如果你跳出固有思维模式,你就会发现一个更好、更快、更便宜、更全球化的金融世界正在开始出现。

撰文:Matt Hougan,Bitwise 首席投资官

编译:AIMan@金色财经

你还记得九点谜题吗?

这是一道经典的视觉谜题,在夏令营里经常出现。谜题内容是这样的:如何用四条线连接九个点,而且不用提笔?

这是一项(字面意义上的)跳出思维定式的测试。如果你一直局限于思维定式,就无法把所有点串联起来。

然而,在它的线外画,就很容易了。

自从我读了彭博社专栏作家艾莉森·施拉格 (Allison Schrager) 最近关于加密货币的专栏文章后,我就一直在思考九点谜题。

施拉格是一位优秀的作家,但她长期以来对加密货币持怀疑态度。多年来,她一直在专栏中预测加密货币的消亡,并将其与郁金香和其他经典泡沫相提并论。最近,她承认加密货币将继续存在,但现在她有了新的批评:我们不需要它。

在她最新的加密专栏文章「你的 401(k) 计划里有比特币吗?我不会冒这个险」中,施拉格对比特币的未来不以为然,并指出「政府发行的货币非常棒」。

她在之前的专栏中也表达了类似的看法:「美国已经有了一种支付手段——它叫做美元——而且运行得相当好。」

这些专栏让我很难过。「相当棒」和「相当好」?

施拉格陷入了两难境地。她想不出更好的办法。

有更好的方法

现实情况是:我们的金融体系实际上并不是那么好。

如今,支票账户的平均利率为 0.07%。所谓的「储蓄账户」收益率为 0.38%。支票五天即可兑现。股票结算采用 T+1(而非周末结算,正如我们去年的广告宣传中指出的那样)。Visa 只需 1-3 个工作日即可向商家付款,同时保持 80% 的毛利率。我们的政府通过隐性担保为少数几家银行提供支持,并定期用纳税人的钱救助它们。与此同时,在我有生之年,美元价值已下跌约 80%。

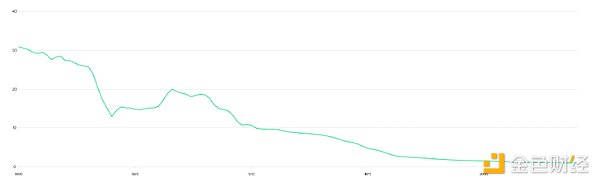

美元的购买力,1900-2020

来源:Statista

「相当棒」?

我从事加密工作的最大原因之一是我知道我们可以做得更好。

我们可以生活在一个支付即时、费用几乎为零、政府不会通过通货膨胀消耗你的钱的世界。

我们可以生活在这样一个世界:你可以从资产中获得真正的收益——收益是逐秒、逐日累积的,而不是根据服务提供商的突发奇想而定期累积的。

我们可以生活在一个全天候、全球化的世界,旅行时无需支付货币兑换费或银行间转账费。

我觉得我们竟然如此轻易地接受现状,真是不可思议。想象一下,如果你的邮箱周五下午 4 点就关机了,直到周一早上 9:30 才恢复。我们的经纪账户实际上就是这样的。或许更幸福一些,但这绝不是管理经济的方式。

当我遇到 TradFi 的拥护者时,我想向他们展示通过 Base 转账有多快(几乎是即时的)和多便宜(0.002 美元)。我想让他们在 Aave 上借出一项资产,并看到利息每秒都在累积。我想让他们周六晚上 7 点在账户之间转账,因为,嘿,这是你的钱。当然,我还想给他们看一张比特币图表,它看起来像我上面展示的美元购买力图表的倒数。

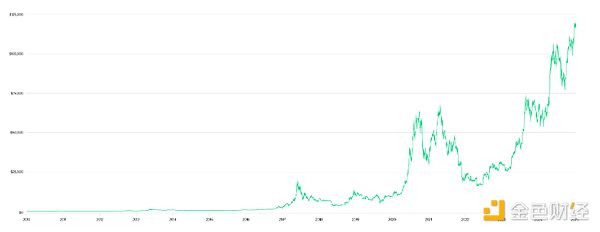

2009 年至今比特币价格

资料来源:Bitwise Asset Management。数据范围为 2010 年 7 月 17 日至 2025 年 7 月 28 日

我知道像艾利森这样的批评者会说什么:现实世界的用途在哪里?如果加密货币这么好,为什么我还没用它来买东西呢?

答案是,与许多新技术一样,加密货币尚不完美。它需要技术专家、投资者、监管机构和立法者付出大量努力才能充分发挥其潜力。因此,与大多数新技术一样,最初的采用发生在边缘地带,即现有系统尤其糟糕的地方。

但如果你跳出固有思维模式,你就会发现一个更好 / 更快 / 更便宜 / 更全球化的金融世界正在开始出现。

你可以在像 Yellowcard 这样的公司中看到这一点,它帮助撒哈拉以南非洲的企业使用稳定币进行跨境交易,从而避开效率极低的银行业。你可以在 Stripe 以 11 亿美元收购 Bridge 的案例中看到这一点,Bridge 是一家稳定币服务提供商,帮助像 Starlink 这样的公司向全球客户开具发票。你可以在每个周末看到这一点,因为股市休市,宏观交易员转向加密货币。你也可以在像 Ray Dalio 这样的人身上看到这一点,他因为担心美元的前景而勉强购买比特币。

新技术总是如此。第一批手机有行李箱那么大,曾遭到很多人的质疑,但对一小部分政客和 CEO 来说却非常有用。第一批数码相机的分辨率很差,而且「根本用不了」,但它们让 NASA 能够从太空发送图像,也让记者无需处理胶片就能撰写报道。随着时间的推移,技术越来越先进。如今,我们无法想象没有数码相机的世界。

我预计加密货币领域也会如此。在适当的情况下,这项技术已经能够比传统系统更好、更快、更便宜地转移资金和金融产品。随着监管法规的演变和用户体验的提升,我认为我们将看到所有金融产品都迁移到加密货币轨道上。

这将给世界带来巨大的推动。同时也提醒我们,我们不必满足于现状。情况可以变得更好。

我始终坚信,加密技术能帮助我们实现这一目标。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。