来源:Simply Bitcoin博主

近日,一则鲜为人知的消息悄然引发关注:美联储发布了一份研究报告,表面上探讨如何在不卖出一盎司黄金的情况下,利用黄金储备的增值来释放资本,但紧接着却提到了比特币。这不是来自推特上的比特币狂热者,而是美联储的正式文献。这份报告似乎为美国政府提供了一份隐秘的金融转型蓝图:重新估值黄金,释放资本,然后用这些资本购入比特币。这不仅是一场金融体系的悄然转向,更可能是我们这一生中最大的财富转移机会。

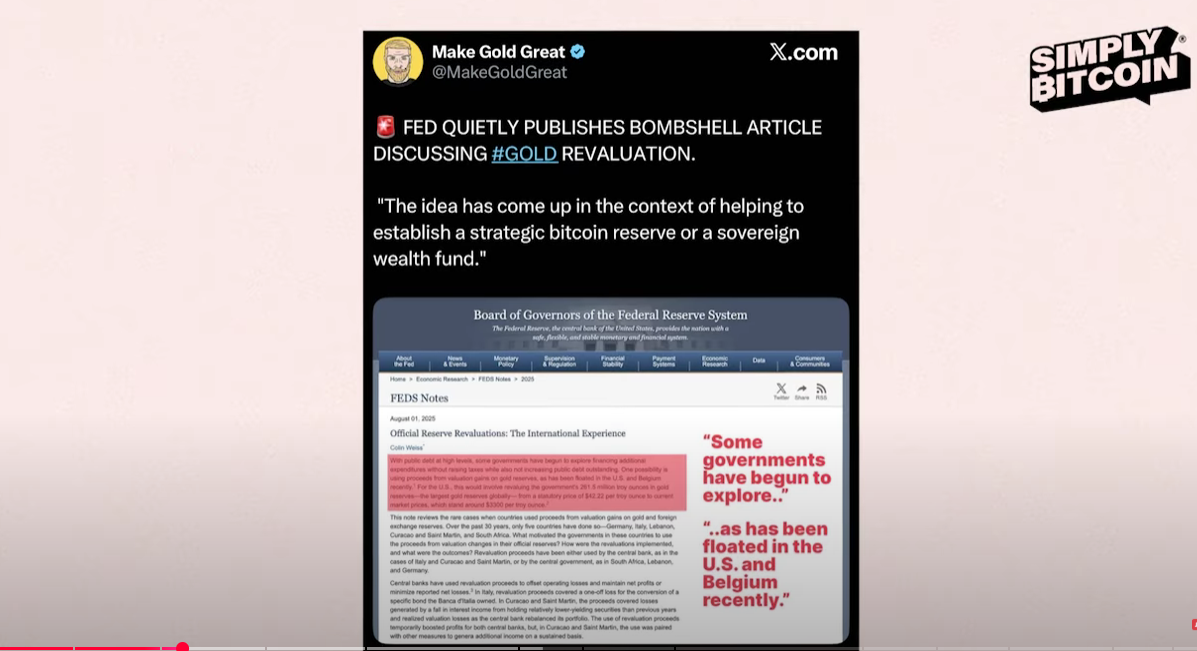

美联储的“隐秘计划”

根据美联储的最新研究,多国已通过重新估值黄金储备,在不卖出任何黄金的情况下解锁了数十亿美元的资金。这种机制被明确讨论为“战略比特币储备”的潜在路径。换句话说,美联储似乎在暗示一种策略:利用黄金储备的增值来积累更多比特币。这一想法并非空穴来风,早在比特币倡导者迈克尔·塞勒(Michael Saylor)和美国参议员卢米斯(Senator Loomis)的提议中已有类似的声音。如今,美联储的文献进一步将其合法化。

具体而言,报告提到可以将黄金从1974年的低估值(约46美元/盎司)重新调整至市场价值,然后用释放的资本购买比特币。假设美国将其在诺克斯堡的黄金储备全部用于购买比特币,理论上可以购得500万枚比特币。这不仅可能使黄金作为资产类别“去货币化”,还可能削弱持有黄金的对手国家的资产价值,同时将美国的资产价值推高至100万亿美元,掌控全球储备资本网络和货币网络。

黄金还是比特币?游戏规则正在改变

这一策略引发了市场的强烈反响。传统黄金投资者(俗称“黄金虫”)开始动摇。例如,黄金矿业公司ECR Minerals宣布将比特币纳入其资产负债表,这一举动标志着连黄金的坚定支持者也在转向比特币。知名黄金倡导者彼得·希夫(Peter Schiff)或许需要重新审视他的立场,因为游戏规则正在改变。

与此同时,经济学家亚瑟·海斯(Arthur Hayes)提供了一份令人震惊的分析,指出美国金融体系正面临巨大压力。美国抵押贷款系统(如房利美和房地美)需要约5万亿美元来维持偿付能力,再加上地区银行救助、影子银行风险和商业地产违约,未来可能需要高达9万亿美元的流动性。海斯的结论是:要么印钞,要么崩溃。而印钞的后果将推动比特币价格飙升,他认为250,000美元的比特币价格不是幻想,而是保守估计。

特朗普的助推与401K的开放

更令人振奋的是,唐纳德·J·特朗普近期签署了一项行政命令,允许美国401K退休账户(总规模达77万亿美元)投资比特币。这一举措为华尔街、家族办公室和养老基金等传统机构打开了投资比特币的大门。比特币的固定供应量(2100万枚)意味着,当如此庞大的资金流入时,价格上涨几乎是必然的。

特朗普强调,这一转型将以“预算中立”的方式进行,不增加纳税人负担。他提到,通过比特币挖矿、发行“比特债券”或税收优惠等多种创意方式,美国可以积累更多比特币,而无需明确公开具体计划,以免限制可能性。

隐私与法律的博弈

然而,在政府拥抱比特币的同时,监管机构对隐私的打压仍在继续。最近的Tornado Cash案件就是一个例证。开发者罗曼·斯托姆(Roman Storm)被判经营未经许可的资金传输业务罪名成立,尽管他并未被控洗钱或违反制裁。这一判决引发了广泛争议,因为Tornado Cash只是开源代码,旨在保护金融隐私。斯托姆表示,这场斗争远未结束,它不仅关乎Tornado Cash,更关乎所有开源开发、隐私权以及比特币者的未来。

这提醒我们,在政府购买比特币的同时,自我托管(self-custody)已成为生存的关键。专家建议通过多重签名、遗产规划或完全离线的设置,确保比特币的安全。一些服务如The Bitcoin Way为此提供了专业支持,帮助用户构建“不可治理”的资产堡垒。

通货膨胀与代际财富转移

海斯进一步指出,传统资产正面临“死亡螺旋”。随着婴儿潮一代退休,他们需要卖出股票和房地产以换取现金,但年轻一代(千禧一代)更倾向于流动性和自由,选择比特币而非高价传统资产。政府可能成为最后买家,通过印钞填补缺口,这将导致更大规模的通胀。真正的代际财富转移将通过通胀而非继承实现,而比特币作为硬性上限的资产,将成为吸收通胀的避险工具。

市场信号与未来展望

宏观数据进一步印证了这一趋势。市场预计9月降息的可能性高达93.2%,第四季度通常是比特币价格上涨的窗口。业内人士预测,到本十年末(2030年),大多数公司和政府将不得不持有比特币以保护其财富。甚至连特斯拉创始人埃隆·马斯克和财政部长斯科特·贝塞特(Scott Bassett)都暗示,唯一的出路是让通胀“撕裂”并推动经济增长,而比特币将成为这一过程中的核心资产。

美联储的报告、特朗普的行政命令、海斯的经济分析以及市场的宏观信号,都指向一个清晰的趋势:比特币不仅是未来的趋势,更是当下财富保值的核心资产。无论是个人、企业还是政府,持有比特币已成为不可忽视的战略选择。正如业内人士所言:“比特币不需要政府,但政府需要比特币。”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。