Bitcoin has risen to 123,000, and I've seen many people say: I actually shorted the world's highest quality asset. Many others say it would be better to return to 40-50,000. I tell you, if it drops to 10,000 or 20,000, you still won't buy. If you don't have enough understanding of Bitcoin, you won't be able to hold on.

BTC has reached a historical high again, but currently, there isn't much fear of missing out (FOMO) or obvious top signals: ✅ Mainstream media coverage of BTC's rise is not enthusiastic ✅ Coinbase's ranking in app stores is far from the top 1 ✅ No messages from friends outside the crypto circle yet

Ethereum is still 37% lower than its historical high three years ago. SOL is down 42%, and interest rates have not yet been lowered. The traditional financial cryptocurrency Treasury Ponzi scheme has just begun to accumulate, and there are no obvious signs of collapse yet.

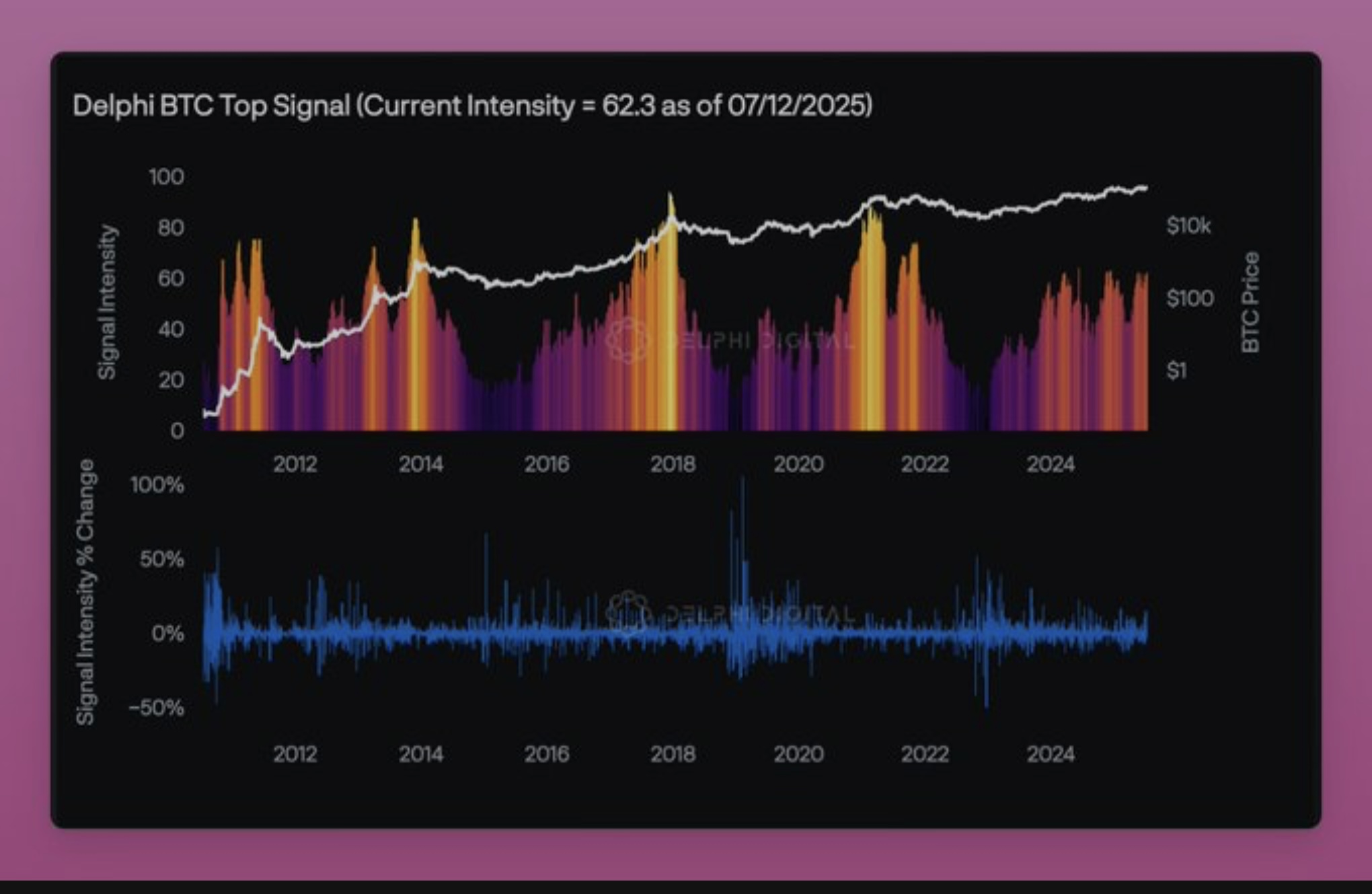

Perhaps the only chart to look at is Delphi's BTC top signal: it includes a weighted compilation of on-chain, technical, sentiment, and macro data, and we are currently at 62 points. Top conditions will start from 75 points, so buckle up and enjoy the ride.

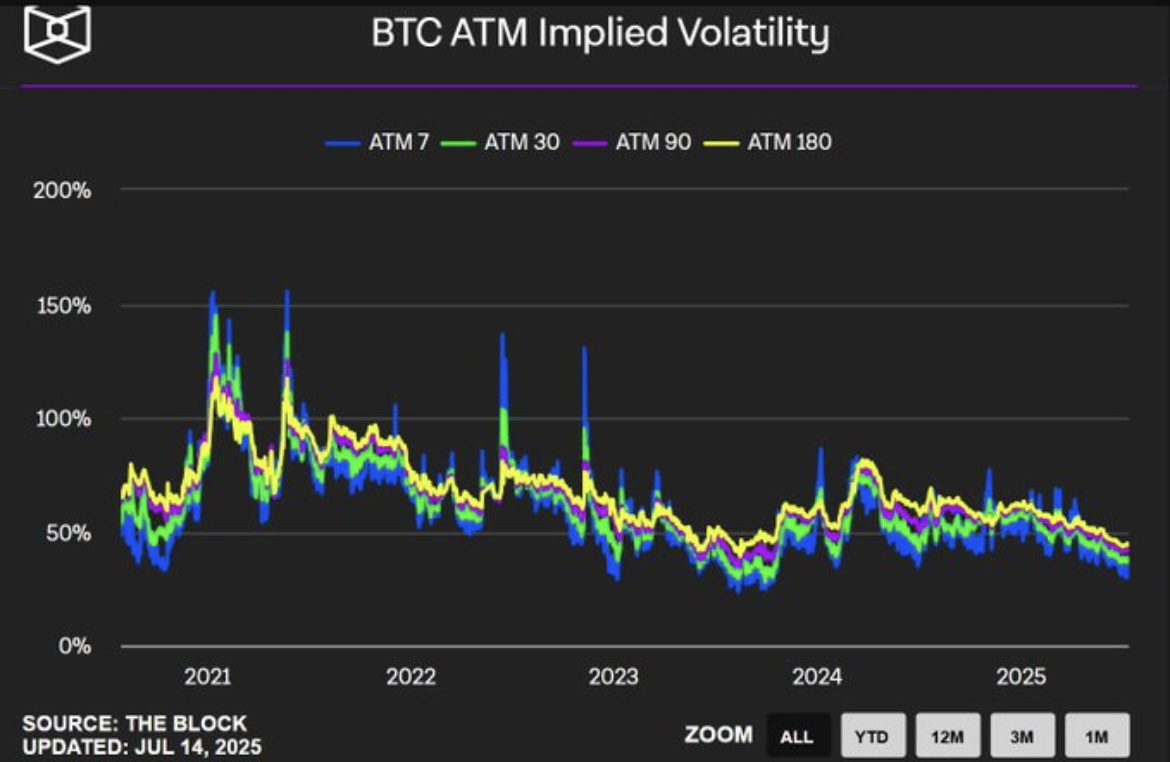

Another excellent top indicator comes from CryptoQuant: Bitcoin Bull-Bear Market Cycle Indicator. This momentum indicator uses the profit and loss index to track bull and bear cycles. ✅ Bitcoin is currently firmly in the bull market zone (orange), confirming a strong upward trend. ✅ It has not yet entered the overheated bull market zone (red), which has historically been the cycle top, with low volatility and decent financing rates.

Bitcoin reached a high of over 123,000 yesterday but started to pull back in the afternoon, currently dropping to a low of 116,333, a pullback of over 6,000 points. Rapid rises and falls are normal in a bull market. There's no need to panic; as long as it doesn't drop below 112,000, it remains a bull market trend.

The ETH/BTC exchange rate is facing a breakout. Ethereum and altcoins have opportunities for catch-up as Ethereum's pullback is relatively small. In this round of the bull market, Bitcoin continues to hit new highs, but the market response is very sluggish, with no profit effect. No matter how much Bitcoin rises, it seems unrelated to them. Most people don't hold Bitcoin, so they won't care; they are more concerned about whether altcoins and Ethereum can bring them significant benefits, but it still seems quite difficult at the moment.

Bitcoin

Bitcoin has set a historical high of over 12,300, followed by a rapid pullback of over 6,000 points, which is very normal in a bull market. A bull market doesn't guarantee a bull market, and shorting in a bull market is not advisable; rapid rises and falls are the norm. This situation is a nightmare for leverage, but clearing more leverage is more beneficial for the bull market's rise. The hourly downtrend has broken through the rebound pressure at 120,000. After that, we will see if it needs to consolidate or continue upward; from a bullish perspective, the probability of continuing to rise is higher. As long as it doesn't drop below 112,000, the long-term outlook remains bullish.

Support: 11200—11400—11600

Resistance: 120000—123274

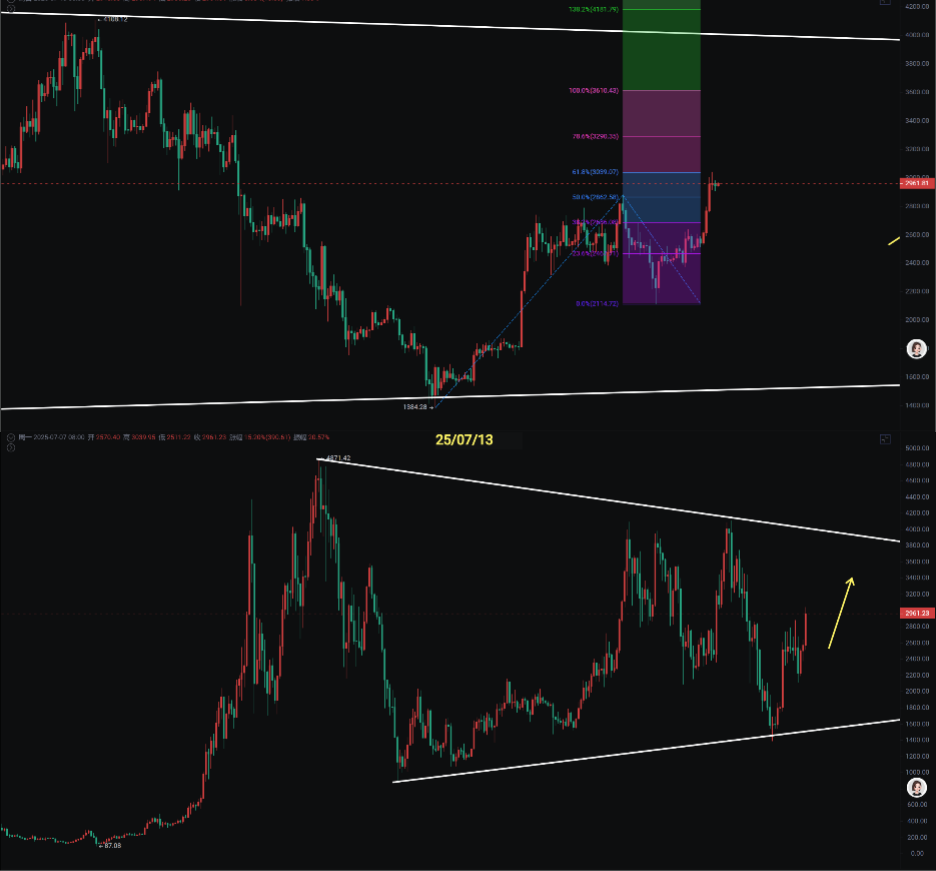

Ethereum

Ethereum reached a high of 3083 and has basically pulled back. The probability of continuing to rise is higher, with the first target still at 3300 to 3500. The ETH/BTC exchange rate has a trend of breaking upward, so there is a demand for catch-up in Ethereum and altcoins. Previously, I mentioned that many altcoins have performed quite well, such as SUI, XRP, BONK, SEI…

Support: 2876—2900

Resistance: 3300—3500—4000

If you like my views, please like, comment, and share. Let's navigate through the bull and bear markets together!!!

The article is time-sensitive and for reference only, updated in real-time.

Focusing on K-line technical research, sharing global investment opportunities. Official account: BTC Trading Prince Fusu

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。