梅开多度,BR 也拉闸了。

撰文:ChandlerZ,Foresight News

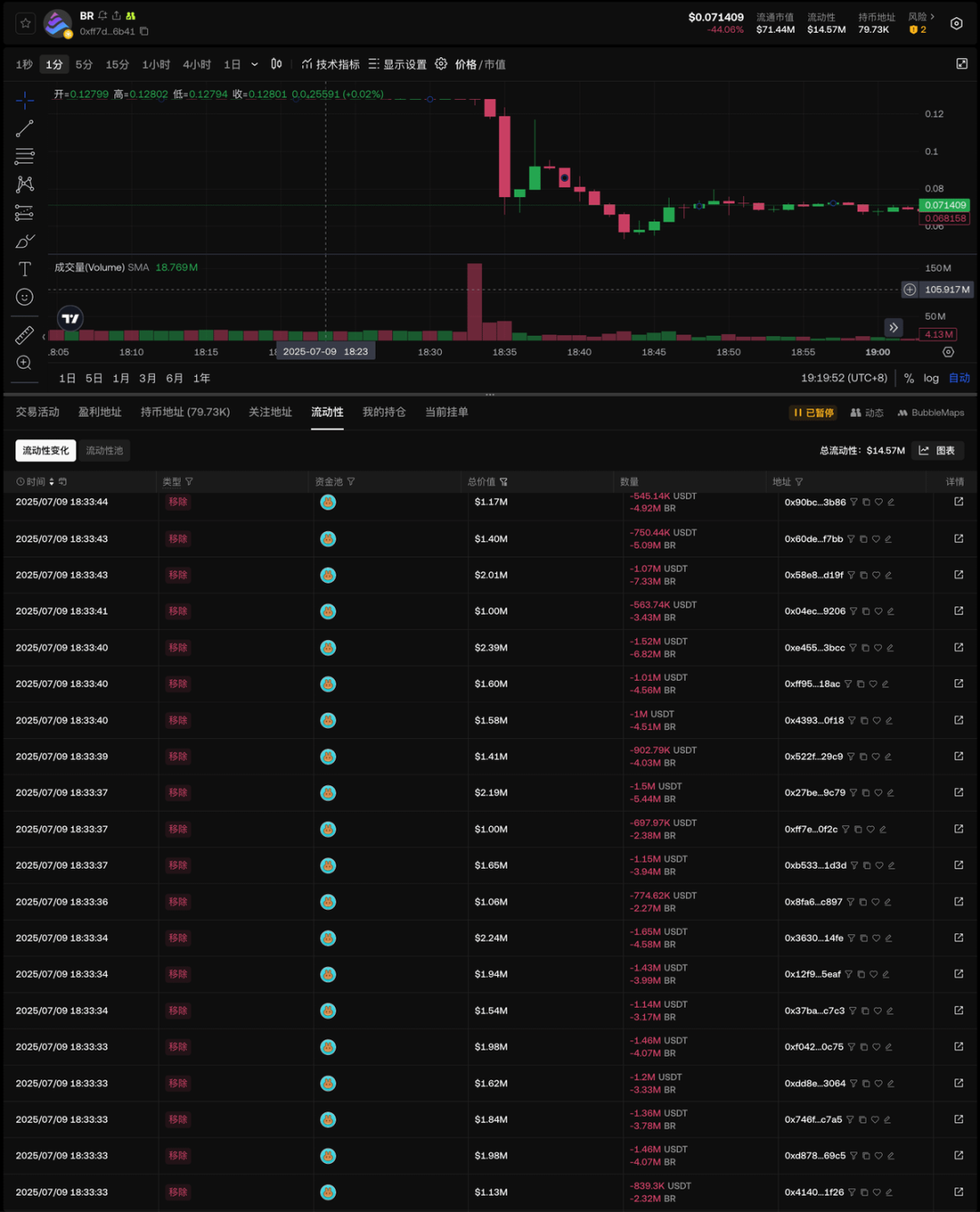

7 月 9 日,币安 Alpha 项目又见一场熟悉的闪崩。在不到 10 分钟的时间里,近期币安 Alpha 项目中的明星代币 BR 从高点 0.129 USDT 急跌至 0.053 USDT,价格瞬间腰斩。

暴跌过程可以用 「干净利落」来形容。据 @ai_9684xtpa 监测,OKX 流动性板块显示,在闪崩发生前,BR 的交易池流动性仍稳定维持在较高水平,一度超过 6000 万美元。但事件爆发点集中在短短 100 秒内,共有 26 个地址几乎同步撤出了 4759 万美元的流动性。紧随其后,16 个地址发起高额代币抛售,其中包括 3 个百万美元级别和 13 个 50 万美金地址,集中式的卖压瞬间打穿了流动性,造成币价瀑布式下滑,BR 流动性目前仅剩余 1456 万美元。

以下是 TOP5 主要砸盘地址

- 0x00E0E2225E48e40ac7A1C5C48C3359325C7F41c3

- 0x20c375580C4BD0DA36aec0c55406fa645F964FBd

- 0x63293340bb17D9bc0f66f1956a810f7BFC7c857B

- 0x58e837F8F9C1aCfE618AdbBa95314BE2ab55d19F

- 0x31A256E01900f93831361dF928EB32F83A6Af40E

谁在砸盘?

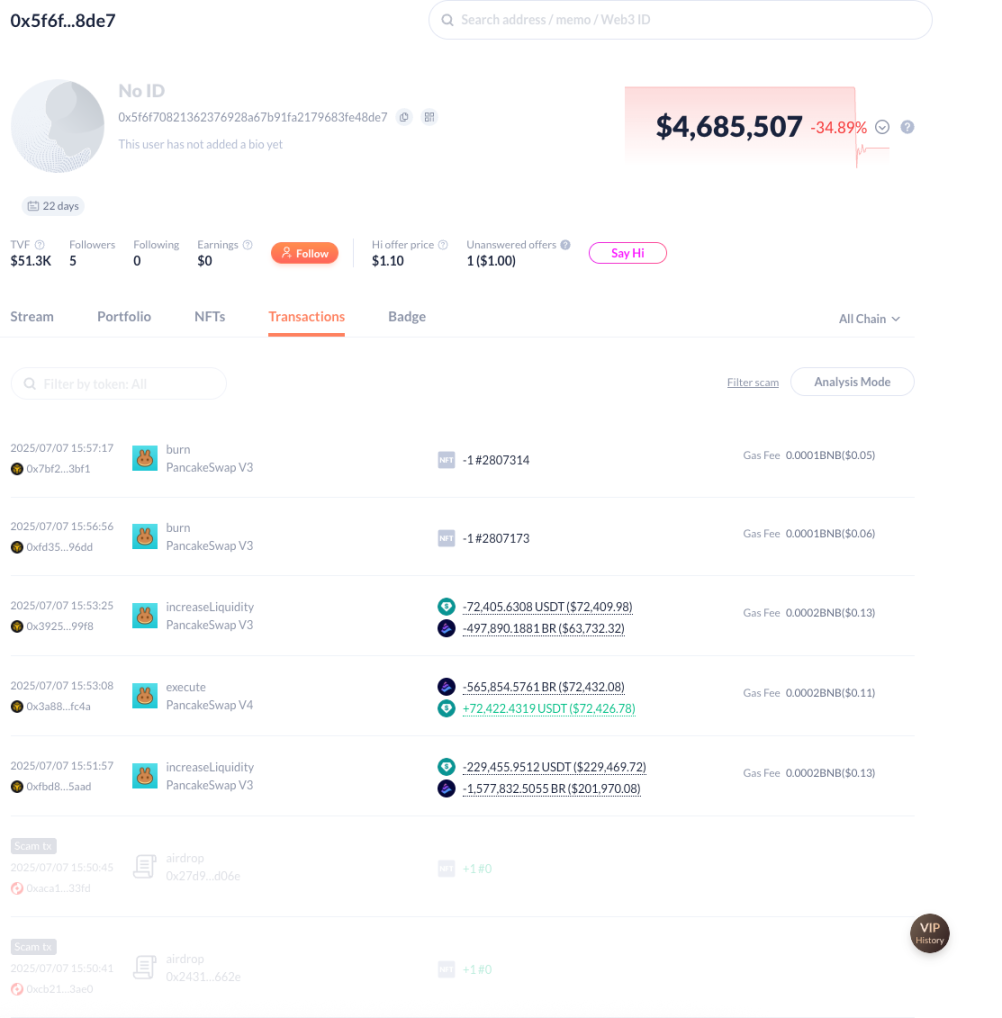

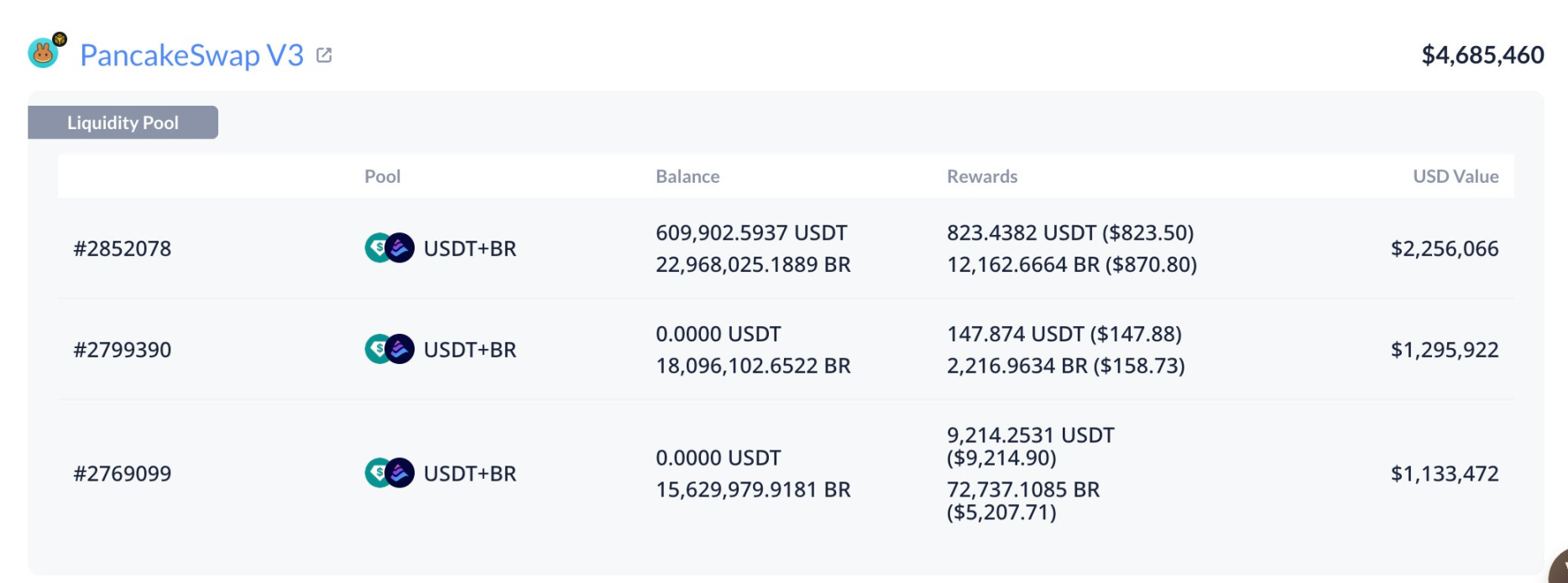

分析称,本次砸盘看起来不像项目方行为。首先是动机,有 ZKJ 崩盘的前车之鉴这样搞也太过「明目张胆」,这波大额刷量个人更倾向于是为了上个合约 / 现货;其次是数据,项目方主流动性地址 0x5f6f70821362376928a67b91fa2179683fe48de7 目前仍持有 468.5 万美元的流动性,上一次操作已经是 07.07,暴跌期间的确没有任何操作。

百万美金级别的 3 个主要砸盘地址都是 2 周前的新建地址,6 月 24 日至 6 月 28 日期间从交易所提出资金后就直接开始大额建仓 BR,意图明显且资金来源单一。

TOP4 砸盘地址 0x58e837F8F9C1aCfE618AdbBa95314BE2ab55d19F 的信息相对多一些,资金来源最早可以追溯到 2017 年,与云币 / 中币 / Liqui / YoBit 等老牌交易所有过交互,是个妥妥的 OG。

手段和上次 ZKJ 崩盘没有什么差别,都是「瞬时抽走流动性 + 大额砸盘 + 多地址配合」,只是排查起来困难还是挺大的,主要地址的资金来路都很单一。

ZKJ 闪崩的前车之鉴

事实上,此类操作早已有迹可循。ZKJ 的闪崩事件可谓 BR 本轮暴跌的前车之鉴。就在不到一个月前的 6 月 15 日,ZKJ 代币也曾在短时间内暴跌超过 80%。根据 Polyhedra 事后发布的初步调查报告,ZKJ 闪崩源于多个地址协同从 PancakeSwap V3 中抽离大额流动性,并迅速砸盘。而这波链上抛压又直接触发了中心化交易所上的强平机制,加之 Wintermute 在极短时间内转入 339 万枚 ZKJ 至 CEX,进一步加剧了市场恐慌,最终造成近 9400 万美元的强制清算。更值得关注的是,ZKJ 闪崩同样是在币安 Alpha 激励机制下,形成流动性高度集中且未受锁定的市场结构。这些高度相似的特征,几乎重叠在 BR 闪崩的整个链条上。

目前 BR 项目方表示项目方未撤出流动性,并已进行流动性地址公示,在未来也不会撤出流动性,希望用户保持理性。同时其指出,为进一步支持在 PancakeSwap BR/USDT 交易池中进行交易的用户,将为 PancakeSwap BR/USDT 交易用户提供特别空投计划,在价格剧烈波动期间,如用户因市场波动或滑点而产生明显价差,即有资格获得空投补偿。空投的具体规则及发放方案将于未来几日内公布并完成。

尽管项目方可能并未「亲自下场」,但机制本身的问题却难以回避。BR 是币安 Alpha 项目中的「刷分型」 代币之一,项目方通过做量刷分的方式,吸引散户提供流动性参与 Alpha 活动积分竞争。

6 月 25 日,链上数据显示 BR 已成为币安 Alpha 交易量最大的代币,24 小时交易量 2.38 亿美元。疑似 Bedrock 官方 LP 主要地址之一 0x9bd 开头地址自 6 月 19 日以来已净投入 5000 万枚 BR(约 400 万美元)用于提供流动性,包括 5 小时前在链上以均价 0.07959 美元出售了 4143.6 万枚代币,价值 329.8 万美元,随后该地址向 Pancake 添加了 927 万枚 BR 和 342.7 万枚 USDT 的双边流动性,五小时内产生了 5412 美元的手续费。

币安 Alpha 流动性机制再遭质疑

社区对此类事件的反应也日趋激烈。加密 OG @BroLeonAus 在 BR 暴跌后迅速发文指出,这类「刷量 + 吸池」模式的风险早已有迹可循。早在 BR 与 AB 等项目尚处上线初期,就曾观察到它们采用线性 K 线、低交易费率、持续引导流动性加入的行为特征,具备典型的「刷分吸池」倾向。如今两者几乎同时出现闪崩迹象,一语成谶。

在他看来,当前币安 Alpha 机制所采用的积分计算规则存在明显缺陷,间接诱导项目方通过制造表面活跃度来获取平台曝光与奖励。在这种设计下,只需在链上营造出「流动性深、走势稳、费用低」的假象,便能吸引大量散户作为 LP 参与,形成流动性堆积。项目方只需「打窝」等待,一旦条件成熟,便可迅速撤走流动性并实现出货,普通用户则成为最后的接盘者。

BroLeon 透露,上周 Bedrock 团队曾与其沟通宣发合作事宜,他明确提出风险控制建议,要求对项目方流动性进行第三方锁定,以保障用户安全。然而对方并未给予明确回应,合作也因此未能推进。他强调,虽然目前尚无确凿证据表明 BR 项目方直接参与了此次砸盘,但责任更大的是明明看到这个规则有极大风险和漏洞却置若罔闻的币安钱包团队。

平台原本是想让利于散户,实际情况却变成了项目方借助机制漏洞收割散户、并反过来引发对平台的负面情绪,这样的结果显然违背了初衷。在当前的 DeFi 市场中,任何激励机制一旦不能约束其被滥用的边界,都有可能成为投机者的「提款机」。Alpha 曾被视为币安对链上流动性生态的一次积极探索,旨在用平台激励推动更多用户参与链上交易,提高代币活跃度与分散度。

但目前看来,该模式在设计上的初衷已经被逐渐异化。激励机制没有与锁仓、真实流动性挂钩,导致刷量行为泛滥;项目方或短期套利者无需承担太多成本,便可诱导市场形成表面繁荣,最终在缺乏审查与约束的状态下完成一次收网。如果不进行变革,仅靠事后补偿或解释,恐难阻止下一个「闪崩」的发生。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。