Source: The Week On-chain, Glassnode

Translation: Golden Finance xiaozou

Bitcoin has reached a historic high, with a peak trading price of $122,600, bringing all BTC investors back into profit. According to key on-chain indicator analysis, if historical patterns hold, prices may continue to rise towards the $130,000 mark before demand exhausts.

Summary of the Article:

• Bitcoin has successfully broken through its historical high and has stabilized above two key accumulation ranges, indicating a strong bullish trend and a recovery in investor confidence.

• Short-term holders are currently realizing substantial unrealized profits, pushing several indicators describing this type of investor into overheated territory.

• We observed that the first wave of tokens realized significant profit-taking after breaking the historical high, which is a typical behavior characteristic of market euphoria.

• The realized profit-loss ratio had sharply surged past the 2 standard deviation threshold but has since retreated to a more moderate level later this week.

Historical patterns indicate that market tops often form after multiple rounds of profit-taking by investors. If Bitcoin demand remains resilient and the market rises again, the $130,000 price range will become the next significant resistance level. Despite the continuation of the bullish trend, signs of pressure on the demand side suggest that caution should be exercised in the near term.

1. Breakthrough Accumulation Range

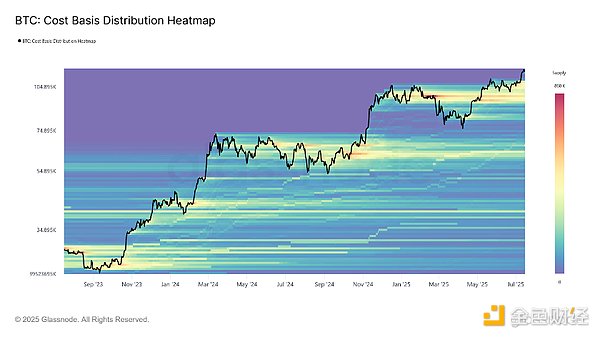

After several weeks of oscillation in the $100,000-$110,000 range, Bitcoin regained upward momentum and broke through the historical high of $122,000. The cost basis distribution heatmap shows that during this consolidation phase, there was significant accumulation in the $93,000-$97,000 and $104,000-$110,000 price ranges. Successfully breaking through these dense supply areas may convert them into strong support levels, laying a potential foundation for future market pullbacks.

2. Return to Price Discovery Phase

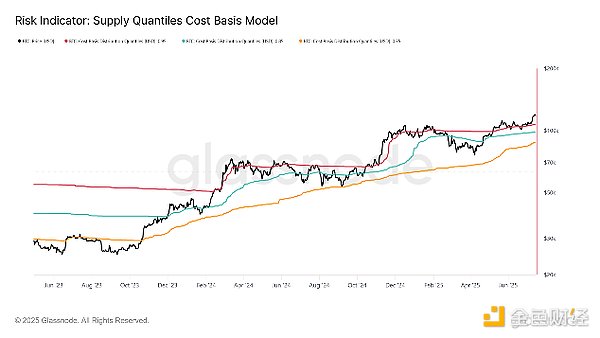

As Bitcoin enters a new round of price discovery, the vast majority of circulating supply is currently in profit. According to the cost basis distribution quartile model, the spot price has surpassed the 95% percentile at $107,400. This model is particularly valuable for identifying potential market top formation periods—when prices rapidly break through the 95% percentile, it typically triggers a wave of profit-taking due to an expanding holder base, ultimately redistributing supply to higher cost price levels. If such sell-off activities continue to accumulate, it may create a top-heavy market structure: a large number of investors holding high-cost positions, making the overall investor group increasingly sensitive to price fluctuations.

3. Signs of Overheating Begin to Emerge

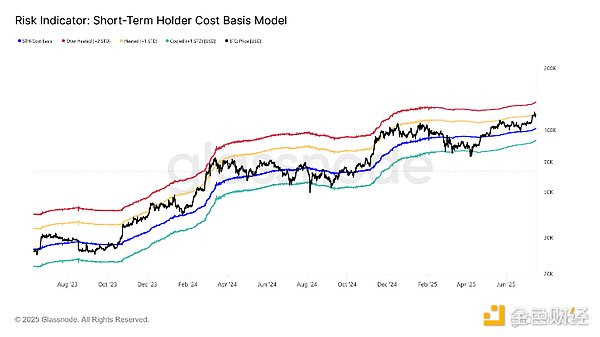

After Bitcoin reached a historic high of $122,600, it retreated to $115,900, a movement consistent with investors increasing selling pressure as the market strengthened. This pullback occurred after a brief price breakout above $120,000 (i.e., above the short-term holder cost basis +1 standard deviation range). Historical data shows that this level often becomes a natural resistance point, especially during periods of heightened speculative sentiment. If the current upward momentum is maintained, the next key resistance level will be in the +2 standard deviation range (currently around $136,000).

4. Bull Market Compass

Given that the market has confirmed entry into a short-term overheating state, the following will focus on identifying key indicators of extremely high-risk market structures. By utilizing these indicators, we aim to outline the market conditions that typically appear before significant tops or sharp pullbacks.

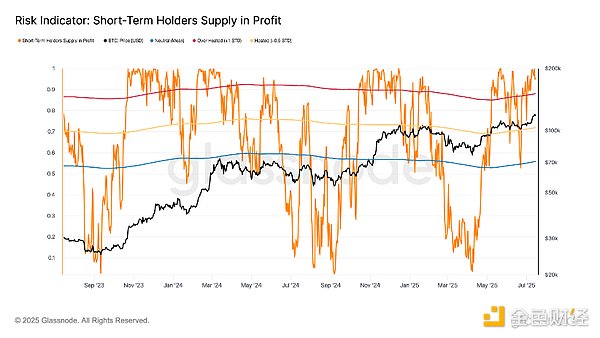

To measure the degree of profit dominance among recent investors, we use the short-term holder profit supply ratio indicator. This indicator is currently at 95%, exceeding the long-term average of 88% by more than 1 standard deviation, indicating that new market entrants are enjoying significant unrealized profit growth.

This is the third time since early May 2025 that this indicator has broken the critical threshold, reinforcing the judgment that the market is entering a more euphoric phase. If this indicator begins to stabilize or retreat below 88%, it may serve as an early signal of weakening demand or distribution of positions.

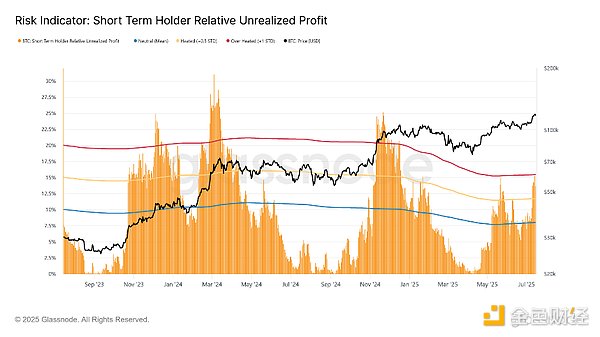

To assess the level of unrealized profits held by these investors, we turn to the short-term holder relative unrealized profit indicator. This indicator recently touched the overheating threshold of 15.4% (mean +1 standard deviation) before retracting to 13.6%, reflecting a moderation of unrealized gains during the price pullback.

Historical data shows that this area often marks the beginning of top formation—due to the continuous profit-taking behavior of short-term holders, top formations typically exhibit a lag. Given that these investors respond quickly to price changes, this indicator is crucial for capturing early signs of demand exhaustion.

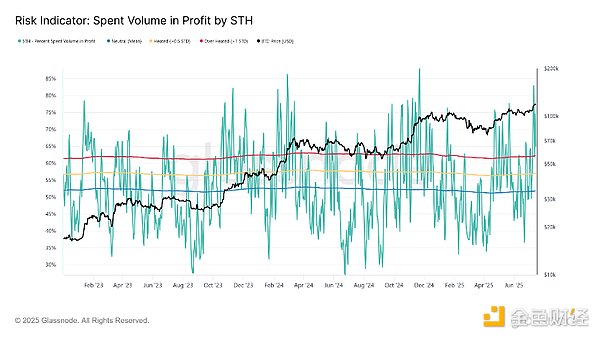

As unrealized profits have entered the overheating range, it is foreseeable that short-term holders will accelerate the sale of profitable positions. Such behavior will be confirmed when the proportion of profitable trading volume among short-term holders breaks above the upper band of 1 standard deviation.

This pattern has historically often signaled that demand on the supply side is about to exhaust. So far, we have observed the first wave of large-scale profit-taking since the peak at the end of 2024.

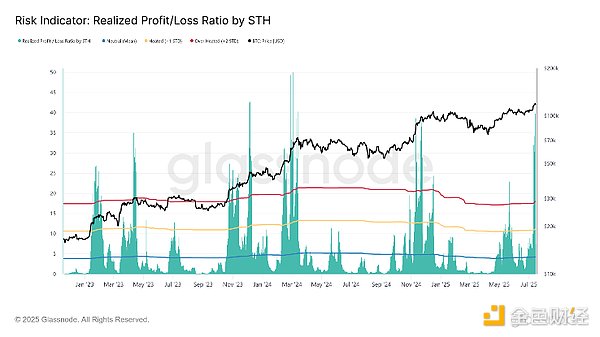

In addition to the proportion of profitable trading volume, we can also assess the intensity of profit realization through the realized profit-loss ratio. This indicator recently surged to 39.8, far exceeding the +2 standard deviation threshold, and then retreated to 7.3—though still at a high level, it has become more moderate relative to the bull market environment.

Multiple breaches of the overheating range can serve as strong signals of extreme profit-taking activity, which will ultimately deplete the inflow demand across the entire market.

5. Conclusion

Bitcoin has broken through two major dense accumulation areas, and such structural breakthroughs typically indicate strong sustained upward movement. However, short-term holders, as a more sensitive group, are currently in the overheating range of unrealized profits, which is likely to trigger more intense profit-taking behavior.

Currently, the proportion of profitable trading volume and the realized profit-loss ratio have both issued the first round of excessive profit-taking signals. Historical experience suggests that such top formations often occur through multiple rounds, indicating that the market still has potential upward space, possibly probing above the short-term holder cost basis +2 standard deviation range (around $130,000).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。