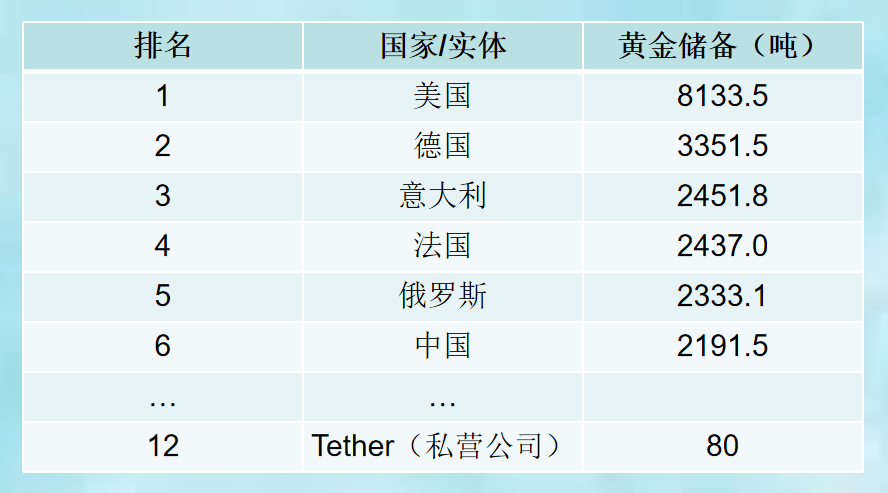

On the evening of July 8, 2025, Tether CEO Paolo Ardoino revealed in an interview that Tether owns its own vault in Switzerland, currently holding gold worth $8 billion (approximately 80 tons). The news quickly attracted global financial market attention, making Tether one of the largest holders of gold outside of banks and sovereign nations, comparable to the precious metal reserves of UBS Group. For security reasons, Tether declined to disclose the specific location and establishment date of the vault. Previously, Ardoino stated at the Bitcoin 2025 conference in Las Vegas in May that the company held 50 tons of gold, and in just two months, the reserves surged by 30 tons, highlighting its ambitions in the precious metals sector.

Vault Strategy: Dual Considerations of Cost Control and Independence

Tether's Swiss vault is wholly owned by the company, aimed at reducing long-term custody costs and enhancing control over reserve assets. Ardoino pointed out in the interview that traditional precious metal vault operators charge annual fees, which for an $8 billion gold reserve could mean additional costs of tens of millions of dollars each year. If Tether's gold-backed stablecoin XAUT expands to $100 billion, custody fees would continue to soar. Building its own vault not only significantly cuts costs but also grants Tether greater autonomy, avoiding reliance on third-party custodians.

Gold currently accounts for nearly 5% of Tether's total reserves, primarily used to support its gold token XAUT and as collateral for the stablecoin. Tether Gold (XAUT) is a stablecoin issued by Tether's subsidiary TG Commodities Limited, pegged to physical gold, with each XAUT token representing 1 ounce of gold certified by the London Bullion Market Association (LBMA).

Gold Rush: A Strategic Choice to Hedge Against Fiat Risks

Tether's aggressive accumulation of gold stems from profound concerns about the instability of the global fiat currency system. Ardoino noted that gold, as a safe-haven asset, is "logically safer than any national currency," especially against the backdrop of rising U.S. debt and escalating geopolitical tensions. In 2025, gold prices have risen by 25%, partly driven by the continued accumulation by central banks in BRICS nations. The People's Bank of China added 5 tons of gold reserves in January 2025, with BRICS countries collectively holding 20% of the world's gold reserves.

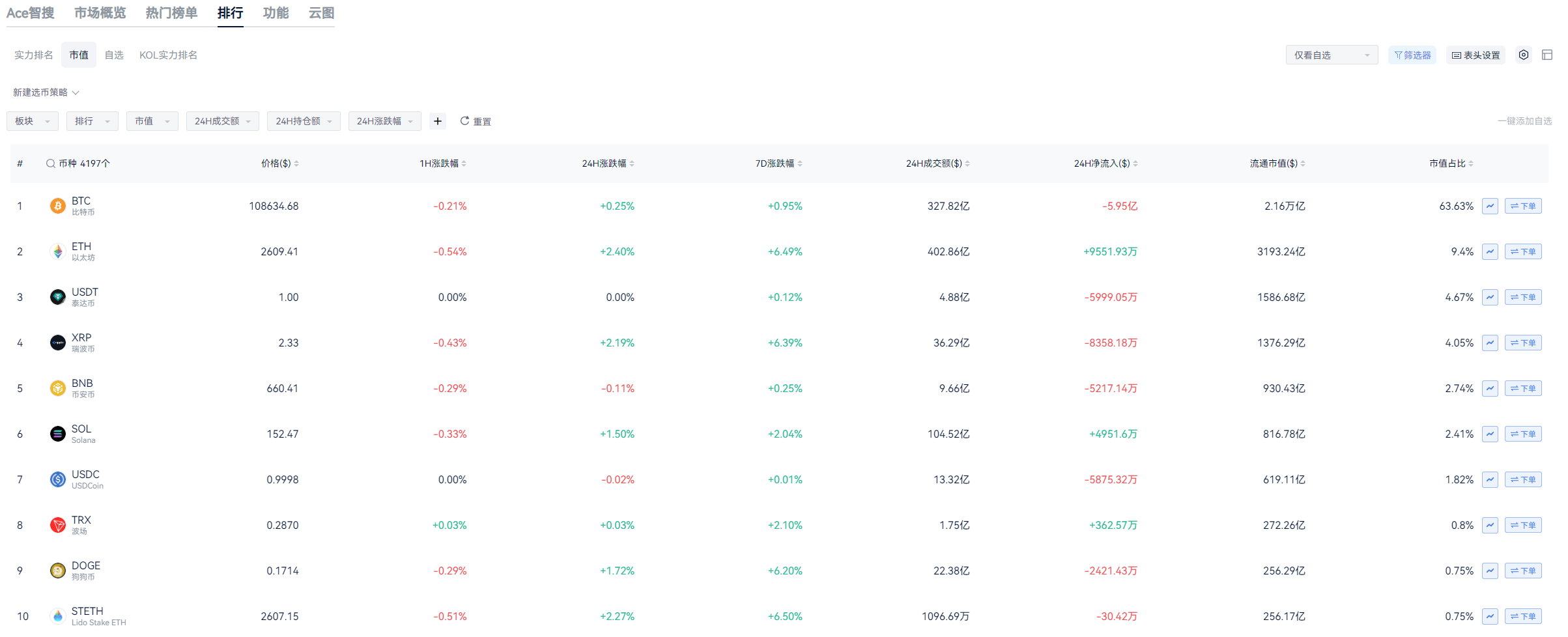

Tether's gold strategy is not only a financial consideration but also reflects a deep insight into the global monetary landscape. In a speech at the Bitcoin Policy Institute in March 2025, Ardoino warned that BRICS nations are seeking to challenge the dollar's hegemony through gold-backed currencies, while USDT, through widespread adoption in emerging markets, indirectly creates demand for U.S. Treasury bonds. However, he also admitted that if the global financial system undergoes a reset, Bitcoin could replace fiat currencies, and the role of USDT would gradually diminish. This "Bitcoin supremacy" belief drives Tether to invest profits into Bitcoin infrastructure while retaining gold as a tool to hedge against fiat risks. As of the time of writing, the market size of USDT has reached $158.668 billion, accounting for 4.67% of the stablecoin market.

Regulatory Shadows: Compliance Concerns Over Gold Reserves

Despite Tether's ambitious gold strategy, it faces significant regulatory pressure. Stablecoin regulations in the U.S. and the EU require reserve assets to be limited to cash and short-term government bonds, potentially prohibiting non-liquid assets like gold. If Tether seeks formal authorization in these regions, it may be forced to divest its gold reserves to comply with regulatory requirements. This potential regulatory conflict adds uncertainty to Tether's vault strategy. Ardoino anticipates that if investors lose confidence in U.S. fiscal sustainability, demand for XAUT could surge. However, the circulation of XAUT is negligible compared to USDT, indicating that its market acceptance still needs improvement. In contrast, Circle's USDC (market cap $61.911 billion) adopts a more conservative reserve strategy, focusing on government bonds and cash, thus avoiding the regulatory risks associated with gold.

This article is for informational purposes only and does not constitute investment advice for anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。