今天回来的路上还在和 @Trader_S18 老头说最近喝酒太多了,脑子都有点不清醒了,最近这一周七天中有五天在喝酒,虽然没有影响码字,但是回复的频率确实降低了,这要检讨一下,下周开始要少喝酒了,每周控制在一次到两次,不能再多了。正好下周酒搭子去度假,我也休息一下。

传说中 8万 枚的 $BTC 继续没有造成伤害,很多等着看笑话和做空的小伙伴也暂时落空了,其实废话不想来回的说了,就看交易所存量这个数据应该是这个周期帮助最大的数据了,又简单又一目了然,还不用花钱。

目前所有交易所的 Bitcoin 存量已经是近五年的最低点了,横跨了两个周期,从2024年11月开始,不论 BTC 的价格走势如何,交易所的存量都是下降的,说明了一直都有投资者在不断的买入或者是提现,而这也代表了大多数的投资者都没有短期的离场的兴趣。

我是实在想不到,在这种情况下除非是出现系统性风险,否则这么强的共识下,BTC 能下跌到多少,前两天我在 109,000 美元附近的时候就在说,虽然我觉得有做空的空间,但我不原因做空,就是不知道什么情况下一条利好就把 BTC 的价格顶起来了。

今天就在贝森特宣布关税伙伴关系的时候,市场就开始博弈周一美国投资者能给出正面的回应,就是一个三天的假期,美股都还没有反应,BTC就完成了从川马吵架到关税交易的信息交替。

这么一个数据就是最好的市场情绪的晴雨表。我是非常推荐的。

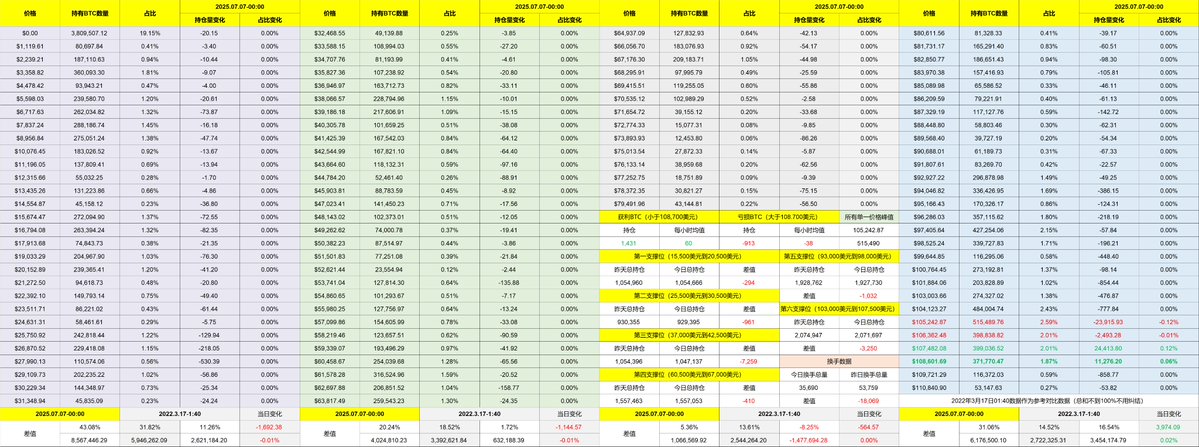

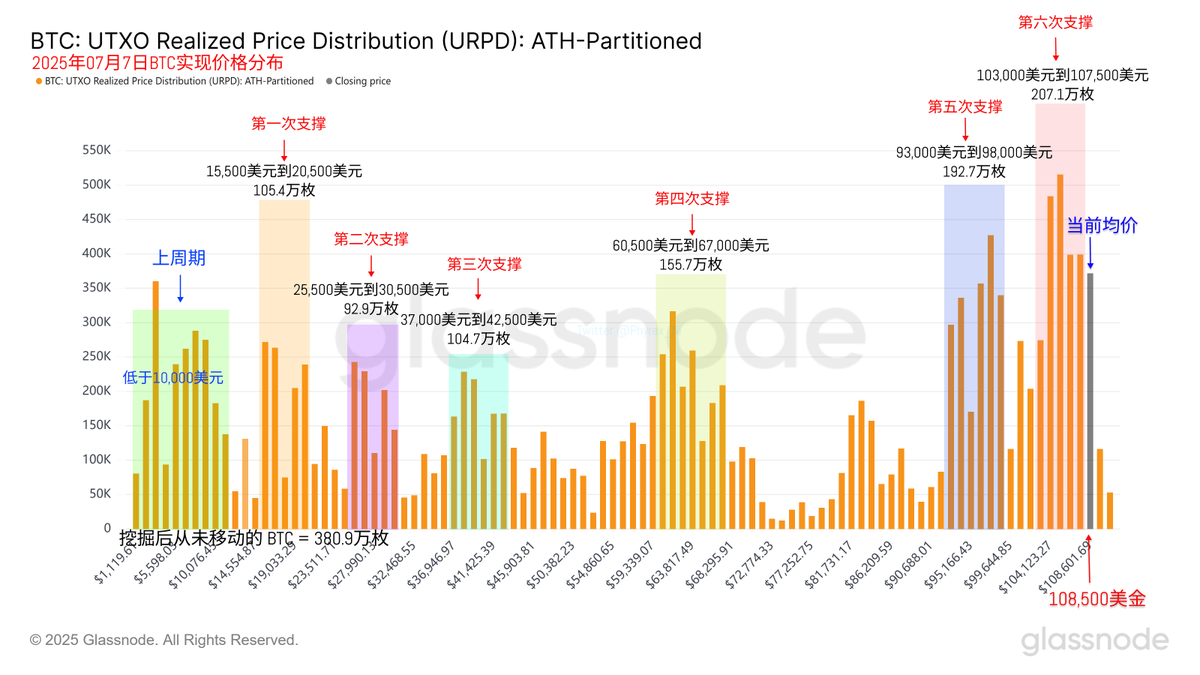

其次就是支撑数据了,这个数据的有效性也是获得了多次的验证,只要是支撑不被破坏,价格的稳定就有保证,这个数据也是我多次抄底的参考依据。

现在我不确定涨了看涨是不是对的,但在没有系统性风险的情况下跌了看跌,可能是不对的。更重要的是不要自己去吓自己,天塌了,还有高个的人顶着。

数据地址:https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。