Author: Professor Yi

The long-awaited regulatory framework for stablecoins in Hong Kong has turned out to be a conservative proposal that has left many in the industry calling it "too cautious." Is this excessive prudence, or a missed opportunity? Let’s take a closer look at the freshly released "Stablecoin Regulation."

(1) From High Hopes to Sudden Disappointment

Just a few days ago, the "preview" of Hong Kong's stablecoin regulatory framework felt like a cold shower for many Web3 practitioners. Originally, everyone was hoping that at a time when dollar-pegged stablecoins were gaining momentum, Hong Kong would introduce an open and innovative regulatory scheme to help it become the Web3 hub of Asia. Who would have thought that the details released would instantly dampen many expectations?

This feeling is reminiscent of last year when the application for exchange licenses in Hong Kong went from being highly sought after to facing a cold reception. At that time, the regulatory policies in Hong Kong led to a wave of withdrawals from the industry (to revisit that history, where is the Hong Kong crypto market headed? / Who is to blame for the cooling of exchange license applications?).

(2) Three Major Pain Points of the New Regulations

On August 1, the "Hong Kong Stablecoin Regulation" will officially take effect. However, upon careful examination of this regulation, several key points make it hard to be optimistic:

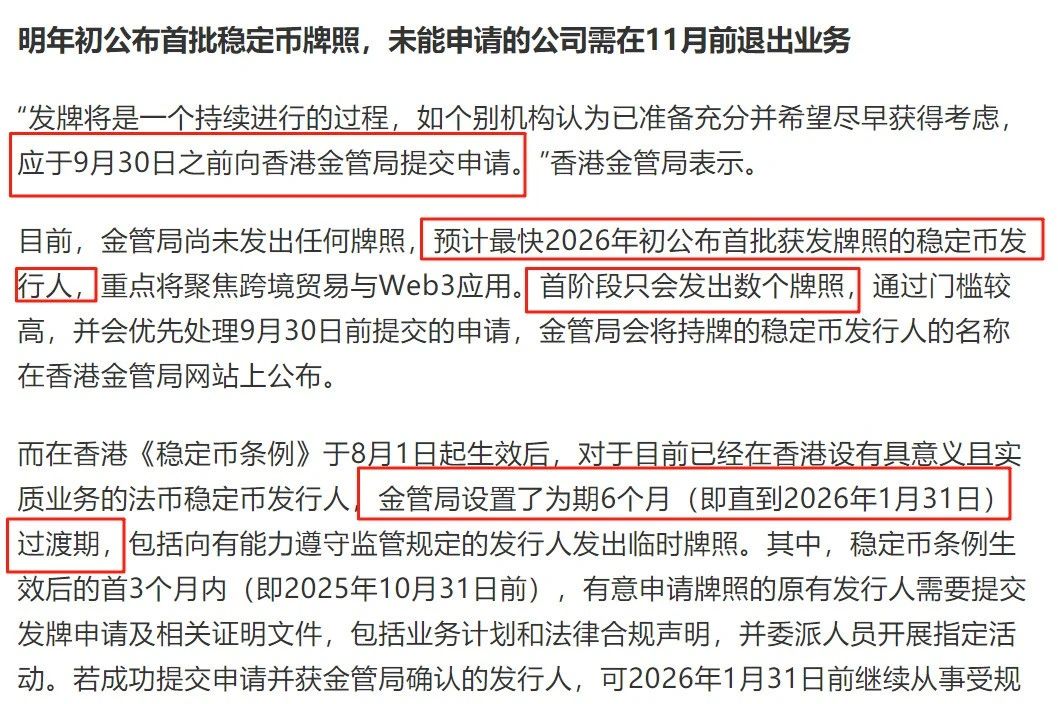

Pain Point 1: Tight Timeline, High Threshold, Few Licenses, Most Players Fear "Running Alongside"

Short Application Window: Applications are only open from August 1 to September 30 this year. For institutions that haven't "prepared in advance," the time is simply insufficient!

Temporary License "Limited Experience": Even if one manages to apply in time, what they receive is merely a temporary license valid for only 6 months. The real "graduation certificate" is still far off.

Formal Licenses "Scarce": Officials have revealed that the first batch of formal stablecoin licenses will be in single digits! Currently, there are over 50 institutions eager to apply. This means that the vast majority of applicants are destined to be "just along for the ride."

With such high thresholds, is this merely paving the way for a few "pre-selected" players?

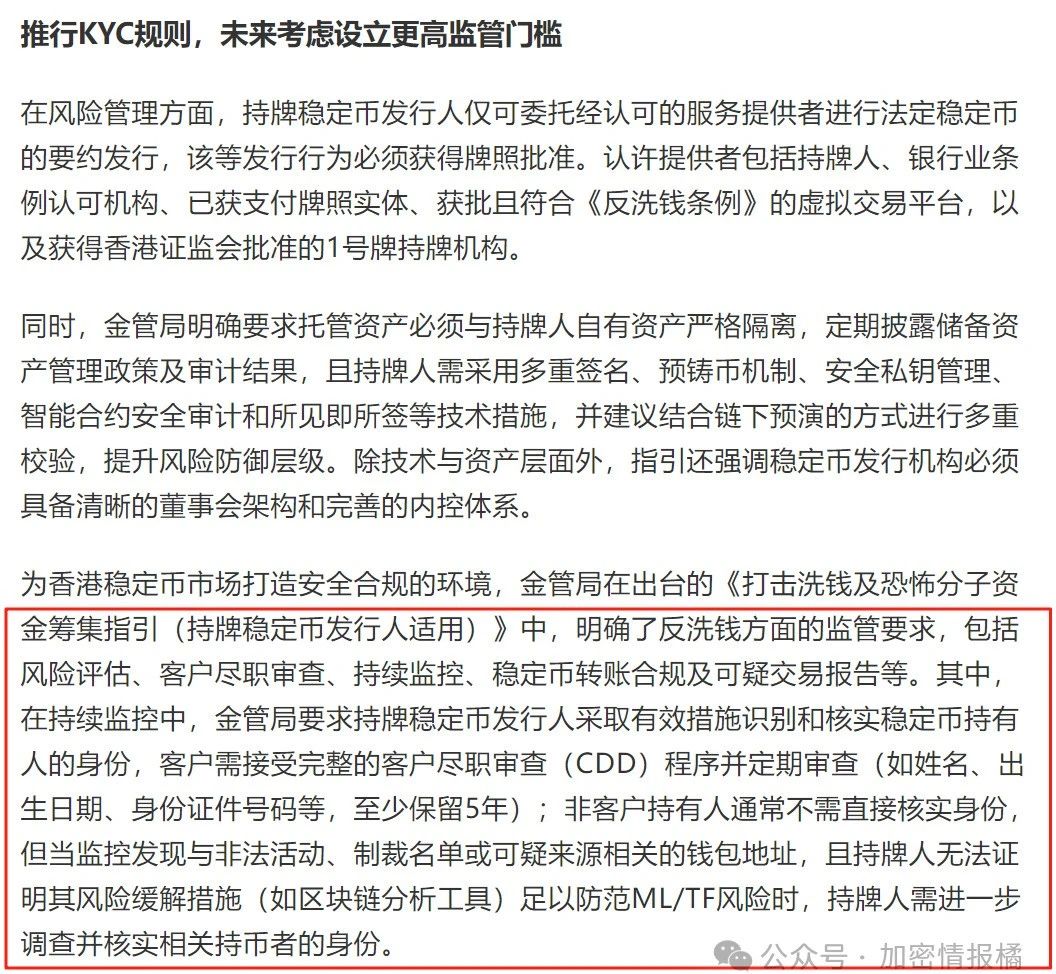

Pain Point 2: Holders Must Also KYC? This Operation is Unclear!

It is understandable to have strict requirements for issuing institutions, as protecting investors is a regulatory obligation. However, the regulation states that stablecoin holders (i.e., ordinary users) must also undergo identity verification (KYC) and due diligence by the issuer, with related records to be kept for at least 5 years.

This operation leaves many puzzled: buying stablecoins is not like opening a bank account or purchasing high-risk assets; why the need for such stringent measures? It feels as if all holders are presumed to be "risky" and must be screened first. This significantly increases the usage threshold and privacy concerns for ordinary users.

More critically, the Hong Kong government has hinted that future regulations will only become stricter.

Is this risk prevention or user prevention? Does such pre-screening go against the original intent of stablecoins being convenient?

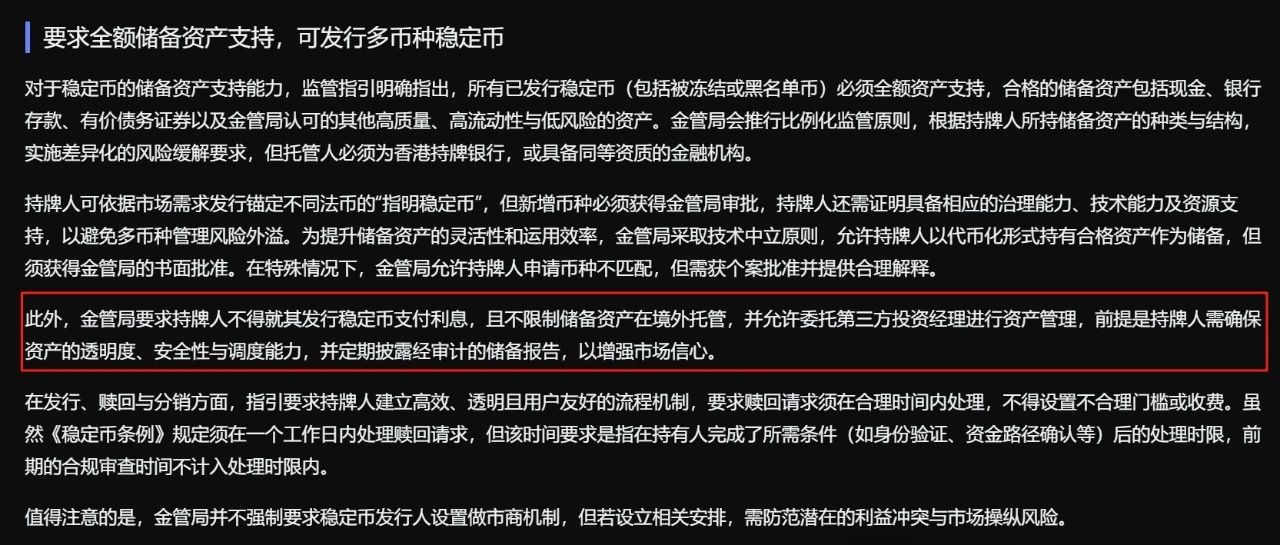

Pain Point 3: No Returns, Narrow Application Scenarios

The Monetary Authority has clearly stated that issuers cannot pay interest on stablecoins. This means that holding Hong Kong stablecoins will yield zero returns.

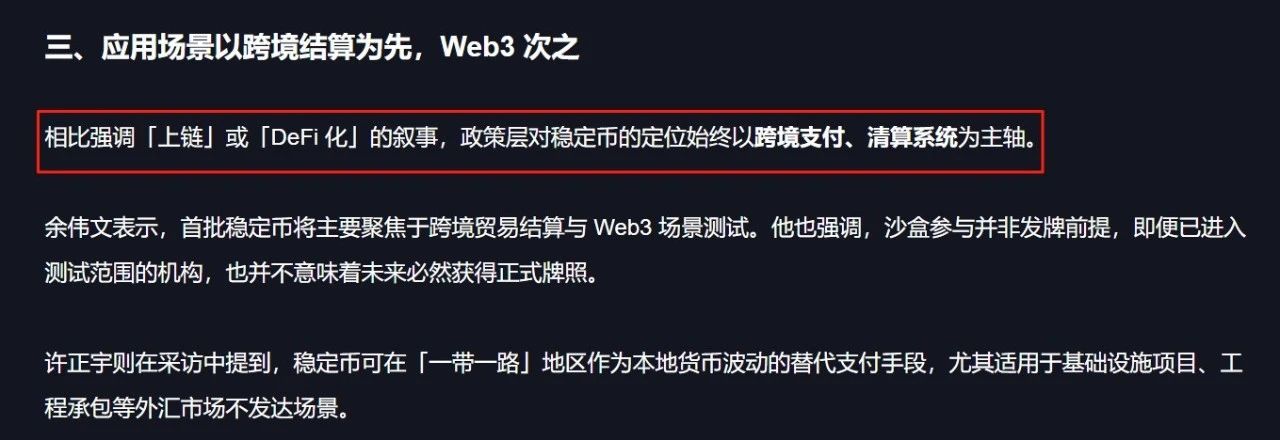

At the same time, the authorities seem uninterested in allowing stablecoins to deeply integrate into the Web3 ecosystem (such as DeFi), limiting their main battlefield to cross-border payments and settlements. While optimizing the existing payment system is a good thing, is the scope too narrow?

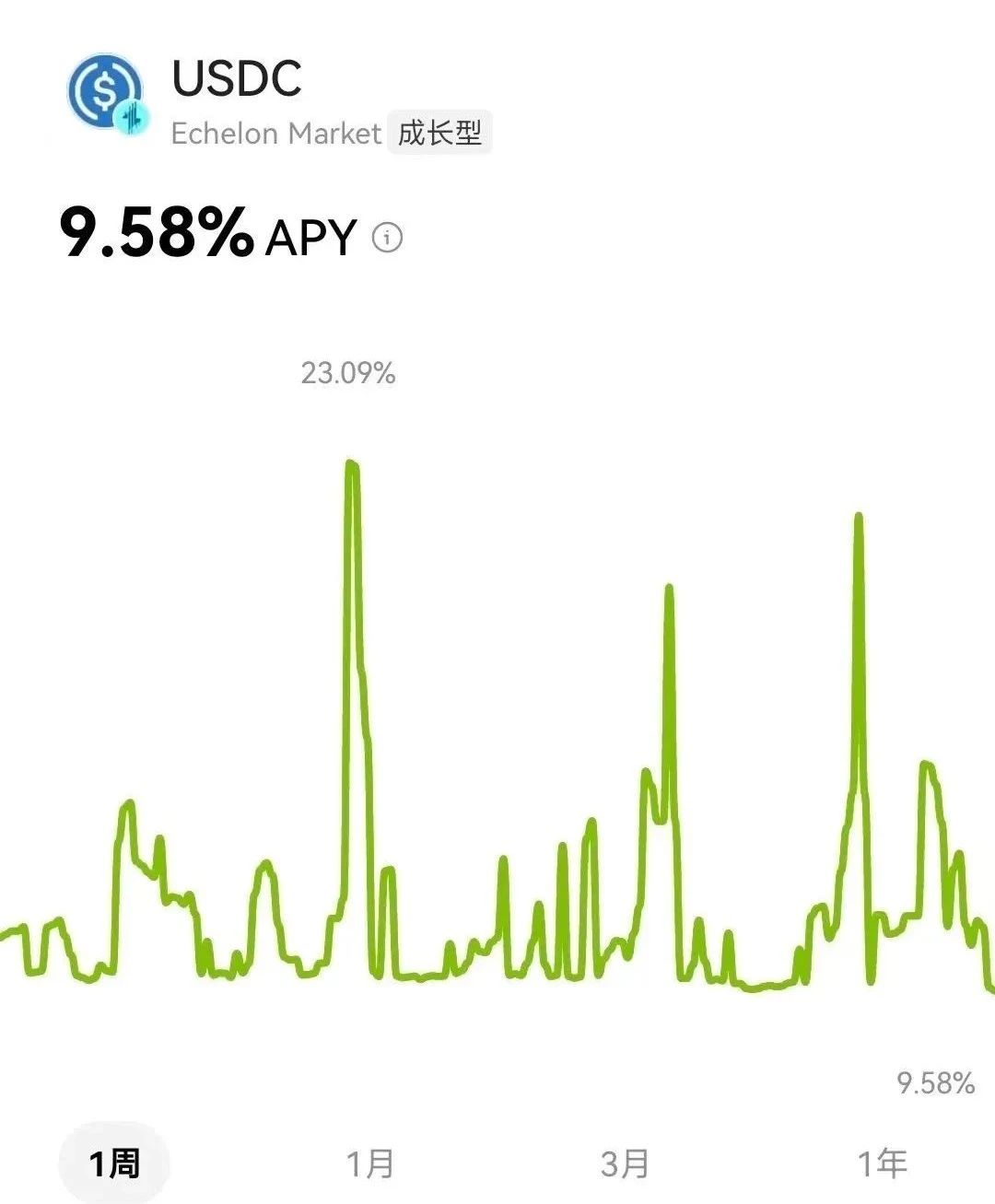

In comparison: mainstream dollar-pegged stablecoins (like USDC) can easily earn annual returns (some reaching 5%+ in the current market environment) on compliant platforms, with application scenarios spread across various corners of Web3.

With 0 returns and limited applications, how will Hong Kong stablecoins attract users and capital?

(3) More Caution than Initiative: What Lies Ahead for Hong Kong's Web3?

In my view, the core idea of this proposal is encapsulated in one word: "Control." Control the number of licenses, control the application time, control user identities, control the scope of business. The purpose is clear: cautiously introduce stablecoins within the framework of traditional finance (mainly cross-border payments and settlements), while strictly guarding against any potential "explosions."

This extremely cautious attitude, in contrast to the legislative direction being pursued across the ocean in the United States, which aims to establish a broad regulatory framework (despite its shortcomings), appears particularly conservative and somewhat "timid." The Hong Kong government seems to want a piece of the stablecoin pie while fearing the heat, and even more afraid of others snatching it away, resulting in a high plate that only a few "familiar faces" are handed forks.

Can such a "beta version" high-threshold policy truly promote industry development, or is it yet another instance of "self-entertainment"?

(4) Will the Market Vote with Its Feet?

The effectiveness of a policy is best reflected in market reactions:

1. Disparity in Scale: The planned issuance benchmark for Hong Kong's stablecoin is only $25 million, while the global dollar stablecoin settlement volume has already surpassed $26 trillion in 2024. The scale difference is like a puddle compared to the ocean.

2. Liquidity Concerns: With such a small scale, the cost of large funds entering and exiting will be very high, raising liquidity concerns.

3. Yield Disadvantage: 0 returns VS the considerable earning potential of dollar stablecoins.

4. Experience Gap: Complicated KYC VS the relative convenience of mainstream stablecoins.

When users have better options, where does the competitiveness of Hong Kong stablecoins lie? I worry that if policies do not adjust, the outcome may repeat the fate of exchange licenses: loud thunder but little rain, leaving only a few participants in the end.

After missing the opportunity for exchange licenses, will stablecoins become the next "mirage"?

Hong Kong stands once again at the crossroads of crypto asset regulation. The conservative stance of this "Stablecoin Regulation" has disappointed many who hoped Hong Kong would lead the Web3 wave in Asia. Overemphasizing "risk control" may have shackled innovation and weakened its own competitiveness.

The future of stablecoins is a global competition. If Hong Kong truly wants to become an international financial center and Web3 hub, it may need not only prudence but also the courage and wisdom to embrace innovation while balancing risk and development. Otherwise, the "Asian Financial Center" brand may face severe challenges in the Web3 era.

Can Hong Kong reclaim a victory in the stablecoin field and recover the missed opportunities? Share your thoughts in the comments!

Note: The articles from this account do not constitute any investment advice. Investment carries risks; please proceed with caution. Follow "Circle's Night Watchman" for more timely value updates.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。