Today's homework is much simpler compared to yesterday's. There are no complex macroeconomic data or overly sensitive information. The biggest event is that Trump signed the stablecoin bill at the White House. From the moment of signing, the United States has taken a significant step in the cryptocurrency field. Stablecoins can be said to be the foundation of cryptocurrencies and an extension of the dollar's hegemony in the blockchain space.

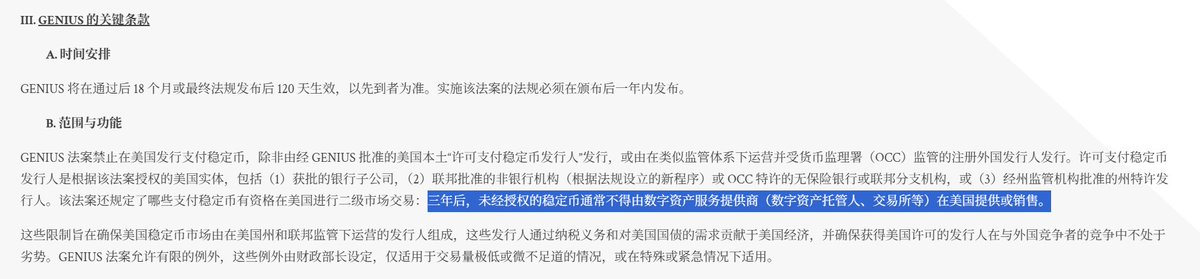

Not only Trump, but the Treasury, the Federal Reserve, and even the judicial system are all looking forward to the birth of this bill. In yesterday's vote, there were 102 votes from the Democratic Party, which indicates that the stablecoin bill represents the United States' attitude towards cryptocurrencies. The regulation will take effect 18 months after passing or 120 days after the final regulation is published, whichever comes first. The regulations implementing this bill must be published within one year of its enactment.

The successful signing of the stablecoin bill marks the transition of cryptocurrencies in the United States and even globally from a wild era into a federal regulatory system. It is an important step for the U.S. to attempt to gain global digital financial dominance through dollar stablecoins, and it opens new opportunities for compliant institutions, financial giants, and innovative companies.

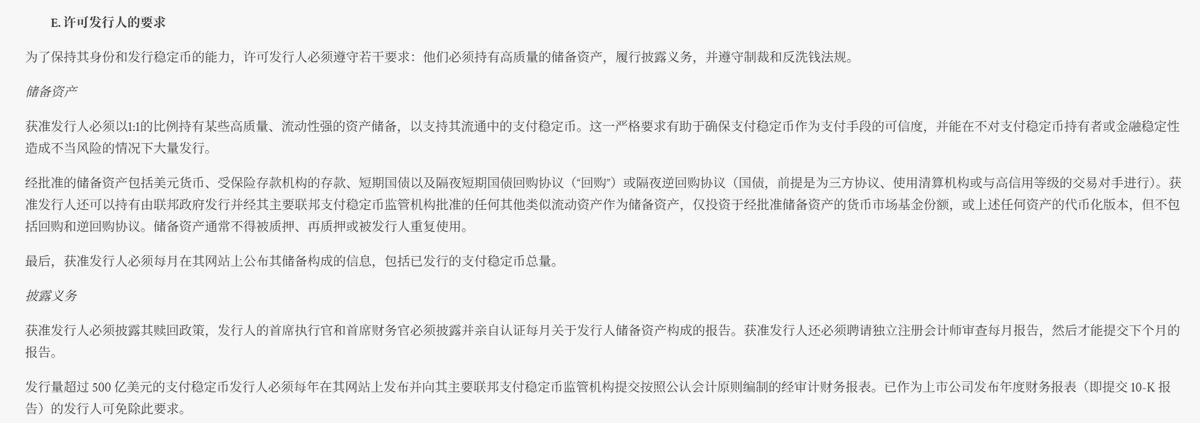

The next step is for stablecoin companies to apply for the Payment Stablecoin Issuers (PPSIs) license. Currently, USDC, PYUSD, and USD1 are eligible to apply, while USDT will have to leave the U.S. market in three years if it cannot obtain the license, which means it won't be able to operate in the secondary market either.

There isn't much else to report. Although a few Federal Reserve officials spoke today, their impact on the market was minimal. The only somewhat comedic moment was when Waller stated that he would be willing to take on the role of Federal Reserve Chair if Trump allowed it, but he mentioned that Trump has not contacted him.

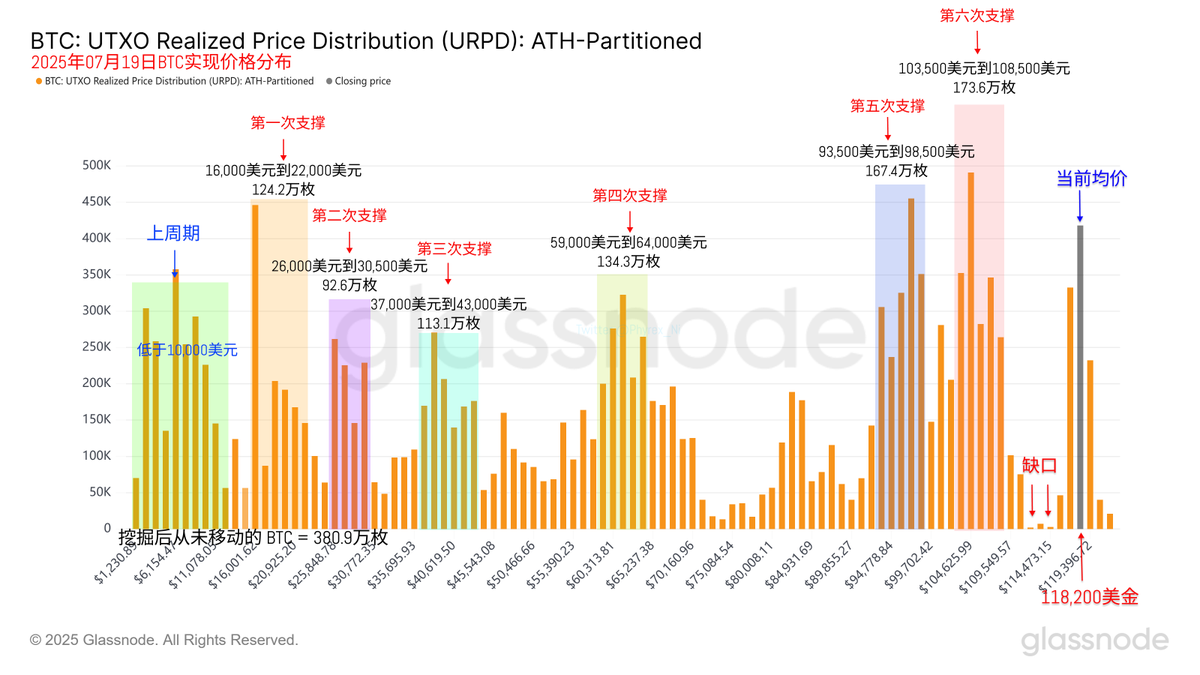

Returning to Bitcoin, the turnover rate continues to decrease, and investors' FOMO sentiment is starting to weaken. The purchasing power of ETFs in $BTC is declining, while $ETH is rising. Tomorrow is the weekend, and liquidity will significantly decrease, which will be a time for emotional expression. It remains to be seen whether the continuously rising ETH can drive the arrival of altcoin season over the weekend, or if the market will enter a correction period due to the weakening of FOMO.

Currently, the supporting data remains very stable, and the decrease in turnover has reduced the pressure on prices. Of course, the key factor is still the purchasing willingness of investors. As mentioned before, the price increase in the first half of this round was not due to an increase in purchasing power, but rather a decrease in selling pressure. However, after surpassing $120,000, BTC's selling has indeed increased. If purchasing power decreases, it is likely to experience some volatility for a while.

But as long as there are no obvious negative factors, I believe BTC's price can remain relatively stable. Let's see how it goes after this weekend.

Data address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。