原文标题:《3 分钟读懂 Yzi Labs 投资的 Aspecta》

原文作者:Alex Liu,Foresight News

7 月 10 日晚,Yzi Labs 宣布战略投资 Aspecta。本文旨在简要解读 Aspecta——其试图为传统资本市场中「非流动性资产」(illiquid assets)构建链上标准与信任机制,包括项目的设计逻辑、产品体系、应用进展与行业潜力。

团队背景

团队背景方面,Aspecta 并非从零起跑。项目于 2022 年在耶鲁大学的 Tsai CITY(Tsai Center for Innovative Thinking at Yale)孵化,核心团队成员出身于包括耶鲁、清华、伯克利和麦吉尔在内的顶级高校与科研机构,拥有 AI、图学习领域多项专利与论文成果。联合创始团队包括前 Tinder 首席科学家 Steve Liu(加拿大工程院院士)担任首席科学家,Jack He 担任联合创始人,团队还汇集了多位资深工程师与增长负责人如 Jane Yang 等。

联创 Jack He 在 TreeHacks 演讲

为何出现?解决哪些痛点

传统市场中,早期股权、锁定代币、私募股权、真实世界资产(RWA)等大量资产无法在公开市场交易,缺乏透明定价,严重制约了流动性与定价效率。Aspecta 提出:让这些「封闭资产」拥有链上的「生命」,不仅可实现定价,还能提供交易能力,从而降低信息不对称、提升资产利用率。

在解析这个逻辑时,不妨想象:一个项目在 A 轮锁定一部分代币,到期后不敢立即退出,因为市场缺乏流动性与定价机制。而 Aspecta 通过一套标准化的「包装 + 信誉机制」,使这些资产可以被定价、交易与追踪——为其「解锁」新价值。

两大核心产品:BuildKey 与 Aspecta ID

Aspecta 的设计脉络清晰,核心分为两条互相辅佐的路径:

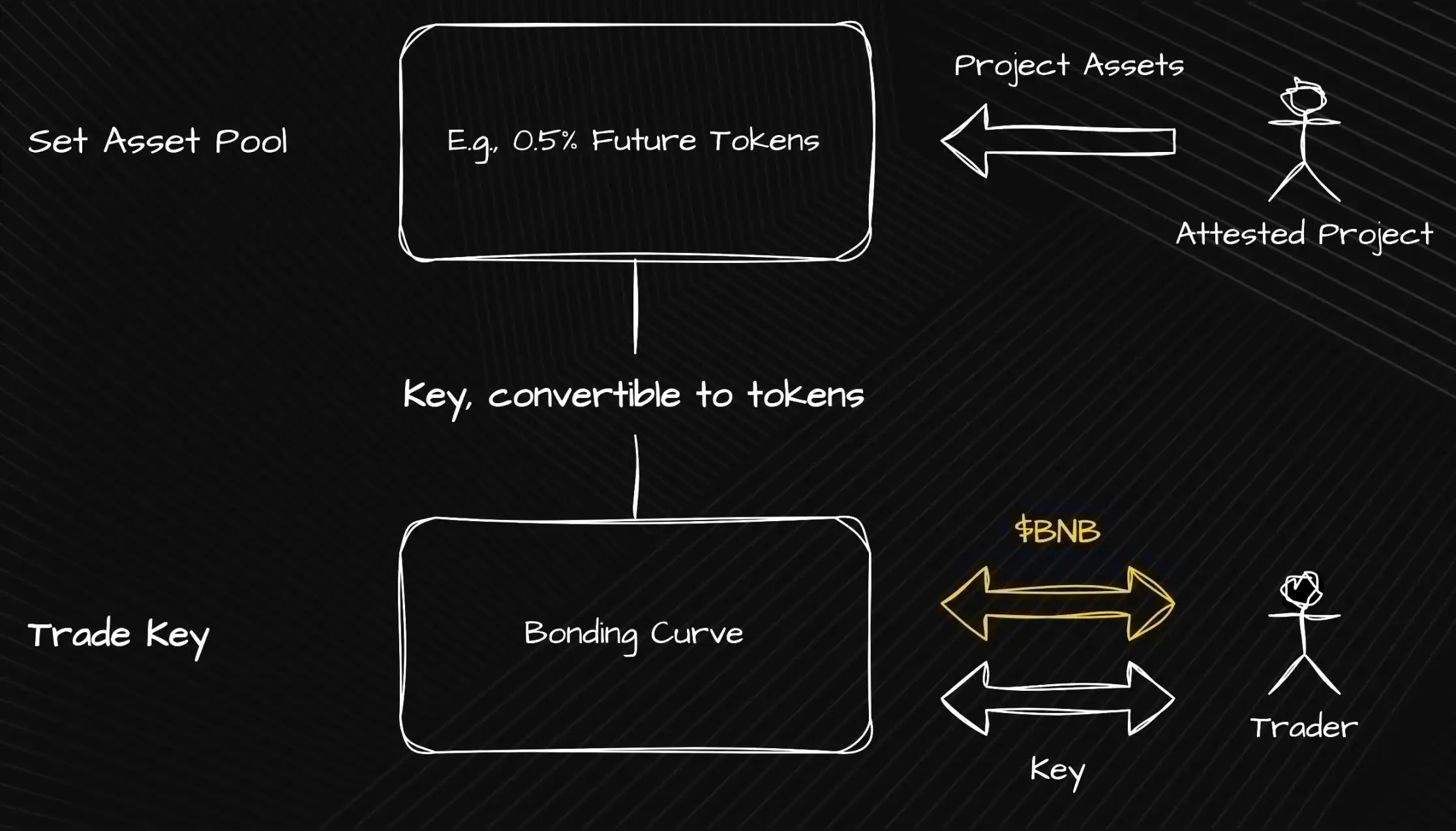

BuildKey:资产标准化与生命周期定价

BuildKey 将非流动资产以可交易的 ERC‑20 类凭证形式呈现。例如,预 TGE 股权、锁定期代币、私募配售权等,都能通过 BuildKey 链上发行与交易。该机制不仅支持 AMM、订单簿、拍卖等多种定价方式,还允许资产在不同生命周期阶段切换,如从风投资本到公开交易市场之间的「链上接力」。

值得注意的是,BuildKey 自推出以来,已支持 25 多种数字资产参与定价,完成 5,000 万次以上交易,一度证明封闭资本对链上流动机制有强烈需求。它不是简单的代币铸造,而是一套「生命周期资产变体」体系:用户可以在 TGE、锁仓、二级市场等多个阶段自由进出,资产价格更具连续性。

Aspecta ID:AI 驱动的可信身份协议

如果 BuildKey 是资产凭证工具,Aspecta ID 则是赋予发行方背书的信任机制。它通过集成 GitHub 提交、链上行为、项目贡献等数据,使用 AI 算法对开发者、项目乃至资产发行者进行信用画像,并发放信誉分值。

这一机制让资产包装无「信任真空」。项目早期或处于封闭阶段时,Aspecta ID 的信任输出能降低投资者与交易者的顾虑。现阶段已有 54,000 多名 GitHub 开发者完成验证,系统正在从信任协议走向社区治理层面。

产品联动:如何形成闭环?

在 Aspecta 的架构中,BuildKey 与 Aspecta ID 并非孤立存在,而是相互配合、贯通始终,构建起一套从资产生成到信任确立再到交易流通的完整闭环生态。例如,当开发者在 GitHub 提交代码并关联到某一项目时,其技术贡献与链上活动会被 Aspecta ID 系统识别、评估并形成信誉画像。基于这一身份认证机制,项目在后续发行如预 TGE 股权等非流动资产时,即具备了明确的信任支撑。而这些资产再通过 BuildKey 的机制进行链上凭证化,公开发售并完成初步价格发现,同时建立交易记录。

随着社区参与的深入,BuildKey 支持的 AMM、订单簿与拍卖机制逐步增强资产的价格透明度与交易深度。在整个过程中,用户依据发行方的信誉评级与市场定价,灵活决定是否参与认购或退出投资,从而让资产形成完整的生命周期轨迹,累积出可验证的交易历史和价值反馈。这样的机制不仅促进了早期资产的定价透明,也让信任机制与流动性之间实现了正向循环:一方面,Aspecta ID 为资产提供底层信用锚定;另一方面,链上的交易数据又不断反哺信任评估体系,使后续的资产发行更具效率与可信度。

社区、用户与生态

截至 2025 年中,Aspecta 已吸引超过 65 万名用户参与平台使用,其中包括 54,000 多名通过 GitHub 验证的开发者,他们在生态构建中发挥着重要作用,进一步强化了身份系统的实用性与吸引力。同时,BuildKey 已支持超过 25 种非流动资产的链上发行与交易,显示出该机制对市场的广泛适配能力。社区的积极参与也推动了诸如多链兼容、混合式 AMM 与订单簿模型等机制的快速落地,整体生态朝着更开放、更灵活的方向扩展。

从实践层面看,Aspecta 正在搭建一个「AI + 资产 + 社区」的三角结构,试图打通从身份识别、资产包装到链上治理与激励的全流程闭环,初步形成基础设施级的网络效应。

结语

Aspecta 正在用自己的一套方法,试图以「可信身份 + 生命周期资产包装 + 链上流动机制」,打开传统资本与 Web3 之间的断层。从 GitHub 提交到代币凭证,从封闭发行到二级市场交易,其产品体系不断自洽升级。虽然仍在初期,但超 5000 万美元的 BuildKey 交易量和超 65 万用户基数让其具备了底层基础。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。