In the context of intensified market volatility in 2025, investment legend Warren Buffett continues to adhere to his conservative strategy of "cash is king," but as a result, he misses out on substantial opportunities. According to the latest analysis, if Berkshire Hathaway had allocated 5% of its cash reserves to Bitcoin, the company could have made approximately $850 million in profits in the first half of the year. This figure is based on Bitcoin's increase of 16.85% so far this year, far exceeding Berkshire's stock increase of 3.6%, as well as the performance of its major holdings such as Apple, American Express, and Coca-Cola.

Conservative Fortress and Potential Costs

As of June 2025, Buffett's Berkshire Hathaway holds over $189 billion in cash reserves, primarily invested in short-term government bonds and low-yield instruments. This massive cash accumulation stems from Buffett's cautious philosophy: cash provides flexibility, allowing for quick deployment of funds to acquire quality assets during market lows. In the first half of 2025, Berkshire reported that its cash and equivalents reached $344 billion, placing the company in a secure position during periods of economic uncertainty (such as expectations of Federal Reserve rate cuts and geopolitical risks). However, this strategy also means that funds are idly sitting in low-return assets, with an average yield of only about 4%-5%, significantly below inflation and market averages.

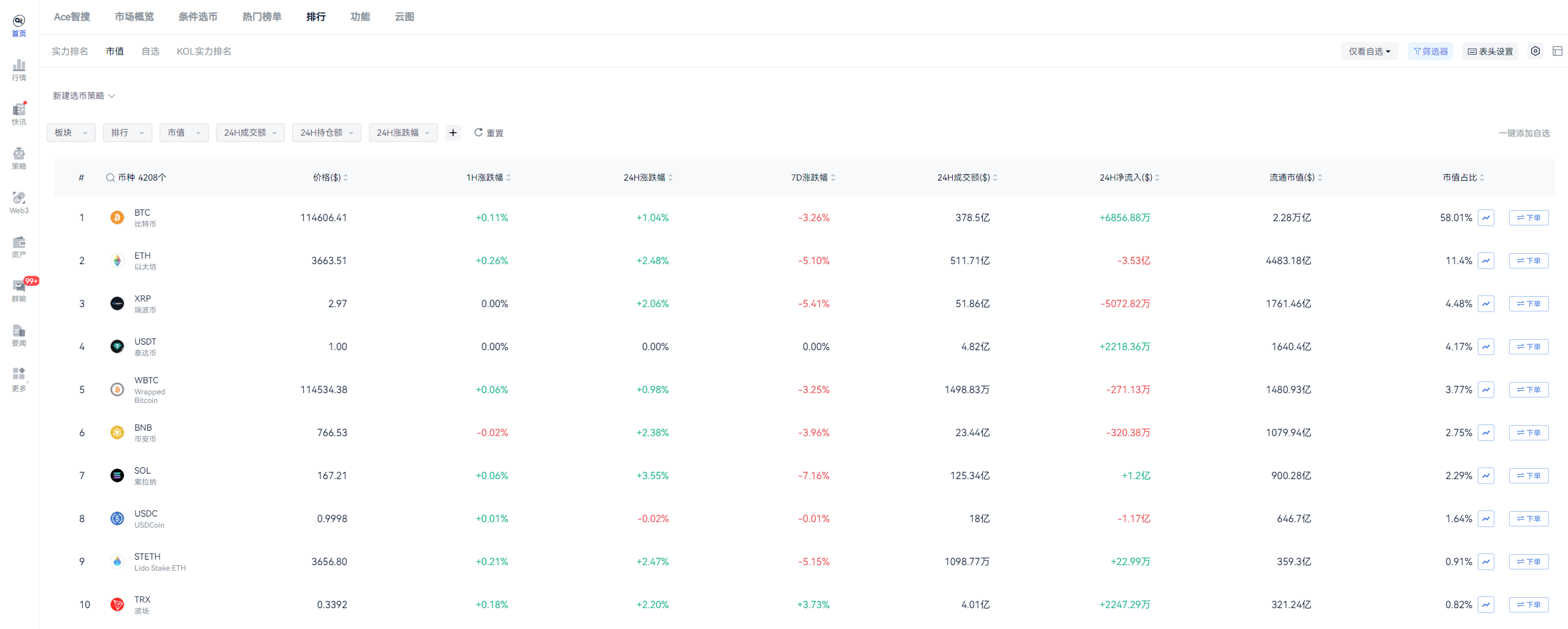

Analysis shows that if Berkshire had invested 5% of its cash (approximately $9.45 billion) in Bitcoin at the beginning of the year, it would have generated nearly $850 million in unrealized gains by early August. This is based on Bitcoin's performance, which rose from about $89,100 at the beginning of the year to approximately $114,500 currently, a 16.85% increase, firmly leading the cryptocurrency market. In contrast, Berkshire's stock only rose 3.6%, with its top holdings Apple rising about 5%, American Express rising 6%, and Coca-Cola rising 4%. Bitcoin not only outperformed these blue-chip stocks but also surpassed the S&P 500 index's 7.5% increase. This opportunity cost highlights the price of Buffett's avoidance of crypto assets: while cash is safe, it appears passive in the face of high-growth opportunities.

Buffett's preference for cash is not new. As early as 2014, when Bitcoin broke through $600, he criticized it as "not meeting the definition of money"; in 2018, he dismissed Bitcoin as "rat poison squared," predicting a poor outcome. At the 2025 shareholder meeting, although he softened his language and acknowledged that "some people hold other currencies," he still stated that Bitcoin "will not become a lasting unit of value." This philosophy allowed Berkshire to avoid the crypto bear market in 2022, but it also missed out on Bitcoin's recovery. Currently, the Federal Reserve's expectations of three consecutive rate cuts are stimulating risk assets, and Bitcoin's role as an inflation hedge is becoming increasingly prominent, putting Buffett's strategy to a greater test.

From Speculation to Mainstream Hedge Tool

In 2025, Bitcoin's price rebounded from its low at the beginning of the year, trading at about $118,400 in early August, down 1.2% but still resilient. Data shows that Bitcoin's year-to-date return is 16.85%, far exceeding traditional assets. This is attributed to institutional inflows: net inflows into spot ETFs exceeded $20 billion, and MicroStrategy's holdings reached 628,700 Bitcoins. In contrast, Berkshire's cash yield is only slightly above inflation, highlighting the potential of digital assets in diversification.

Bitcoin's performance is not isolated. In the first half of 2025, it outperformed Apple (5%), American Express (6%), and Coca-Cola (4%), which are core holdings of Berkshire. Macroeconomic factors such as Federal Reserve rate cuts and geopolitical tensions are driving investors to turn to Bitcoin as "digital gold." On platform X, users mock Buffett for "choosing fiat currency over crypto," pointing out that Satoshi Nakamoto's wallet is worth over $131 billion, surpassing Buffett's personal wealth. This comparison reinforces the opportunity cost: while cash is stable, it lags in high-growth cycles. Matrixport predicts Bitcoin will reach $160,000 by the end of 2025; if true, Berkshire's missed opportunity will be further magnified.

Limitations of Traditional Investment

Berkshire's second-quarter financial report shows no stock buybacks, with cash reserves at a record high. This reflects Buffett's patience: waiting for undervalued assets. However, in an AI and crypto-driven bull market, this waiting could be costly. Value investors like Bill Smead agree with Buffett, stating that cash wins in recessions, but acknowledge that tech stocks have left Berkshire behind.

Balancing Conservatism and Innovation

Buffett's case serves as a warning: cash is king, but it is not omnipotent. In the uncertain environment of 2025, moderate exposure to digital assets could enhance returns, but risk must be controlled. Recommendations include monitoring Bitcoin's support at $112,000; if it breaks, shift to defense; diversify into ETFs to avoid leverage. In the long term, Bitcoin's role as an inflation hedge strengthens, but volatility remains high. Investors should assess coldly: opportunities often lie within risks, and rational decision-making is essential to avoid pitfalls. This event is not only a personal strategy dispute but also a signal of a shift in investment paradigms.

This article is for informational sharing only and does not constitute investment advice for anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。