Written by: Ding Dong (@XiaMiPP)

After several unsuccessful attempts to break through the $120,000 mark, Bitcoin's price has retreated and consolidated, with the crypto market experiencing another pullback today. According to OKX market data, Bitcoin has dropped 3.35% in the last 24 hours, falling below the daily support level, currently reported at $114,840; Ethereum has seen a 5.96% decline in the same period, now at $3,635; SOL has declined for the fifth consecutive day, showing almost no signs of rebound, currently at $168.

Currently, the overall market sentiment is at a standstill, with increasingly obvious divergences between bulls and bears.

Risk sentiment is also reflected in the liquidation data. In the past 24 hours, a total of 162,820 traders have faced liquidation, involving funds as high as $637 million. Among them, long positions accounted for $588 million, while short positions totaled $48.76 million. The largest single liquidation occurred on the Binance platform's ETHUSD perpetual contract, amounting to $13.79 million.

CryptoQuant data shows that the trading volume of ETH and altcoin contracts has rapidly rebounded in recent times, with the latest statistics reaching $22.36 billion, a five-month high, indicating a potential increase in speculative enthusiasm.

However, data from Coinglass.com shows that the open interest in BTC contracts has slightly retreated to $84.13 billion after reaching a historical high of $86.864 billion on July 18, releasing some leverage pressure and indicating that the market is slowly contracting from high levels.

Capital sentiment shifts to wait-and-see, ETF inflows show divergence

According to data from sosovalue.com, since July 21, Bitcoin spot ETFs have experienced consecutive net outflows after a short-term concentrated net inflow, indicating that capital sentiment is shifting from active to wait-and-see. In contrast, Ethereum spot ETFs have not recorded clear outflows, but the inflow intensity is also weakening, suggesting that the market may hold a reserved attitude towards future policy expectations and market developments.

Bitcoin's market dominance (BTC.D) rebounded after a significant drop on July 21, while altcoins have gradually shown weaker relative performance, indicating that the strength relationship between sectors may be undergoing new changes.

Macroeconomic disturbances: Trump's tariff order ignites risk aversion demand

Behind the market volatility, there are certainly policy disturbances at play. U.S. President Trump signed a new tariff executive order last night, deciding to impose tariffs ranging from 15% to 41% on imports from 67 trading partners, raising the overall tax rate to its highest level in over a century. Notably, this policy will officially take effect on August 7, rather than the previously expected August 1, interpreted by the outside world as leaving a buffer window for multilateral negotiations.

Meanwhile, according to CME's "Fed Watch," the probability of the Federal Reserve maintaining interest rates in September is 61.8%, while the probability of a 25 basis point rate cut is 38.2%. The cumulative probability of a rate cut in the October meeting is also approaching 60%. On July 30, the predicted probability of a 25 basis point rate cut in September was 60.9%. The market's bet on the reduced probability of a Fed rate cut may further enhance the market's defensive sentiment.

Hong Kong introduces stablecoin regulatory details, releasing compliance dividends

On the regulatory front, Hong Kong has officially implemented stablecoin management rules. On August 1, the "Stablecoin Ordinance" took effect, and the Monetary Authority simultaneously released the "Regulatory Guidelines for Licensed Stablecoin Issuers," clarifying the licensing application thresholds and regulatory framework. According to reports from the Securities Times, major issuing banks such as Bank of China (Hong Kong) and Standard Chartered Hong Kong may be among the first to submit applications, with several Chinese banks and large internet companies actively preparing.

As of now, 44 financial institutions have completed the upgrade of their securities trading licenses, with initial business covering stablecoin trading, custody, and financing services, laying a systemic foundation for the entire crypto compliance ecosystem.

Public companies "buying up" crypto assets, financial report data is eye-catching

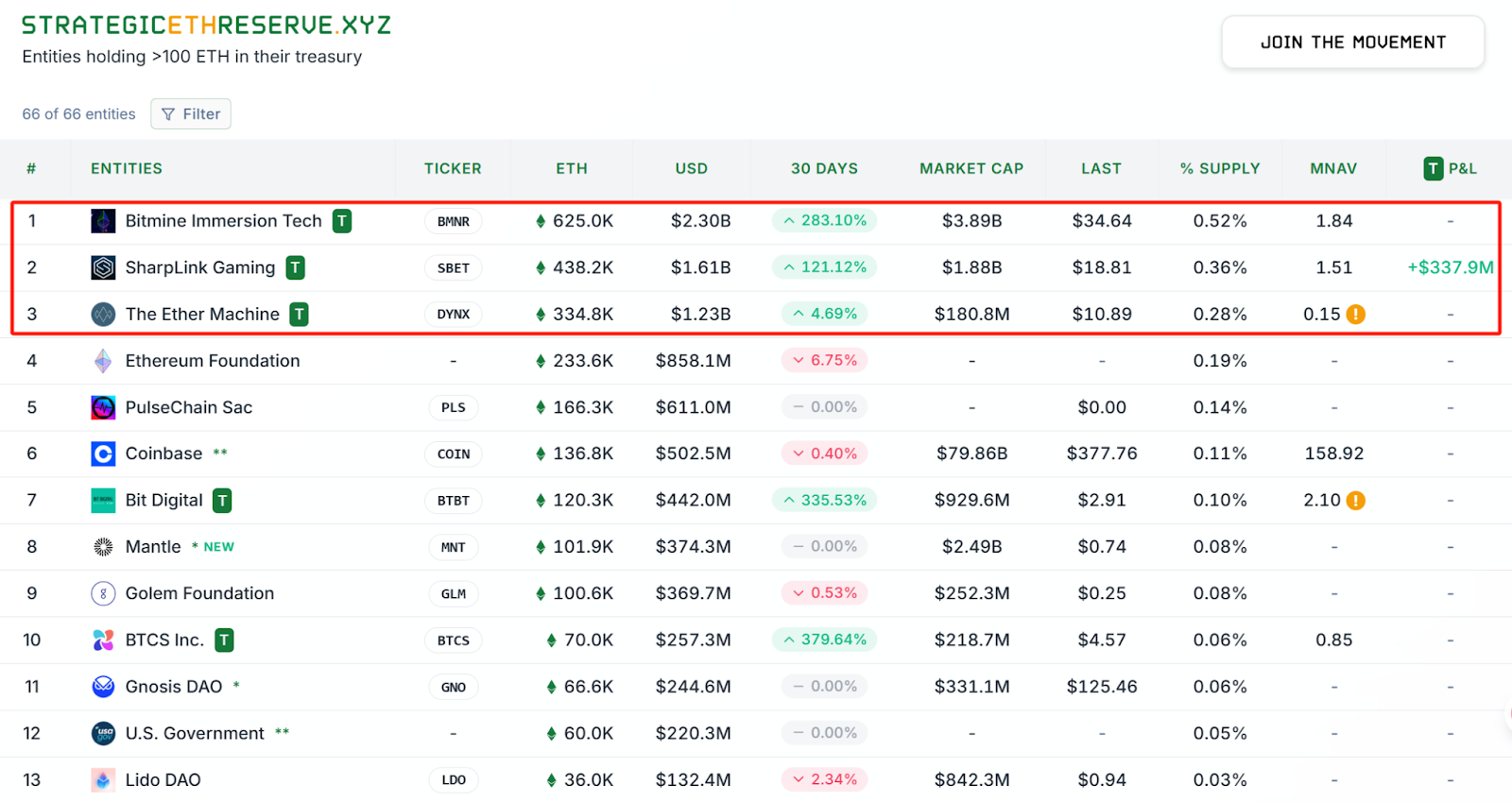

Behind this round of crypto price increases, institutional capital is a key driver. According to a report released by Galaxy Research on Thursday, financial companies like Strategy, Metaplanet, and SharpLink currently hold a total of $100 billion in crypto assets. Among them, Bitcoin accounts for the absolute majority, with a total of 791,662 BTC (approximately $93 billion), equivalent to 3.98% of Bitcoin's circulating supply; the Ethereum portion is 1.3 million ETH, valued at over $4 billion, accounting for 1.09% of the supply.

Strategy (MSTR) also reported that its Q2 revenue reached a historical high of approximately $14.03 billion, a year-on-year increase of 7106%. This includes unrealized gains from digital assets of $14 billion. As of July 30, Strategy held a total of 628,791 BTC, with an average holding cost of $73,277 per coin. The company also announced plans to apply for $4.2 billion in STRC issuance financing, which will be further used to increase its BTC holdings.

Another whale, The Ether Machine, holds 334,800 ETH (approximately $1.24 billion), making it the third-largest holder of Ethereum.

Interplay of technology and sentiment: Institutional movements become market indicators

Glassnode analysis indicates that the current Bitcoin price remains above the average cost range for short-term holders (24 hours to 3 months) ($110,000 to $117,000), which overlaps with historically low trading volume areas, providing strong support during the pullback.

CryptoQuant analysts also pointed out that when Bitcoin reached the psychological threshold of $120,000, long-term holders (LTH) showed signs of net reduction in holdings. Institutional investor Galaxy Digital has sold approximately 80,000 BTC. Analysts suggest that this round of market adjustment is primarily driven by institutions, rather than retail investors. Currently, the overall profit-taking scale remains controllable, and the market is watching whether this adjustment will evolve into a larger-scale pullback.

Market research firm SentimenTrader noted that U.S. stocks are about to close a "super July": the S&P 500 has set a new historical high 10 times this month, while the Nasdaq index has set records 14 times, marking the third-best performance for the same period since 1928. However, historical data shows that after a hot July, August often underperforms, with a significantly increased probability of pullbacks.

Bernstein stated in a report to clients that the current crypto bull market cycle is still in its early stages, and trading platforms like Robinhood and Coinbase are expected to benefit from increased trading volume and mainstream market adoption. Bernstein reiterated its "outperform" rating for these two companies, maintaining confidence in their performance. The report shows that Robinhood's Q2 performance was impressive, and it continues to expand its cryptocurrency products. In July, its trading volume surged to a six-month high, thanks to the rebound in market volatility and increased investor interest in ETH, SOL, and DeFi tokens influenced by factors such as Circle's listing. It is expected that cryptocurrency trading volume will significantly rebound in the second half of the year. Additionally, the report mentioned that Coinbase has reached a strategic partnership with JPMorgan, which will greatly promote the adoption of digital assets. JPMorgan's embrace of an industry previously criticized by its CEO will accelerate Coinbase's customer acquisition. Bernstein believes that the current crypto bull market is still early, and recent developments support this view, indicating that "no action is needed at this time."

On-chain games: Chip distribution is quietly changing

On-chain analyst Yu Jin monitored that a whale that accumulated $73.96 million in profits from ETH trading has started to buy ETH again. This address transferred 173 million USDT to Wintermute in the past four hours and then received 20,000 ETH, valued at approximately $74.06 million.

This whale previously bought 132,000 ETH at an average price of $2,540 in June and sold 113,600 ETH at an average price of $2,923 in July, realizing a profit of $43.5 million. Currently, this address holds 40,000 ETH, with an average holding cost of $3,121.

Onchain Lens monitoring also shows that a newly created wallet has received 23,314 ETH from Galaxy Digital, valued at approximately $8.827 million. This wallet currently holds a total of 62,966 ETH, with a total value of approximately $233 million.

The story of contract whale AguilaTrades is less smooth. Its highly leveraged BTC long position on HyperLiquid has been partially liquidated again, with cumulative losses reaching $39.8 million, and the account funds are nearly zero.

Strategic games amid divergence: The main line is ETH, while altcoins may become sacrificial victims?

Crypto KOL @0xSunNFT posted on social media that there is currently a serious divergence between bulls and bears in the market, and he has established a hedging position: going long on ETH while shorting a basket of underperforming altcoins, with a ratio of about 1:1. His strategic logic is that ETH is the main asset driving this round of increases, while also holding a prominent position in the narrative of infrastructure like stablecoins; the funds that institutions use to increase their ETH holdings through coin-stock financing are unlikely to spread to non-mainstream coins.

0xSun pointed out that if the market continues its upward trend in the second half of the year, ETH is likely to continue leading; if the market weakens, ETH at least still has institutional support, while altcoins are more likely to become the vanguard of declines.

However, on-chain data also shows that a newly created wallet address recently withdrew approximately $4.2 million worth of various token assets from Binance, specifically including: 80,126 LINK (approximately $1.46 million), 11.034 billion SHIB (approximately $1.45 million), 3.44 million MATIC (approximately $762,000), and 142.62 ETH (approximately $552,000). The current ownership of this address is still unclear.

Conclusion

Bitcoin has repeatedly failed to break through key resistance levels, while Ethereum continues to consolidate at high levels without a breakthrough, and capital sentiment is gradually turning conservative. ETF inflows are diverging, whales are frequently adjusting their positions, and macro policy disturbances are ongoing. Under the intertwining of various variables, the market is increasingly showing strong defensive sentiment as it enters August. At such a sensitive moment, even slight fluctuations could evolve into a new round of bull-bear battles. For investors, this may not be a window for proactive action, but rather a suitable phase to stabilize positions and patiently wait for clearer direction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。