The original text is from Chilla

Translation|Odaily Planet Daily Golem (@web 3golem)_

The crypto market is expanding rapidly. After years of observation, traditional institutional investors have finally decided to change their stance; everyone wants a piece of the crypto market, which is almost being completely divided among them.

But sometimes we forget that this is not the only cake in the world. The volatility of traditional finance (TradFi) is much lower than that of the crypto market, with lower risks and lower returns, making it seem less attractive. However, don't forget that there is a hidden area in traditional finance that ordinary people find difficult to access: the private market. And now is the time for blockchain to break this taboo.

What is the private market?

In short, the private market, especially private equity, refers to companies that are not listed on stock exchanges. This includes startups, growth-stage companies, and mature companies like Anthropic, SpaceX, or OpenAI.

Most companies in the world are actually private because remaining private allows them greater control, less regulation, and freedom from pressure from public shareholders. Although the private market carries higher risks and lower liquidity, investors are still attracted to private equity because it offers opportunities for substantial returns, especially if they participate in early investments or help companies grow.

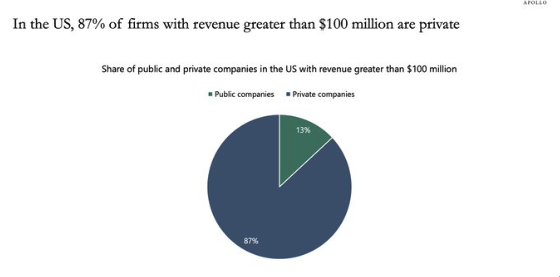

Source: S&P Capital IQ, Apollo Chief Economist. Note: Statistics are for companies with revenue exceeding $100 million in the past 12 months.

As shown in the figure above, according to Apollo's latest data, about 87% of U.S. companies with revenue exceeding $100 million are private, while only 13% are public companies.

Retail investors have no access to the private market, and even in the public market, it is becoming increasingly difficult for them to obtain such information.

According to data from the EQT report, the number of publicly listed companies in the U.S. has sharply declined over the past 30 years, from about 7,000 in 1996 to just over 4,000 in 2025. This decline is not due to a decrease in the overall number of companies, but rather an increasing number of companies choosing to remain private. Meanwhile, venture capital and private equity funds have achieved high returns by investing in companies like Stripe, SpaceX, and OpenAI, which have delayed their IPOs for years or even decades.

Case Study: Amazon vs Airbnb

Amazon was founded in 1994 and went public in 1997, just three years after its establishment. At that time, it had just started selling books online, with revenue of less than $20 million and was not yet profitable. Its IPO valuation was about $438 million. In contrast, another company, Airbnb, remained private for over a decade and was valued at about $47 billion at its IPO in 2020.

In this example, early investors in Airbnb saw their capital multiply by 100 times, while retail investors could only enter after most of the value had been captured. Clearly, these markets carry higher risks, but most value creation occurs in the private market, leaving only a small portion of growth potential for the public.

How Venture Capital Firms Manipulate IPOs to Harm Public Interests

The way these institutional investors seize maximum profits in plain sight is almost comical. Take the recently listed Figma as an example. Figma's IPO was priced at $33, with an opening price of about $95 per share.

"Pricing at $33" means that its shares were sold to institutional investors at $33 before the opening. "Opening price of about $95" means that when the stock began trading publicly, the issue price was already $95. This indicates that private investors who bought at $33 immediately realized nearly three times their return, while retail investors who could only buy at the opening found themselves forced to be the institutional investors' exit strategy.

Even mainstream retail stock platform Robinhood only allowed a few users on its platform to purchase a share before the Figma IPO. It’s like giving ordinary people a rare chance to experience the "privileges of the upper class" while still maintaining restrictions on the public.

Figma's IPO was priced at $33, and the next day it surged to $143, providing investors with a 4.3 times return in less than 24 hours. The real winners were Index Ventures, Sequoia Capital, Greylock, and other early investors.

As a retail investor, do you feel protected from participating in the private market?

Pre-IPO Platform Landscape

Given the growing interest, the number of platforms providing access to Pre-IPO companies is also significantly increasing. While some traditional financial companies already offer such services, such as Hiive, EquityZen, and Forge, the mainstream trend for the future is tokenization.

Therefore, we will focus on companies that adopt tokenization technology:

In the intersection of traditional finance and cryptocurrency, there are some platforms, such as:

- Republic, which allows qualified investors, and in some regions even retail investors, to purchase shares of private companies like SpaceX or Anthropic on its Solana-based secondary market after going through KYC processes.

- Robinhood, which has launched U.S. stock token trading on Arbitrum and is conducting preliminary tests for Pre-IPO token trading limited to European users, requiring KYC.

In the crypto-native space, there are some emerging projects, such as:

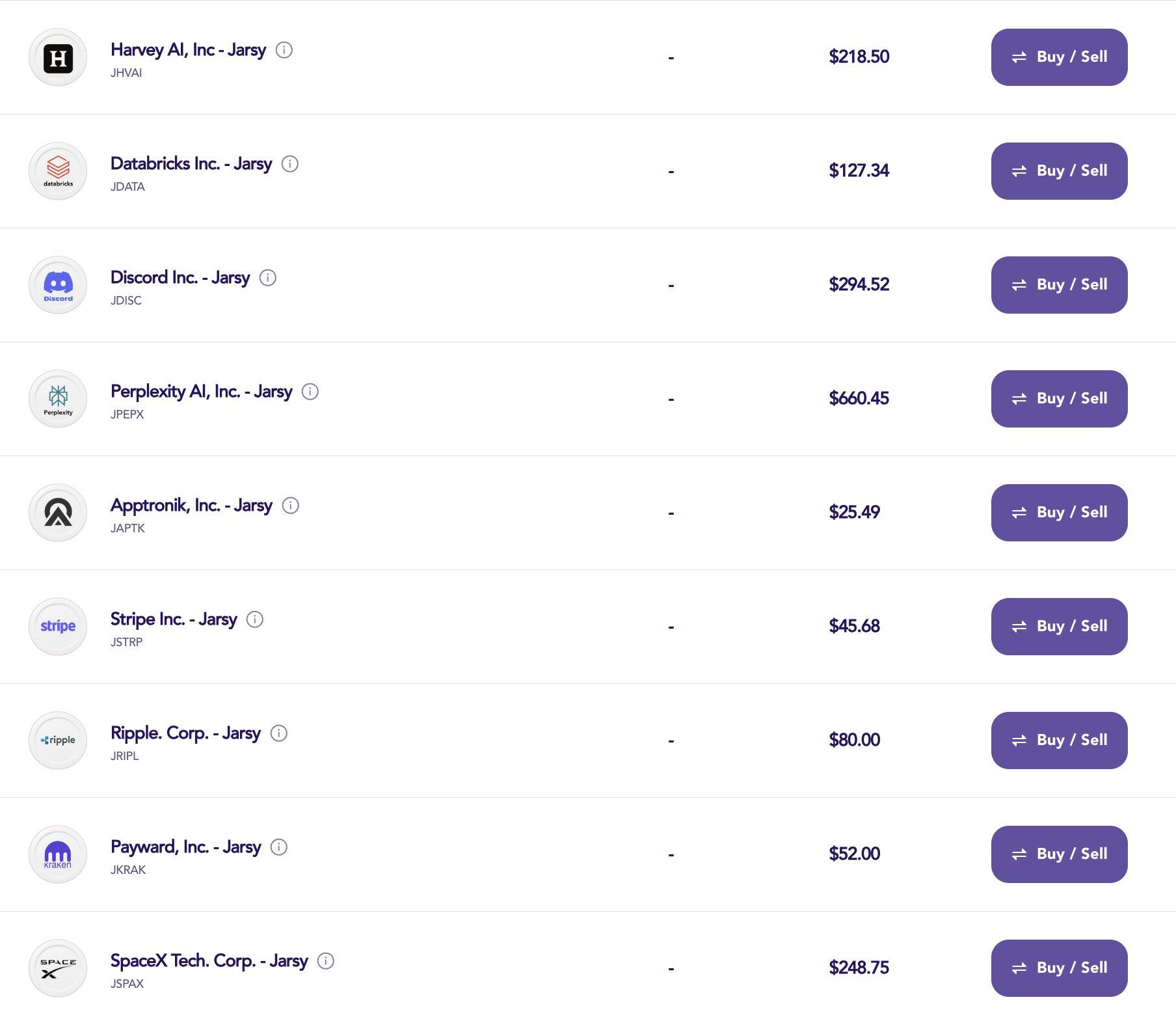

- Jarsy, which offers 1:1 collateralized tokens that replicate private equity on-chain, allowing KYC-verified investors to invest a minimum of $10 while always legally holding the underlying equity.

- PreStocks: After failing to find a PMF for trading Pre-IPO perpetual products without holding the underlying equity, they recently pivoted to Solana, allowing users to trade tokens directly on Jupiter. They hold shares using SPV (Special Purpose Vehicle) but are not fully compliant (no KYC required). However, the product has not yet launched.

- Ventuals: This project is built on the Hyperliquid ecosystem, allowing Pre-IPO token trading through a non-custodial order book, with leverage up to 10 times. No KYC is required, and since no one actually holds the underlying equity, compliance is lower.

In-Depth Analysis of Jarsy

The Jarsy platform operates very simply: users deposit dollars (or USDC) and convert them into an internal currency, JUSD, for investment. The platform is divided into three parts: private equity (1:1 token collateral), presale (early allocation without actual shareholding), and public equity. The private equity section covers numerous companies like Stripe, Kraken, xAI, and Perplexity.

It is worth noting that the equity of these tradable Pre-IPO companies has actually been acquired by Jarsy. Therefore, even if users are only purchasing the tokenized version, they are effectively trading the underlying assets, which also provide similar economic rights as shareholders: for example, if the company distributes dividends, users who purchase tokens will be entitled to the distribution.

Additionally, if the company goes public, Jarsy will receive shares and convert them into tradable equity tokens; if cash is received, the proceeds will be distributed to users.

In terms of security, these shares are held by a regulated Special Purpose Company (SPV), separate from Jarsy, ensuring that even if Jarsy itself goes bankrupt, users' assets remain secure. Furthermore, each asset will have reserve proof published on-chain.

However, given that Jarsy focuses on retail adoption, the wallet operates in a custodial mode, and tokens cannot yet be used in DeFi. Currently, Jarsy is invite-only; although KYC is not part of the spirit of cryptocurrency, it remains mandatory for compliance. However, in fact, non-U.S. users can invest freely, while U.S. users must be accredited investors.

The future roadmap of Jarsy emphasizes becoming a fully integrated DeFi platform, adopting non-custodial wallets, and being able to rely on a combination with other applications to gain liquidity and users.

Conclusion

We are witnessing the emergence of a brand new market sector with enormous potential. Due to limited market accessibility in the past, most cryptocurrency users are not familiar with this market.

But importantly, how this sector will integrate with the DeFi space in the future, similar to the situation with RWA in recent years, is crucial. Ample liquidity is essential, volatility will be higher, and the accompanying risks and returns will also be greater.

While there is market competition in this field, the solutions they build all share the same goal: to open the private market to the public.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。