作者:Ana Levine

来源:E1 Ventures

编译:Shaw 金色财经

最尖锐的批评来自欧洲央行的经济学家,他们实质上指责比特币不过是披着加密外衣的庞氏骗局。他们的论点简洁而犀利:由于比特币不会提升经济的生产潜力,其价格的持续上涨只会造成纯粹的财富再分配效应,消费收益直接以其他人的损失为代价。这不过是多此一举的零和博弈,还伴随着碳排放。

这一批评建立在早期研究的基础上,该研究表明,比特币当前的设计产生的福利损失约相当于消费的 1.4%,这使得其效率比中等通胀的货币体系低约 500 倍。即便比特币协议达到最优设计,其造成的福利损失仍相当于每年 45% 的通胀率。

生产力方面的批评不仅限于抽象的模型,还延伸到了令人不安的现实情况。比特币的安全模式存在经济学家委婉称之为「根本性局限」的问题——即其能耗与所保障的价值呈线性增长关系。随着比特币价格的上涨,用于挖矿的资源投入也必须增加,而这些资源本可以用于资助人工智能、研发或基础设施建设等富有成效的活动。

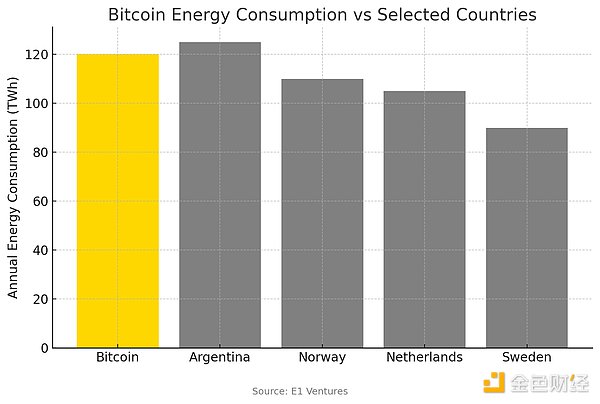

近期的实证研究表明,比特币挖矿如今所消耗的计算资源相当于整个国家的经济规模。如果比特币是一个国家,其耗电量将介于阿根廷和挪威之间,这不禁让人发问:这种「数字黄金」真的值得让地球付出如此代价吗?

然而,越来越多的研究成果对所谓的生产力批评提出了质疑,彻底重新定义了比特币的经济角色。这些研究不再将其视为一种会将资本从生产性用途中抽离出来的投机性资产,而是将其定位为能够增强长期经济稳定性和效率的基础性基础设施——这与互联网在彻底变革一切之前,曾被视为一种昂贵的猫咪视频分享工具的情况颇为相似。

奥地利学派经济学家所钟爱的「硬通货」论点认为,比特币固定的供应计划和透明的货币政策从根本上优于法定货币体系。

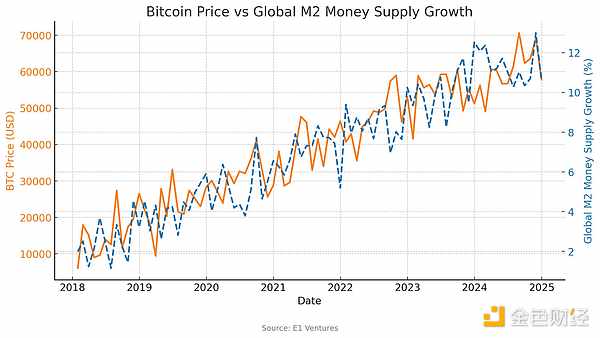

富达的宏观研究人员已证实,比特币与广义货币供应量指标之间存在很强的正相关性(R² = 0.70+),这表明比特币起到了抵御货币扩张的作用,而非投机性干扰。这种相关性在流动性扩张时期尤为明显,表明比特币充当的是货币政策过度扩张的减压阀,而非与生产性投资竞争。印钞机开动时,比特币价格就会上涨。

实证证据:四大影响渠道

消费与财富效应渠道

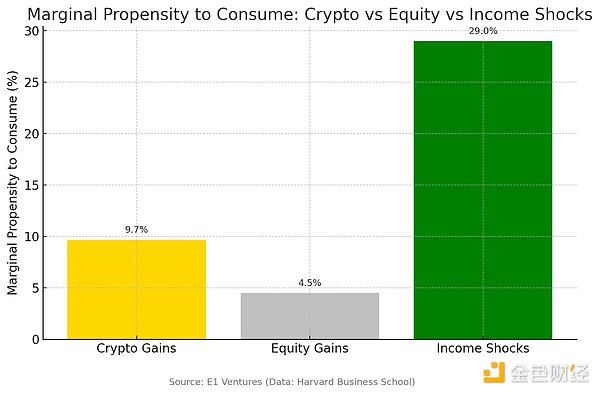

哈佛商学院利用数百万家庭的交易层面数据进行的研究表明,比特币的财富效应实际上刺激了实体经济活动,而非抑制。家庭从加密货币收益中表现出的边际消费倾向约为 9.7%,这一比例是传统股票收益的两倍多,大约是直接收入冲击的三分之一。这种较高的消费反应表明,比特币升值直接刺激了经济需求,而非将资源困在投机的泥潭中。

消费模式尤其具有启发性。比特币财富的增长主要流向现金和支票支出、抵押贷款以及可自由支配的消费——这些类别直接支撑了就业和企业收入。在加密货币采用率较高的国家,随着加密货币市场的上涨,房价的涨幅明显更高,这表明其对当地经济产生了显著的溢出效应。

这一证据直接反驳了「挤出效应」假说。如果比特币投资真的将资源从生产性用途中抽离,那么我们应当看到实体经济中的消费和投资减少。然而,加密货币财富却形成了正反馈循环,扩大而非收缩了经济活动。

投资配置渠道

华沙大学的研究运用马科维茨优化模型表明,比特币是对传统生产性投资的补充而非替代。包含比特币的投资组合在多种再平衡频率和回溯窗口下都能实现更优的风险调整后收益。至关重要的是,比特币的最优配置会随着宏观经济状况的变化而可预测地变动——在货币扩张时期增加,在传统生产性资产更具吸引力时减少。

这种复杂的再平衡行为表明,投资者将比特币视为抵御货币不确定性的一种对冲手段,而非生产性投资的替代品。当货币政策变得更加宽松时,资金流向比特币以保持购买力。当经济增长加速且商业投资机会改善时,资金又会回流至传统资产。

如果比特币投资是以牺牲企业组建、研发支出或生产能力扩张为代价的,那么「挤出效应」的担忧是有道理的。然而,证据表明,比特币的采用主要是以过剩现金持有、政府债券和其他货币资产为代价,而非生产性投资。随着全球货币供应量从 1970 年的不到 1 万亿美元增加到 2025 年的超过 180 万亿美元,比特币在硬货币资产中的份额已从几乎为零增长到超过 8%——这代表着对货币不稳定的一种理性回应,而非放弃生产性机会。

创新与网络效应渠道

基于比特币的金融服务(包括资产代币化、可编程货币和去中心化借贷)的出现代表着真正的创新,它增强了传统经济活动,而非取代。这些基于区块链的金融服务通过去中心化金融(DeFi)协议和智能合约创造了全新的经济价值类别,带来了传统经济模型难以捕捉的生产力提升,这与 1995 年的 GDP 统计数据未能预见到互联网的变革性影响如出一辙。

货币政策约束渠道

跨国分析揭示了一个经济学家们普遍忽视的重要宏观经济益处:比特币对货币政策的约束作用。比特币采用率较高的国家往往能体验到更稳定的货币政策,因为政府面临着来自替代货币体系的竞争压力。

这种约束作用通过几个渠道发挥作用。首先,拥有其他价值储存手段的公民对通货膨胀政策的容忍度降低。其次,资金流向比特币为政策的可信度提供了即时反馈。第三,替代资产的存在限制了政府获取铸币税收入的能力。

多家机构的研究表明,货币政策公告对比特币价格有着可衡量的影响,这表明加密货币市场能够实时对政策风险进行评估。这种反馈机制能够防止纯粹法定货币体系所特有的繁荣与萧条周期。比特币并非削弱货币权威,而是通过使不良政策决策的成本变得显而易见且即时,从而增强而非削弱宏观经济的稳定性。

宏观层面结论:互补而非竞争

全面的实证证据表明,比特币在经济上是有益的基础设施,而非投机性的干扰因素。其对消费的影响是积极的,投资配置趋于成熟,创新效应显著,货货币政策的纪律性也得到了加强。试图找出挤出效应的研究始终发现,比特币的采用是对生产性投资的补充而非竞争。

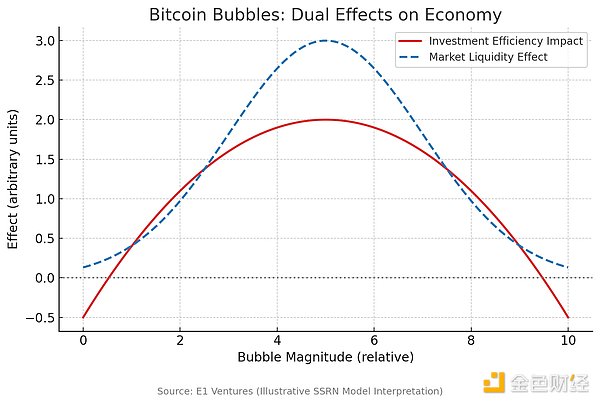

SSRN 的研究对无限期生产经济中的比特币进行了建模,发现尽管加密货币泡沫会降低投资效率,但同时也能提供市场流动性,从而促进实际投资。关键在于,比特币的经济影响是通过多种渠道发挥作用的,而传统的挤出效应模型未能涵盖这些渠道。比特币并非简单地取代生产用途的资本,而是创造了新的经济效率形式,降低了交易成本,增强了货币稳定性,并促进了金融服务的创新。

比特币市场的周期性波动能够暂时提升流动性,同时适度降低投资效率——这两种力量在动态经济中可以并存。

将比特币视为与传统生产性投资相竞争的观点从根本上就偏离了重点。比特币并非从生产性用途中抽调资源,而是作为补充性的货币基础设施发挥作用,提高了现有经济活动的效率。人们购买比特币时,通常是在出售美元、债券或其他纸面资产,而非取消工厂建设或研发项目。

宏观经济方面的证据表明,对比特币持怀疑态度的人关注的指标有误。政策制定者不应衡量比特币对国内生产总值(GDP)的直接贡献(这忽略了其基础设施的作用),而应评估其对经济效率、创新和货币稳定产生的系统性影响。

适当的政策应对措施包括提供清晰的监管,使比特币的有益效应得以蓬勃发展,同时抑制过度投机。这意味着要建立明确的税收、消费者保护和机构采用框架,而不是试图限制这种看似对经济有益的创新。

那些试图禁止或严格限制比特币采用的国家,为这类政策的成本提供了天然的实验样本。证据表明,这些限制措施主要损害了国内的创新和金融包容性,而带来的宏观经济益处却微乎其微。

结论:个人理性与系统效益相结合

微观经济学中有关个体精明决策的证据汇聚成对宏观经济有利的系统性结果。当数以百万计的个人选择将其部分资产配置于比特币时,他们是在对有关货币不确定性、金融体系低效以及技术创新的真实经济信号作出回应。

这些个人决策通过改善货币纪律、完善金融基础设施以及增强经济韧性,带来了集体利益。比特币的采用并非是将资源从生产性用途转移开来的投机狂热,而似乎是针对现有货币体系结构性问题的一种理性回应。

因此,宏观经济分析支持对比特币经济影响持谨慎乐观的看法。尽管人们对能源消耗和投机行为存在合理担忧,但大量证据表明,比特币增强了而非削弱了经济产出和生产力。对于一种据说「不产生任何东西」的资产类别而言,比特币在提高货币本身的效率方面表现出了非凡的生产力——这或许是所有经济活动最基础的基础设施。

奥地利学派经济学家或许一直以来都是对的:稳健的货币并非只是抽象的理想——它是富有成效的基础设施。在货币实验层出不穷、央行资产负债表不断扩张的时代,比特币越来越不像投机泡沫,而更像是人类最古老的技术——货币本身的必然演进。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。