在MEV机器人与狙击账户横行的Solana链上,手动交易者如同裸身穿越雷区——滑点吞噬利润,夹击收割本金,流动性薄弱的代币更沦为量化程序的提款机。BonkFun市值管理机器人正是破局之刃:

PandaTool以链上原子级操作重构交易逻辑,将「多钱包批量拉盘/砸盘」「哈希级防夹刷量」等机构级策略封装为零门槛工具。通过98%成功率的自动化引擎,您可精准执行价格策略,更以独创的客户端私钥隔离架构彻底杜绝密钥泄露风险。

BonkFun市值管理机器人,简单来说就是一个支持LetsBonk代币自动交易、批量交易的机器人系统,可以按照设定好的目标价格、交易次数等方式进行自动化批量买卖。

BonkFun机器人使用教程

在PandaTool打开批量交易/市值管理机器人,需要进行以下操作

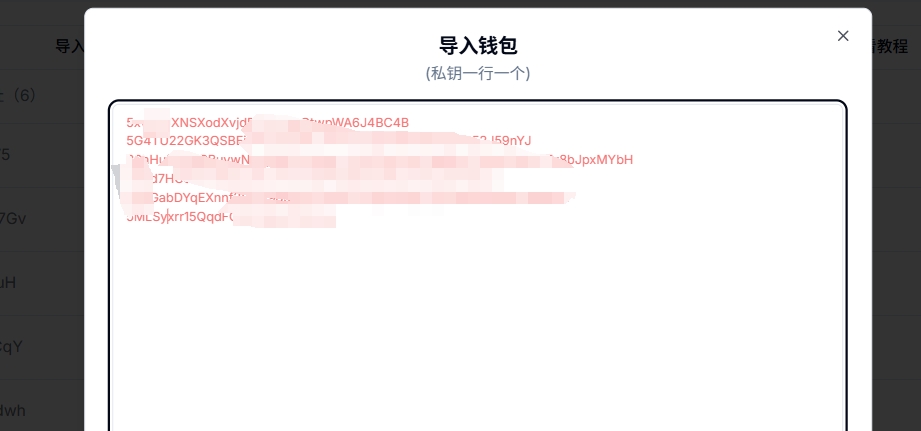

1、导入钱包

进入到批量交易网页后,我们第一步需要导入参与交易的钱包私钥。例如您要使用 20个钱包进行买卖,就点击导入钱包按钮,在输入框内填入20个私钥。(私钥一行一个)

安全提醒:所有的交易都是基于您的设备前端进行的,所有私钥不会上传服务器。PandaTool没有任何办法获取到您的私钥,请您妥善保管好自己的钱包私钥

2、选择代币

接下来,我们需要选择要交易的代币。您要对哪个代币操盘,就在基础代币那里搜索自己的代币

正常情况下,会提示您“已找到流动性池”,这说明可以进行下一步。如果没有找到流动性,那可能是您输入的代币地址错误,请重新核查。

3、选择交易模式

接下来,我们需要选择交易模式。目前的交易模式有三种:拉盘/买入、砸盘/卖出、防夹刷量

拉盘:多地址批量、快速买入代币

砸盘:多地址批量、快速卖出代币

防夹刷量:在同一个哈希完成一笔买卖,防止夹子攻击

4、填写目标价格

所谓目标价格,是代币需要达成的一个价格。如果您选择拉盘模式,就是将代币拉升到某个价格。如果您选择砸盘模式,就是将代币卖出,使其降低到某个价位。

拉盘:代币要拉升到某个目标价位

砸盘:代币要降低某个目标价位

防夹刷量:无需设置价格,改为设置刷量次数(买一笔+卖一笔为一次)

需要注意的是,当您选择拉盘模式的时候,目标价格不得低于当前价格。当您选择砸盘模式的时候,目标价格不得高于当前价格

5、填写交易金额

在拉盘模式下,这里的金额就是你所花费的sol数量。在砸盘模式下,这里的金额就是你要出售的代币数量。在防夹刷量模式下,金额为你要买入的金额

全部:一次性卖出所有代币,无视价格与滑点

随机:根据设置的金额范围,随机买入/卖出代币

固定:按照固定数额的sol买入,或者按照固定数量的基础代币进行卖出

6、设置时间间隔与滑点

时间间隔:每次买入、卖出或者刷量交易之间的执行间隔时间,以秒为单位。该时间间隔可以是时间范围,也可以是固定时间

滑点:每笔交易能接受的最大磨损成本,默认5%不用修改

7、交易的开始与暂停

设置好所有参数信息后,我们点击开始按钮,即可运行程序。如果您希望在中途停止交易,只需点击停止按钮,即可立即停止交易

LetsBonk机器人疑问解答

1、PandaTool会拿到你的私钥吗?

答:绝对不可能,你的私钥不会存储在平台上,所有操作都是基于前端执行的,请放心使用。如果你比较担心,可以使用新的钱包操作

2、市值管理是收费的吗?

答:当前的交易机器人是免费的,未来可能会收费

3、防夹刷量的逻辑是什么?

答:机器人会按照您设定的金额买入一笔,然后在同一笔哈希中卖出一笔。将买入和卖出放在一个哈希里进行打包确认,从而防止夹子机器人套利

4、导入多个地址进行防夹刷量,次数是单地址次数还是总次数?

答:次数是所有地址的总次数。每个地址买+卖一笔,即为1次。所有钱包轮循进行刷量,直到总次数达到设定值

5、最多可以导入多少钱包?

答:为了确保操作的稳定性和流畅性,一次性导入的钱包数量最好低于100个

6、为什么查不到流动性?

答:先确认一下您输入的代币合约地址,是否为LetsBonk平台的代币,该机器人只支持LetsBonk平台的代币

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。