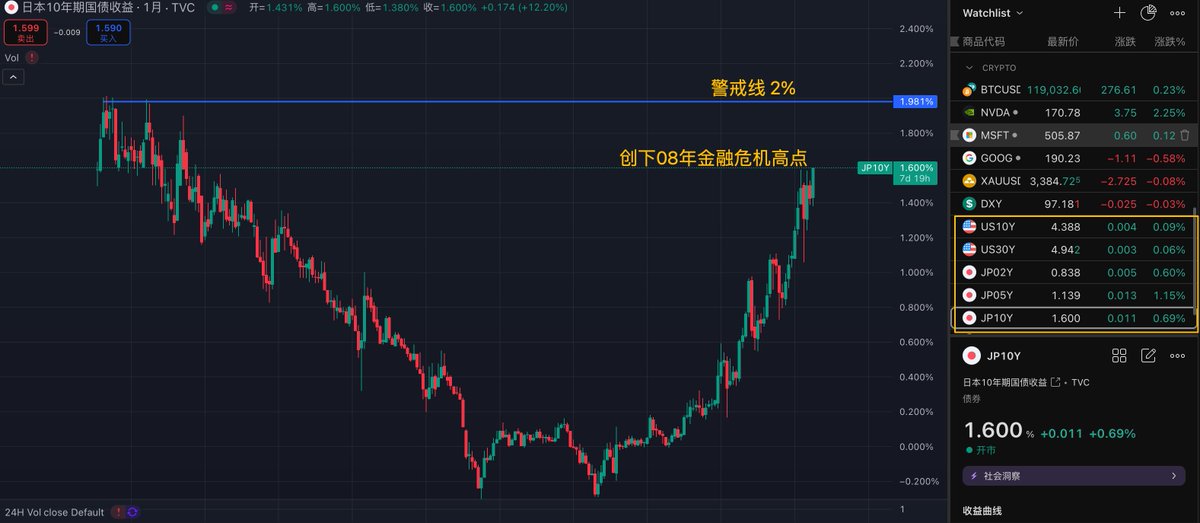

日本10年期国债收益率创下08年金融危机以来的新高!

而警戒线在2%,一旦突破,预示着低利率时代将会终结,我们将会迎来高利率+高资产定价+高通胀的混沌时代!

过去几十年,日本是全球负利率、低利率政策的“极致代表”。10年期国债收益率常年趴在0%左右,背后逻辑是:

✅通缩+人口老龄化

✅央行无限买债(YCC:收益率曲线控制)

✅日元资产被当作“免费资金池”,被广泛用于全球套利(carry trade)。

现在收益率飙到1.6%,代表债券价格大跌,收益率上升,有人开始抛售日本国债,短期可能是市场在试探“日本央行还敢不敢无底线控制债市”,如果突破2%,等于是市场和日本央行正式开战。

过去很多年日本机构(比如寿险、养老金)会把资金借给全球(美国债、欧洲债、甚至美股),因为本国收益太低。

现在,如果JP10Y都能给出1.6%-2%的收益,那就出现了“躺着赚钱”的机会:

1️⃣日本资金可能卖出美债、欧债、外资股票 → 回流日本买本国债券

2️⃣美债、欧债、风险资产都可能因流动性减少而承压

3️⃣美联储若不快降息,压力会变大。

日本债市开始“苏醒”是一头正在苏醒的“债务哥斯拉”,这不仅是日本的事,也是全球利率和资金结构再定价的信号。谨慎谨慎⚠️

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。