原创 | Odaily 星球日报(@OdailyChina)

作者 | Ethan(@ethanzhang_web3)

财报季,是资本市场最诚实的时刻。

当比特币与以太坊不再只是“考虑建仓的投资标的”,而是以资产形式进入企业财务报表,它们就不只是代码与共识,也成为估值模型的一部分——甚至是市值弹性最敏感的变量之一。

2025 年第二季度,一组与加密资产强绑定的上市公司,交出了风格迥异的“中场成绩单”:有人靠 BTC 的涨幅实现净利润几何级扩张,有人用 ETH 质押收益翻转核心业务亏损,有人则以 ETF 的形式嵌入加密资产的“间接敞口”。

Odaily 选取了六家公司深挖——DJT、Strategy、Marathon、Coinbase、BitMine Immersion、SharpLink Gaming——它们分布在不同的行业、市场与战略阶段,却共同展现出一个趋势:当 BTC 是估值放大器,ETH 是现金流引擎,企业的资产负债表,正在发生范式转移。

报表里的比特币:信仰仍是主旋律,但变量正在增多

DJT:用 BTC 写故事,用期权放大估值

没有人比 DJT(Trump Media \u0026amp; Technology Group)更懂如何把比特币写进财报,并放大为一个估值引擎。

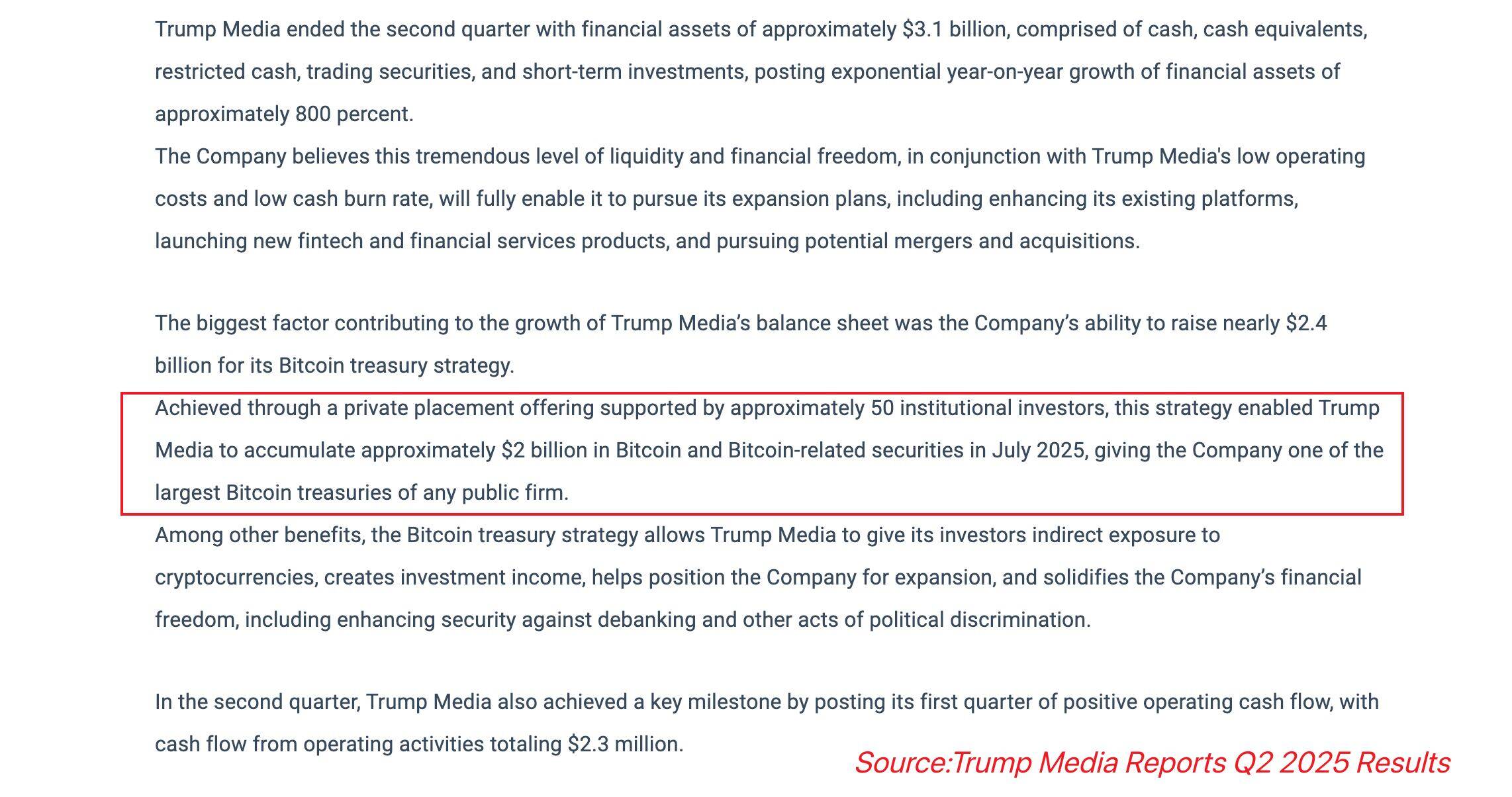

2025 年第二季度,DJT 披露其共持有约 20 亿美元的比特币资产,结构上包括约 12 亿美元的现货持仓与约 8 亿美元的 BTC 看涨期权。这种结构组合本质上是一种“杠杆化的数字资产押注”——不仅吃上涨幅,还嵌入了市值增长的非线性弹性。

其 EPS 从去年同期的 –0.86 美元跃升至 5.72 美元,净利润突破 8 亿美元,几乎全部由 BTC 的未实现估值收益与期权敞口市值变化驱动。

与 Strategy 的“长期主义配置”不同,DJT 的 BTC 策略更像是一次激进的财务剧本实验:借助对 BTC 上涨的市场预期,写进可讲故事的估值模型,对冲业务尚未成型的风险,制造财务端的“叙事外溢”。

同时,DJT 报告还提及未来将持续布局 Truth+ 奖励机制与加密钱包嵌入式代币,并同步提交多只 Truth Social 品牌 ETF 的注册申请,尝试以“内容平台+金融产品”的复合路径锁定更广泛的流动性。

Strategy(MSTR):BTC 守城第一人

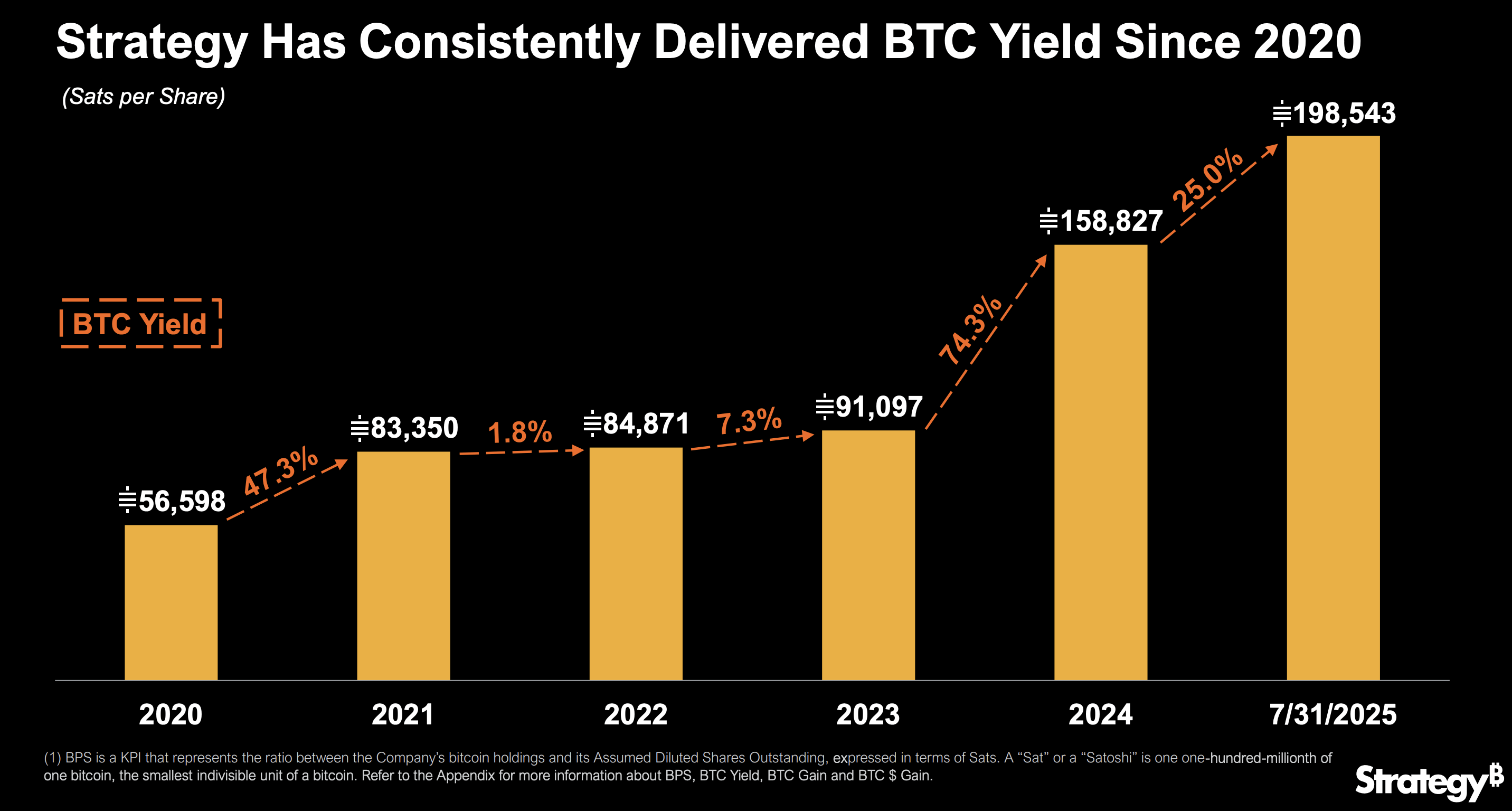

与 DJT 的高波动、高弹性路径不同,Strategy(原 MicroStrategy)仍是 BTC 财报化的范式构建者。

截至 2025 年 Q2,Strategy 的比特币持仓达 628,791 枚,总投入成本约为 460.7 亿美元,平均买入成本为 73,277 美元,季度新增 88,109 枚。由于公司采用公允价值计量模式,第二季度营收高达 140.3 亿美元,其中 140 亿来自 BTC 的未实现浮盈,占比超过 99%。

传统软件业务仅贡献 1.145 亿美元,占比不到 1%,几乎已边缘化。

其 Q2 净利润达 100.2 亿美元,同比扭亏为盈,EPS 达 32.6 美元,预计全年 EPS 将超 80 美元。与此同时,公司宣布通过发行 STRC 永续优先股再次融资 42 亿美元用于继续增持比特币,呈现出“资本加码、信仰递进”的典型扩张路径。

Strategy 的模式,是在比特币金融化过程中,将其写入报表主轴,转型为“数字资产储备平台”,并将 BTC 与美股估值体系高度绑定。

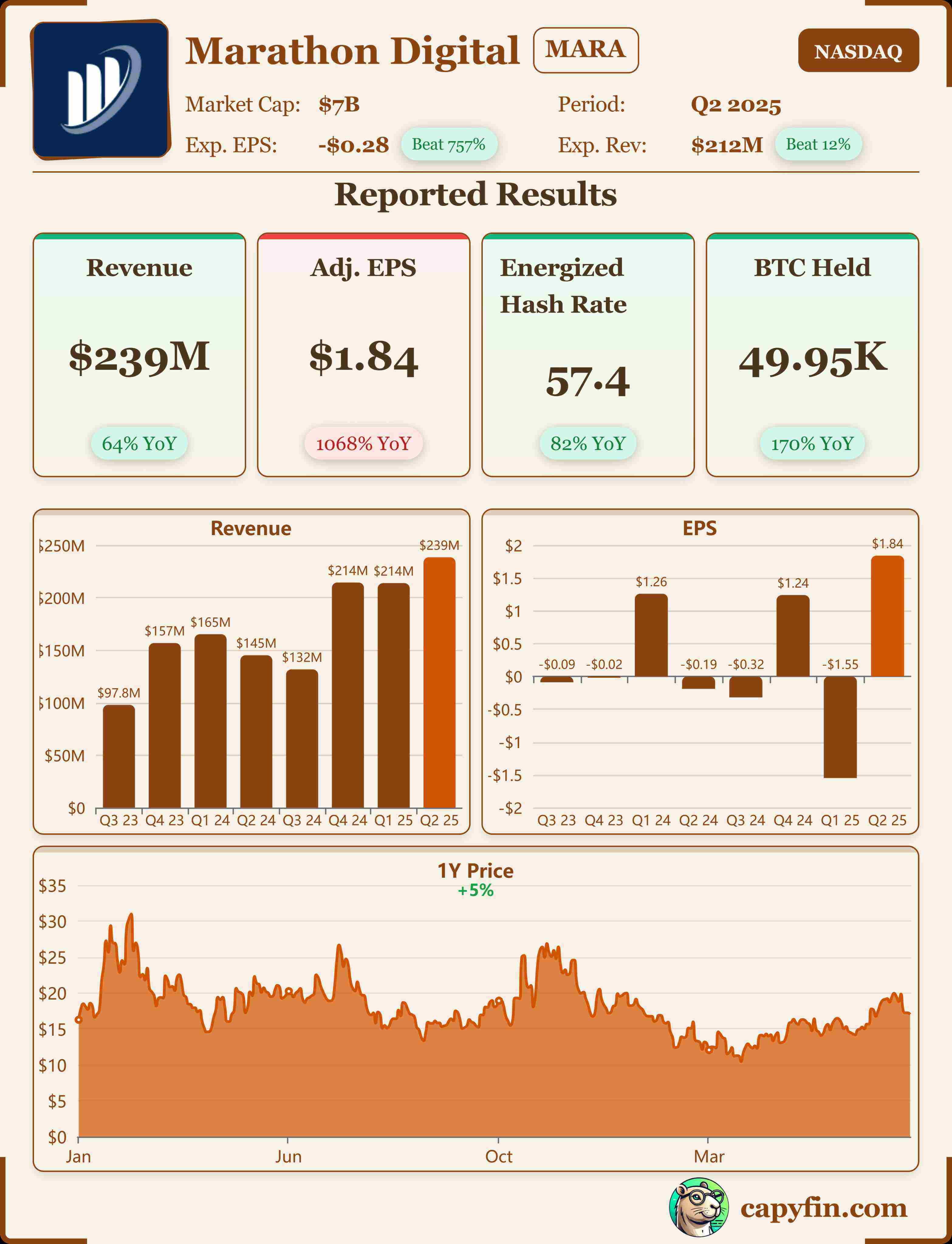

Marathon:BTC 挖矿者的财报边界

作为北美最大矿企之一,Marathon 在 2025 年 Q2 实现 BTC 产出 2,121 枚,同比提升 69%,贡献营收 1.53 亿美元。其比特币库存达 17,200 枚,价值超 20 亿美元。

与 DJT 和 Strategy 不同,Marathon 的 BTC 更多是“运营性产出”,反映为营业收入而非资产配置,在财报中属于典型的“产出派”逻辑,它不能主动影响资产负债表,只能被动记录 BTC 所带来的收益与成本。

Q 2 净利润达 2.19 亿美元,EBITDA 高达 4.95 亿美元,反映其在 BTC 牛市背景下的高经营杠杆。不过,面对全球算力激增、电力价格波动、减半后区块奖励减半等结构性因素,其报表弹性未来或面临一定压缩。

Marathon 是典型的“算力溢价”公司 —— 当 BTC 上行,它创造高利润;当 BTC 回调,它将面临盈亏临界点的挑战。

质押型企业:ETH 是财报里的“现金流引擎”?

与 BTC 以“估值放大”为主的财务逻辑不同,以太坊因具备原生的质押收益能力,正在成为部分企业探索“报表现金流构建”的工具。尤其在美国财务会计准则允许将质押收入归入 recurring revenue(经常性收入)的背景下,这种结构开始成为可能。

虽然目前直接持仓 ETH 的上市公司仍不多,但已有少数“先行者”展现出 ETH 在企业资产负债表中可能扮演的新角色。

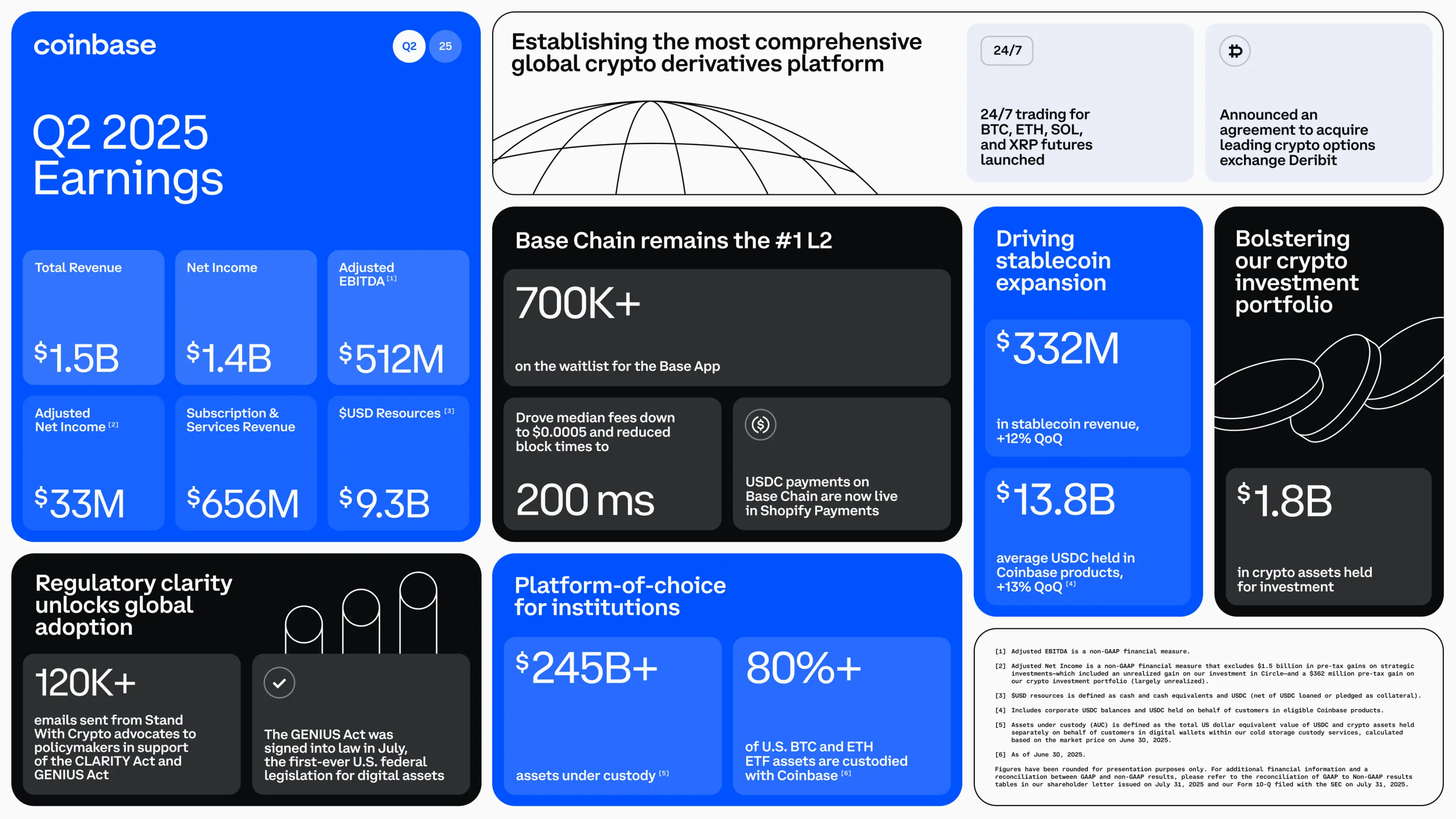

Coinbase:收入首次超交易费对冲双持模型下 ETH 质押正在生成可计量收益

作为全球最大加密交易所之一的 Coinbase ,其资产负债表兼具 BTC 与 ETH 持仓。截至 2025 年 6 月 30 日:

- Coinbase 自营地址中持有约 137,300 枚 ETH;

- 通过 Coinbase Cloud 和 Custody 服务,托管与代理质押的 ETH 总量约为2.6 百万枚,占全网质押份额约 14%;

- 第二季度 staking 服务业务收入约为1.91 亿美元,其中超过 65% 来自 ETH staking,约为1.24 亿美元。

这一部分构成其订阅与服务收入(Subscription \u0026amp; Services Revenue)的核心来源,属于 recurring revenue,Coinbase 在 Q 2 报告中将 ETH 质押正式纳入 recurring revenue 栏目。

2025 年 Q 2,Coinbase 实现总营收 14.97 亿美元,其中 staking 服务营收达 1.91 亿美元(占 12.8%),其中 ETH staking 约贡献 1.24 亿美元,年化增长超 70%。

与交易量下降 40%、交易费收入环比下降 39% 的情况形成鲜明对比,Staking 收入成为 Coinbase 逆周期对冲结构的核心。官方财报说明中首次披露 staking 收入拆分细节,包括用户收益返还、平台运营分成与自营节点收入三部分。

值得注意的是,Coinbase 是目前唯一一家将 ETH staking 收入进行系统性披露的上市公司,其模型具备行业范式引导价值。

BitMine Immersion Technologies:ETH 储备第一,非官方财报模型激进

截至目前(2025 年 8 月),BitMine Immersion 尚未在 SEC 披露 Q2 季度报告,其 ETH 储备与收益数据主要来自媒体报道与链上地址分析,尚未具备纳入财务分析模型的依据,当前仅具备趋势观察价值。

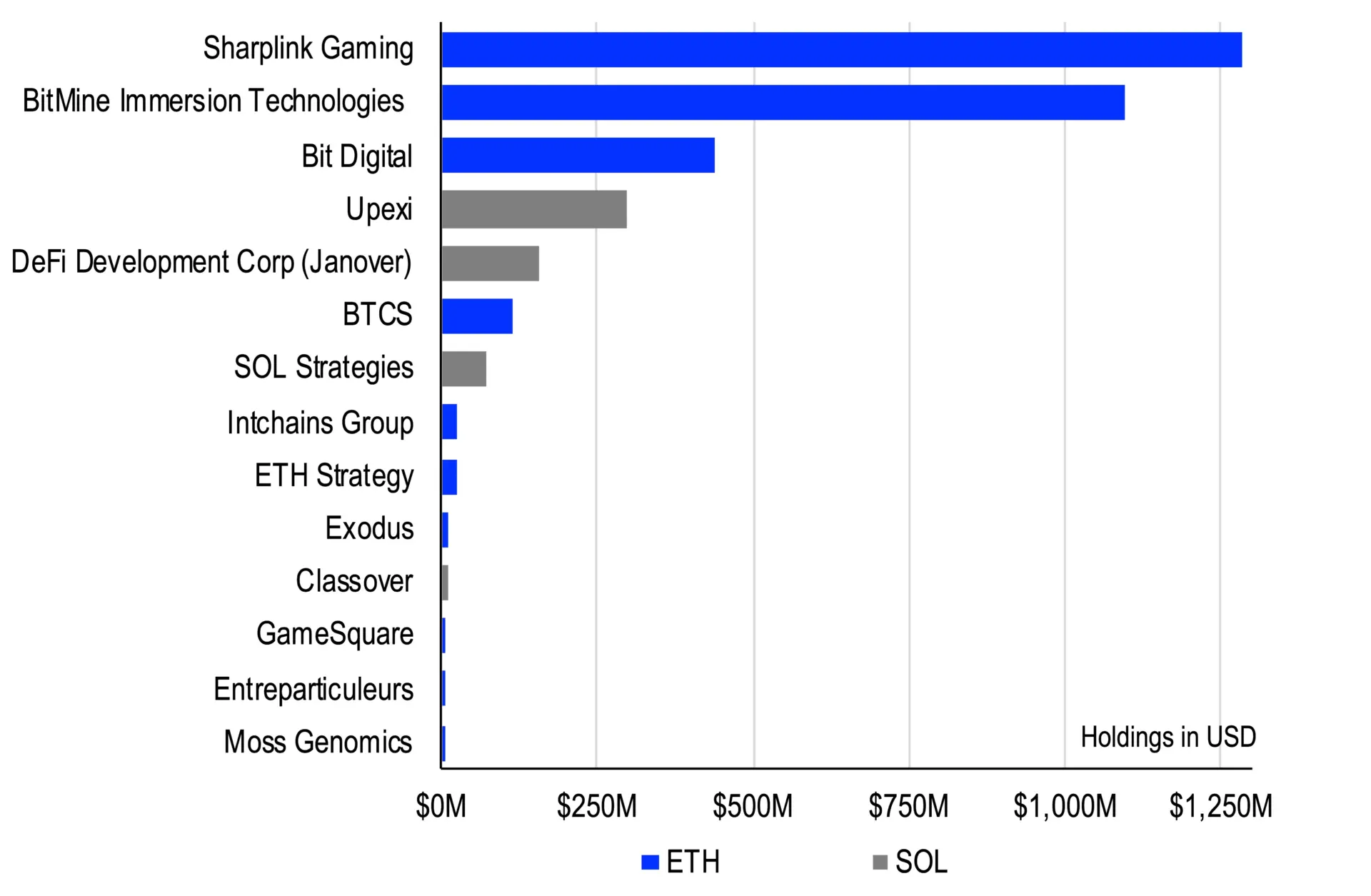

根据 Business Insider 与 AInvest、Cointelegraph 在 7 月底的多篇交叉报道,BitMine 已成为当前ETH 储备量最多的上市公司,其自称在 Q 2 内完成对 625,000 枚 ETH 的建仓,约合市值超过 20 亿美元,其中 90% 以上进入质押状态,年化收益率介于 3.5%–4.2%。

媒体推测其 Q2 来自 ETH 质押的未实现收益(staking rewards)达3200 万至 4100 万美元。不过,由于其尚未披露完整财报,我们无法确认此收益是否入表、以何种方式记账(如计入“其他收入”或作为资产增值)。

尽管如此,BitMine 在 Q2 中的股价上涨超过 700%,市值突破 65 亿美元,其被广泛视为 ETH 财报化方向上的先行实验者,类似于 MicroStrategy 在 BTC 财报化中的定位。

SharpLink Gaming:第二大 ETH 储备企业,但 Q2 财报未披露

依据对公开 ETH 储备追踪数据信息,SharpLink 持有约 480,031 枚 ETH,位列第二,仅次于 BitMine。该公司将 95% 以上 ETH 投入质押池(包括 Rocket Pool、Lido 与自建节点),构建类似“链上收益信托”结构。

据其 Q1 财报,ETH 质押收益已首次覆盖其核心广告平台业务成本,且首次录得季度正向运营利润。若 ETH 价格与收益率在 Q2 保持平稳,预估其来自 ETH 质押的总收益将在2000 万至 3000 万美元区间。

值得注意的是,SharpLink 在 2025 年上半年进行了两次战略股权融资,引入链上基金结构作为抵押物,其 ETH 储备也被用于这些融资的“链上证明”,说明该公司正积极探索将 ETH 质押视为“财务信用工具”。

不过SharpLink Gaming(NASDAQ:SBET)截至目前尚未发布 2025 Q2 财报,其 ETH 储备与收益结构来自 2025 年 Q1 季度报告与媒体跟踪数据,因此仅作为财报结构样本参考,不构成投资数据依据。

结语

从 DJT 到 SharpLink,这些企业共同展现出一个趋势转变:加密资产不再只是投机工具或对冲配置,而正逐步内化为企业的“财务引擎”与“报表结构变量”。比特币为报表带来非线性估值放大,以太坊则通过质押构建稳定的现金流。

尽管当前仍处于财务化早期阶段,合规挑战与估值波动依旧存在,但这六家企业的 Q2 表现预示了一个可能的方向 ——Web 3 资产正成为 Web 2 财报的“下一种语法”。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。