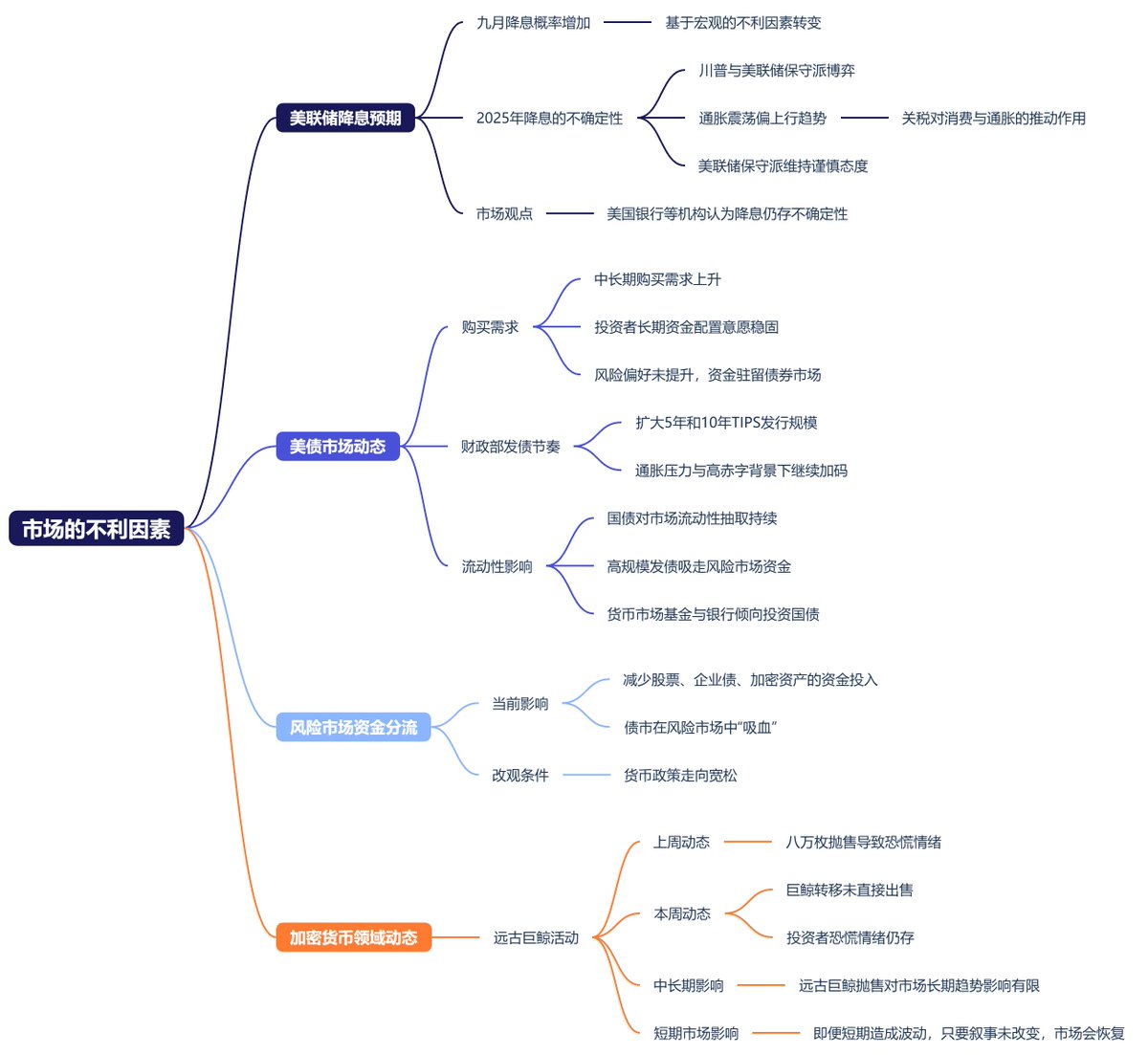

目前市场的不利因素都有那些

1. 宏观方面

虽然前边看到的一些基于宏观的不利因素都转变成了对于美联储降息的预期,增加了美联储在九月降息的概率,但川普和美联储保守派直接的博弈仍然是让2025年的降息有很强的不确定性,包括美国银行在内的部分机构认为通胀处于震荡偏上行的趋势,尤其是关税对于消费的增加以及通胀的影响都可能会使得美联储中的保守派维持谨慎的态度。

2. 债市吸血

过去一周美债拍卖在中长期购买需求上升,投资者在预期降息的背景下长期资金配置意愿依然稳固,风险偏好并未出现提升,主要资金仍然驻留在债券市场,同时财政部扩大了5年和10年 TIPS 的发行规模,在通胀压力与高赤字的双重背景下,发债节奏不但没有放缓反而继续加码,这意味着国债对市场流动性的抽取还在持续,高规模发债会直接吸走风险市场的一部分资金。

尤其是货币市场基金、银行等机构在高利率环境下会倾向将资金投向国债而非股票、企业债或加密资产,这种分流效应在当前宏观环境中最直接的影响就是减少了对于风险市场的投入,说的再直白一些就是债市在风险市场中吸血,这种情况的改观还是要等到货币政策确实走向宽松的时候。

3. 远古巨鲸异动

在加密货币自身的领域中,最近一个月经常有远古巨鲸的活动,上一周出现了八万枚的抛售以后,这一周也陆陆续续的出现了几次远古巨鲸的转移,虽然不同于上周直接到了 OTC 或者交易所出售,但因为有了前车之鉴,所以部分投资者还是会有恐慌的情绪,但说实话,如果仅仅是远古巨鲸的抛售,对于中长期市场的趋势不会有任何的变化。

而即便在短期市场中造成一些影响,只要市场的住叙事没有改变,怎么砸的就能怎么回来。

所以总的来说目前市场的主要博弈仍然是川普和美联储之间的货币政策,尽快实现降息的话确实可以缓解第一点和第二点的不利因素。

本文由 #Bitget | @Bitget_zh 赞助

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。