关键要点

- 全球加密货币总市值为3.77万亿美元,较上周4.16万亿美元,本周内加密货币总市值跌幅为9.38%。截止至发稿,美国比特币现货ETF累计总净流入约541.8亿美元,本周净流出6.43亿美元;美国以太坊现货ETF累计总净流入约94.9亿美元,本周净流入1.54亿美元。

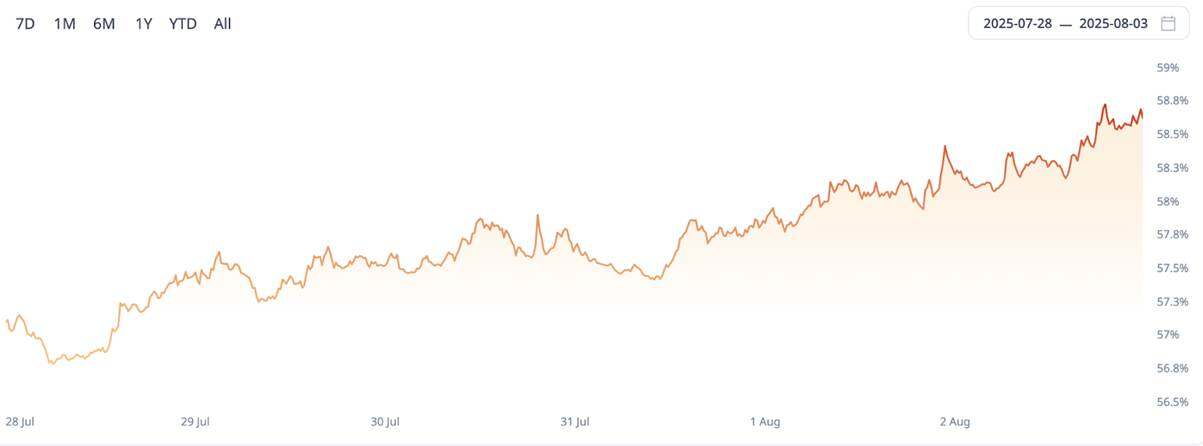

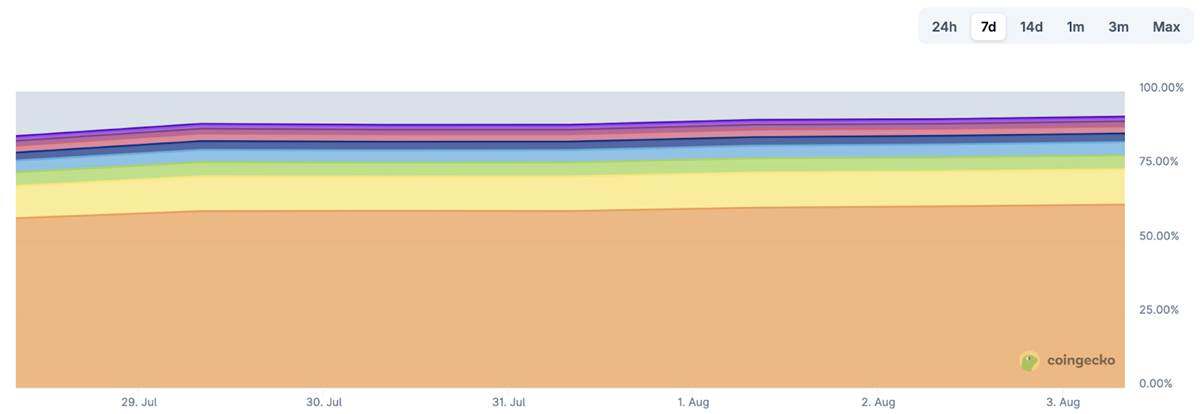

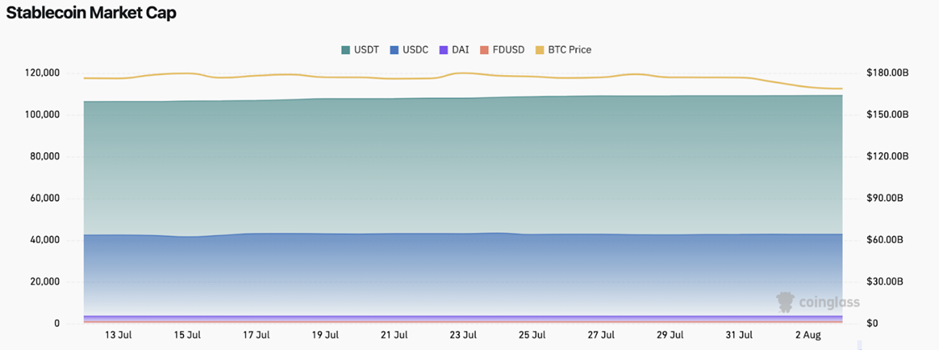

- 稳定币总市值为2,740亿美元,其中USDT市值为1,639亿美元,占稳定币总市值的59.81%;其次是USDC市值为642亿美元,占稳定币总市值的23.43%;DAI市值为53.6亿美元,占稳定币总市值的1.96%。

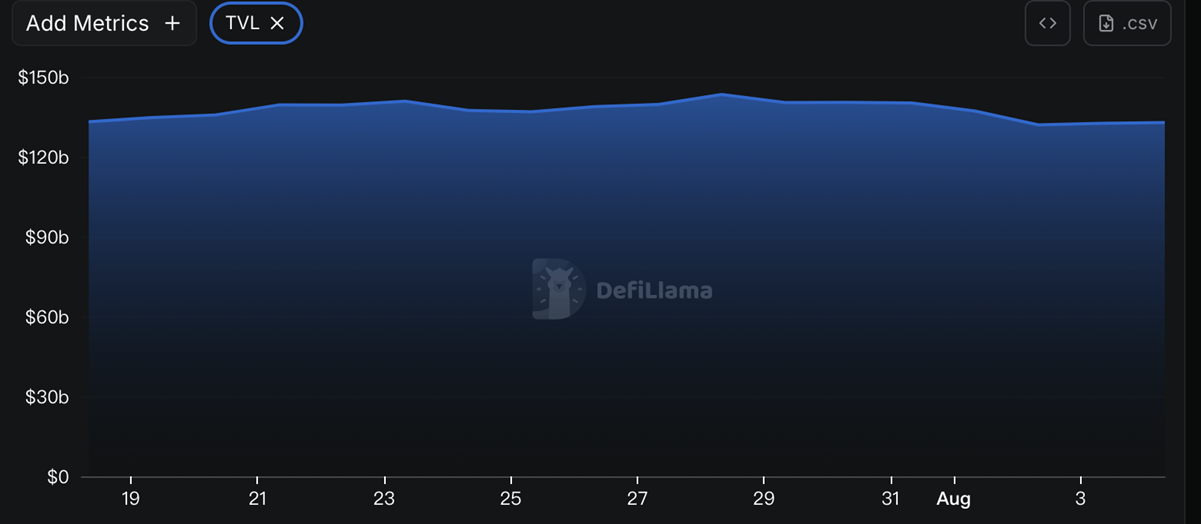

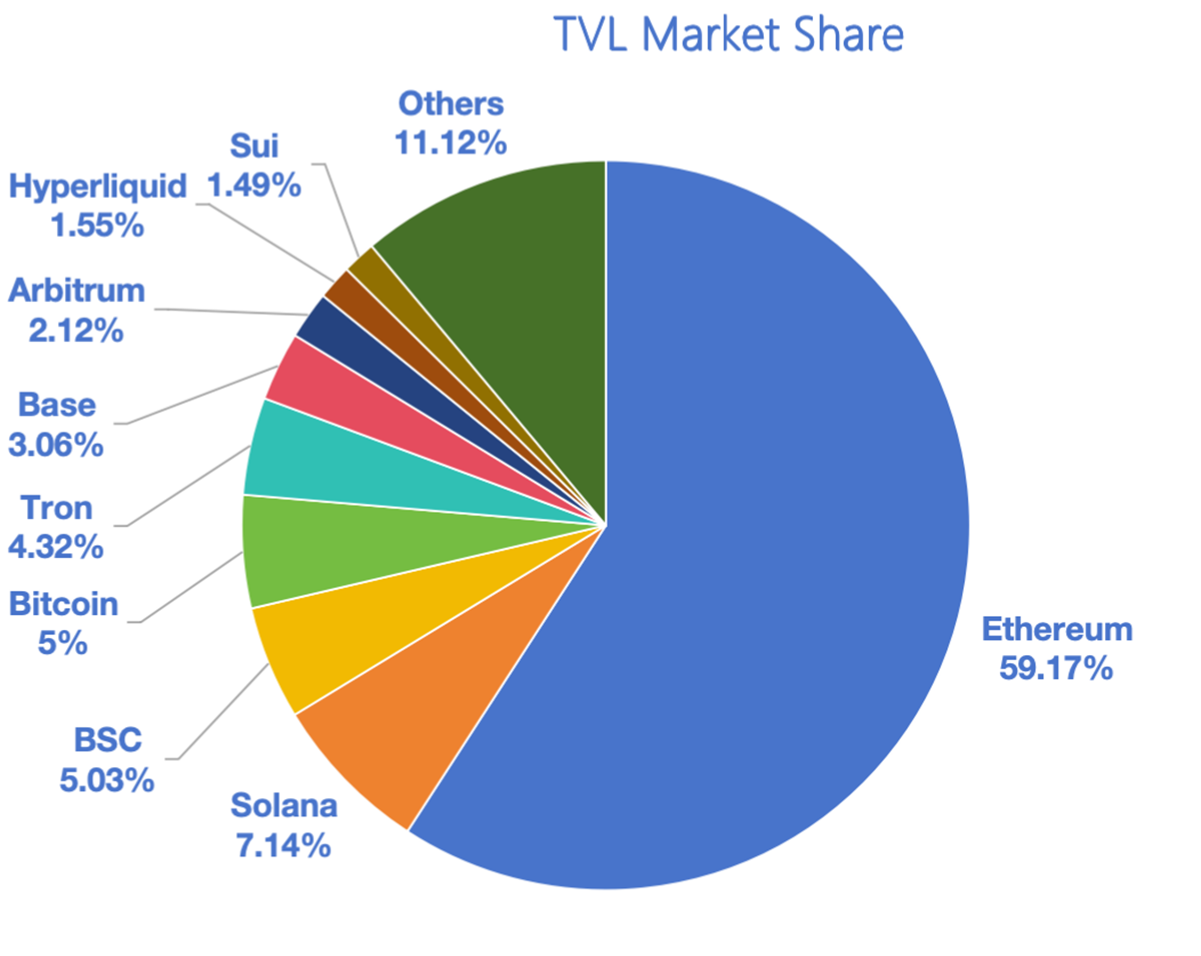

- 据DeFiLlama的数据,本周DeFi总TVL为1,329亿美元,较上周1,432亿美元,本周跌幅为7.19%。按公链进行划分,其中TVL最高的三条公链分别是Ethereum链占比59.17%;Solana链占比7.14%;BSC(BNBChain)链占比5.03%。

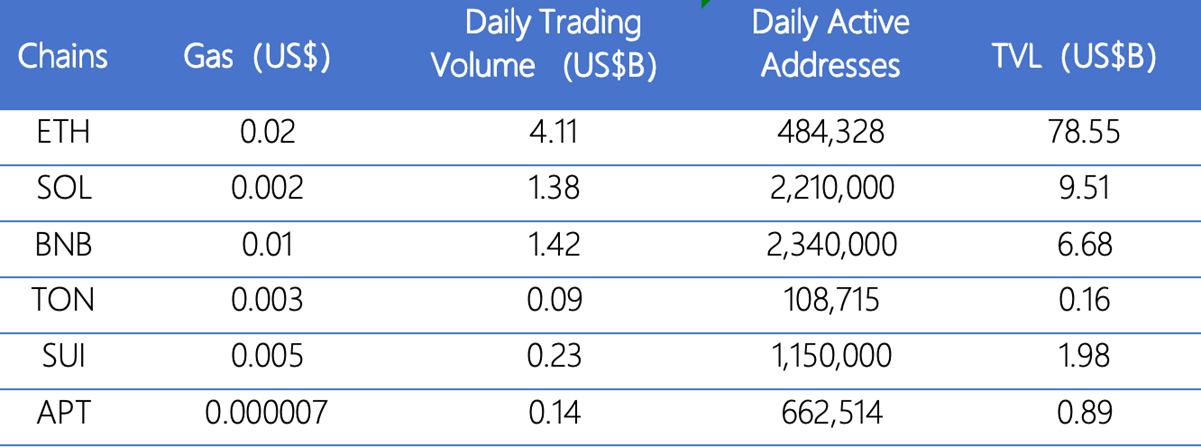

- 从链上数据看,本周日成交量除Ethereum和Toncoin有小幅度增长之外,其余公链整体都是下跌的趋势。其中,BNBChain和Sui下跌最为显著,较上周的跌幅分别为71.9%和60.9%;交易费用上,Toncoin较上周下跌70%,Sui较上周下跌37.5%,Aptos较上周上涨40%,其余公链交易费用较稳定;从日活跃地址上看,BNBChain较上周上涨25.1%,Sui较上周下跌20.4%,其余公链趋于稳定;从TVL上看,除Toncoin和上周持平之外,其余公链都是下跌趋势,其中Sui下跌最为显著,较上周的跌幅为13.9%。

- 创新项目关注:Omni Exchange是跨链去中心化交易平台,致力于打通不同区块链网络之间的资产交易壁垒;Honeypop DEX是部署在Scroll上的去中心化自动做市商(AMM)协议,具备完全无需许可的特性,旨在成为该链生态中的核心流动性枢纽,为用户和项目提供高效、开放的交易与流动性服务;Breeze是构建在Solana上的收益引擎,旨在为任何移动应用快速集成原生收益功能。

目录

关键要点\u0026nbsp;\u0026nbsp;\u0026nbsp;\u0026nbsp;

1.加密货币总市值/比特币市值占比\u0026nbsp;\u0026nbsp;

2.恐慌指数\u0026nbsp;\u0026nbsp;

3.ETF流入流出数据

4.ETH/BTC和ETH/USD兑换比例\u0026nbsp;\u0026nbsp;\u0026nbsp;

5. Decentralized Finance (DeFi)\u0026nbsp;\u0026nbsp;\u0026nbsp;\u0026nbsp;

6 .链上数据\u0026nbsp;

7. 稳定币市值与增发情况\u0026nbsp;\u0026nbsp;\u0026nbsp;\u0026nbsp;

二.本周热钱动向\u0026nbsp;\u0026nbsp;\u0026nbsp;\u0026nbsp;\u0026nbsp;

1.本周涨幅前五的VC币和Meme币

2.新项目洞察\u0026nbsp;\u0026nbsp;\u0026nbsp;\u0026nbsp;\u0026nbsp;

三.行业新动态\u0026nbsp;\u0026nbsp;

1.本周行业大事件\u0026nbsp;\u0026nbsp;\u0026nbsp;\u0026nbsp;

2.下周即将发生的大事件\u0026nbsp;\u0026nbsp;\u0026nbsp;\u0026nbsp;\u0026nbsp;\u0026nbsp;

一.市场概览

1.加密货币总市值/比特币市值占比

全球加密货币总市值为3.77万亿美元,较上周4.16万亿美元,本周内加密货币总市值跌幅为9.38%。

数据来源:cryptorank

截止至发稿,比特币的市值为2.27万亿美元,占加密货币总市值的60.02%。与此同时,稳定币的市值为 2,740亿美元,占加密货币总市值的7.26%。

数据来源:coingeck

2.恐慌指数

加密货币恐慌指数为65,显示为贪婪。

数据来源:coinglass

3.ETF流入流出数据

截止至发稿,美国比特币现货ETF累计总净流入约541.8亿美元,本周净流出6.43亿美元;美国以太坊现货ETF累计总净流入约94.9亿美元,本周净流入1.54亿美元。

数据来源:sosovalue

4.ETH/BTC和ETH/USD兑换比例

ETHUSD :现价 3,537美元,历史最高价 4,878 美元,距最高价跌幅约27.3%。

ETHBTC :目前为 0.030841,历史最高为0.1238。

数据来源:ratiogang

5. Decentralized Finance (DeFi)

据DeFiLlama的数据,本周DeFi总TVL为1,329亿美元,较上周1,432亿美元,本周跌幅为7.19%。

数据来源:defillama

按公链进行划分,其中TVL最高的三条公链分别是Ethereum链占比59.17%;Solana链占比7.14%;BSC(BNBChain)链占比5.03%。

数据来源:CoinW研究院,defillama

数据截止至2025年8月3日

6 .链上数据

Layer 1相关数据

主要从日交易量、日活跃地址、交易费用分析目前主要Layer1含ETH、SOL、BNB、TON、SUI以及APT的相关数据。

数据来源:CoinW研究院,defillama,Nansen

数据截止至2025年8月3日

- 日成交量与交易费用:日成交量和交易费用是衡量公链活跃度和用户体验的核心指标。本周日成交量除Ethereum和Toncoin有小幅度增长之外,其余公链整体都是下跌的趋势。其中,BNBChain和Sui下跌最为显著,较上周的跌幅分别为71.9%和60.9%;交易费用上,Toncoin较上周下跌70%,Sui较上周下跌37.5%,Aptos较上周上涨40%,其余公链交易费用较稳定。

- 日活跃地址与TVL:日活跃地址反应了公链的生态参与度和用户粘性,TVL反应了用户对平台的信任程度。从日活跃地址上看,BNBChain较上周上涨25.1%,Sui较上周下跌20.4%,其余公链趋于稳定;从TVL上看,除Toncoin和上周持平之外,其余公链都是下跌趋势,其中Sui下跌最为显著,较上周的跌幅为13.9%。

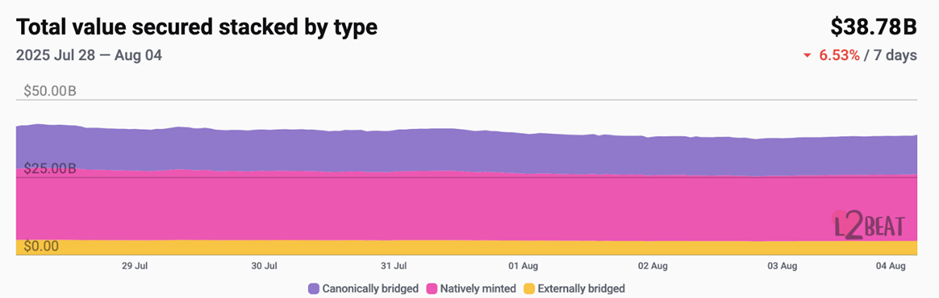

Layer 2相关数据

- 据L2Beat数据显示,以太坊Layer2总TVL为387.8亿美元,本周较上周416.7亿美元,整体跌幅为6.53%。

数据来源:L2Beat

数据截止至2025年8月3日

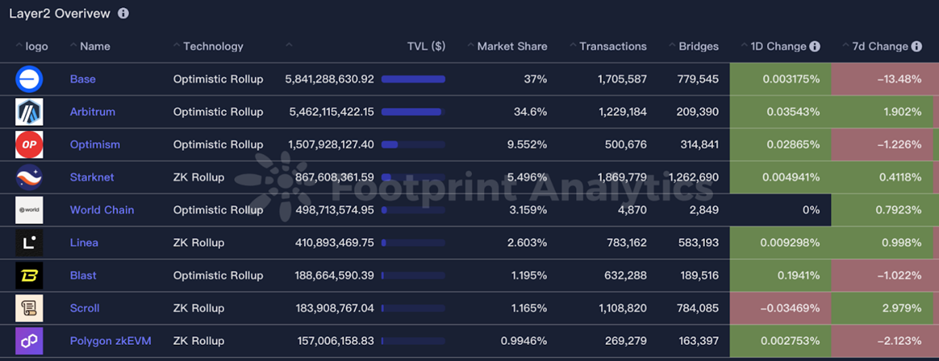

- Base和Arbitrum分别以37% 和34.6% 的市场份额占据前排,本周Base依然在以太坊Layer2的TVL中位居第一。

数据来源:footprint

数据截止至2025年8月3日

7. 稳定币市值与增发情况

据Coinglass数据,稳定币总市值为2,740亿美元。其中USDT市值为1,639亿美元,占稳定币总市值的59.81%;其次是USDC市值为642亿美元,占稳定币总市值的23.43%;DAI市值为53.6亿美元,占稳定币总市值的1.96%。

数据来源:CoinW研究院,Coinglass

数据截止至2025年8月3日

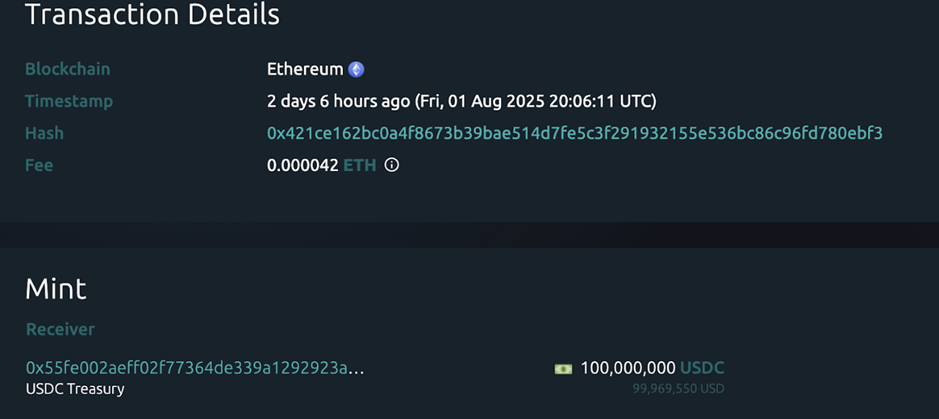

据Whale Alert数据显示,本周内USDC Treasury总计增发14.5亿枚USDC,Tether Treasury总计增发10亿枚USDT,本周稳定币增发总量为24.5亿枚,较上周稳定币增发总量34.12亿,本周稳定增发总量跌幅约为28.19%。

数据来源:Whale Alert

数据截止至2025年8月3日

二.本周热钱动向

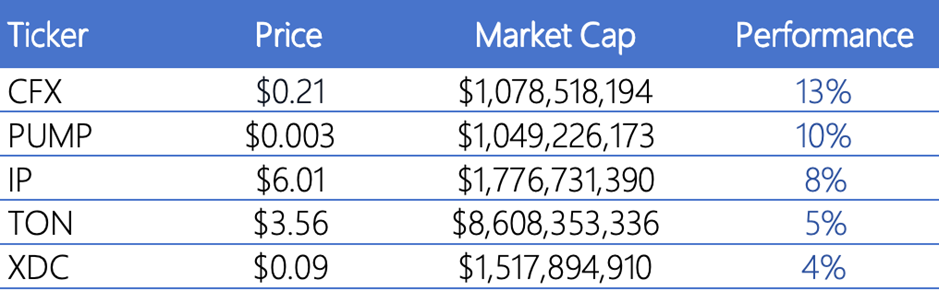

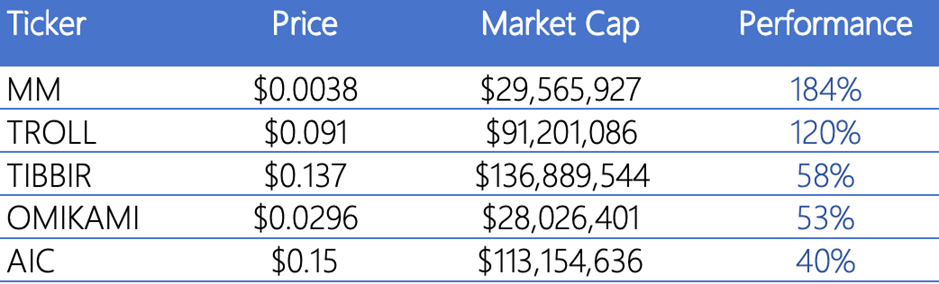

1.本周涨幅前五的VC币和Meme币

过去一周内涨幅前五的VC币

数据来源:CoinW研究院,coinmarketcap

数据截止至2025年8月3日

过去一周内涨幅前五的Meme币

数据来源:CoinW研究院,coinmarketcap

数据截止至2025年8月3日

2.新项目洞察

- Omni Exchange是跨链去中心化交易平台,致力于打通不同区块链网络之间的资产交易壁垒。依托多链基础设施,Omni 为 Web3 生态提供高效、安全的去中心化交易与流动性聚合解决方案,实现跨网络资产的无缝交换与流动性共享。

- Honeypop DEX 是部署在 Scroll 上的去中心化自动做市商(AMM)协议,具备完全无需许可的特性,旨在成为该链生态中的核心流动性枢纽,为用户和项目提供高效、开放的交易与流动性服务。

- Breeze是构建在 Solana 上的收益引擎,旨在为任何移动应用快速集成原生收益功能。开发者只需几行代码即可为应用添加非托管、安全且高速的收益分润机制,帮助产品在不改变用户体验的前提下解锁新的商业模式。Breeze 已获得 Solana 官方、Turnkey 等生态支持,致力于让“收益集成”变得简单、轻量、即插即用。

三.行业新动态

1.本周行业大事件

- Solana 流动性管理平台 Meteora 发布积分查询网站,第一季快照于6月30日拍摄。Meteora 第二季活动正在进行中,用户提供流动性可赚取手续费和获得第二季LP激励计划的积分

- Ethereum L2 网络 Linea 公布空投细节,计划将总代币供应量的 9% 分配给获得 LXP 的用户,目前已完成快照和女巫过滤,10% 将用于奖励早期贡献者,1% 分配给战略建设者。空投资格检查器即将上线,将包含门槛值与乘数说明。生态流动性奖励另行从 75% 的生态基金中发放,与用户空投无关,该基金设有 10 年解锁期,专注长期生态建设。剩余 12% 的流通代币将用于交易所流动性等用途,后续 Linea 还将公布原生收益桥设计和 TGE时间。

- Fetch.ai 与ICP联合发起的 NextGen Agents Hackathon 黑客松正式启动,奖金池 30 万美元。该活动鼓励开发者基于 Fetch.ai 生态构建自主 AI 代理,并连接至 ICP 的去中心化区块链基础设施,优胜团队还将直接晋级 2025 年世界计算机黑客联盟赛事。

- 去中心化 AI 智能体平台 SIA Nexx 上线旗下投资交易类 multi-Agent 平台,等待名单上的用户现可在完成验证后体验更智能、更高效的 AI Agent 交互体验。更多场景的 multi-Agent 平台将于近期推出。此外,SIA 积分互动规则也已同步上线,用户使用 SIA Agents 可获取积分,参与后续活动。

- Ethena 上线 TON,提供 20% APY(包括 12% 基本 tsUSDe APY+10% TON APY)另外,在 STON.Fi、Fiva Protocol、Eva Protocol 和 Affluent 上也可获得 APY 提升,上限为 10000 tsUSDe。

2.下周即将发生的大事件

- dYdX 基金会旗下全资子公司 dYdX Grants Ltd. 正向 dYdX Chain 社区财政部申请 800 万美元的 DYDX 资金,用于启动并运营新的资助计划,预计可覆盖未来 12 至 18 个月的运行周期。该计划旨在进一步支持 dYdX 生态系统中的开发者、研究人员和贡献者,同时提升整体运营效率与成本效益。经过社区反馈后,相关链上治理提案于8月4日正式启动。

- Rice Robotics 将于8月5日在 TokenFi Launchpad 上推出其 RICE 代币,旨在为人工智能机器人构建去中心化数据市场,推动机器人数据的代币化与 DePIN 扩展。此次预售总额为 75 万美元,占总供应量(10 亿枚)的 10%,估值为 750 万美元,合作方包括 BNB Chain、DWF Labs 和 Floki。RICE 代币将用于激励数据贡献、订阅 AI 模型与参与平台治理,并通过手续费回购实现通缩。Rice 的室内配送机器人已部署至软银东京总部、日本 7-Eleven 等场所,公司今年初获得阿里巴巴创业者基金等机构的 700 万美元 Pre-A 融资。

- Solana Mobile 宣布其第二款智能手机 Seeker 于 2025 年 8 月 4 日开始发货,并同步推出原生代币 SKR。作为 Solana 移动生态的核心资产,SKR 将直接分发给参与生态系统的开发者和用户,旨在激励社区建设与应用增长。

3.上周重要投融资

- RD Technologies,完成了总额为4000万美元的A2轮融资,投资方包括Hongshan、Hivemind Capital等。RD Technologies是一家致力于推动信任、稳定与高效支付的创新型金融科技公司,核心产品包括以港币支持的稳定币 HKDR 和获得许可的储值支付工具 RD Wallet。公司旨在通过数字货币与合规金融工具的结合,赋能香港及全球 Web3 经济发展,支持本地、离岸及海外企业实现多币种、跨境、高效的金融交易。(2025年7月30日)

- Stable,完成了种子轮融资,筹集资金2800万美元,投资方包括 Hack VC、Bitfinex、Castle Island、Franklin Templeton等。Stable 是由 Bitfinex 和 Tether 推出的 Layer 1,主打以 USDT 作为原生 Gas 实现免费点对点转账。该链支持在稳定币上直接运行智能合约,具备无 Gas 的用户体验、原生法币端口集成、通过 USDT0 实现的无桥跨链机制,以及合规架构与优先执行通道,旨在为 Web3 应用提供稳定、高效、便捷的基础设施。(2025年7月31日)

- Billions,完成了总额为3000万美元的融资,投资方包括Coinbase Ventures、Liberty City Ventures、Polychain、Polygon等知名机构。Billions Network 是专注于数字身份验证的网络平台,旨在构建一个人与 AI 彼此可信的未来。该平台采用零知识证明技术,致力于为人类和 AI 身份提供可扩展且安全的验证机制,也是 Sam Altman 加密项目 World 的基础设施之一,聚焦于可信身份在加密与人工智能时代的核心作用。(2025年7月31日)

参考链接:

1.Breeze,https://x.com/usebreezebaby

2.Honeypop,https://x.com/honeypop_app

3.Omni Exchange,https://x.com/Omni_Exchange

4.Billions,https://x.com/billions_ntwk

5.Stable,https://x.com/stable

6.RD Technologies,https://x.com/RD_Technologies

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。