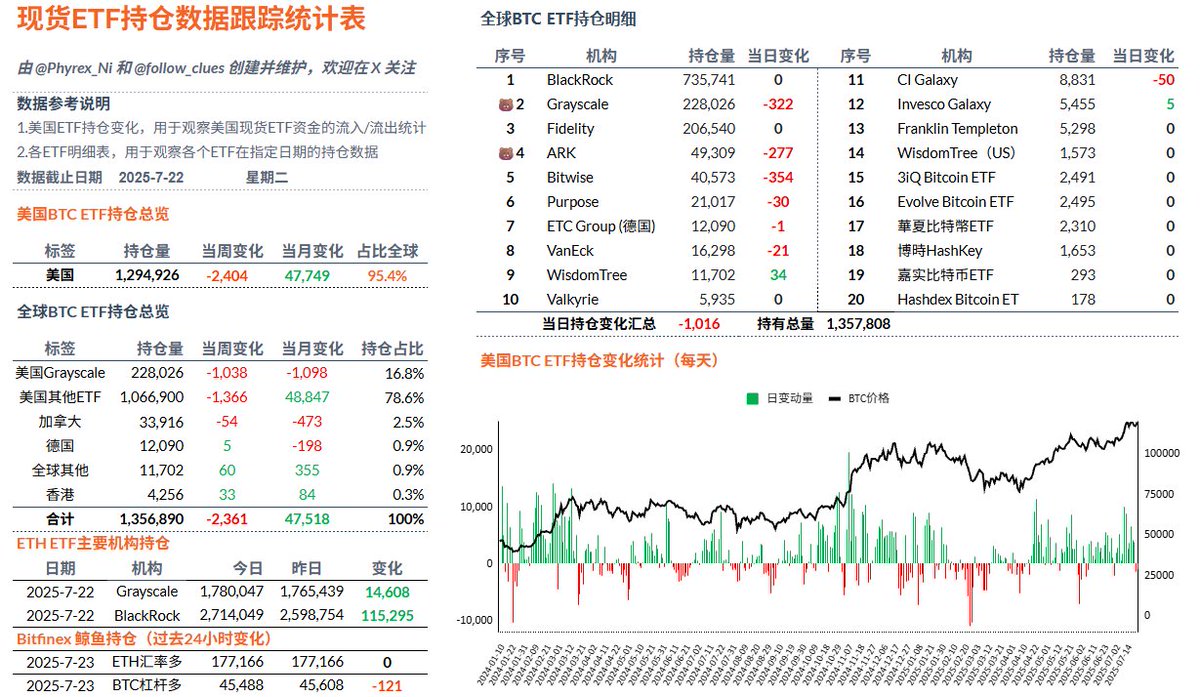

连续第二天 $BTC 现货 ETF 的数据出现净流出,虽然流出量也不大,但也说明了投资者的 FOMO 情绪在逐步的消退,价格的震荡频率会更高一些,而净流出的主要原因还是贝莱德的投资者连续第二天没有流入,数百枚 Bitcoin 的净流出对于 BTC 现货不会有什么影响。

但就像在周报中说的一样,目前 BTC 的上涨并不是因为购买力多强,而是因为抛售降低,所以当抛售上升,购买力下降的时候,自然价格就会有更多的震荡,但并未到改变 BTC 叙事的程度,市场的主要博弈还是在关税和货币政策上。

数据地址:https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

本文由 #Bitget | @Bitget_zh 赞助

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。