原文标题:《投资加密货币⽣态系统:Tether 不只是 USDT 发⾏商》

原文来源:Allscale

稳定币巨头 Tether 在投什么?

稳定币巨头 Tether 不久前披露了其使⽤⾃营资⾦投资的部分公司名单。这些公司名单中,有 Bitdeer、Northern Data 这样的矿业和算⼒⽀持企业,也有 Holepunch、Synonym 这样的去中⼼化技术基础设施企业。

很明显,Tether 并不满⾜于在稳定币发⾏层⾯进⾏边际效益递减的⽆序竞争,相反,他们正在学习微软、苹果和⾕歌的经验,试图通过多元化的投资布局抢占跨⾏业加密货币⽣态系统的⾼地,进⼀步巩固⻢太效应,并在跨⾏业布局和新兴市场寻找增⻓点。Tether 不再单纯追逐发⾏环节的利润,⽽是试图在加密世界中扮演更深层次的⻆⾊⸺既是稳定的⽀付⼯具提供者,也是技术创新的推动者,甚⾄是全球⾦融格局的重塑者。

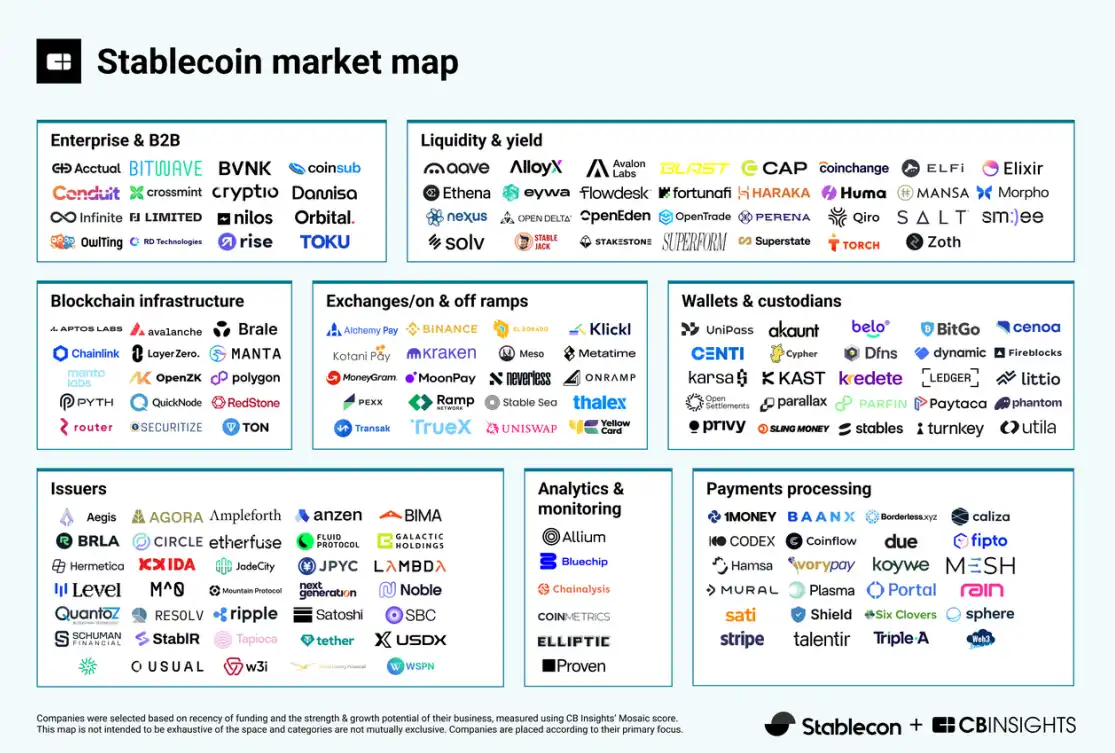

稳定币产业是⼀⽚森林,为了防⽌只看到树⽊,⽽不⻅森林,有必要⻦瞰整个产业的⽣态地图。⾏业上游是区块链基础设施和分析监控,提供区块链⽹络,链上数据分析,合规监控,⻛险评估等标准化的⽣态组件,他们像是稳定币的源头活⽔。⾏业中游主要是稳定币 issuers 和 liquidity & yield,他们是整个产业链价值的核⼼。Tether 就是⾏业中游的稳定币发⾏商。⾏业下游为我们带来更⼴阔多元的应⽤场景,从交易到⽀付,从个⼈到企业,从 Defi 到传统⾦融的融合,这些企业直接⾯向终端⽤⼾提供服务,也在不断探索新的商业模式和应⽤的卖点。

后向投资和前向投资让 1+1>2

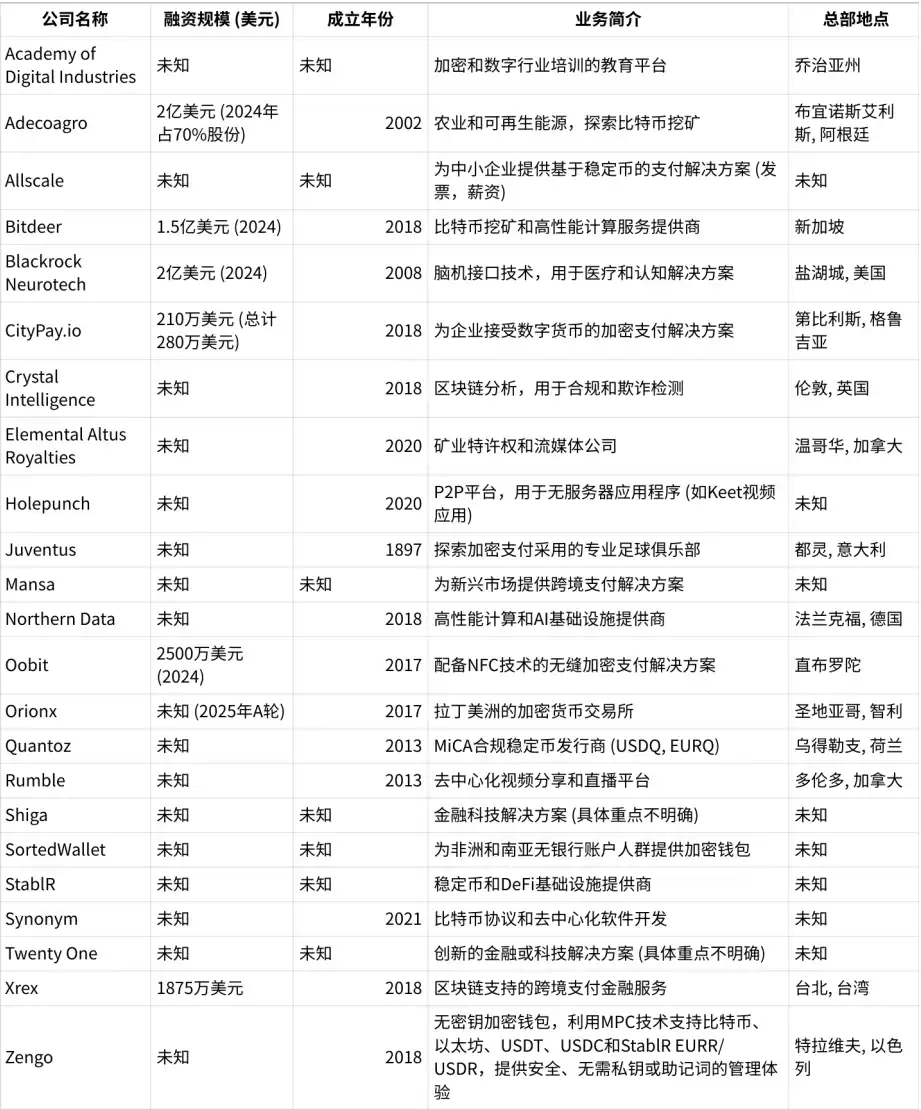

尽管 Tether Venture 投资的公司众多,但我们仍然可以从中分析出投资组合的战略意图,并研判稳定币⾏业的发展⽅向。让我们从战略的⻆度来剖析为什么 Tether 会选择这些公司作为投资重点。拆解 Tether Venture 官⽹披露的 25 家公司的投资组合可以得到如下的分类。

基础设施是 USDT 流通基础

⾸先,区块链基础设施与挖矿(如 Bitdeer、Northern Data、Elemental Altus Royalties)是 Tether⽣态的命脉所在,因此 Tether Venture 通过投资这些上游的基础设施和挖矿的企业来实现后向整合,加强对上游企业的掌控⼒度和议价能⼒。

具体⽽⾔,⽐特币和以太坊等区块链⽹络是 USDT 流通的基础,⽽挖矿算⼒直接决定了这些⽹络的稳定性和安全性。通过投资 Bitdeer 这样的挖矿巨头,Tether 实际上是在喂养⾃⼰的⽣存⼟壤,确保 USDT 在多链环境中的顺畅运⾏。

Northern Data 的⾼性能计算能⼒则为未来的区块链扩展和数据密集型应⽤(如 DeFi 或 NFT)提供了技术储备,甚⾄可能为 Tether 的 AI 相关计划埋下伏笔。

⽽Elemental Altus 的矿业权投资,则像是在为 USDT⽣态增添⼀层实体资产的安全⽹,既分散⻛险,⼜为⻓期收益铺路。Tether 知道如果底层区块链动摇,USDT 的地位也将岌岌可危,所以选择通过后向整合,来增强在区块链基础设施领域的话语权和影响⼒,为企业的⻓期发展铺路。

合规与安全技术塑造信任

其次,合规与安全技术(Crystal Intelligence、Zengo)的投资反映了 Tether 对监管压⼒和⽤⼾信任的双重考量。作为⼀个常被质疑储备⾦透明度的公司,Tether 深知通过合规的姿态向⽤⼾叙述信任是⽣存的关键。

Crystal Intelligence 的区块链分析⼯具不仅能帮助追踪⾮法活动,还向监管机构和公众证明其守法的决⼼,塑造良好的⾏业形象。这是⼀种主动防御的姿态,没有⼈知道下⼀次的雪崩什么时候到来。⽽Zengo 的⽆密钥钱包则直击⽤⼾痛点⸺复杂的私钥管理让普通⼈望⽽却步。Tether 通过这种技术创新,降低了 USDT 的使⽤和流通难度,拉近了与⼤众的距离,拓展了潜在的⽤⼾池,这背后是它对主流市场渗透的野⼼,试图将稳定币从⾼⾼在上的极客玩具变成全⺠⼯具。

应⽤层的⾦融服务公司是 USDT 的⽑细⾎管

前向整合的⽅向上,Tether 投资了许多⽀付与⾦融服务领域的公司,例如 CityPay.io、Oobit、Xrex 等。Tether 的⽣命⼒不在巨⼤的市值跳动,⽽是在⼀笔⼀笔的⽀付⾏为中,这才是 TetherUSDT 的⽣命⼒所在。被投公司让 USDT 从数字资产变成了⽇常⽀付⼯具,⽐如 Oobit 的 NFC⽀付⼏乎复制了 Apple Pay 的便利性,⽽Xrex 则为中⼩企业提供了跨境⽀付解决⽅案。传统⾦融固然有短板,但是要破除路径依赖,必须依赖⽀付最后⼀公⾥的改变,依赖⾦融⽑细⾎管的改变。

⾦融普惠与新兴市场(SortedWallet、Mansa、Quantoz、Orionx)的布局则展现了 Tether 的全球化视野。SortedWallet 将加密钱包带到⾮洲和南亚的⽆银⾏账⼾⼈群,Mansa 优化了跨境⽀付,⽽Quantoz 和 Orionx 则在欧洲和拉美铺路。这些地区往往是传统⾦融服务的盲区,有⼤量的尚未银⾏化的传统⾦融体系下的弱势群体。Tether 看到了机会:通过低成本、⾼效率的 USDT 服务,服务数⼗亿未被触及的⼈群。这不仅扩⼤了⽤⼾基础,还能为 USDT 在全球建⽴本地化⽹络,类似⼀家零售商进军农村市场,挖掘新的增⻓点。更重要的是,这种明智的普惠策略让 Tether 在与监管博弈中占据道德⾼地 ⸺「⾦融平权」。

去中⼼化是时代的声⾳?

为什么去中⼼化是时代的声⾳?Tether⽤实际⾏动完美回答。

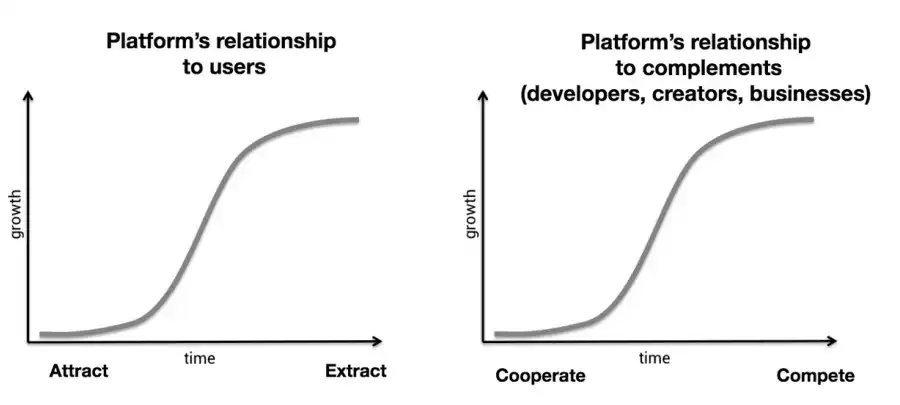

所有中⼼化平台与产品都有⾃⼰的⽣命周期,随着中⼼化平台的成熟,平台对⽤⼾的关系从吸引发展到排斥,平台对构建者(开发者,创作者,商业)也从合作转向竞争,继续增⻓的最简单⽅法在于从⽤⼾那⾥提取数据,与互补者争夺受众和利润。历史例⼦有 Microsoft vs. Netscape, Google vs. Yelp,Facebook vs. Zynga, 和 Twitter vs. 对其第三⽅客⼾的所作所为。⼈们开始厌倦中⼼化平台带来的枷锁,并决⼼打碎这些铁链。

对去中⼼化技术与产品(Holepunch、Synonym、Rumble)的投资体现了 Tether 对未来互联⽹的远⻅卓识。Holepunch 的 P2P 通信和 Synonym 的⽐特币协议增强了 USDT 的抗审查能⼒,⽽Rumble 的去中⼼化视频平台则与 Tether 的⾃由⾦融理念相呼应。这些技术让 USDT 能够在没有中⼼化服务器的情况下流通,降低了被封锁的⻛险。这就像⼀家公司投资⾃⼰的物流系统,确保货物能在任何环境下送达。Tether 可能已经预⻅到,未来监管压⼒会加剧,去中⼼化基础设施将是它的⽣存保障。

跨⾏业多元化渗透

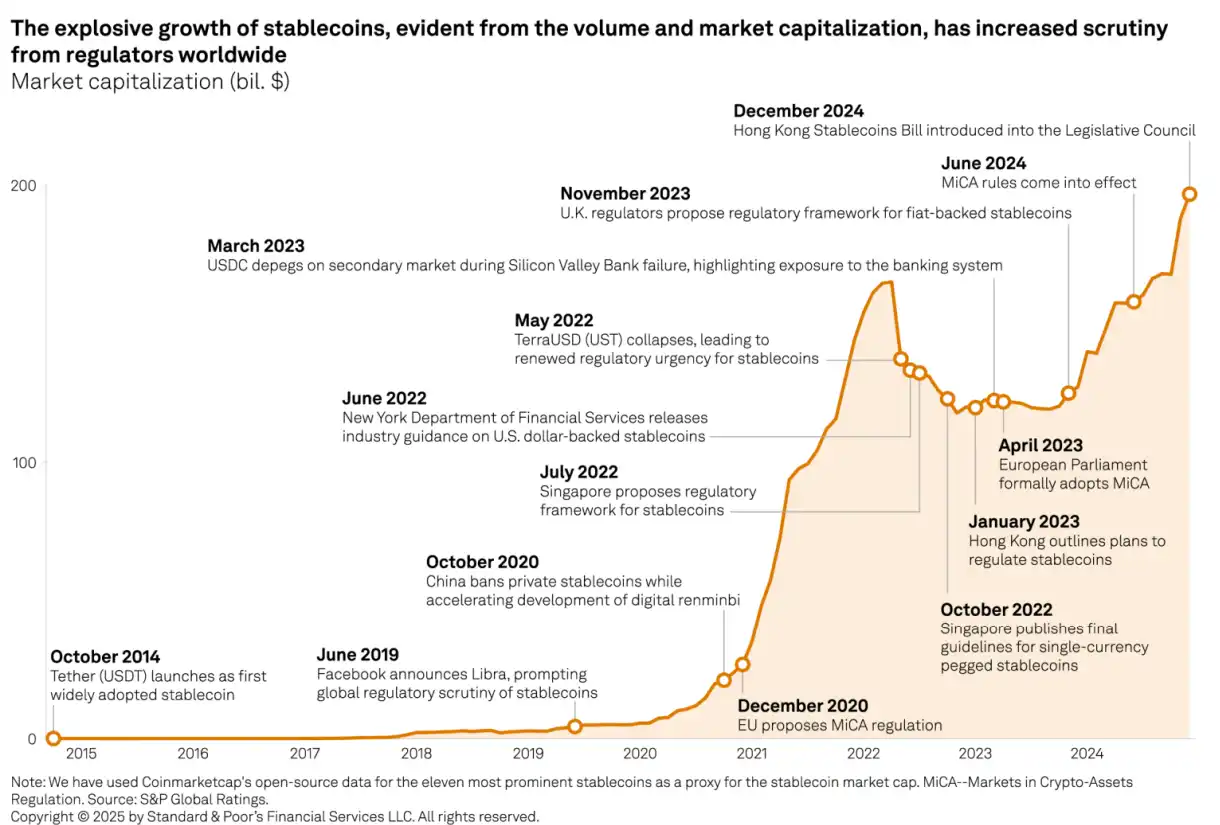

最后,跨⾏业多元化的投资似乎是 Tether 在宣告未来已来。稳定币已经在过去迅速征服世界,尽管存在阶段性的波折。

对 Adecoagro 的农业投资可能⽤于探索 USDT 在传统农业供应链中的应⽤,Juventus 的体育影响⼒则能通过年轻富有活⼒的球迷群体推⼴USDT⽀付,⽽Blackrock Neurotech 的脑机接⼝技术则指向了科幻般的未来⸺或许有⼀天,你可以⽤意念⽀付 USDT!Academy of Digital Industries 则培养了加密⼈才,为加密⽣态的⻓远发展注⼊新鲜⾎液。这种跨界投资,证明了 Tether 的设想:稳定币将会渗透到农业、娱乐、科技教育等传统领域,构建⼀个与现实世界⽆缝衔接的⾦融⽣态,⽽这正是⼈类的未来!

结论与展望

Tether 似乎试图通过投资区块链根基、应对监管挑战、拓展⽀付应⽤、深耕新兴市场、强化去中⼼化技术,并跨界多元化,构建⼀个持续增⻓的强势投资组合,并试图打造⼀个从底层到终端的全⽅位⽣态。在通往⾃由⾦融的道路上,Tether 并不孤单。

本文来自投稿,不代表 BlockBeats 观点。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。