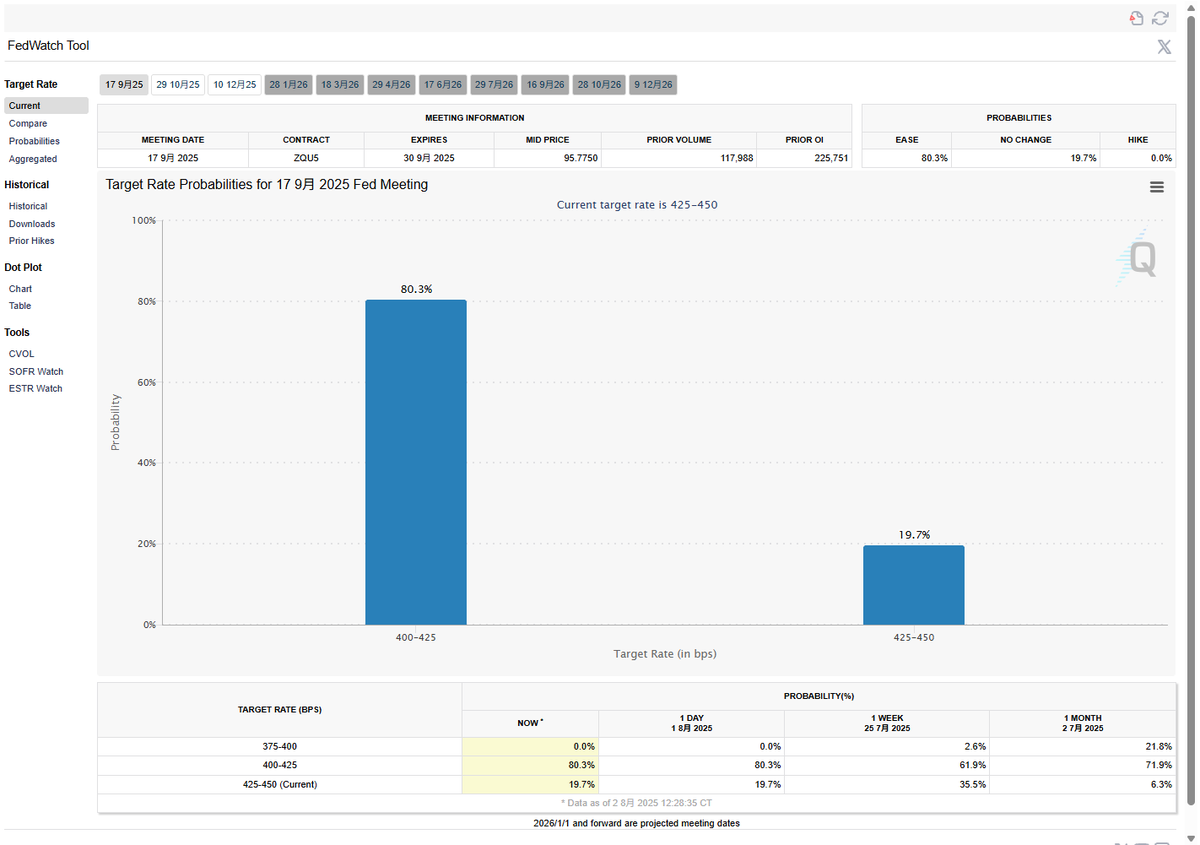

Although the weekend homework is a bit cruel, it's not too difficult to write. The major volatility that I feared did not occur, which I think is already quite good. The current slight fluctuations over the weekend indicate that investor sentiment is relatively stable. I believe the market is downplaying the macro data from the past week; whether it's Powell's speech, inflation, or non-farm payroll data, all have cast a shadow over the possibility of a rate cut in September.

However, the unexpected resignation of Kugler on Friday has brought a surprising turn, and three Federal Reserve officials, including Williams, have clearly stated that they will vote for a rate cut in September. With Kugler's replacement, at least four members of Trump's faction will be present at the September meeting, accounting for one-third of the voting committee. If they can pull in more than two additional members, a rate cut in September is a sure thing.

So my personal view is that the recent macro data is not important because the focus now is on the struggle between the radical faction represented by Trump and the conservative faction led by Powell. The significance of the data itself has diminished; Trump's faction will not consider the data and will only emphasize the need for a rate cut, while the conservatives will insist on not cutting rates to demonstrate their "independence." The impact of the data feels minimal.

Therefore, the current focus is not on the data itself but on the game between Trump and Powell. This is already evident from the expectations in the CME, where the market has begun to gradually ignore the data.

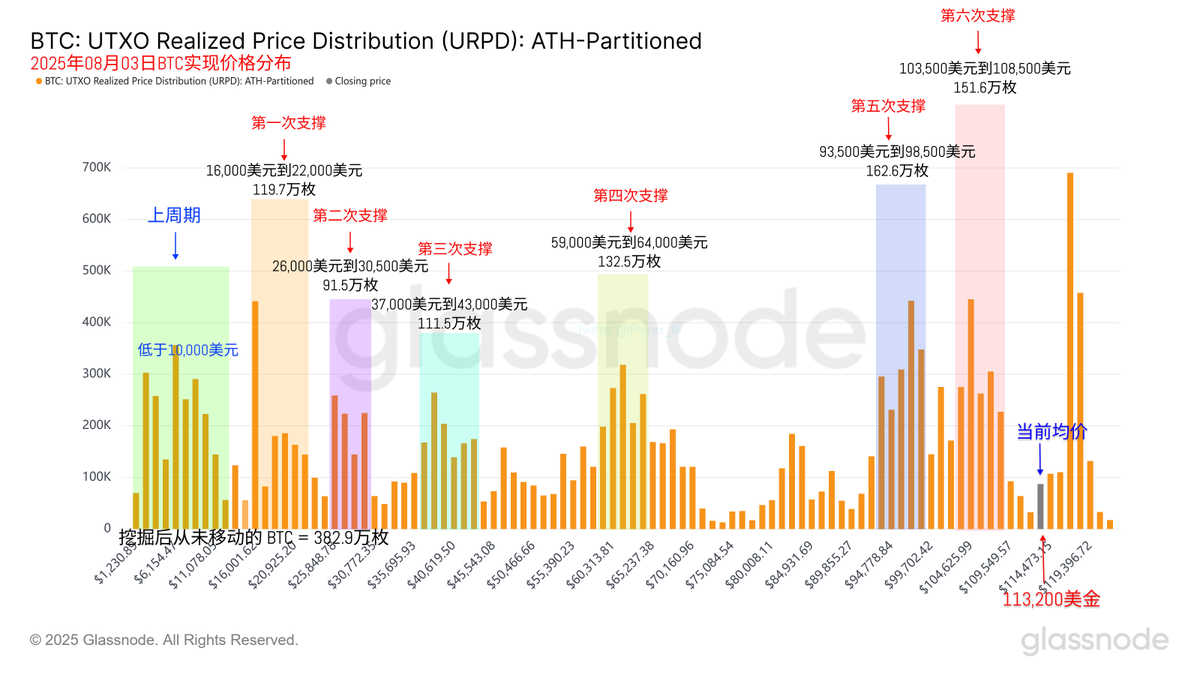

Looking back at Bitcoin's data, the gap of $112,000 in the URPD is what I am most concerned about. This gap has been filled as of today, and there are no gaps left in the URPD. Although filling gaps is somewhat mystical, this data in the URPD has never been wrong, and this time is no exception.

In terms of support, the first level of support is still between $103,500 and $108,500. I don't currently feel that there is systemic risk, so this support level should be quite stable. I plan to wait and see for now; I have no intention of stopping losses on my current long position, which is currently at a 65% unrealized loss.

However, I placed a second long position at $111,500. To be honest, I hope I won't have to take advantage of it, but if I do, I will face it calmly, as this is my own judgment. I believe it is not yet time to be fully bearish, though what I say may not necessarily be correct.

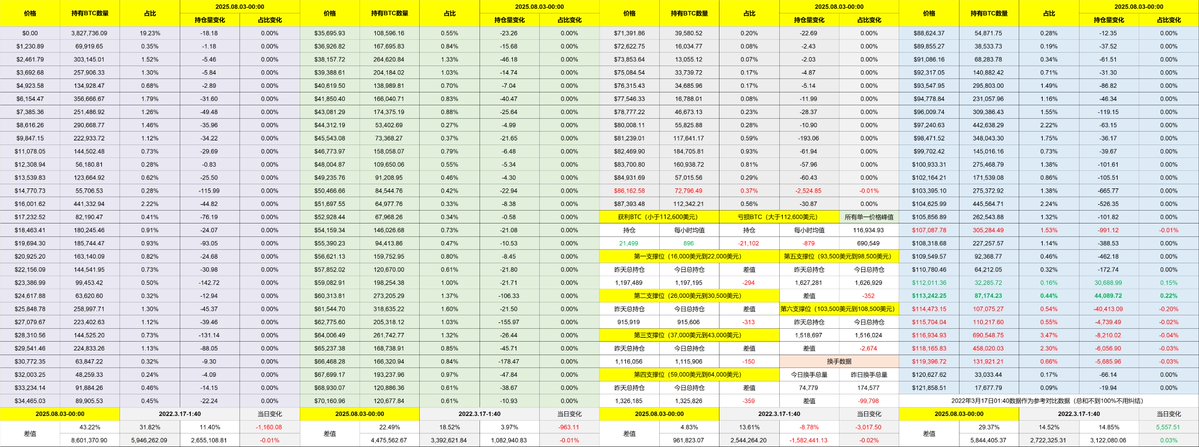

Today, the turnover rate has started to decline significantly. It would be good to get through the weekend safely. A new round of games will begin on Monday.

Data address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。