从各行各业都感受到了艰难,很多人说,2026年,经济就会好转,2026将是康波周期衰退周期的最后一年,希望如此吧!房地产曾经作为最大的风险,经过疫情之后的持续性下跌,目前来讲,可以说大部分已经软着陆了,着陆的方式就是温水煮青蛙式的下跌,让所有的买房人以及投资人分散了风险,这个风险目前已经微乎其微了。各行各业的投资、消费、运转,都在萎缩,但任何事物,都是周期,一个周期的结束,意味着新的周期的开始。

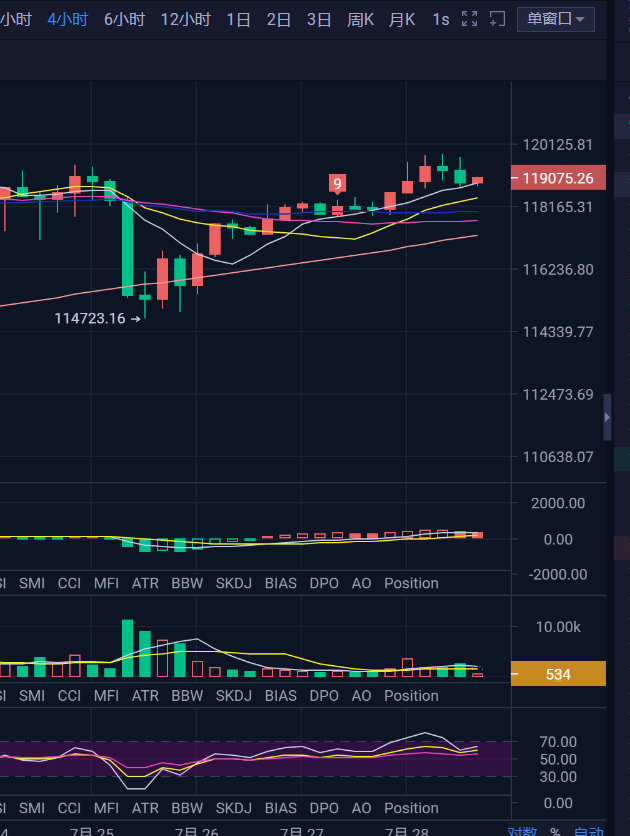

按照我们昨天所给到的行情分析,在目前是持有短线119500附近的空单,昨天的行情也比较简单,属于一个震荡之中缓慢抬升,其实现在来看,也还是可以看到行情就是走一个区域的震荡,不过在短期上以震荡向上这个走势为主,行情在当前短期内的高点给到了119800的位置,依旧处于高位运行。

回到今天的行情上来,周末之后,市场流动性再次有了变化,随着行情震荡上涨,将昨天所堆积在119500附近的短期空头流动性清算掉之后,当前的空头流动性清算强度来到121000附近,而下方多头的流动性要更多一些,主要分布在118000附近和更低位置的116000,目前的这个阶段往往是哪里有流动性,价格就要去哪里搞清算,按照现在的多空流动性分布,短期的多头流动性118000附近完成清算非常有需求,但是当前的短期趋势是一个震荡上行,所以短期内如果想要完成更低位置的多头清算就有些难度了,同时当前现货溢价的降低,后续可以关注溢价的情况,如果出现回调,溢价回升,就是比较好的短多位置了。

技术面上,新的一周了,周线上收到了一根小阳线,处于相对高位的窄幅震荡之中,这种结构对短线的操作没有太强的参考意义,如果本周的收线,继续收阳线,并且破掉前面的高点,那么对于周线级别来说,强势的行情还得持续,周线上的调整结构预期会向后延。接下来2周如果继续震荡,那么在从结构上就是略微利空的信号了,毕竟新高之后价格上涨的幅度太小,越是震荡对多头越不利,并且从指标上,均处于一个相对高位, 利多剧本本应该是价格破新高后,再次持续上涨至周线超买线附近之后再震荡;

四小时级别上,行情震荡运行至高点119800之后,开始小幅回落,从盘面结构上看,高点收到一根十字星阴线,配合上再次收阴,当前结构上是有一个回调预期的存在,另外技术指标上,MACD处于多头周期之中量能高位,同样也有指标修复需求。不过当前的结构下,四小时的回调也看不到会有很大力度的回调出现,四小时下方支撑117200附近。

操作上,目前昨天所给到的 119500附近空单处于盈利状态,我们现在所期望的是行情回调起码能够给到118000下方,然后看现货溢价情况是否回升来进行接多,能够接受的回调极限是116000附近。那么我们今天的操作,首次至118000下方,先进行短多,然后看后续实时行情变化。若接下来直接突破,那么后续做空的位置,我们就要在121000上方来进行了。

【以上分析及策略仅供参考,风险请自担,文章审核发布以及行情实时变化,信息滞后策略不具备及时性,具体操作以实时策略为准,欢迎各位进行联系交流行情】

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。