Zoom $ZM 无疑是历史上最疯狂的股票故事之一。

它在一夜之间变得极为重要。

在2020年2月和3月期间,它是唯一没有崩溃的股票(实际上,在COVID崩盘期间,它上涨了57%)。

但看看这个…

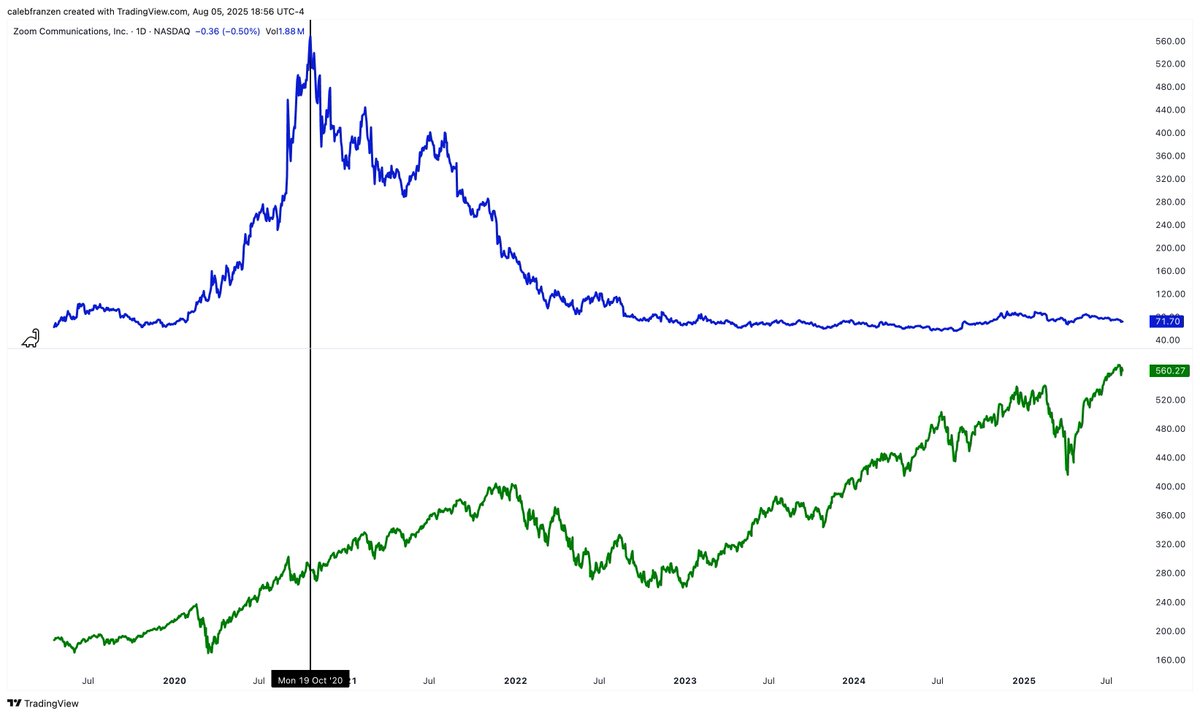

🔵 Zoom $ZM

🟢 纳斯达克100 $QQQ

Zoom在2020年10月之前达到了峰值。

但纳斯达克继续上涨…

自2020年10月19日以来:

• $ZM -87.8%

• $QQQ +97.6%

自股市在2022年第四季度触底以来,它们的回报如下:

• $ZM +1.7%

• $QQQ +119.6%

情况糟糕到Zoom在2023年和2024年都创下了新低!

更疯狂的是,这家公司产生了正的自由现金流并实现了净收入!

以下是Grok对此的看法:

“在2026财年第一季度,Zoom视频通讯(ZM)报告收入为11.41亿美元,同比增长2.7%,自由现金流为4.6335亿美元,比去年第一季度增长11.9%。同一季度的净收入为2.163亿美元,较2025年第一季度增长42.3%。在2025财年,Zoom的收入达到45.67亿美元,比2024年增长3.8%,自由现金流为18.09亿美元,同比增长22.9%。2025财年的净收入为8.383亿美元,比去年大幅增长31.5%,展示了Zoom强劲的财务表现和运营效率。”

这不是一家失败的企业…

相反,它似乎非常稳固。

即使从估值的角度来看,该公司目前的市盈率为22.6倍,基本上与市场持平。每股收益为3.33美元(过去12个月),显然这是一家具有实际基本面的公司。

我不持有这只股票。

我完全没有持有这只股票的意图。

但我忍不住看着这个情况,想想它是多么疯狂。

这提醒我们,市场可以是残酷的,完全不留情面。

这也是我从不基于基本面投资的原因。

股票的市盈率不会给我们带来收益。

股票的自由现金流不会给我们带来收益。

股票的估值当然不会给我们带来收益。

作为投资者,我们获得收益的唯一方式是:

• 低买高卖

• 高买更高卖

唯一重要的是价格。

这就是技术分析如此有价值的原因。

当然,在2020年和2021年的回调中,ZM在某个时刻看起来很有吸引力……但如果采取审慎的趋势失效策略,你会被止损。

是的,你会亏钱……但你会避免基于基本面的陷阱,避免-90%的回撤……因为事实是,基本面多年来看起来都很稳固,但价格却糟糕透顶。

而这才是唯一重要的:价格。

感谢你来听我的TED演讲。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。