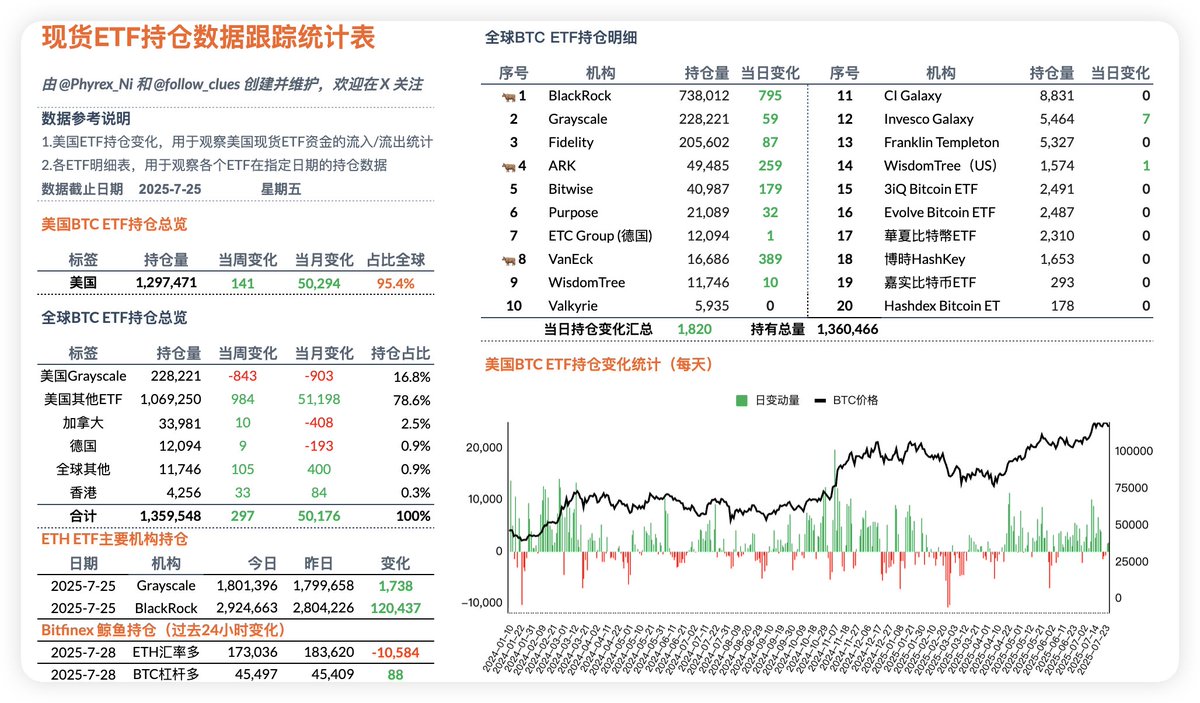

Last Friday, the data for the $BTC spot ETF was still mediocre. Although there was a net inflow, the amount was less than 1,900 coins, especially since BlackRock's investors only had a three-digit purchase, which was already the highest in the market. The FOMO sentiment among investors is still not apparent. Of course, the drop in Bitcoin prices on Friday was mainly due to issues with ancient whales, and this week there is a large amount of macro data to consider. Let's see how it goes after this week.

This is the 80th week since the birth of the BTC spot ETF. Since there were three working days this week with net outflows, the purchasing power of net inflows is significantly lower compared to the 79th week. In reality, the purchasing power of American investors is less than three digits of BTC, but there has been no data indicating sell-offs.

Therefore, the main reason BTC is still maintaining a high level is that the selling investors are still at lower levels.

Data address: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。