撰文:费思

2025年7月18日,《指导与建立美国稳定币国家创新法案》(「GENIUS法案」)在美国国会两院通过后,由美国总统特朗普在白宫正式签署成为法律。该法案的目的是在美国建立支付稳定币(payment stablecoin)的全面法律和监管框架。本文将对GENIUS法案进行详细介绍和解读,以期帮助相关市场参与者了解这部对全球数字资产市场产生深远影响的重要立法。本文还将横向对比美国与中国香港的稳定币监管立法,以便读者进一步了解全球稳定币监管趋势。

01 稳定币概述

1. 什么是稳定币?

稳定币是一种与法定货币(如美元)或其他资产价值挂钩的数字资产,旨在通过锚定机制维持价格稳定性。与比特币、以太坊等波动性较大的加密货币不同,稳定币的价值通常以1:1的比例与参考资产(如美元或其他法定货币)绑定,确保其作为支付工具和储值工具的可靠性。

2. 稳定币有何优点?

在电子支付、手机银行等服务方便高效的当下,稳定币支付的优势何在?与传统货币和其他形式的电子支付不同,稳定币仅存在于 Web3 生态系统中,即稳定币已经「上链」(on-chain),因此可以方便地用作Web3 生态系统中交易的支付手段。例如,稳定币可以用来(代替法定货币)认购或投资通证化的金融产品和现实世界资产(RWA),而这些通证化产品和资产的发行者又可以使用稳定币(代替法定货币)进行派息或赎回。在去中心化金融(DeFi)的情景下,稳定币还可用于借贷和其他金融活动。因此,稳定币通过与法币的价值锚定机制,链接了传统金融体系和加密市场,成为Web3生态系统的价值储存工具和价值交换媒介。

3. 为什么要推进稳定币的监管与合规化?

全球主要监管机构在认可稳定币和数字资产行业带来的金融创新的同时,都更关注如何能够使得金融创新在安全稳定的环境下可持续发展。正因为稳定币与传统金融体系之间的高度关联(稳定币本身与法定货币挂钩且稳定币的储备资产主要由银行存款、政府债券等传统金融产品组成),如何规避稳定币可能给传统金融市场甚至整个实体经济带来的重大负面影响已成为各国政府的重要监管考量之一。同时,各国政府也担忧稳定币的广泛使用是否会导致对法定货币的边缘化,进而带来货币政策、货币主权、金融稳定、消费者保护、网络安全、反洗钱等方面的风险。GENIUS 法案作为美国推动稳定币监管的工具,旨在通过建立全面框架(如牌照制度、储备资产要求和其他合规标准)来缓解这些风险,在促进金融创新的同时,达到保护消费者、强化货币主权及维护金融稳定的政策目标。

02 GENIUS法案中如何界定稳定币监管中的核心概念?

1. 支付稳定币(payment stablecoin)

GENIUS法案将支付稳定币定义为:

- 一种「数字资产」(digital asset),即在加密的分布式分类账上记录的数字价值表示形式(digital representation of value recorded on a cryptographically secured distributed ledger);

- 该数字资产被用于或被设计用于支付或结算(payment or settlement);

- 其发行人有义务按固定金额的「货币价值」(monetary value,指以美元和「外国中央银行发行的货币」等「国家货币」计算的价值)兑换、赎回或回购该数字资产;且

- 其发行人承诺将使得这一数字资产相对于固定金额的货币价值维持稳定价值,或为此创造合理预期(reasonable expectation)。

此外GENIUS法案还规定,支付稳定币不包括:

- 作为国家货币的数字资产;

- 存款(deposit),包括使用分布式分类账技术记录的存款;及

- 证券(security)。

为避免监管重叠,GENIUS法案明确规定,获准支付稳定币发行人(permitted payment stablecoin issuer)发行的支付稳定币不构成:

- 美国联邦证券法下的「证券」(security);及

- 美国《商品交易法》(Commodities Exchange Act)下的「商品」(commodity)。

2. 获准支付稳定币发行人(Permitted Payment Stablecoin Issuer)

GENIUS法案规定,除获准支付稳定币发行人外,任何人都不得在美国发行(issue)支付稳定币。换言之,只有支付稳定币发行人才可以在美国合法发行支付稳定币。

支付稳定币发行人(PPSI)是指在美国成立的以下人士:

- 受保存款机构子公司:已根据法案获准发行支付稳定币的受保存款机构(如美国商业银行)的子公司;

- 联邦合格发行人:包括非银行实体在内的联邦层级合格发行人,需通过联邦审批程序批准;及

- 州合格发行人:由各州支付稳定币监管机构批准的合格发行人。

需要注意的是,获准支付稳定币发行人的监管层级(联邦或州)主要取决于其发行规模,联邦监管一般适用于稳定币合并发行总量超过100亿美元的大型发行人,合并发行总量不超过100亿美元的中小型发行人一般可以自愿选择州级监管(该州级监管制度必须在实质上类似于美国联邦层面的支付稳定币监管框架),但当发行量突破100亿美元时,需按法案程序(包括通知、审核和移交程序)逐步转入联邦监管体系。

获准支付稳定币发行人的相关美国联邦监管机构视发行人的法律地位和受监管状态而定,主要包括以下机构:

- 美联储(Federal Reserve)

- 货币监理署(OCC)

- 美国联邦存款保险公司(FDIC)

- 国家信用合作社管理局(NCUA)

3. 向美国境内人士的销售限制

自GENIUS法案颁布生效3年后,任何数字资产服务提供商(Digital Asset Service Provider )均不得向美国境内人士提供或销售(offer or sell)支付稳定币,除非该稳定币系由(1)获准支付稳定币发行人或(2)获豁免的外国支付稳定币发行人发行。

获豁免的外国支付稳定币发行人是指在美国本土以外设立或注册的支付稳定币发行人,且该发行人:

- 受到经美国财政部长认定的与 GENIUS 法案等效的外国稳定币监管制度约束;

- 已在美国货币监理署(OCC)注册;

- 在美国金融机构持有足以满足其美国客户的流动性需求的储备资产,除非根据互惠安排(见后文)另有许可;且

- 其注册地及主要监管所在国未受到美国全面经济制裁,且未被美国财政部长认定为「首要洗钱关注管辖区」(a jurisdiction of primary money laundering concern)。

数字资产服务提供商是指以营利为目的,在美国从事以下业务的人:

- 将数字资产兑换为货币价值或其他数字资产;

- 向第三方转移数字资产;

- 作为数字资产托管人;或

- 参与与数字资产发行相关的金融服务,

但不包括:

- 分布式分类账协议(distributed ledger protocol);

- 从事开发或运营分布式分类账协议或自托管软件接口(self-custodial software interface)业务;

- 不可更改(immutable)的自托管软件接口;

- 交易验证(validating transactions)或分布式分类协议节点运营(operating a distributed ledger node)业务;及

- 参与流动性池(liquidity pool)或其他点对点交易的流动性提供机制(mechanism for the provisioning of liquidity for peer-to-peer transactions)。

上述例外明确了GENIUS法案的规管对象是中心化服务商(如交易所、托管机构),而非DeFi生态的参与者(如协议开发人员、节点运营商或流动性提供商等)。这为DeFi的持续发展提供了法律清晰度,在一定程度上避免DeFi参与者被认定为「数字资产服务提供商」。

GENIUS法案还规定,上述美国境内发行限制以及向美国境内人士的销售限制不适用于以下情形:

两名个人之间出于自身合法目的(acting on their own behalf and for their own lawful purposes)、且不涉及中间人(without the involvement of an intermediary)的数字资产直接转账;

涉及同一个人在同一公司开立的在美账户与美国境外账户之间进行的任何数字资产交易;或

通过便于个人保管数字资产的软件或硬件钱包(software or hardware wallet)进行的任何交易。

4. 受监管稳定币的特殊待遇

GENIUS法案规定,非由获准支付稳定币发行人发行的支付稳定币不得:

- 在会计上(for accounting purposes)被视为现金或现金等价物;

- 作为期货公司、衍生品清算组织、经纪交易商、注册清算机构和掉期交易商的合格现金或现金等价物保证金和担保品(margin and collateral);或

- 作为银行之间或支付基础设施用于促进银行之间货币兑换和结算的结算资产(settlement asset)。

03 GENIUS法案对获准支付稳定币发行人有何要求?

1. 储备资产要求及合格储备资产

获准支付稳定币发行人必须维持与其所发行的稳定币等值(1:1)的可识别(identifiable)储备资产,以支持其所发行的流通中的支付稳定币。合格储备资产包括(但不限于):

- 美元现金或存入任一美联储银行账户的资金;

- 在受保存款机构的活期存款(或可随时提取的其他存款),须遵守 FDIC 制定的特定风险标准;

- 93 天内到期的短期、中期、长期美国国债;

- 以期限不超过 93 天的美国国债作为抵押的隔夜回购协议项下所获得的资金;

- 支付稳定币发行人作为逆回购方,以短期、中期、长期美国国债作为抵押的隔夜逆回购协议(需签订市场标准的三方清算或中央清算协议,或与信誉良好的交易对手签订双边协议);

- 仅投资于上述基础资产的货币市场基金;

- 经主要联邦支付稳定币监管机构批准的任何其他同样具有流动性的由美国联邦政府发行的资产;或

- 任何以通证形式(in tokenised form)存在的上述资产,前提是该资产符合所有适用法律法规。

2. 禁止储备资产的再质押

储备资产不得出质(pledged)、再质押(rehypothcated)或重复使用(reused),除非出于以下目的:

- 为满足作为储备资产的回购/逆回购交易项下的保证金要求;

- 为满足标准托管服务协议项下的特定义务;或

- 为满足流通中稳定币赎回需求的合理预期而提供流动性。为此,作为储备资产的美国国债可通过期限不超过 93 天的回购交易出售,前提是:

-回购交易由获批准的中央对手方清算;或

-回购安排获相关监管机构批准。

3. 及时赎回与信息披露要求

获准支付稳定币发行人必须:

- 建立及时赎回流通中支付稳定币的程序并公开披露赎回政策,该政策需用通俗语言清楚披露与购买或赎回支付稳定币相关的所有费用(费用变更须提前至少 7 天通知客户);

- 在其网站上发布其月度储备资产组成信息,包含流通中的支付稳定币总数及储备资产的金额和组成(包括相关资产的平均到期期限及各类资产托管所处的地理位置);

- 定期安排注册会计师审计其上一个月末报告中披露的信息;且

- 由首席执行官和首席财务官向相关联邦或州监管机构提交关于月度报告准确性的认证(certification)。

4. 年度财务报表要求

支付稳定币合并总发行量超过500亿美元、且不受1934年《美国证券交易法》报告要求约束的获准支付稳定币发行人必须根据美国通用会计准则(GAAP)编制年度财务报表,以披露任何关联方交易。

年度财务报表必须:

- 由注册会计师事务所根据适用的审计标准进行审计;

- 在获准支付稳定币发行人的网站公开;且

- 每年向相关主要联邦支付稳定币监管机构提交。

5. 资本、流动性及风险相关要求

获准支付稳定币发行人的监管机构应:

- 根据发行人业务模式和风险状况制定资本要求(包括资本缓冲,如适用)、流动性标准、储备资产多样化(包括存款类储备资产集中度)和利率风险管理标准,但这些监管要求不得超过确保其持续运营所需的水平;

- 适合发行人业务模式和风险状况的适当运营、合规和 IT 风险的原则性管理标准,包括《银行保密法》和制裁合规标准

上述监管措施均遵循差异化原则(tailoring),即监管机构可综合考虑某个或某类发行人特殊的资本结构、风险状况、复杂性、金融活动、规模和其他风险因素来制定适用的资本、流动性及风险相关要求。

6. 反洗钱/反恐融资义务

由于根据美国《银行保密法》,获准支付稳定币发行人应被视为金融机构,其应遵守适用于位于美国的金融机构的所有美国联邦法律,包括与经济制裁、反洗钱、客户识别和尽职调查相关的法律,包括:

- 制定有效的反洗钱制度;

- 适当保留的支付稳定币交易记录;

- 监控和报告可疑交易;

- 保证充足的技术能力,制定相应的政策和程序,以阻止、冻结和拒绝违法交易;

- 制定有效的客户识别计划,包括识别和验证账户持有人、高价值交易和适当的强化尽职调查;及

- 制定有效的经济制裁合规项目,能够验证制裁名单并识别被制裁主体。

7. 执行美国联邦政府或法院「合法命令」的技术能力要求

法案要求获准支付稳定币发行人应具备执行美国联邦政府或法院发布的任何具有终局性且有效的「合法命令」的「技术能力」(technological capacity)且应真正执行该等法令,否则不得发行支付稳定币。

除了上述要求以外,外国支付稳定币发行人还额外需要具备遵守法案第18节规定的互惠安排的技术能力,否则不得在美国境内提供或销售其于海外发行的稳定币。

一旦外国支付稳定币发行人被美国财政部长认定为不遵守合法命令,美国财政部将于认定之日起30日内通知该发行人,如自通知之日起30日内发行人仍未进行合规整改,财政部长将于联邦公报发布该发行人不合规的认定,并禁止各数字资产服务提供商在美国境内就该发行人发行的稳定币提供二级交易服务。

「合法命令」是指根据美国联邦法律由联邦政府或法院发布的任何具有终局性且有效的令状、程序、命令、规则、法令、指令或其他要求,包括:

要求某人扣押(seize)、冻结(freeze)、销毁(burn)由支付稳定币,或阻止其转让(prevent the transfer);

明确指定需封锁(subject to blocking)的特定支付稳定币或账户;且

依法受司法或行政审查,且当事人有权上诉。

8. 禁止支付利息

任何获准支付稳定币发行人或外国支付稳定币发行人均不得仅因持有、使用或保留支付稳定币,而向支付稳定币的持有人支付任何形式的利息或收益(无论是以现金、代币还是其他形式的对价)。

9. 业务限制及搭售禁止

除非相关监管机构允许,获准支付稳定币发行人业务范围仅限于:

- 发行和赎回支付稳定币;

- 管理相关储备资产(包括根据相关联邦法律买入、卖出、持有储备资产,或提供托管服务);

- 为支付稳定币、储备资产或支付稳定币的私钥提供托管或保管服务;及

- 直接支持上述任何功能的其他活动。

- 获准支付稳定币发行人不得对其提供的服务设置以下前提:

- 客户需从该获准支付稳定币发行人或其任何子公司获取额外的付费产品或服务;或

- 客户需同意不从竞争对手处获取额外产品或服务。

10. 虚假陈述及使用具有欺骗性的名称

获准支付稳定币发行人不得:

- 在支付稳定币的名称中使用与美国政府相关的任何术语组合;或

- 以任何可能使人合理认为支付稳定币为法定货币、或系由美国政府发行、担保或批准的方式营销支付稳定币。

不过,仅使用与锚定货币相关的缩写,例如USD,并不受上述限制。

任何关于支付稳定币具有美国政府的完全信用和信誉支持(full faith and credit)、系由美国政府担保或受联邦存款保险保障的声明均属违法行为。

除非某产品系根据GENIUS法案合法发行,否则不得将该产品作为「支付稳定币」营销。

11. 禁止「不良行为者」从业

曾因以下罪行被定罪的个人不得担任获准支付稳定币发行人的高管或董事:

- 内幕交易;

- 挪用公款;

- 网络犯罪;

- 洗钱;

- 资助恐怖主义;或

- 金融欺诈。

12. 非金融类上市公司的特别规定

非主要从事金融活动的上市公司(non-financial services public companies)及其全资或控股子公司/关联企业,在满足以下各项条件并获得稳定币认证审查委员会(Stablecoin Certification Review Committee)全票(unanimous vote)通过前,不得发行支付稳定币:

- 无重大风险:稳定币发行不得对美国银行体系安全稳健性、美国金融稳定或存款保险基金(Deposit Insurance Fund)构成重大风险;

- 数据使用限制:上市公司必须遵守数据使用限制条款,未经消费者明确同意,不得将稳定币交易数据中的非公开个人信息作如下使用:

-广告及其他内容的定向投放、个性化定制或推荐排序;

-向第三方出售;或

-与非关联方共享。

- 搭售禁止:上市公司及其关联企业须遵守GENIUS法案中的搭售禁令。

稳定币认证审查委员会由美国财政部长、美联储主席或负责监管的副主席以及美国联邦存款保险公司主席组成。

以上禁令同样适用于非主要从事金融活动的非美国企业。

13. 破产程序

在获准支付稳定币发行人的破产程序中,该发行人发行的支付稳定币持有人的索赔权(赎回权)优先于发行人及其任何其他债权人对其储备资产的索赔权。

如果发行人储备资产不足以赎回流通中的支付稳定币,持有人的任何剩余索赔金额一般应优先于对于发行人的任何其他索赔。

04 GENIUS法案中的其它关键条款

1. 互惠安排

美国财政部长可以与其它司法辖区创建并实施互惠安排或其他双边协议,前提是该司法辖区的支付稳定币监管制度与GENIUS法案建立的监管制度具有可比性(comparable)。法案要求美国财政部长应在GENIUS法案颁布后2年内落实互惠安排。

2. 稳定币托管

只有特定受监管金融机构才能提供支付稳定币储备资产、用作担保品的支付稳定币或与用于发行支付稳定币相关的私钥的托管或保管服务。托管服务应遵循以下三个原则:

- 客户资产原则:对于用作担保品的支付稳定币或与用于发行支付稳定币相关的私钥,托管人必须将其视为归相关客户或受益人所有,并采取合理措施保护此类资产免受发行人或托管人的债权人追索。

- 禁止混同原则:托管人持有的支付稳定币储备资产、支付稳定币、现金和其他相关财产必须与托管人的自有资产隔离(segragated),但:

-为便利管理,允许将发行人或客户的支付稳定币储备资产、支付稳定币、现金或其他相关财产分类集中至一个综合客户账户(omnibus customer account)中;

-以存款机构存款负债形式持有的现金形式的任何支付稳定币储备资产不得受任何关于将此类现金与存款机构财产分离的要求约束

- 客户优先原则:不论相关资产是否隔离,客户对托管资产的索赔权均优先于发行人或托管人索赔权。

3. 银行等传统金融机构的角色保留

GENIUS法案不限制受监管银行、信托公司或其他类似实体根据适用法律从事允许的活动,包括:

- 接收存款并发行代表存款的数字资产;

- 使用分布式分类账作为其簿记工具,及进行银行内部转账(intrabank transfers);及

- 为支付稳定币、相关私钥或储备资产提供托管服务。

对于从事托管活动的受监管金融机构,GENIUS法案还规定美国联邦金融监管机构不得要求受监管银行、信托公司或其他类似实体在任何财务报表或资产负债表上将托管资产列为负债,也不得要求这类受监管机构为其所托管或保管中的资产保有额外的监管资本,除非监管机构认为该额外监管资本系缓解受监管金融机构运营风险所必需。

4. 法案生效日期及各州层面的协调立法

GENIUS法案将在以下日期中较早者生效:

- GENIUS法案颁布后18个月;或

- 主要联邦支付稳定币监管机构发布任何实施GENIUS法案的最终法规后120天。

在GENIUS法案颁布之日起1年内,每个主要联邦支付稳定币监管机构、美国财政部长和各州支付稳定币监管机构应制定适当和协调的规则来实施GENIUS法案。

05 回顾:中国香港《稳定币条例》

作为国际金融中心与全球数字资产枢纽,香港在包容Web3创新的同时,坚守严格的监管标准。香港近期出台的《稳定币条例》,长达269页,是目前全球最为全面的专门针对稳定币发行与分销的立法之一。

该条例经广泛公众咨询,并对标国际标准,其核心特征与金融稳定委员会(FSB)、巴塞尔银行监管委员会(BCBS)等国际组织的全球标准、以及包括美国在内的主要司法管辖区的相关制度大体一致。

《稳定币条例》的核心内容如下:

- 发牌要求:任何人士在香港发行锚定法币(如港元或美元)稳定币,或面向香港公众积极推广相关稳定币发行业务,必须获得香港金融管理局(HKMA)发放的稳定币发行人牌照。

- 合格储备资产:持牌发行人须以高质量流动性资产对流通中的稳定币进行 100%全额备付,储备资产将受到严格监管,旨在最大限度地降低信用、市场及流动性风险。储备资产须与发行人其他资产隔离,并由具资质的托管人托管。

- 审慎及行为要求:发行人必须满足严格的审慎标准,包括资本和流动性要求、治理和风险管理标准以及运营弹性,并采取业务活动限制、全面透明的信息披露及审计等举措,保障市场诚信和投资者信心。

- 消费者及投资者保护:《稳定币条例》注重投资者保护,仅允许获 HKMA 许可的持牌发行人发行的稳定币向香港零售投资者发售。此外,仅特定持牌机构才能在香港发售或分销稳定币。

- 反洗钱/反恐融资合规:发行人必须遵守 AML/CFT 相关法规,并建立有效内部制度以防范潜在违法活动。

- 监管和执法:HKMA被授予广泛的监管与执法权,包括现场检查、发出指示、以及对违规者采取纪律处分等。

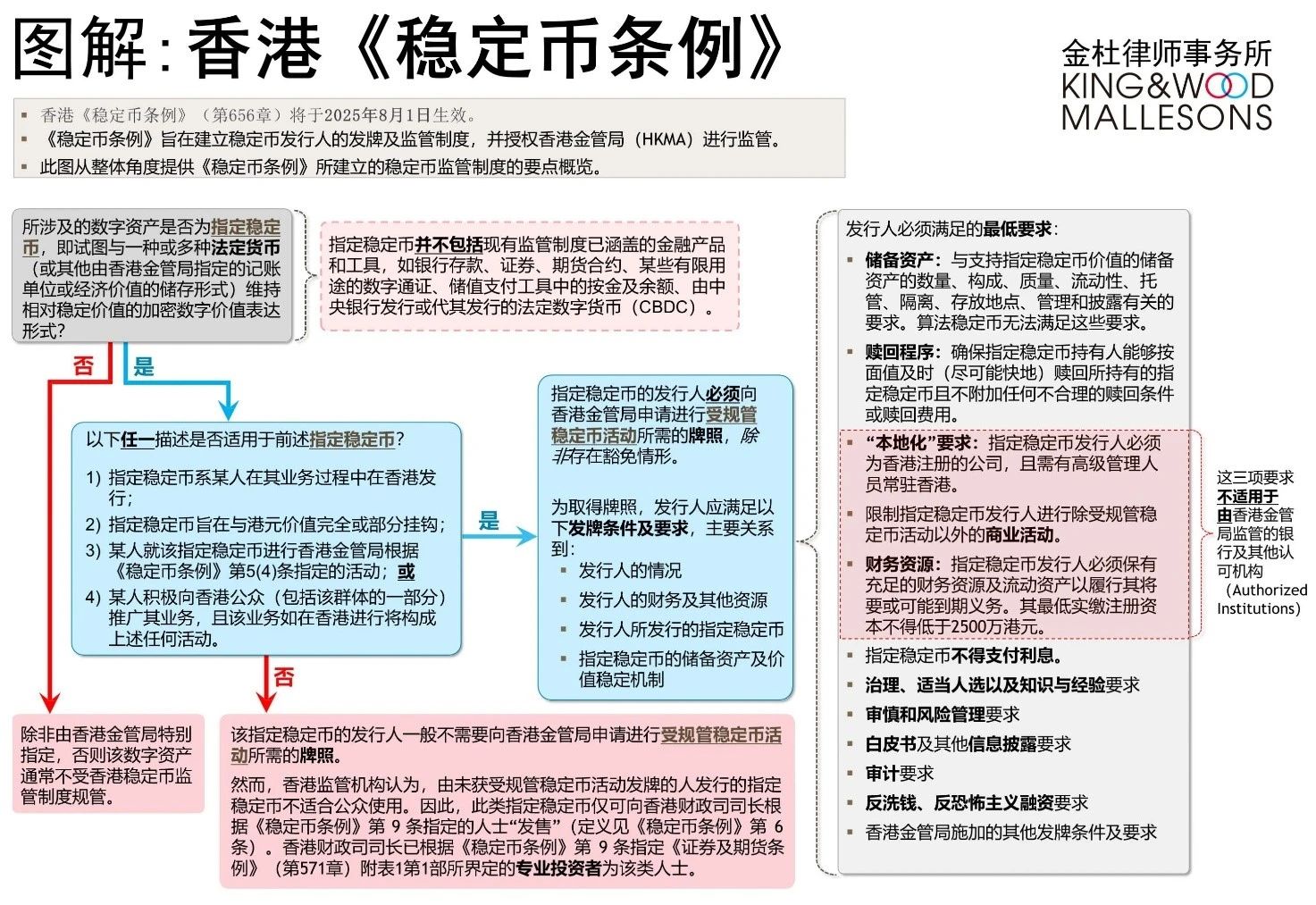

下图载列香港《稳定币条例》的核心内容:

06 中国香港和美国稳定币立法对比

香港《稳定币条例》和美国GENIUS法案的大致框架相似:均对稳定币发行人及相关活动实施全方位监管。二者均参照FSB、BCBS制定的国际标准,对持牌发行人储备资产的规模及构成设置了严格标准,并设定多元化合规与风险防控措施,切实保护投资者利益。

但两地的稳定币立法分别存在于截然不同的法律体系下。例如,美国为联邦制国家,GENIUS法案中专门设计了联邦与州的分级监管条款。同时,美国有三个主要的联邦银行监管机构(美联储、OCC和FDIC),而香港仅有HKMA作为银行和审慎监管机构。这一差异也使得美国的稳定币监管体系更为复杂。

此外,GENIUS法案的一大目标是巩固美元在数字时代的主导地位、并创造对美国国债的持续性需求。因此,储备资产要求基本限定为美国银行机构的美元存款或美国国债。与GENIUS法案的宏观经济政策目的相比,香港《稳定币条例》则更侧重投资者和消费者保护,例如仅允许获HKMA许可的持牌发行人发行的稳定币向香港零售投资者发售等。

结语

美国《GENIUS法案》的正式生效标志着稳定币监管在全球主要金融市场进入了全新阶段。作为美国首部联邦层面的稳定币专项立法,该法案通过建立清晰的监管框架,即明确定义支付稳定币的内涵与外延、建立发行人许可制度、规定严格的储备资产要求以及制定透明的信息披露机制,为稳定币市场参与者提供了法律确定性。其核心设计——如分层监管体系、100%储备资产要求、禁止算法稳定币等,既平衡了创新与风险,也为传统金融与加密生态的融合铺平了道路。

GENIUS法案的宏观经济战略意图同样显著:通过将稳定币纳入「美元-美债」循环,美国有望扩大美元在全球支付中的使用场景,并为美债市场创造长期需求。长期来看,GENIUS法案或将成为数字美元战略的关键支点,其影响远超加密行业本身,甚至可能重新定义国际货币体系的权力结构。

此外,该法案的影响力远不止于美国本土。其独特的互惠安排机制,实质上为全球稳定币监管设定了基准,将对国际市场的合规标准产生深远影响。与此同时,香港《稳定币条例》也将于八月正式生效,也反映出全球主要金融中心正积极构建稳健的数字资产监管体系。尽管中美两地在具体路径和政策重点上(如美国的美元战略考量与香港对审慎合规及投资者保护的侧重)有所差异,但这一全球性的监管趋同态势已然明朗。

对行业而言,GENIUS法案的实施也意味着稳定币从灰色地带正式走向主流化,合规将成为相关业务生存之前提。对于全球数字资产市场的参与者而言,其对于稳定币监管变革的态度需要从「密切关注」转向「积极应对」,深入评估《GENIUS法案》等新法规对其业务模式的直接影响,并及时调整其合规战略,以适应这个日渐清晰且严格的全球监管新环境。

金杜将持续关注各司法辖区有关稳定币相关的立法进程,并及时为客户提供最新动态和专业分析。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。