Author: Slow Fog Security Team

Background

On July 29, 2025, the Hong Kong Monetary Authority (HKMA) released multiple guidelines and explanatory documents regarding the regulatory framework for stablecoin issuers, which will officially take effect on August 1, 2025. Two sets of guidelines were published in the gazette on August 1, 2025.

Summary of Consultation and Guidelines for Licensed Stablecoin Issuers;

Summary of Consultation and Guidelines for Anti-Money Laundering and Counter-Terrorist Financing (AML/CFT) applicable to Licensed Stablecoin Issuers;

Summary Explanation of the Licensing System and Application Procedures for Stablecoin Issuers;

Summary Explanation of Transitional Provisions for Existing Stablecoin Issuers.

These documents constitute the core regulatory components for the implementation of the stablecoin system in Hong Kong: they include not only summaries related to licensing applications and regulatory transitions but also two core standards developed around the AML/CFT framework. The content directly relates to whether stablecoin issuers can establish a compliant, controllable, and sustainable business framework, reflecting the HKMA's systematic response to money laundering and terrorist financing risks, which is also the focus of this article's interpretation.

Consultation Summary and Guidelines Released in July

Consultation Summary: Establishing Directions for System Optimization

During the public consultation period from May 26 to June 30, 2025, the HKMA received a total of 38 feedback submissions from banks, virtual asset platforms, Web3 companies, technology service providers, and law firms. The summary document primarily addresses several key issues of concern to the industry and revises the originally proposed requirements accordingly:

Adjustment of Regulatory Intensity for Non-Custodial Wallets: There is a general consensus in the market on the need to manage risks associated with customer wallets, but some opinions point out that due to current technological and analytical limitations, it is difficult to effectively distinguish between on-chain non-custodial wallets and custodial wallets. The HKMA requires licensees to verify the ownership or control of each customer wallet without needing to classify wallet types.

Flexible Application of On-Chain Monitoring Technology: Most opinions support the use of blockchain data to track transactions but express concerns that mandatory technical specifications may hinder small and medium-sized enterprises. The HKMA ultimately adopted a "technology adaptation" principle, encouraging the use of rather than mandating specific tools, requiring compliance capabilities to align with business scale.

Role Identification under the Travel Rule: Opinions indicate that licensees need to clarify whether they are the "originator," "intermediary," or "recipient" in transactions to fulfill different obligations. The HKMA stated it would continue to work closely with industry stakeholders and provide further guidance where appropriate.

Reasonable Limitation of Secondary Market Responsibilities: Regarding whether stablecoin issuers should bear monitoring responsibilities for the secondary market, some opinions argue that issuers should play a role because they have the most comprehensive understanding and ultimate control over the stablecoin lifecycle. Others believe that issuers have limited visibility and control over secondary market transactions and that it is technically challenging to monitor every peer-to-peer transaction, especially those involving non-custodial wallets. The HKMA's response reiterated the necessity for stablecoin issuers to establish and implement adequate and appropriate control systems to prevent and combat money laundering/terrorist financing and other criminal activities in their licensed stablecoin operations. Considering certain characteristics of stablecoins that may attract criminals, as well as the risks associated with peer-to-peer transactions and non-custodial wallets, the HKMA will adopt a cautious approach during the initial implementation phase. Unless licensees can demonstrate to the HKMA that their risk mitigation measures can effectively prevent and combat money laundering/terrorist financing and other crimes, the identity of each stablecoin holder (including holders without a client relationship with the licensee) must be verified by one of the following parties: (i) the licensee; (ii) a properly regulated financial institution or virtual asset service provider; or (iii) a reliable third party.

In summary, the "Consultation Summary" reflects the HKMA's increased emphasis on enforceability and regulatory flexibility while adhering to regulatory principles, responding institutionally to practical issues such as uneven technological development and market diversity.

Guidelines: Institutional Codification and Execution Refinement

The "Guidelines" are authorized by Section 171 of the "Stablecoin Ordinance" (Chapter 656) and Section 7 of the "Anti-Money Laundering and Counter-Terrorist Financing Ordinance" (AMLO, Chapter 615). They inherit the policy framework from the May "Consultation Document" and have undergone substantial refinement and legal transformation based on feedback from the July "Consultation Summary" regarding non-custodial wallets, technical feasibility, and scope of responsibilities. Unlike the earlier "Consultation Document" and "Consultation Summary," which focused on policy design and public feedback, the "Guidelines" constitute a compliance operations manual with enforceable power within Hong Kong's stablecoin AML/CFT regulatory framework. They not only stipulate the obligations that stablecoin issuers must fulfill but also directly establish institutional mechanisms for administrative accountability, violation penalties, and coordination with the Securities and Futures Commission (SFC).

(I) Scope of Application and Overall Structure

The "Guidelines" apply to all licensed stablecoin issuers (licensees) under Section 15 of the "Stablecoin Ordinance." The document adopts a "risk-based" approach throughout, setting norms in the following core areas, considering the decentralized, cross-chain, and highly anonymous characteristics of virtual assets:

Governance structure and AML system framework at the institutional level;

Customer due diligence requirements during issuance and redemption processes;

Ongoing transaction monitoring mechanisms for stablecoin circulation;

Management measures for on-chain wallet types (especially non-custodial wallets);

Obligations for identifying, reporting, and following up on suspicious transactions;

Record-keeping, employee training, and senior management oversight responsibilities.

(II) Seven Key Regulatory Dimensions

- Institutional Risk Management Framework

Licensees must establish written internal policies, control systems, and audit procedures to identify, assess, and mitigate money laundering and terrorist financing risks associated with stablecoin activities. Risk assessments should cover customer categories, geographic areas, payment tools, types of stablecoins (single fiat currency-backed vs. multi-asset-backed), and their on-chain liquidity; a dedicated AML/CFT compliance officer must be appointed to report directly to the board; all institutional executions must be recorded and available for subsequent audits.

- Customer Due Diligence and Enhanced Due Diligence (CDD and EDD)

The "Guidelines" categorize customer relationships into "business relationships" and "occasional transactions," setting due diligence intensity accordingly: if a customer establishes a business relationship through ongoing interactions, the licensee must collect their identity information, verify documents, obtain beneficial ownership information, and assess the nature of the business, cross-referencing risk levels with on-chain behavior. If the customer involves politically exposed persons (PEPs), high-risk jurisdictions, or uses mixing services, enhanced due diligence (EDD) must be implemented, including but not limited to proof of source of funds and increased frequency of ongoing reviews.

- Management Measures for Non-Custodial Wallets

The "Guidelines" clearly state that non-custodial wallets are considered high-risk channels, and licensees must not equate them with regulated financial accounts. Specific requirements include:

Transaction control measures: setting limit thresholds for transactions involving non-custodial wallets or only allowing participation in low-risk redemption phases;

Behavior identification and enhanced KYC: recording the on-chain behavior patterns of the first interaction wallet and taking a series of additional due diligence steps (such as on-chain profiling and address binding records);

Blacklist and whitelist mechanisms: establishing an on-chain address database and blacklisting addresses identified as related to sanctions or illegal activities;

Technical monitoring requirements: deploying on-chain analysis tools to regularly scan the behavioral linkages between wallets and transactions, generating audit trail reports when necessary.

It is noteworthy that the "Guidelines" do not prohibit the use of non-custodial wallets but require their inclusion in a "behavioral risk-based" review system.

- Monitoring and Tracking Analysis of Stablecoin Transactions

The HKMA has identified the identification and tracking of stablecoin transfer paths on-chain as one of the compliance focuses. Licensees must establish real-time transaction monitoring mechanisms and possess the following capabilities:

Real-time tracking of transaction links, identifying high-risk hops, cross-chain bridges, mixers, and other behaviors;

Establishing a database of on-chain behavior patterns, setting up automatic alerts for abnormal transaction paths;

Integrating with wallet identification mechanisms to record counterparty identities and address risks;

Producing compliance review reports to support the HKMA's on-site inspections and law enforcement interventions.

On-chain monitoring is regarded as equally important as bank payment monitoring, and the failure to deploy effective on-chain systems will be viewed as institutional negligence.

- Obligations for Identifying and Reporting Suspicious Transactions (STR Mechanism)

For any discovered or suspected customer involvement in illegal activities, abnormal on-chain behavior, or unexplained sources of assets, licensees must submit suspicious transaction reports (STR) to the Joint Financial Intelligence Unit (JFIU) within a reasonable time:

Customer identity, address, transaction type;

Types, quantities, and wallets of stablecoins involved;

System prompts and personnel responses at the time of suspicious behavior;

Handling measures and follow-up actions (such as freezing or limiting rights).

Regulatory authorities will regularly inspect STR systems and response logs to verify whether suspicious events have been effectively addressed. Additionally, the STR mechanism should be linked with on-chain monitoring and KYC modules to form an automated auxiliary generation mechanism.

- Data and Record-Keeping Requirements

The "Guidelines" set strict retention periods for compliance data records:

Customer due diligence-related materials (including on-chain address mapping information): at least 5 years;

Transaction records (on-chain data including path snapshots, transaction labels, address analysis reports): at least 5 years;

Risk assessments, internal reviews, and system parameter change records: the HKMA may require extended retention periods.

Licensees must ensure that all records are traceable, secure, and tamper-proof for compliance audits.

- Employee Training and Organizational Culture

All employees involved in customer identification, transaction monitoring, risk assessment, and compliance reporting must undergo regular AML/CFT training before employment. Executives and board members must receive training on role definitions to ensure resource allocation and institutional execution are in place. The HKMA may inspect training systems and effectiveness records, and if institutional setups are found to be nominal, they will be treated as significant violations.

(III) Legal Responsibilities and Regulatory Power Enforcement Mechanisms

The consequences of violating the "Guidelines" are not merely advisory corrections but may trigger the following enforcement actions:

The HKMA may suspend, restrict, or revoke stablecoin issuance licenses;

In severe cases, the matter will be referred to law enforcement agencies for handling under the "Anti-Money Laundering Ordinance" or other criminal laws.

Furthermore, the HKMA reserves the right to conduct surprise inspections, risk assessment interviews, and technical system verifications, and will collaborate with multiple departments, including the HKMA, the SFC, Customs, and the JFIU, to carry out comprehensive law enforcement actions.

(IV) Summary of Institutional Significance and Regulatory Logic

The introduction of the "Guidelines" is not only a legal response to the "Consultation Document" and "Consultation Summary" but also reflects a significant shift by Hong Kong regulators from a "principle-based" approach to a "mechanism-based" approach. Compared to traditional finance, the risks in the stablecoin sector are more dynamic, and on-chain behaviors are harder to characterize. Therefore, the institutional significance of the "Guidelines" is reflected in:

Completing a full institutional loop from policy initiative (May) → consultation summary (July) → statutory enforcement (August);

Introducing on-chain behavior regulatory mechanisms, evolving the AML system towards "visualization, verifiability, and traceability";

Balancing regulatory rigidity with compliance flexibility, emphasizing "clear boundaries of responsibility" and "controllable and quantifiable risks";

Providing a platform for institutional experimentation for future expansions into on-chain payments, asset tokenization (such as RWA), and cross-chain compliance.

The "Guidelines" are an indispensable execution standard for licensed operators' compliance and serve as the core interface for technology service providers (such as on-chain monitoring, identity verification, address management tools) to connect with the Hong Kong regulatory system.

Comparative Analysis of the Three Documents

The "Consultation Document" released in May 2025, the "Consultation Summary" published in July 2025, and the "Guidelines" to be gazetted in August 2025 together form a complete loop of the design, revision, and execution of Hong Kong's stablecoin AML/CFT regulatory system. The three documents reflect the HKMA's cautious identification of the unique risk characteristics of stablecoins and regulatory expectations, as well as the ongoing adjustments and deepening of regulatory feasibility and enforceability based on market feedback. By comparing the structure and content of the three, it is not difficult to see the logical evolution and key changes in the regulatory system from "principle setting" to "operational guidance."

On one hand, the "Consultation Document" (May 2025) proposed a preliminary framework, establishing core principles and objectives for regulation, particularly emphasizing the ML/TF risks faced by stablecoin activities, and proposing ideas around customer due diligence, non-custodial wallet management, transaction monitoring, and STR reporting. This document included a draft version of the guidelines aimed at guiding market participants to provide feedback on regulatory direction and technical pathways.

Subsequently, the "Consultation Summary" (July 2025) reflected the HKMA's absorption of 38 market opinions and responded to specific contentious issues (such as whitelist mechanisms, difficulties in classifying non-custodial wallets, and the operability of the Travel Rule), proposing more enforceable revisions. Notably, the "Consultation Summary" has already shown a tightening of regulatory positions on several core requirements, such as the cancellation of the whitelist concept and the strengthening of non-client identity verification obligations.

Finally, the "Guidelines," which will take effect in August 2025, formally establish the legal obligations of licensed stablecoin issuers in AML/CFT compliance. The content is more systematic and detailed than the previous two documents, enhancing enforceability and auditability through enumeration, operational steps, and record-keeping requirements. The "Guidelines" not only transform principled requirements into compliance operational processes but also introduce regulatory enforcement mechanisms, penalty mechanisms, and inter-agency cooperation powers, ensuring that regulatory objectives are binding and enforceable.

In terms of content, the three documents reflect the following hierarchical progression and key differences:

Regulatory requirements shift from abstract principles to rigid operations: For example, the "Consultation Document" proposed using blockchain analysis tools to trace illegal funds, while the "Guidelines" specifically require the use of external technology service providers with real-time monitoring capabilities and due diligence on their coverage, update frequency, and accuracy, emphasizing that the tools themselves must also bear compliance proof responsibilities.

Significant shift in non-custodial wallet management strategies: The "Consultation Document" proposed a "whitelist mechanism" as a potential measure to control secondary market risks, while the "Consultation Summary" canceled this idea, shifting to requiring identity verification for all non-client holders unless the licensee can prove the effectiveness of other control measures. The "Guidelines" inherit and solidify this revision, explicitly requiring identity verification for all stablecoin holders in the absence of evidence supporting the effectiveness of risk mitigation. This change extends the licensee's KYC obligations from clients to "holders," reflecting regulatory vigilance towards the anonymity structures in DeFi.

The Travel Rule system transitions from principles to an execution framework: In the "Consultation Document," the Travel Rule was proposed as a clause requirement within the AML framework, while in the "Guidelines," its execution requirements are significantly detailed, including amount gradation, obligations for remittance/intermediary/recipient parties, encrypted transmission mechanisms, procedures for handling missing information, and due diligence standards for technology providers, ultimately establishing a comprehensive regulatory model for "stablecoin transfers subject to due diligence." This reflects the complete localization of FATF technical standards.

Legal responsibilities and regulatory power systems are comprehensively clarified: The "Guidelines" introduce numerous regulatory enforcement clauses, including penalties for non-compliance (impacting licensing qualifications), regulatory intervention rights over record retention periods, and authority descriptions for on-site verification of technical systems and operational processes. In contrast, the "Consultation Document" touched on this very little, failing to constitute an enforcement deterrent.

Organizational governance and audit requirements are significantly strengthened: The "Guidelines" enhance the regulation of AML/CFT organizational structures, requiring the establishment of senior management oversight mechanisms, the designation of compliance officers (CO) and money laundering reporting officers (MLRO), and clarifying their responsibilities. Independent audit requirements are also introduced, requiring direct reporting to the board and stipulating that employee recruitment should consider integrity and suitability. These aspects were not elaborated upon in the previous two documents.

Overall, the "Consultation Document" serves more as a conceptual blueprint, proposing regulatory goals and directions; the "Consultation Summary" makes substantive revisions based on market feedback, clarifying regulatory bottom lines and core obligations; while the "Guidelines" complete the legal, operational, and procedural handling of regulatory requirements, reflecting the HKMA's regulatory path of strictly preventing and controlling new risks based on international standards combined with local realities. Particularly in key areas such as non-custodial wallet handling strategies, Travel Rule implementation mechanisms, technical tool due diligence standards, and full-process record retention, the "Guidelines" are no longer merely "advisory suggestions" but constitute regulatory provisions with clear legal binding force, establishing an executable, operable, and auditable compliance system for licensees.

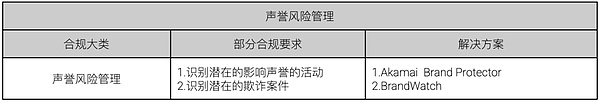

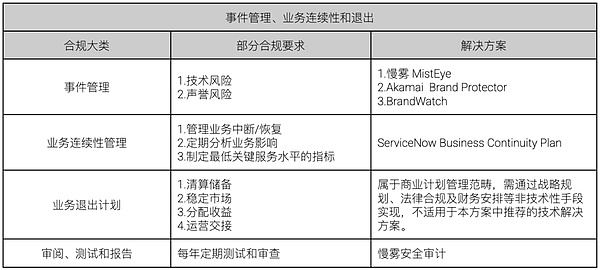

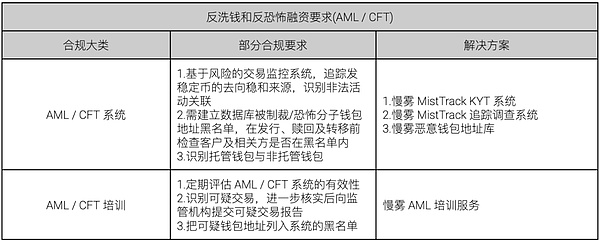

Compliance Security Solutions

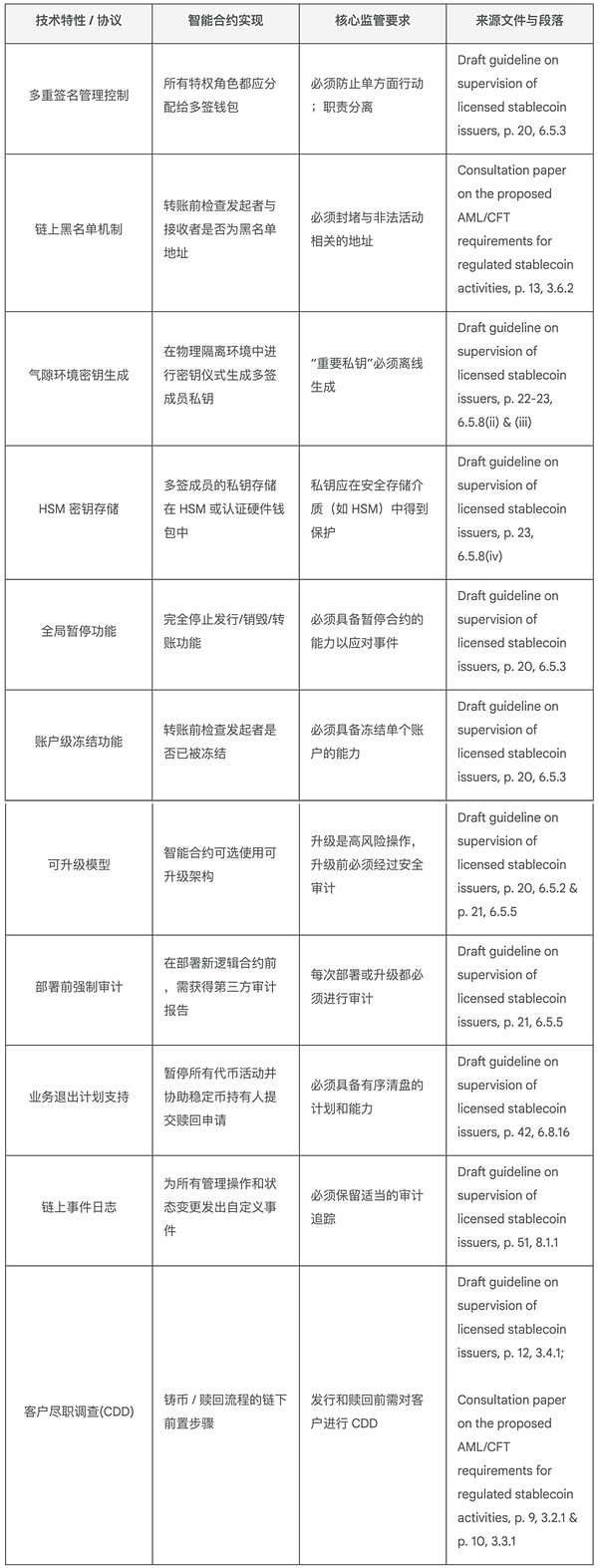

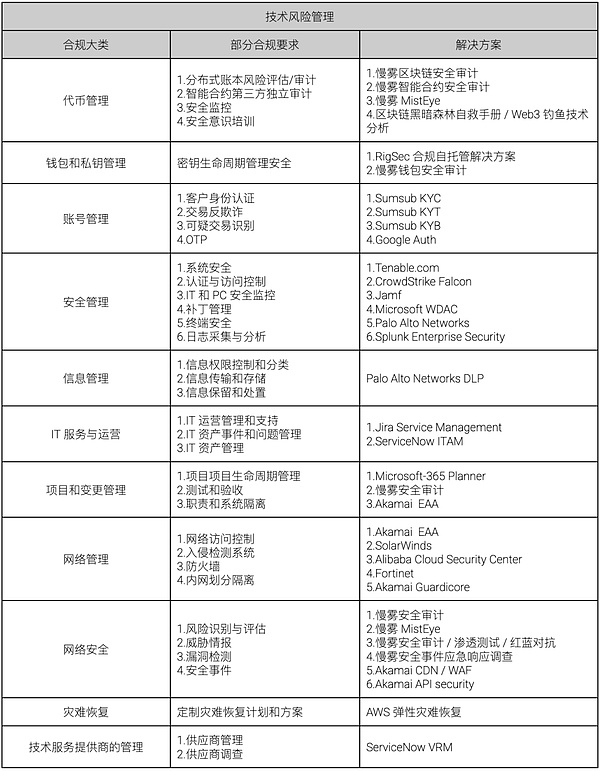

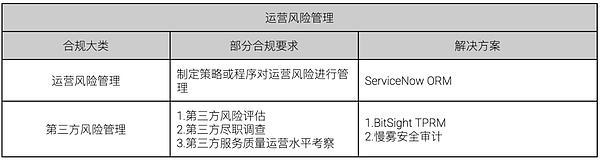

Although the "Guidelines," which will take effect on August 1, 2025, have refined and strengthened several specific requirements compared to the "Consultation Document," the compliance solutions previously constructed by the SlowMist team based on the "Consultation Document," particularly the "Smart Contract Implementation Guidelines for Hong Kong Stablecoin Issuers" and the jointly developed "Stablecoin Risk Management and Anti-Money Laundering/Counter-Terrorist Financing (AML/CFT) Compliance Security Solutions" with ecosystem partners, still provide highly adaptable compliance reference paths for the current "Guidelines" in terms of logical architecture, systematic design, and technical modules.

On one hand, the smart contract guidelines already cover multiple technical control measures consistent with the formal requirements of the "Guidelines," providing a reference blueprint for licensees to construct contract architectures.

On the other hand, the "Stablecoin Risk Management and Anti-Money Laundering/Counter-Terrorist Financing (AML/CFT) Compliance Security Solutions" are based on the SlowMist team's practical experience in blockchain security, compliance auditing, and risk management. The recommended technical solutions and implementation paths also possess strong operability.

Overall, the compliance requirements covered by the "Guidelines" are extensive and complex, involving multiple dimensions such as technology, operations, governance, and anti-money laundering (AML/CFT). This solution focuses only on the interpretation of some key clauses and provides response strategies, and does not constitute a complete coverage of all the requirements of the "Guidelines." Additionally, the compliance system for stablecoin issuers needs to be continuously optimized and adjusted in conjunction with business scenarios, technical architectures, and regulatory dynamics. The solutions listed in this document are based on the analysis of current technical capabilities and industry practices and may require further adjustments and supplements based on actual business needs, technological evolution, and changes in the regulatory environment. It is recommended that issuers continuously communicate with professional compliance and security service organizations (such as SlowMist Technology) in light of their business characteristics and refer to the latest guidelines from relevant regulatory agencies to ensure the integrity and effectiveness of their compliance systems.

Conclusion

The Hong Kong Monetary Authority has constructed a stablecoin AML/CFT regulatory framework with legal effect, clear systems, and defined responsibilities through a consultation draft, a round of market summaries, and a formal guideline. This system not only responds to the international requirements of the FATF for virtual asset regulation but also provides important institutional support for Hong Kong to build an international fintech hub and protect market stability and user rights. As the system officially takes effect on August 1, 2025, stablecoin issuers will face unprecedented regulatory compliance challenges. In this context, it is necessary to establish organizational governance, introduce technical tools, enhance on-chain visual management, and improve employee compliance awareness to truly realize the regulatory logic of "compliance equals market access."

Reference Links:

[1] The "Consultation Document on the Proposed AML/CFT Requirements for Regulated Stablecoin Activities" published in May 2025

[2] The "Consultation Summary on the Proposed AML/CFT Requirements for Regulated Stablecoin Activities" published in July 2025

[3] The "Guideline on Anti-Money Laundering and Counter-Financing of Terrorism for Licensed Stablecoin Issuers" effective in August 2025

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。