随着比特币 BTC 超越历史最高点,其他加密货币也大幅上涨,稳定币供应的增加提供了一个信号,表明这次反弹可能有更深层的根源。

根据 TradingView 的数据,Tether 的 USDT 和 Circle 的 USDC,这两种最大的美元挂钩稳定币,本周均达到了新的供应记录。自七月初以来,USDC 的市值增长了 13 亿美元,达到了 628 亿美元,而 USDT 增加了 14 亿美元,接近 1600 亿美元。

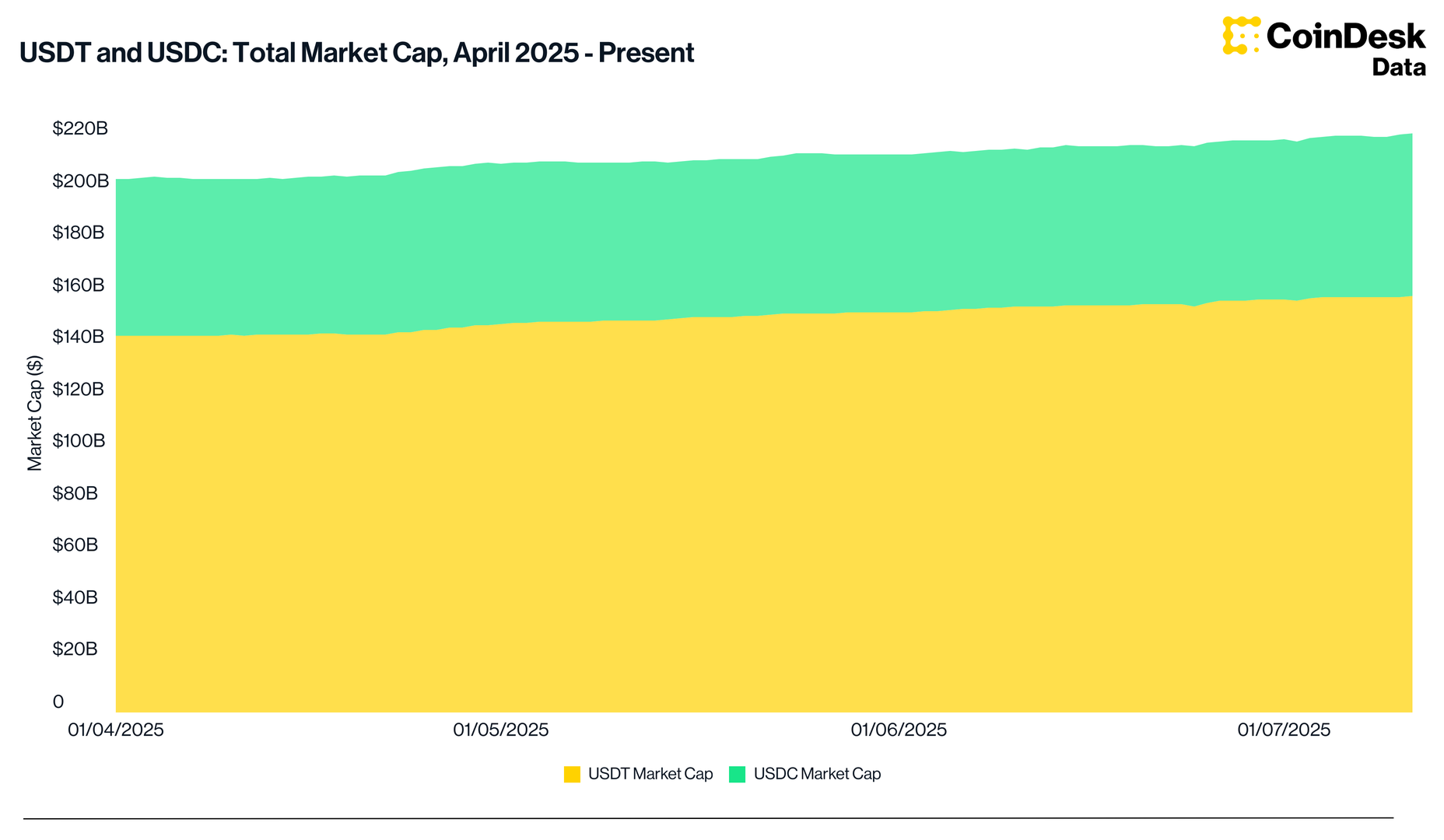

回顾四月,当市场达到短期低点时,增长更加明显。USDT 增加了 152 亿美元,约 10.5%,而 USDC 增加了 27 亿美元,或 4.6%。

稳定币是价格与外部资产挂钩的加密货币,主要与美元挂钩。虽然它们在支付中越来越受欢迎,但这一资产类别作为加密交易所的关键流动性和交易对来源。

因此,分析师通常将它们的增长视为新资本进入更广泛的加密经济的代理。

Cubic Analytics 的创始人 Caleb Franzen 在一张 分享在 X 上的图表 中指出,稳定币增长加速的时期与比特币的急剧反弹相吻合。

阅读更多: 比特币从 7 万美元到 11.8 万美元的“低波动性”反弹:从狂野西部到华尔街动态的转变故事

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。