Although there has been a downturn today, from my personal observation, the three major U.S. stock index futures are all up in pre-market trading. Although the increase is not significant, it is indeed a slight rise, indicating that the overall risk market sentiment has not been broken. Moreover, U.S. stocks have recovered the losses from Friday, and I haven't seen any negative news upon a quick scan.

On the contrary, after the U.S. stock market closed in the early morning, the market capitalization increased by over $1 trillion. U.S. investors have provided the best answer with their money. As for Bitcoin, which is highly correlated with U.S. stocks, I still feel that there is no systemic risk. Every time $BTC and U.S. stocks diverge, I like to look at the three indicators.

Having reviewed the macro perspective, there are no issues. Then there is the information from @ai_9684xtpa and @EmberCN, which seems to suggest that ancient whales are interfering with the market again. This has happened countless times. From the hourly chart, the price decline started at 6 AM during Asian hours, which aligns with the timeline. Of course, I don't know if there are other reasons, but at least from a macro and informational perspective, there doesn't seem to be any issues.

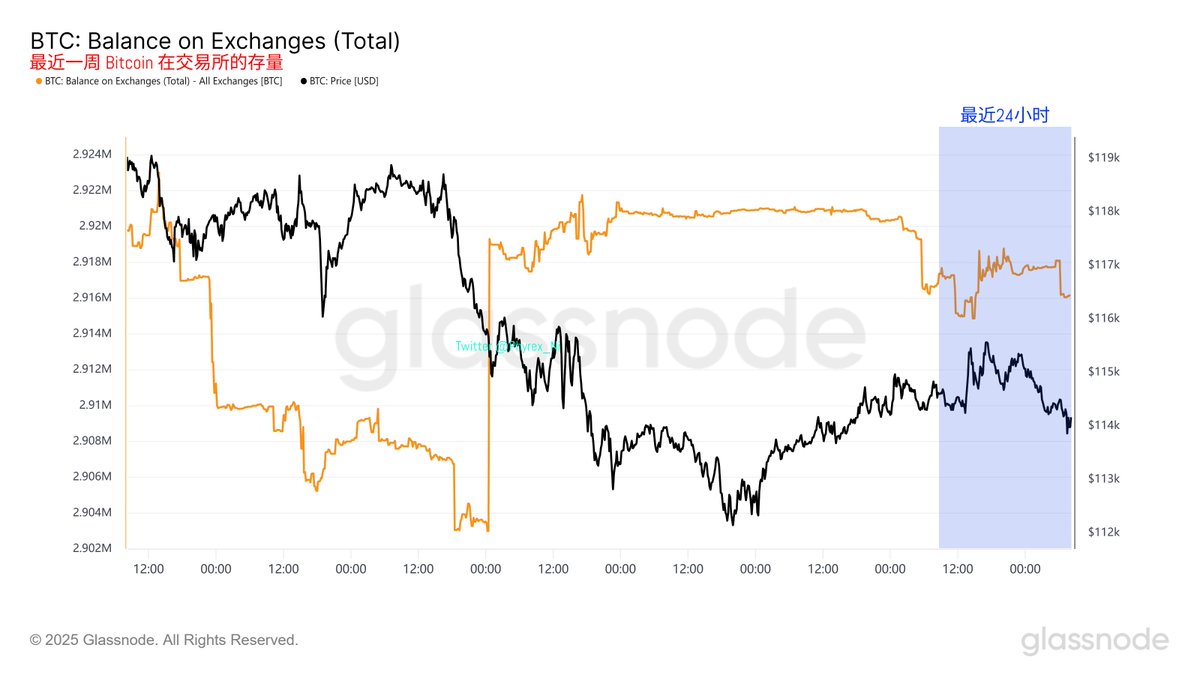

Then, from the data perspective, I won't elaborate too much. Although the exchange inventory increased by 13,000 coins due to the price drop last weekend, there have been signs of gradual digestion in the last two days. Even with reports of ancient whales selling off again, the exchange inventory is still decreasing, and I don't feel there will be too much pressure.

Of course, from the detailed data, #Binance and #OKX are still showing net inflows after reports of whale sell-offs. Moreover, it is during Asian hours, and it seems that some Asian partners are worried about being hit right after they wake up, so there are signs of some exiting. However, overall, the impact of this volume of data is not significant.

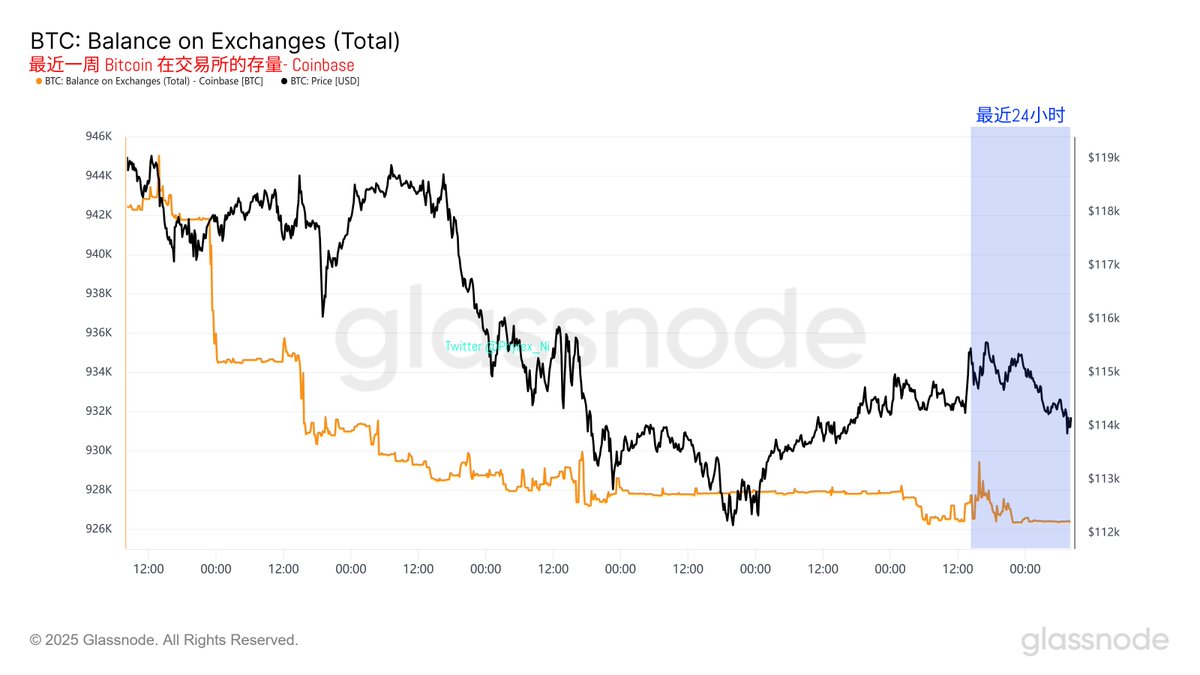

Then, for #Coinbase, it is clear that even after reports of whale sell-offs, although there was a small amount of inflow, it was quickly digested. This also indicates that Coinbase investors still have purchasing power for Bitcoin.

So, overall analysis shows that there is currently no obvious systemic risk, especially since the trend of U.S. stocks is relatively healthy. Let's continue to observe; I still hold my long positions, and my current net loss is 36%, with no plans to stop-loss for now.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。