pricing power. Capital from Silicon Valley and the U.S. does not want to miss out on this piece of cake.

What is the Price Ceiling for ETH? It May Rise to $20,000

For the current market, the crucial next question is: What is the price ceiling for ETH? At a time when market sentiment is increasingly greedy, the representative views of the market are often more aggressive and bold. Here are the relevant views from industry representatives and institutions:

Analysts: The ETH Price Uptrend Channel Has Opened, with a Maximum Target Price of $20,000

Analyst Merlijn stated that the price uptrend channel for ETH has opened, with the current maximum target price potentially set at $20,000. Additionally, trader BitBull pointed out that due to large-scale short squeezes and institutional buying, it may be easier for ETH to reach new historical highs. If the weekly closing price is above the $4100 range, a new historical high could appear within 1-2 weeks. It is reported that ETH's previous high was approximately $4,875, set in November 2021.

Bitmine Chairman: ETH May Rise to $16,000

BitMine (BMNR) Chairman Thomas Lee stated that if we refer to the high levels of the Ethereum to Bitcoin (ETH/BTC) exchange rate in 2021, the price of ETH could potentially rise to $16,000.

Placeholder Ventures Partner: ETH Could Conservatively Rise to $8,000, Optimistically to $13,000 and Beyond

Placeholder Ventures partner Chris Burniske pointed out that market sentiment around ETH has changed dramatically over the past month, with ETH shifting from being "unpopular" to "the market darling." Institutional investor activity is also warming up, supporting a bullish outlook for ETH. For example, on-chain data shows that SharpLink Gaming recently added 77,210 ETH to its Ethereum treasury. Analyst "Wolf" outlined two scenarios for ETH price movements, predicting a "conservative" target of $8,000 and an "optimistic" scenario that could reach $13,000 or even higher.

Greeks.live: $4,300 May Be an Important Support Level for ETH, Expected to Rise to the $4,900-$5,000 Range

Greeks.live macro researcher Adam wrote that the group shows a clear bullish sentiment towards the market direction, with traders generally focused on the potential impact of tonight's CPI data on the market. Most members believe Ethereum is performing strongly, with the key price level of $4,300 becoming an important support, and they expect it may break historical highs to reach the $4,900-$5,000 range.

Yi Lihua: A Super Bull Market is Coming, ETH Will Rise to $4,800, Mainstream Coins Will Start to Rally

Liquid Capital founder Yi Lihua stated: "With the trade war settling and interest rate cut expectations starting, a super bull market is here. According to the rotation rally principle, BTC will rise first, followed by ETH, which will reach a new high near $4,800. After that, mainstream coins will rise in rotation, so hold onto mainstream coins like LTC, ENA, UNI, etc. Finally, the altcoin season will begin, especially for altcoins with fundamentals. Make sure to hold spot positions and do not short. For outsiders asking if they can buy, the unified advice is to allocate 10% of your assets to buy."

In summary, Yi Lihua, who was one of the first to say "ETH price will soon break $3,000," is actually the most conservative among them.

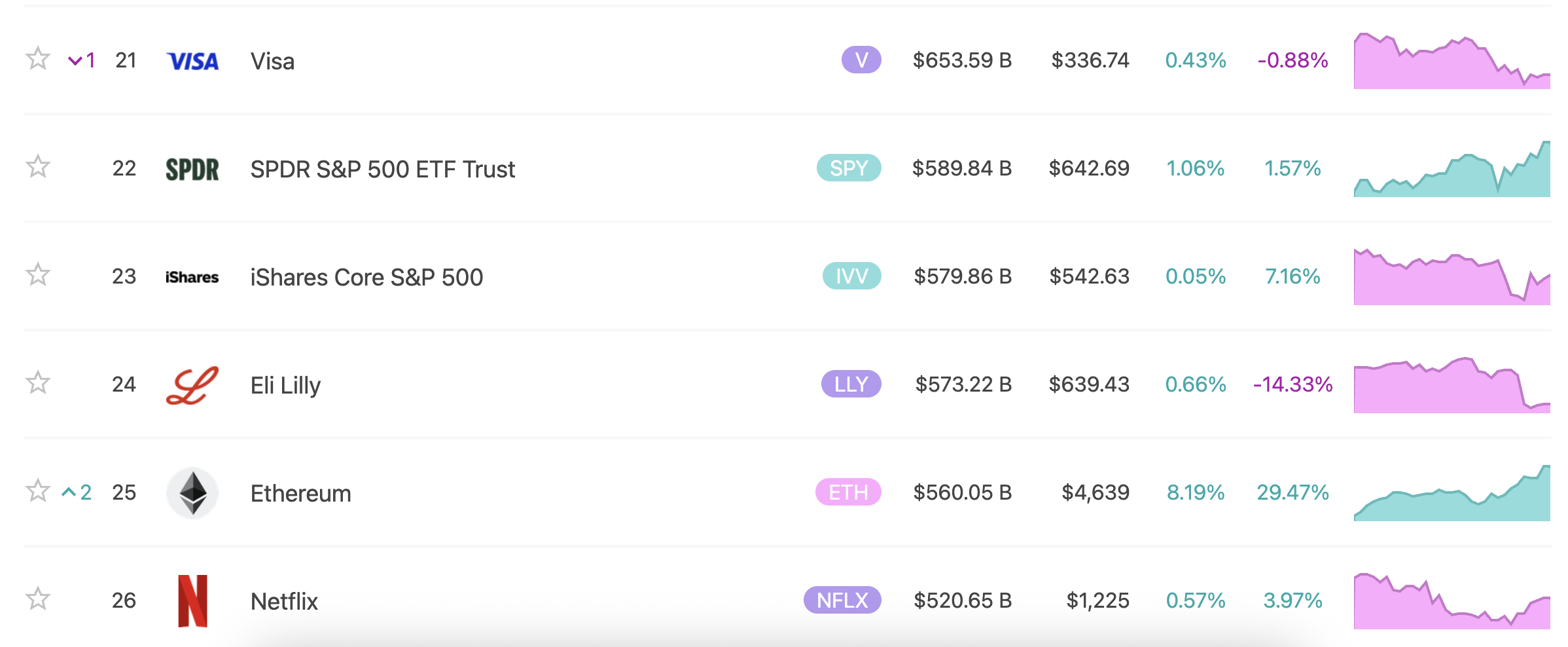

Finally, according to 8 Marketcap data, the market capitalization of ETH is currently reported at $560 billion, surpassing the U.S. publicly listed company Netflix, ranking 25th in global asset market capitalization, and this may just be the beginning. For ETH, the next market cap target to surpass may be the payment giant Visa, ranked 21st.

ETH Market Capitalization Ranking

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。