原文来自Richard Chen

编译|Odaily 星球日报 Golem(@web 3_golem)

2025 年,加密货币迎来“主流化曙光”。美国《GENIUS 法案》已签署成为法律,加密市场终于有了明确的稳定币监管,主流机构正在积极采用加密货币。相比过去 10 年,赢麻了!

随着加密技术跨越鸿沟,早期风投开始看到更多融合加密(crypto-adjacent)项目,而不仅仅是加密原生项目。“加密原生”是指由“加密货币专家”为“加密货币专家”构建的项目,而“融合加密项目”是指在其他更大的传统领域中使用加密技术的项目。这是我职业生涯中第一次见证这种转变,这篇文章将讨论在构建两者时,有哪些关键差异。

为加密原生用户打造的项目

迄今为止,最成功的加密产品几乎都是为加密原生用户打造的:Hyperliquid、Uniswap、Ethena、Aave 等等。如同任何亚文化运动一样,加密技术是如此前卫,以至于身处加密原生泡沫之外的人无法“理解”它,也无法成为狂热的日常活跃用户。只有那些在一线奋战的加密原生 Degens 才拥有足够的风险承受能力,愿意亲自动手,对每一款新产品进行测试,并经受黑客攻击、网络欺诈等等的考验。

大多数传统的硅谷风险投资公司此前之所以会放弃加密原生项目,是因为他们认为加密原生用户的潜在市场规模 (TAM) 太小。事实确实如此,因为加密技术的发展还处于非常早期的阶段。当时几乎没有任何链上应用,“DeFi”这个词直到 2018 年 10 月才在旧金山的一个群聊中被提出。

但当时的创业者必须也只能抱有信心,祈祷宏观方面的顺风最终会到来,大幅提升加密原生应用的潜在市场规模 (TAM)。果然,2020 年 DeFi 之夏来临,流动性挖矿加上 2021 年零利率时代,让加密原生应用的市场规模迅速膨胀,一夜间,硅谷的每一位风险投资家都因 FOMO 情绪而涌入加密货币领域,并向加密 VC 请教,希望他们能弥补过去四年错失的机会。

然而从那时到今天,与非加密货币市场相比,加密原生应用的 TAM 仍然相当小。X(加密领域中重要的社媒)上的加密用户规模可能最多才几万人。因此,为了在年营收(ARR)上达到九位数,平均每用户收入(ARPU)必须非常高。这就引出了以下重要的事实:

加密原生应用的核心在于为加密重度用户打造。

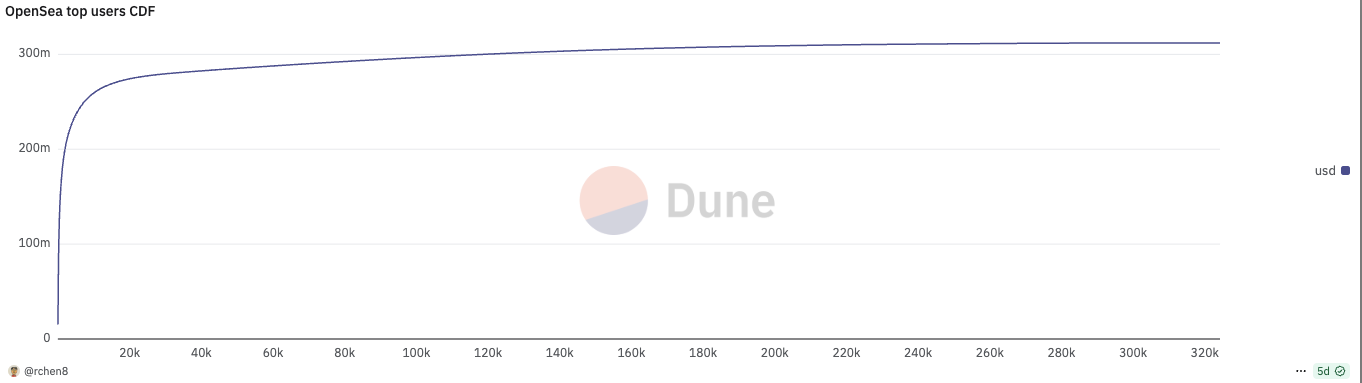

每一款成功的加密原生产品,其用户使用情况都呈现出极端的幂律分布。上个月,排名前 737 位的用户(占比总用户 0.2%)的交易量占 OpenSea 交易量 的一半;排名前 196 位的用户(占比总用户 0.06%)的交易量占 Polymarket 交易量 的一半。

作为一个加密原生项目的创始人,真正让你夜不能寐的应该是如何留住你的核心用户,而不是吸引更多新用户。这与硅谷的传统观念背道而驰,硅谷注重的是用户增长,例如日活跃用户数量 (DAU)。

但加密领域的用户留存历来都很困难。核心用户往往唯利是图,并且对激励措施反应良好。这使得新兴竞争对手很容易凭空出现,只需挖走你的几名核心用户,就能蚕食你的市场份额。 Blur 和 OpenSea、Axiom 和 Photon、LetsBonk 和 Pump.fun 等例子都在说明这个事实。

所有这些都表明,加密原生产品的防御性远低于 Web 2,而且所有东西都是开源的,很容易被复制。加密原生项目来了又去,去了又来,很少有能持续超过一个周期,甚至几个月的项目。创始人在代币发行(TGE)之后致富,往往会选择悄悄退出项目,转而从事天使投资,作为退休后的工作。

留住核心用户的唯一秘诀是不断创新产品,永远领先竞争对手一步。七年过去了,Uniswap 依然能够保持竞争力,因为它不断推出新的从 0 到 1 的产品功能,让重度用户满意:V 3 集中流动性,紧接着 UniswapX、Unichain、 以及 V 4 hooks 接连发布。尽管 Uniswap 构建的是去中心化交易所 (DEX),而 DEX 赛道是在这个拥挤且竞争激烈的加密行业中最为拥挤和竞争最激烈的赛道,但它依然能傲视群雄。

构建融合加密应用

过去,人们曾多次尝试将区块链技术应用于更大的现实世界市场,例如供应链管理或银行间支付,但都因时机未到而失败。财富 500 强企业在其创新实验室中尝试使用了区块链,但并未认真到真正将其大规模应用于生产。还记得那些“区块链不是比特币”和“分布式账本技术”这两个流行口号吗?

如今,我们看到现有企业对加密的态度发生了 180 度的大转变。大型银行和大型企业正在推出自己的稳定币。特朗普政府的监管明确性为加密货币的主流应用打开了“奥弗顿之窗”(Odaily 注:一种政治理论,指曾经被断然拒绝的政策理念现在正受到广泛讨论)。加密货币不再是金融领域不受监管的狂野西部。

在我们的职业生涯中,我们将第一次看到融合加密项目比加密原生项目更多。这也是有充分理由的,因为未来几年最大的成果很可能来自融合加密项目而非加密原生项目,因为传统金融市场的 IPO 规模能以数百亿美元计,而加密领域的 TGE 规模则只在数亿到数十亿美元之间。

这类项目的例子包括:

- 使用稳定币进行跨境支付的金融科技公司;

- 使用 DePIN 激励机制进行数据收集的机器人公司;

- 使用零知识证明传输层安全协议 (zkTLS) 验证私人数据的消费品公司;

- ......

这些项目的共同点是,将加密技术当成是一种功能而非产品。

在融合加密行业中,重度用户当然仍然很重要,但其影响力已经没有那么大。当加密仅仅成为一种功能时,项目成功与否就和加密的关系不大,而更多地取决于创业者是否是融合加密行业的深度专家,并了解哪些因素至关重要。下面以金融科技为例。

金融科技的核心在于以具有良好的单位经济效益(CAC/LTV)获取分销渠道。如今,新兴的加密金融科技初创公司始终担心,一家拥有更广阔分销渠道、更成熟的非加密金融科技公司会将加密技术作为一项功能,从而压垮它们,或推高 CAC,使其无法竞争。而且,与加密原生项目不同的是,它们无法通过发行一个从叙事上看交易良好的代币来拯救自己。

讽刺的是,加密支付长期以来一直是一个不太吸引人的类别,但在 2023 年之前正是创办加密金融科技公司并抢占分销渠道的绝佳时机。在 Stripe 收购 Bridge 之后,我们看到加密原生公司的创始人从 DeFi 转向支付,但他们不可避免地会被那些深谙金融科技套路的前 Revolut 员工干掉。

加密 VC 该如何做?

对于加密风投来说,融合加密企业意味着什么?重要的是不要对那些非加密专业的风险投资公司都会放弃的创始人进行逆向选择,因为加密风险投资公司往往是那些对非加密原生行业了解不够深入的傻瓜。这种逆向选择很大程度上表现为选择了那些最近转向融合加密行业的加密原生创始人。

但令人不安的事实是,普遍情况是,加密货币领域往往对那些无法在 Web 2 中取得成功的创始人进行逆向选择。

从历史上看,加密 VC 创始人套利的一个好方法是寻找硅谷网络之外的人才。他们没有光鲜亮丽的简历(例如斯坦福大学、Stripe),也不擅长向 VC 路演,但他们深刻理解加密原生文化,并建立了一个充满激情的在线社区。Hayden 从西门子机械工程部门中离职,以学习 Vyper 的方式创建了 Uniswap。Stani 在芬兰完成法学院学业期间创建了 Aave(原 ETHLend)。

但一个成功的融合加密项目的创始人原型与加密原生项目的创始人原型是截然不同的。他们并非那种深谙加密原生行业变数、能够在自身及其代币网络周围营造个人崇拜的狂野西部金融牛仔。而可能是一位更成熟的、具有商业头脑的创始人,他们可能来自传统行业,并拥有独特的市场推广策略来获得用户。加密行业逐渐走向成熟,下一批成功的创始人也同样如此。

对融合加密项目创业者的启发

- 2018 年初的 Telegram ICO 很好地体现了硅谷风险投资家和加密原生风险投资家思维方式的分歧。Kleiner Perkins、Benchmark、Sequoia、Lightspeed、Redpoint 等公司之所以投资 Telegram,是因为他们认为 Telegram 拥有成为主导应用平台的用户和分销渠道。而几乎所有加密原生风险投资家都放弃了它。

- 加密行业目前并不缺乏消费者应用。但绝大多数消费者应用并非风险投资愿意支持的行业,因为收入缺乏粘性。对于这类企业,创始人不应该寻求风险投资,而应该自力更生,找到盈利途径。然后,在这股消费者潮流转变之前的几个月里,继续利用当前的消费热潮印钞。

- Nubank(一家总部位于巴西的数字银行平台) 拥有不公平优势,因为他们在“金融科技”一词被明确定义之前就率先进入该领域。同样,他们只是在与巴西现有的大型银行争夺用户,而不是与其他金融科技初创公司竞争。巴西人对现有的银行感到厌倦,以至于在 Nubank 产品推出后立即转向了 Nubank,这使得 Nubank 罕见地同时拥有了接近零的获客成本 (CAC) 和产品市场契合度。

- 如果你正在为新兴市场打造一家稳定币新银行,那你不应该住在旧金山或纽约。你需要脚踏实地的与这些国家的用户交流。这实际上是一个很好的初步筛选标准。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。