Written by: Tuo Luo Finance

In the United States, cryptocurrency has never been so important.

Just last week, the U.S. Congress welcomed a highly anticipated "Cryptocurrency Legislative Week," transitioning from being avoided like the plague to being rebranded, culminating in a congressional agenda focused on cryptocurrency. The past decade in the crypto world has not been particularly stable, but it has certainly been fast-paced.

With a series of ups and downs, the cryptocurrency bills have all been passed, and the much-anticipated GENIUS Act for stablecoins has been officially signed by Trump, marking a new journey for the crypto industry.

Milestone Event! Three Major Cryptocurrency Bills Passed

Let's rewind to last Monday, July 14, when the U.S. House of Representatives boldly declared that week as "Cryptocurrency Legislative Week," attracting market attention. The core of Legislative Week revolves around three existing cryptocurrency bills: the "Digital Asset Market Clarity Act" (CLARITY Act), the "Anti-CBDC Surveillance State Act," and the "Guidance and Establishment of a National Innovation Act for U.S. Stablecoins" (GENIUS Act).

Among these three bills, the GENIUS Act and the CLARITY Act were both proposed this year, while the Anti-CBDC Surveillance State Act has the longest history, having been introduced as early as 2022. Although all three are cryptocurrency bills, their core focuses differ. The GENIUS Act centers on the issuance of stablecoins, gaining the most recognition. The bill focuses on payment-type stablecoins and implements a dual regulatory system at both the state and federal levels, stipulating that all stablecoins must be pegged to high-quality, low-risk liquid assets in a 1:1 ratio with the U.S. dollar, specifically including U.S. Treasury bonds maturing within 93 days, insured bank deposits, or physical U.S. dollar cash (including Federal Reserve notes), and requires stablecoin issuers to disclose detailed reserve information monthly. This bill was proposed in February and has now been signed by Trump, leading the legislative process among the three bills, highlighting the importance placed on it by legislative bodies and senior officials.

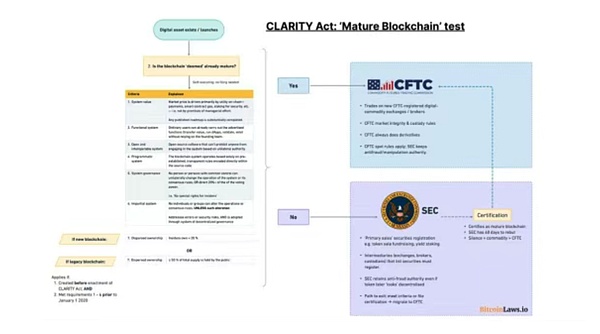

In contrast to the GENIUS Act, the CLARITY Act is much less familiar to outsiders. This proposal was first submitted by J. French Hill, the chairman of the House Financial Services Committee and a Republican congressman from Arkansas, on May 29, 2025, and has undergone multiple rounds of hearings and reviews to form its latest version. As the name suggests, the term "clarity" reflects the bill's most important focus—regulatory authority issues. Due to the difficulty in defining the nature of cryptocurrencies, the debate between the securities and commodities theories has never ceased since the inception of cryptocurrencies. Coupled with the relatively abundant confiscated capital in the crypto industry compared to other sectors, the competition for jurisdiction between the SEC and CFTC is intense. Before Trump took office, the SEC was known as the "crypto cop," frequently investigating various projects, and the frequent Wells notices created a climate of fear in the industry, affecting USDT, USDC, ETH, and SOL.

The CLARITY Act aims to resolve this issue by establishing clear classification standards for digital assets, categorizing them into digital commodities, investment contract assets, and non-commodity collectibles, clarifying the property disputes surrounding cryptocurrencies, and constructing a regulatory framework with dual agency responsibilities, where the CFTC oversees the digital commodity spot market, and the SEC is responsible for securities issuance and anti-fraud enforcement.

The "Anti-CBDC Surveillance State Act" directly states its content in the name, with the key provision being the prohibition of the Federal Reserve from issuing retail central bank digital currency (CBDC) without explicit authorization from Congress. It is well known that during Biden's administration, there was a relatively open attitude towards CBDCs and digital dollars, and in 2022, he even signed an executive order directing government agencies to study the creation of a CBDC. However, in U.S. politics, changes in policy are commonplace. In January 2025, Trump signed an executive order to suspend all retail CBDC development, citing concerns that it could be used as a government surveillance tool. Subsequently, this "Anti-CBDC Surveillance State Act," proposed in 2022, quickly rose to the legislative agenda and was passed by the House Financial Services Committee on April 3, becoming a topic during Cryptocurrency Legislative Week.

From the latest approval status, both the CLARITY Act and the Anti-CBDC Surveillance State Act have passed the House vote and are heading to the Senate agenda, while the GENIUS Act, which moved the fastest, has already become formal law after being signed by Trump. It will take effect 18 months after Trump's signature or 120 days after the "primary federal payment stablecoin regulatory agency" (including the Treasury and the Federal Reserve) issues the final regulations for implementation. This is the first cryptocurrency law in the U.S. and undoubtedly represents a significant breakthrough in cryptocurrency legislation. Upon closer examination of the bill's content, it is not coincidental that the three bills were included in Cryptocurrency Week; they are indeed interrelated. Stablecoins, as the ballast of the industry, continue to expand the boundaries of the dollar and attract institutional participation, while the CLARITY Act clarifies regulatory clarity, further promoting industry scale expansion, and the Anti-CBDC Act directly stifles the biggest competitor to cryptocurrencies, the digital dollar, stabilizing the crypto foundation and establishing an ideological framework. It can be said that the combined effect of the three will maximize the value of cryptocurrency, achieving the reconstruction of the dollar's value in the digital currency realm through the integration of cryptocurrency and traditional finance.

Not Smooth Sailing: The Interest Games Behind the Three Bills

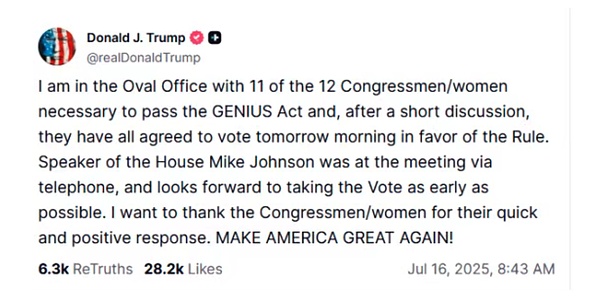

However, where there are interests, there are naturally games. The seemingly smooth approval process was not without its challenges, as the interest games behind the legislation were quite dramatic. On the eve of the GENIUS Act's approval, Trump urged party supporters to immediately agree to the bill, stating that given the 220:212 split in this year's election, along with some Democratic supporters, the bill's passage should be a foregone conclusion. However, on July 15, the House voted against the GENIUS Act with a tally of 196-223, with key defections from 12 Republican members.

The reason was that at the time, there was intense debate between the two parties over whether the GENIUS Act should include provisions from the Anti-CBDC Surveillance State Act. The Republicans believed that if the anti-CBDC clause was not included, it might leave hidden dangers for the future issuance of a U.S. CBDC. One issue led to another, and new problems arose regarding the integration of the CLARITY Act and the Anti-CBDC Surveillance State Act. The bundling faction, represented by major industry players like Coinbase, argued for a comprehensive approach to complete all cryptocurrency legislation at once, while the pragmatic faction centered around DeFi advocated for a more gradual approach, first passing the GENIUS Act before discussing others. This demand is quite understandable; many industry giants have already accumulated significant compliance advantages, and if cryptocurrency legislation is completed, they could capture the most market benefits. At the same time, the giants, being large and unwieldy, naturally prefer a more certain comprehensive legislative approach. On the other hand, DeFi has always existed in a regulatory gray area, and for the community, any piece of legislation is beneficial, clearly indicating that the faster the process, the better.

After the defections, Trump was clearly frustrated. That evening, he took swift action, bringing the 12 members who voted against the bill into his office for discussions, the content of which remains unknown. However, from the results of the second vote on July 18, it was evident that the arm could not ultimately twist the leg. After nearly ten hours of back-and-forth, which was dubbed the longest legislative vote in history, the U.S. House of Representatives successfully passed the GENIUS Act with a vote of 308 in favor and 122 against.

Overall, although the three legislative bills faced some setbacks during the process, their passage was merely a matter of time with the strong support of the president. If we consider that more than one-fifth of Trump's cabinet holds cryptocurrency, the timeline for passage is expected to be significantly shortened. Industry analysis suggests that the CLARITY Act will face relatively higher hurdles for passage due to its implications for ownership transfer and its greater market impact, leading to stronger resistance from the Democrats, while the Anti-CBDC Act is likely to come into effect by the end of this year.

What Impact Will the Three Bills Have on the Market?

The impact of the three bills on the market is visibly significant, with both cryptocurrency and stock markets celebrating this event. Bitcoin has continuously broken new highs, surpassing $120,000 three times, peaking at $123,000, and currently retreating to $119,000, while the ETH sector has officially begun to rotate, with ETH soaring to $3,790, SOL reaching $189, and BNB breaking through $760 again. Among the top 100 cryptocurrencies by market capitalization, 52 are showing upward trends. Benefiting from the stablecoin bill, the first stablecoin stock, Circle, rose over 1.45%, and the related Coinbase also increased to the $400 range, currently reported at $419.78.

Beyond prices, changes in the industry are quietly emerging. First, the CLARITY Act outlines seven objective, measurable criteria to determine the attributes of digital assets, significantly reducing securities risks, especially for DeFi projects that have been heavily impacted by securities regulations. It allows DeFi systems to be exempt from federal intermediary rules, although the secondary regulatory model may raise concerns about increased regulatory costs, it provides regulatory assurance for the industry. In this context, it is foreseeable that the CFTC will gradually gain enforcement authority from its previous marginal role, transitioning to become a more important regulatory body for cryptocurrencies, with large centralized exchanges benefiting the most, potentially opening up new institutional pathways, while DeFi and other application projects will either need to integrate into the system to gain certain benefits or face marginalization.

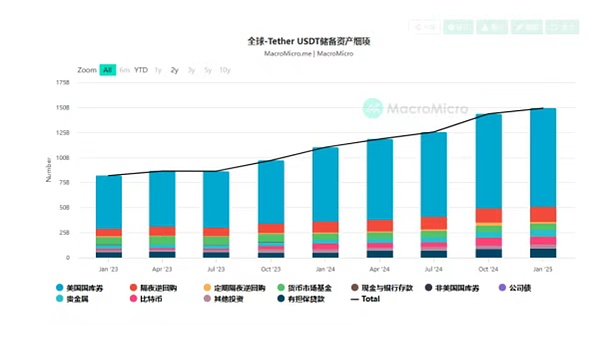

At the same time, stablecoins will be the most affected area. As previously mentioned, the epoch-making impact of the GENIUS Act is the establishment of a new rule for private issuance of currency, and the Anti-CBDC Act further reinforces this point. Thus, the era of private minting taxes will begin. Traditional companies, financial institutions, and even qualifying tech companies can enter this field. For example, both Bank of America and JPMorgan have actively expressed their intention to participate in stablecoin development, and the field is expected to become crowded quickly. However, according to predictions, new entrants will face initial setup costs of $1-3 million and ongoing compliance costs of $2-10 million per year, indicating that only financially strong companies will be able to stand out.

For the existing stablecoin sector, the industry landscape is likely to be reshaped. First, leading players will face dual challenges of compliance and competition. Offshore issuer Tether not only faces compliance issues regarding its collateral (approximately 85% of which is backed by cash and cash equivalents, not 100%), but also must confront the impact of widespread competitors. Decentralized stablecoins will face even more challenges, as both reserve ratios and governance structures will undergo rigorous regulatory scrutiny, and if they fail to comply within the two-year transition period, they will be explicitly prohibited from issuance.

In addition, there has been much discussion regarding whether stablecoins can pay interest under existing regulations. To mitigate the impact of stablecoins on the current system, the GENIUS Act explicitly states that payment-type stablecoins cannot pay interest to holders, and users need to seek other DeFi protocols to earn returns. However, there is operational flexibility, such as switching to yield-bearing stablecoins or using payment-type stablecoins to purchase U.S. Treasury tokens, thereby indirectly achieving the property of earning interest.

Regardless of whether interest is paid or how fierce the competition is, the biggest winner will undoubtedly be the U.S. dollar system. Through layers of legislative nesting, the long-arm mechanism of the dollar, leveraging stablecoins, has been further strengthened. Under the influence of the core assets pegged to stablecoins, the essence of stablecoins is actually dollar assets, and stablecoins objectively serve as a measure of value and a medium of circulation in the crypto market. In this context, the U.S. is consolidating cryptocurrency under regulatory oversight, not only harvesting existing crypto achievements without deploying any troops but also successfully reshaping the dollar's hegemony in the crypto realm, extending the influence of the dollar into the digital age as the scale of cryptocurrency expands, further creating a competitive landscape with global CBDCs. On the other hand, under the strong legislative support, the development of stablecoins will promote market demand for U.S. Treasuries, alleviating the current debt crisis in the U.S. and forming a capital return mechanism.

The finalization of the legislation marks the official arrival of the institutional era. Cryptocurrency has ultimately become an appendage of the dollar, leaving the market with mixed feelings, yet it still concludes with a rise. Perhaps for many, it is fortunate that cryptocurrency has made it to the table, and position is always more important than ability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。