今天的作业还算好,并没有什么太复杂的,虽然市场有波动但都算是在正常范围之内,尤其是看美股目前还是小幅上涨的状态,就说明整体并没有大问题,加密货币的回调主要还是山寨币的问题,今天也重点讲了这个情况,如果没有溢出的流动性,山寨季还是要等等的。

今天花了大量的篇幅和数据就是要讲明这个问题,虽然 $ETH 上涨,但更多的购买力并不是来自于加密货币领域,反而是来自于现货 ETF 的一级市场和二级市场,这种情况下即便有溢出资金也很难会到币圈中,更别说目前还没有明显的迹象这部分投资者已经止盈离场。

所以山寨季可能还要等一等,先等 $BTC 和 ETH 稳定了再说,这次的 ETH 走势有点像 2024年初的 Bitcoin 了,都是由于传统投资者的买入而带动的行情。

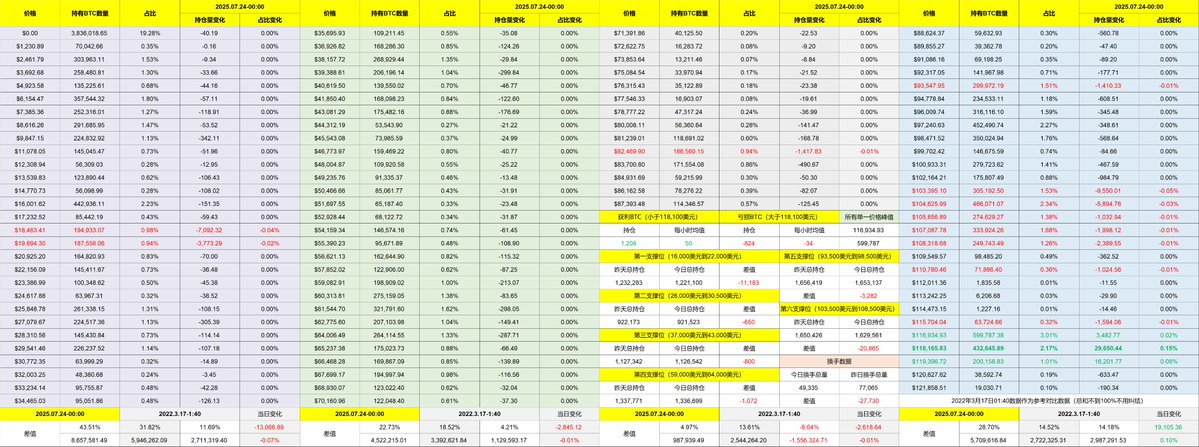

回到 Bitcoin 的数据来看,换手率在继续大幅下降,已经完全不像是工作日的数据了,反而是回到了垃圾时间一样,要知道一周以前的今天换手率起码是目前的三倍以上,换手降低就说明了投资者的博弈情绪在放缓,投资者在等待市场的信号。

目前主要的信号就是关税和货币政策,关税今天川普已经宣布了和日本的关税,15%和5,000亿美元的投资确实是不错的结果,昨天菲律宾的19%也低于预期了,今天还传出了和欧盟即将达成 15% 的关税,剩下的就是中国了,这些都是让市场情绪稳定的原因。

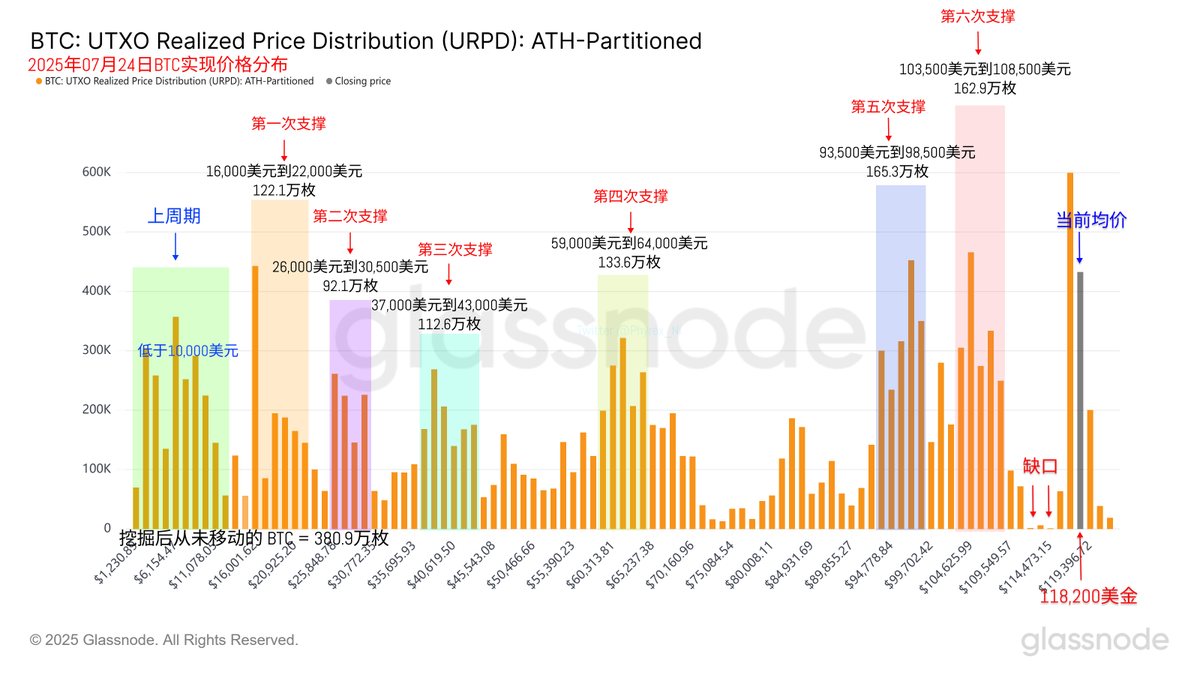

货币政策上就没什么多说的了,市场还在期待川普尽快选出鲍威尔的继任者,这才能让市场预期利率能快速下降,支撑方面也没有发现什么问题,但缺口仍然是我关注的重点。

数据地址:https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

本文由 #Bitget | @Bitget_zh 赞助

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。