虽然今天 $BTC 的价格再次突破了新高,但今天的作业仍然没有什么可说的,狗一样低的流动性和狗一样低的成交量,并且已经画了很多推文来解释,目前 Bitcoin 价格的稳定上涨并不是因为太多的购买力导致的,而是因为抛售的数量太少了,大多数的投资者都将 BTC 作为了长期持有的资产。

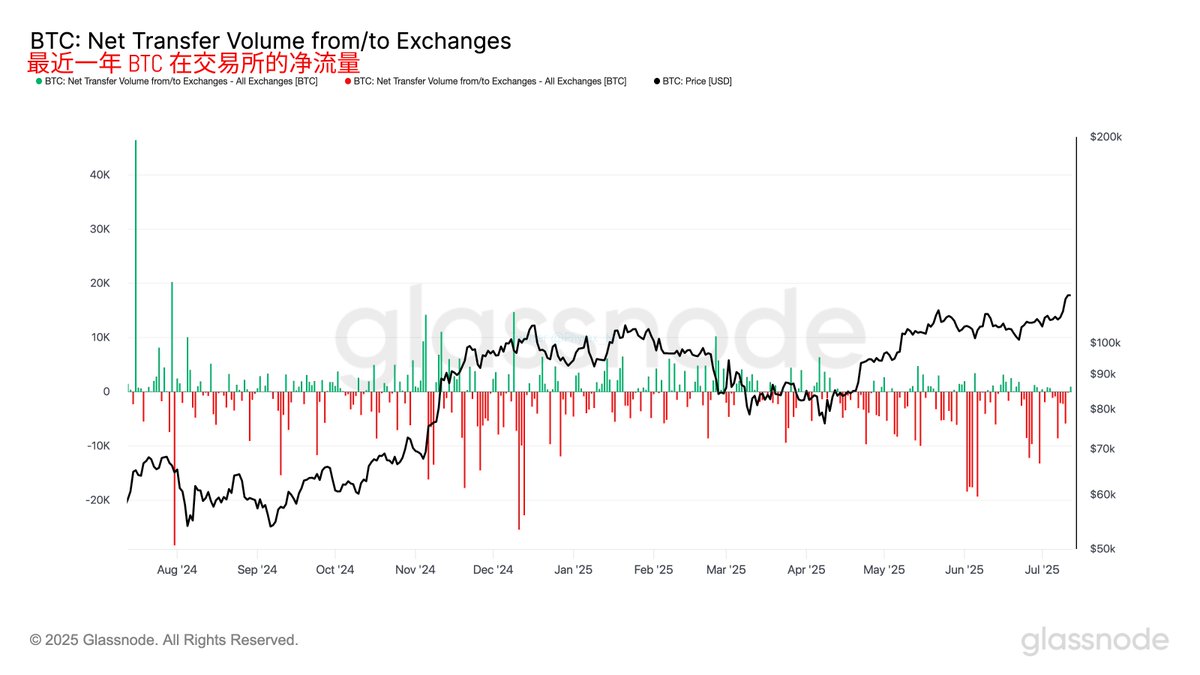

从最近一年 BTC 在交易所的净流量数据就能看到,最近半年能在交易所积累的 BTC 已经越来越少,更多的提现力量在释放,当然最近一周也出现了下降的趋势,但因为准备抛售的投资者太少了,所以价格的稳定性还是较高的。

这也是为什么说,除非是系统性的风险,否则很难让投资者释放筹码。

下周的宏观数据会比较多,从周二的 CPI 到周三的 PPI 到周四的零售数据,可能都会让市场震荡一下,尤其是 CPI 数据市场的预测并不是很好,可能会降低对九月降息的预期,当然这大概率是短期的,毕竟后边还有七月和八月的数据。

今天再次新高 URPD 还是没办法更新,等明天再说吧。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。