Author: arndxt

Translation: Tim, PANews

I know this is not what you want to hear, but I have to say it.

Solana is becoming the Bloomberg terminal of the crypto world, designed for high-speed trading, on-chain composability, and massive yield throughput.

Three pieces of data support my viewpoint:

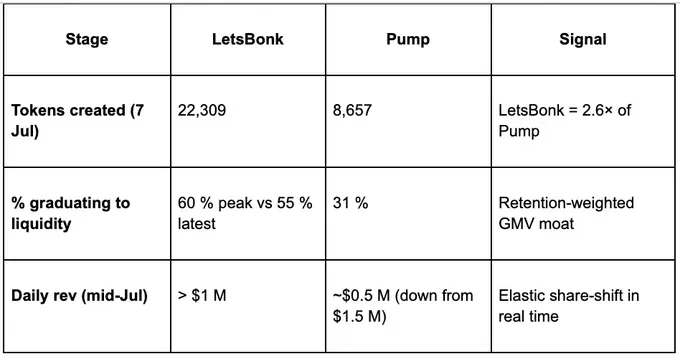

- The launch platform has now been transformed into a SaaS model: LetsBonk has surpassed Pumpfun, with a 60% graduation rate and entry into liquidity pools, generating daily revenue exceeding one million dollars. Creator loyalty is declining, and retention rates weighted by GMV have become a new moat.

- Tokenized stocks are core collateral: They provide around-the-clock liquidity, modular margin, and capital unlocking for private markets. The real market potential lies in the circulation of re-IPO equity.

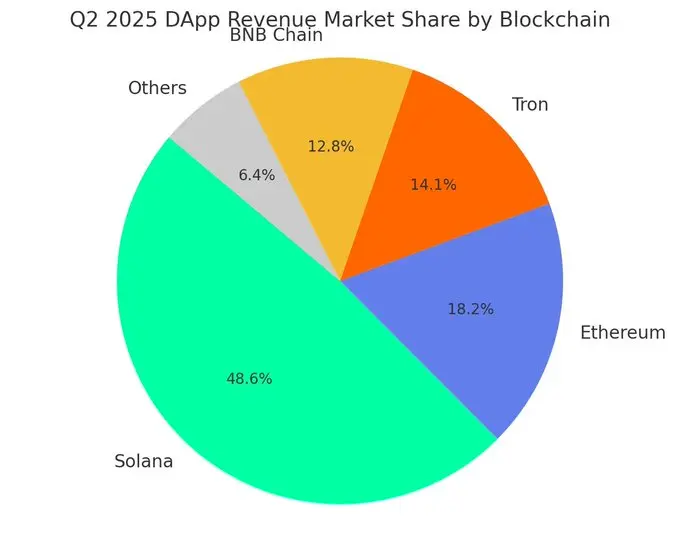

- Solana's revenue structure is diverse: Q2 revenue reached $570 million, accounting for 46% of all public chains. Its revenue mainly comes from decentralized applications, bot services, launchpads, and productive tools.

1. Launch platforms compete for PMF after practical testing

The highlight moment for LetsBonk is not just a digital competition:

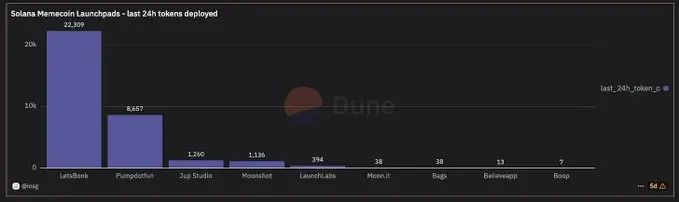

The market share has reversed: On July 5, the volume of new tokens launched on its platform accounted for 66% of the total market, while the Pumpfun platform only accounted for 26%.

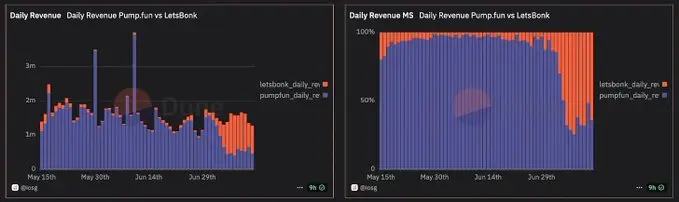

The quality of funds is more important than the scale of fundraising: LetsBonk has a graduation rate of about 60%, while Pumpfun's graduation rate is only 31%.

Monetization capability: Daily revenue surged from about $0 to over $1 million, while Pumpfun's revenue dropped to $500,000.

My Thoughts

Retaining weighted GMV is the true moat. The graduation rate essentially serves as a net income retention rate indicator for launch platforms; whoever can institutionalize it first will win the enterprise-level API integration market (Telegram bots, "one-click token issuance" SDKs, etc.).

Pumpfun still occupies a significant share of creators' minds (with cumulative revenue of about $700 million), but the LetsBonk platform has proven that user switching costs are approaching zero. The next wave of user attrition for Pumpfun may not occur naturally but could be orchestrated, envisioning top influencers providing "24-hour exchange listing" guarantee services.

Valuation of project scale: Even with a stable daily revenue of $1 million, annual revenue could reach $100 million. With a profit margin of about 80% from Solana's infrastructure, this protocol, which has been online for just one year, has already shown a SaaS-level economic model. Even excluding extreme volatility factors, a valuation of $1-2 billion remains valid based on a 10-15 times forward sales estimate.

With switching costs approaching zero, user loyalty is rented rather than truly owned.

The Pumpfun platform has accumulated $700 million in revenue in just 18 months, but LetsBonk, with its trading competitions, has captured a large market share in less than three weeks.

The paradigm shift in incentive mechanisms means:

- Creator loyalty is akin to mercenaries; airdrop activities and influencer promotion packages for "24-hour exchange listing" can lead to a mass "job-hopping" of creators overnight.

- Defensive moats equate to liquidity networking rather than UI experience. Pumpfun is expected to achieve linear growth through native decentralized exchanges and liquidity provider bribery mechanisms, thereby increasing exit costs.

The competitive strategy of newcomers: Excessive investment in incentive strategies, promoting token and daily-based leaderboard visuals, monetizing before the customer acquisition cost model resets.

Funnel economics indicate that gaining trading volume is easy, but graduation is key.

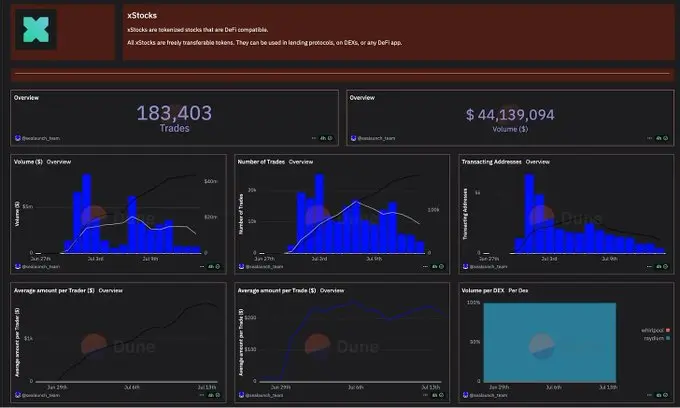

2. Tokenized stocks as the "Trojan Horse" for introducing traditional financial liquidity

Tokenized stocks are not just "Apple stocks on the blockchain"; they:

- Compress traditional financial settlement delays to minutes

- Open up a new category of collateral assets

- Unlock financing channels for large private institutions

The ultimately successful blockchain ecosystem must meet three core requirements: a regulated token issuance mechanism, a robust oracle system, and a highly liquid perpetual contract market. The eventual winner will become the "Stripe Connect" level infrastructure in the tokenized equity space, fully capturing the value upside.

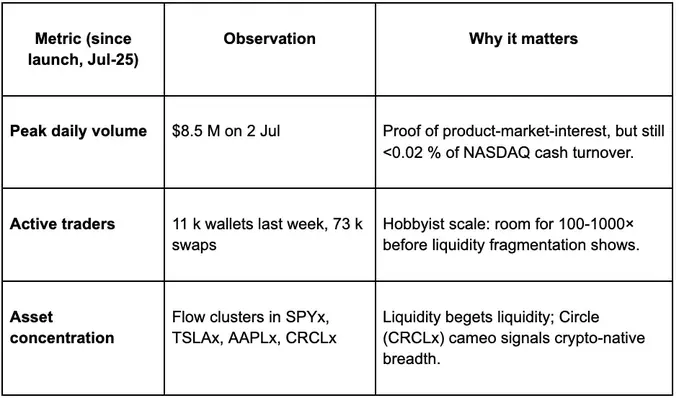

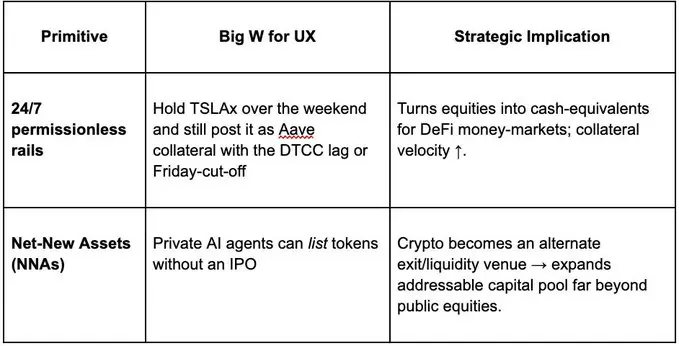

Where exactly are we on the "S-growth curve"?

xStocks and Robinhood have whitelisted synthetic put options for Apple Inc. ($AAPL) on-chain while converting illiquid assets or private equity into composable collateral.

Two fundamental structures that enable tokenized stocks to realize true value rather than gimmicks

3. Using Solana as the "yield mechanism" of the production and sales chain

Solana's Q2 revenue reached $570 million, capturing 46% market share.

- Ethereum: $213 million

- Tron: $165 million

- Binance Smart Chain: $150 million

- Others: up to $75 million

Two facts can be observed:

- The main application scenario for cryptocurrencies remains trading as a service.

- Building for professional users: Professional users drive profit and loss; mainstream exchanges will subsequently lead the public into the market.

Why have "professional users" in the crypto space defeated the "general public"?

Solana optimizes the full lifecycle value for professional users, while centralized exchanges must bear the costs of KYC verification, fiat channels, and new user support.

- Delayed arbitrage cycles: A 400-millisecond trading period and nearly zero fees allow bots to refresh orders dozens of times per second; every slight advantage directly translates into protocol fees.

- Composable leverage: Launching tokens → instant AMM liquidity pools → perpetual contract collateral, all within minutes. The capital turnover speed is an entire order of magnitude higher than Ethereum L2.

- Network incentive mechanisms align closely with the needs of whales: Professional users are willing to pay more fees, have lower attrition rates, and can establish liquidity foundations for the platform, continuously attracting a new generation of professional users.

Conclusion

Solana is committed to maximizing the full lifecycle value of professional users, while centralized exchanges bear the costs of KYC, fiat channel maintenance, and new user support.

The fastest-growing companies in the crypto space view blockchain as a high-speed track for capital markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。