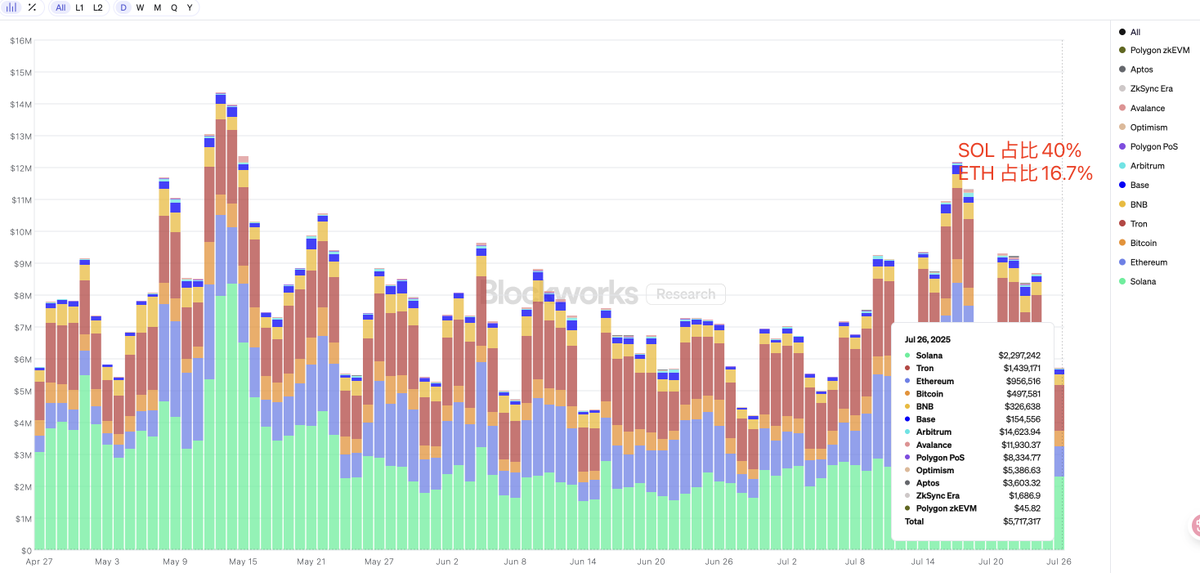

Recently, many friends have privately messaged me to discuss some issues regarding the recent price weakness of #SOL. I have always believed that the logic behind #SOL's value is sound. Whether it's the foundation's proactive upgrades and iterations of core performance, continuous investment in the ecosystem (#Payfi #RWA #AI, etc.), or a focus on cutting-edge directions and strategies. Additionally, the data 📊 is also impressive; whether it's the revenue data of public chain protocols or the revenue rankings of its ecosystem projects, they are among the top (as shown in Figure 2).

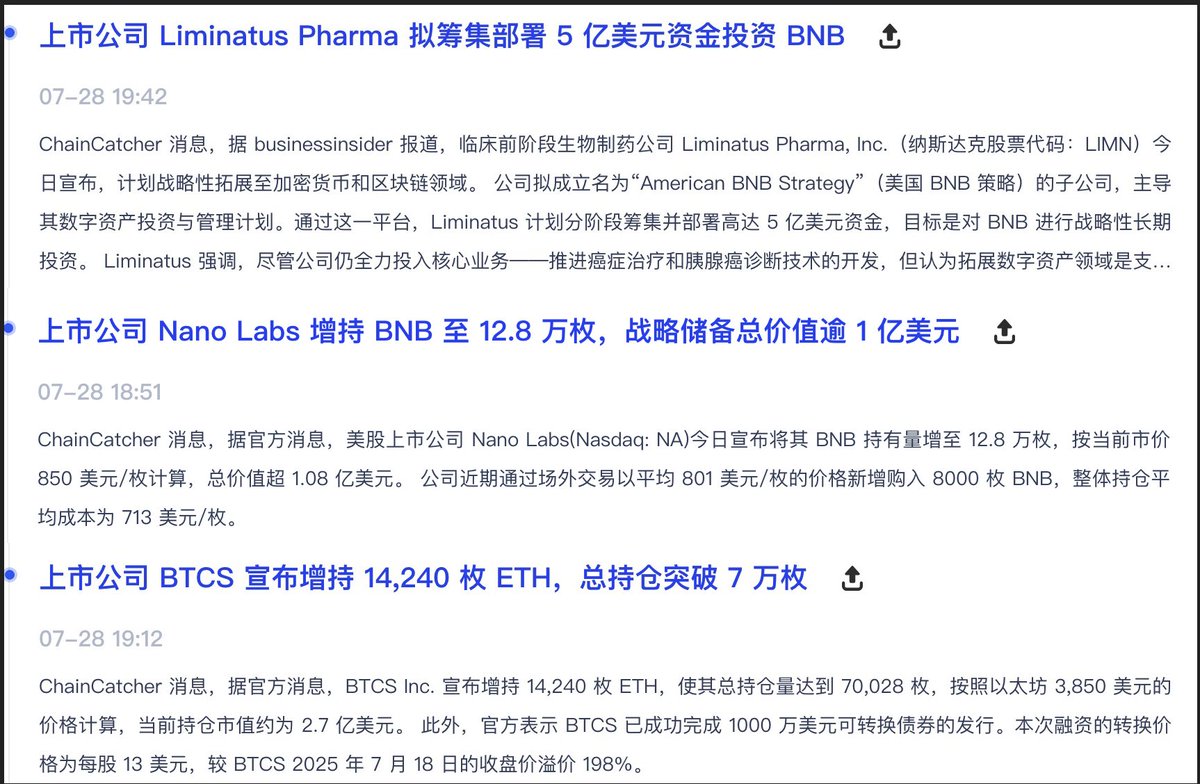

Currently, the only issue I see with #SOL is its capital operation, which is too conservative! (as shown in Figure 1, compared to #ETH and #BNB).

First, there are too few #SOL ETF issuers; currently, there is only one, REX-Osprey, and the fees are relatively high at 0.75%, which is significantly higher than the average fee of 0.20% - 0.25% for #BTC #ETF.

Second, the path to capitalization is essentially a leveraged path, which is overly conservative. However, being conservative has its benefits; no financial market has a trend that only goes up without any downturns. Once it enters a downward cycle, the perpetual bond's XX coin micro-strategy will accelerate the death spiral. As the saying goes, leveraging is enjoyable for a moment, but deleveraging is inevitably a painful process.

The overall steady and solid approach and strategy of #SOL, I believe, is suitable for investors who can endure loneliness and are long-term thinkers. We hold a considerable amount of #SOL and have been nurturing it; we have also received a lot of internal support and assistance. I believe in it, and the future will be even better! Let's keep pushing forward! 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。